I put this link up yesterday but thought it worth adding the text....it's well worth a read if you skipped it.

"In afternoon New York trade on Thursday copper for delivery in May jumped more than 2% topping $2.70 per pound on renewed hopes of a soft landing for the economy of top consumer of the metal China.

Copper is now trading at the highest price since January 12 when a dramatic 8%-plus slide over just two sessions spooked the market. By the end of January the metal had declined to $2.42 a pound, the lowest since July 2009, but gains for February now top 8%.

On Thursday the People's Bank of China extended its system-wide cut to bank reserve requirements first announced three weeks ago and in its daily newsletter the central bank urged further easing of lending requirements to deal with deflation risks. Expectations of an interest rate cut as early as the second quarter also boosted stimulus hopes sending mainland Chinese stocks racing ahead led by the state-owned railway, construction and power giants. Beijing has already brought forward $1 trillion in infrastructure spending with the State Grid company alone spending nearly $70 billion this year.

This being China, the timing could well be part of a coordinated effort to ready markets ahead of key March meetings that set government budgetary agendas for the year

Meanwhile, we could be about to witness another rally in Chinese equities, perhaps not unlike the one we saw in the autumn of 2014 argues Christoffer Moltke-Leth of Saxo Bank's Singapore hub:

"There has been a nice rally in mainland Chinese stocks on talk that the government will take steps to address the ongoing domestic slowdown Prime minister Li Keqiang has called for a more active fiscal policy and the People's Bank of China also issued a report that mentioned the possibility of monetary easing." This being China, the timing could well be part of a coordinated effort to ready markets for some kind of accommodation with key meetings in March due to set the government budgetary agendas for the year, says Moltke-Leth. Monetary stimulus aside, the fundamentals in China which constitute nearly half the global copper trade, also appear to be improving. Yesterday a Chinese manufacturing survey showed the country's factories are producing at the highest rate in five months on the back of strong domestic demand with output, work backlogs and new orders all increasing at a faster rate.

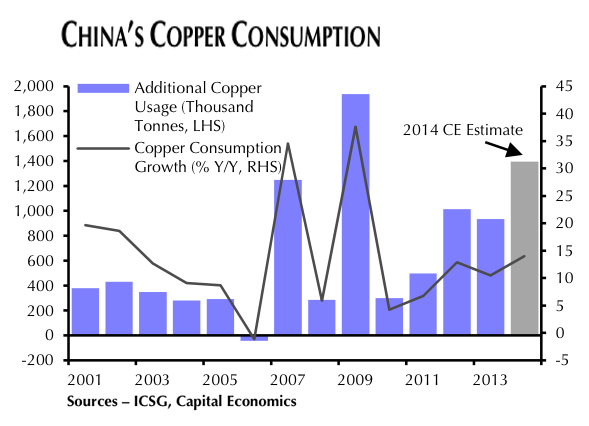

A new note from Caroline Bain of independent research house Capital Economics in London estimate growth in China’s apparent consumption at 14% last year. While growth is expected to slow this year it's coming from a much higher base which should push the price to $7,200 per tonne ($3.26 a pound) by end-2015 and $8,000 ($3.63 a pound) by end-2016 according to Bain:

Here's why copper price is rallying

"The 14% increase in copper usage in 2014 translated into 1.4m tonnes of additional copper consumption. A similar growth rate in 2003 represented just 350,000 tonnes of additional copper. As such, lower growth rates will still represent large incremental increases in the volume of copper consumed."

While demand may turn out better than expected (and not only in China), history is repeating itself on the supply side. The industry is prone to disruptions (more so than the de-risked supply flooding iron ore markets) that can turn surpluses into deficits rather rapidly (case in point: electrical failure last week has put BHP Billiton's Olympic Dam out of commission for six months). Problems with falling grades and rising impurities pushing up costs (only temporarily alleviated by the lower oil price) have also been well documented. Country risks also tend to be higher. (Mongolia anyone?) "

(The bold is my edit)

http://www.mining.com/heres-copper-...g-150226&utm_medium=email&utm_campaign=digest

- Forums

- ASX - By Stock

- What copper surplus?

I put this link up yesterday but thought it worth adding the...

- There are more pages in this discussion • 77 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)