ref the other REITS - there is going to be a lot of volatilty out there for a while to come yet - a lot of speculation - a lot of fear.

EG. GMG dropped 21% yesterday, but it is just part of the trading retrace. It doubled from the 10 Mar to the 18 MAR in one week.

CER - jesus I am glad I got outta that one. I honestly don't know what is going on there - especially yesterday - biggest daily volume in 2 years. Something is around the corner, and I suspect it is not good. Somebody knows something. Maybe ORBIS just dumped their 14% - or - maybe they now own the whole company. Will be very interesting to STAND BACK and watch.

IIF is an intersting one. On the 12MAR someone placed 10 MIL shares at 0.12 on market during Pre-CSPA. They were filled. It is exactly what happenned to BBI yesterday at during Pre-CSPA. Lets see what happens to BBI... hmm...

IMO - If you look at weekly charts - generally quality REITS are an exaggeration of the trend. As soon as the big money starts smelling credit markets recovering the REITS will fly.

I love the analogy that ORBIS uses. I.e. you could buy the building for 5M, or you could buy the company that owns the building for 500k. REITS are so oversold at the moment. People are worried about retailers closing down. Good article in the paper the otherday with an interview with Lowy Jnr regarding the fact that they were being pushed to the wall by their tennants. Bakers Delight (who are in a very strong position) was quoted as saying they saw this crisis as a massive opportunity to squeeze their landlords for rental reductions.

The other things I like about VPG are that

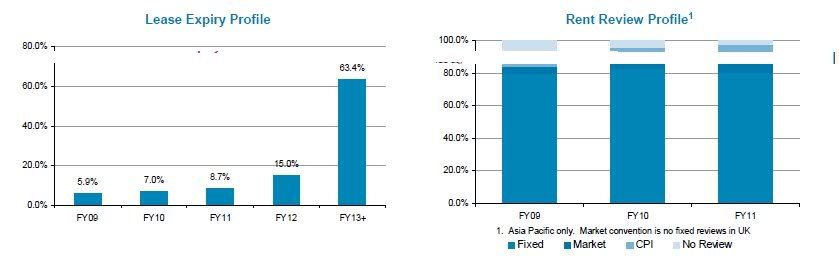

1/ If you look at the below lease expiry and rent review graphs, you will notice that the VAST majority of ther rents expire in 2013. If the credit market does not free up by then, we will have bigger problems than wondering how our shares are performing..

Also, over 80% of their rents reviews are fixed - this is a massive positive!

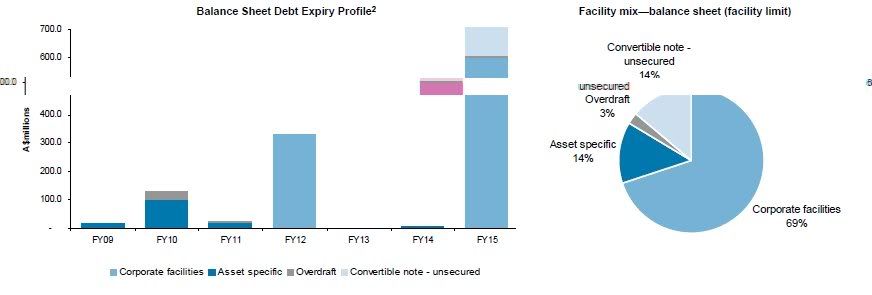

2/ Also they have no corporate debt due until FY 2012

3/ The group balance sheet gearing has increased from 33% to 47% due to asset impairments. Asset values return.

Either somebody knows something I do not, or this is massively oversold.

- Forums

- ASX - By Stock

- VPG

- uk realestate

uk realestate, page-41

-

-

- There are more pages in this discussion • 13 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add VPG (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$1.79 |

Change

0.000(0.00%) |

Mkt cap ! n/a | |||

| Open | High | Low | Value | Volume |

| 0.0¢ | 0.0¢ | 0.0¢ | $0 | 0 |