While global macroeconomic conditions remain challenging, spearheaded by the unpredictable Chinese economy and the dual risks of higher interest rates or a recession, Australia’s financial system remains surprisingly robust.

This is the central theme of the Reserve Bank of Australia’s (RBA) latest stability report. Its core finding that matters to everyday Australians is that the nation continues to live up to its “lucky country” namesake.

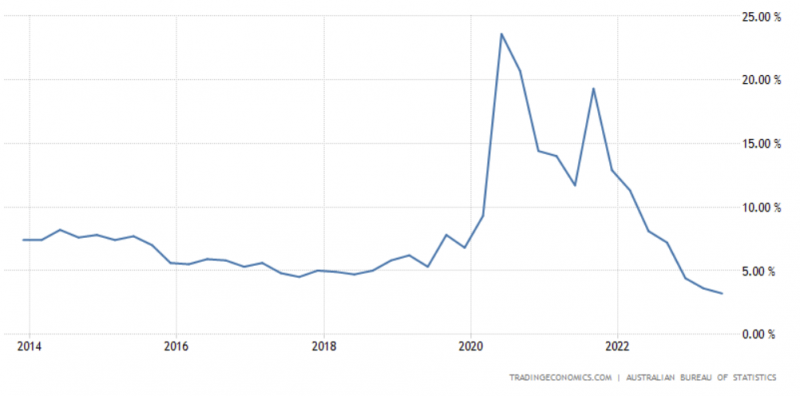

A retail data update provided by the Australian Bureau of Statistics (ABS) today perhaps reinforces this thesis: despite numerous challenges, the Australian consumer is still increasing their purchases.

Seasonally adjusted retail data for August shows a 1.5 per cent year-on-year increase, compared to August 2022.

Mortgage stress

Mortgage stress continues to affect everyday Australians. However, it’s not as severe as commentators had initially anticipated when interest rate hikes began a year and a half ago.

Of course, real interest rates take a considerable amount of time to impact the real economy, possibly spanning multiple years, making it challenging to predict precisely what Australia will look like over the next 24 months.

Given that Australia’s economic performance (and currency) essentially serve as an indicator of the overall health of the Chinese economy, it makes sense that the RBA closely monitors the heartbeat of our largest trading partner.

Meanwhile, our markets essentially mirror those of the USA.

The Australian financial system, by which the RBA means the strength of its major banks remains robust and will continue to be so long as households continue to service their mortgages.

Predicting how long this situation will persist is a difficult task. The housing crisis, characterised by issues of unaffordability and supply, is not unique to Australia. As noted by the RBA today, it is unfolding in most advanced economies.

Furthermore, housing prices, both in the on-market and rental sectors, are contributing to elevated inflation in Australia. It comes as no surprise that lower-income households are disproportionately affected by these unusual economic circumstances.

Financial stress quietly rising

The bank did highlight, as mentioned on page 18 of its report, that “a small but increasing portion of borrowers are teetering on the edge or in the initial stages of financial stress.”

“These estimates show that a small but rising share of borrowers are likely to have seen their essential expenses and mortgage costs exceed their income as interest rates have increased since May 2022,” the bank wrote.

“However, they do not necessarily indicate that these borrowers are in mortgage stress. Rather, these estimates indicate that a share of borrowers need to make adjustments beyond significantly reducing consumption – such as drawing on their savings buffers.”

This situation is reasonable and manageable, but it becomes concerning when you consider that the Australian household savings ratio is diminishing and cannot be sustained indefinitely.

Commercial real estate resilience amid uncertainty

It’s worth noting that Australian commercial real estate owners aren’t experiencing widespread difficulties, even with empty offices in every major capital city and a general shift towards risk-off attitudes in the sector.

This situation persists even as banks’ net interest margins (NIMs) decline, which has led most analysts to take a cautious stance on Commonwealth Bank. It’s essential to remember, though, that Fitch Ratings is anticipating a US recession in Q4. Another banking crisis in the US could potentially have negative implications from the RBA’s perspective.

Of course, for every entity that raises concerns about a recession, there are others that dismiss the notion. The substantial stock market volatility on the ASX throughout September, even during what historically has been the market’s weakest month, underscores the uncertainty among investors.

Both Australian and US bond yields reflect this ambiguity as competing narratives play out in the psychologies of millions of different actors (and algorithms).

In short, there is no consensus, and the future remains quite uncertain.