IMO Great result for Holista, continuing to increase revenues on a quarterly basis and FOCUSING on the CORE BUSINESS

Interesting statistics on the global wellness industry below. Holista is involved in a growing industry and IMO upside is clearly evident by our continual growth and focusing on our core business.

Highlights

• Interim revenue increases by 26% to record a high of $4.5m as 1H22 net loss

improves

• Double-digit growth in the Group’s two largest divisions, Supplements and Food

Ingredients, were the primary drivers for this result

• Continued recovery from the 2020 pandemic expected to carry through to the rest

of the year

• 1H22 growth would have been stronger if not for higher costs and global supply

chain disruptions

• Several growth drivers and easing macroeconomic headwinds place Holista in a

strong position to deliver improved FY22 results over FY21, which was a good

year for revenue

Divisional Performance

Holista’s Dietary Supplement division was the standout in 1H22 as sales increased 34% to

$3.4 million. Easing social restrictions in Malaysia, the increased focus by consumers on

boosting their health and immunity through supplements and Holista’s brand leadership

position in this market have contributed to the division’s good performance.

Further, the recent launch of the Group’s water-soluble vitamin D product, Hydro D,

contributed to the growth of the division and Holista is planning on launching new innovative

supplements over the coming months.

Holista’s Healthy Food Ingredients division also contributed strongly to the 1H22 result even

though delays in shipments to the US weighed on the result. Revenue from the sale of its

low glycaemic index (GI) premix, GI LiteTM, and its sugar substitute, 80LessTM, increased by

30% vs. the pcp to just over $1 million during the period.

Another growth contributor to this division in 1H22 was the receipt of an initial order for GI

LiteTM and 80LessTM from Country Farms Sdn Bhd, which is owned by Malaysian

conglomerate Berjaya Corporation Berhad, in April this year. While the first order was

modest, there are opportunities for Holista to expand its relationship with Berjaya, which

owns several international franchises in Malaysia, including Starbucks and 7-Eleven.Global Wellness Economy

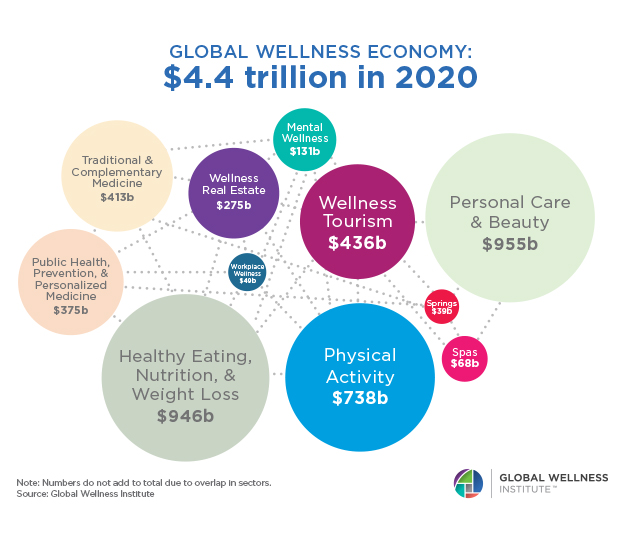

GWI is the first and only organization to conduct comprehensive, objective, and global research on the wellness industry. We first defined and measured the wellness economy and its component sectors in 2014, and these figures are updated and released every 2-3 years in the Global Wellness Economy Monitor. Our most recent report, The Global Wellness Economy: Looking Beyond COVID (released in December 2021), provides data for 2020.

- The global wellness economy was valued at $4.9 trillion in 2019 and then fell to $4.4 trillion in 2020, due to the widespread impacts of the COVID-19 pandemic.

- As we emerge from the pandemic, GWI predicts that the wellness economy will return to its robust growth. We project 9.9% average annual growth, with the wellness economy reaching nearly $7.0 trillion in 2025.

- The wellness economy represented 5.1% of global economic output in 2020.

The wellness economy includes eleven sectors:

- Personal Care & Beauty ($955 billion)

- Healthy Eating, Nutrition, & Weight Loss ($946 billion)

- Physical Activity ($738 billion)

- Wellness Tourism ($436 billion)

- Traditional & Complementary Medicine ($413 billion)

- Public Health, Prevention, & Personalized Medicine ($375 billion)

- Wellness Real Estate ($275 billion)

- Mental Wellness ($131 billion)

- Spas ($68 billion)

- Workplace Wellness ($49 billion)

- Thermal/Mineral Springs ($39 billion)

- Forums

- ASX - By Stock

- HCT

- Ann: Record Interim Revenue and Improved Earnings

Ann: Record Interim Revenue and Improved Earnings, page-6

-

-

- There are more pages in this discussion • 26 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add HCT (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

1.5¢ |

Change

0.000(0.00%) |

Mkt cap ! $4.286M | |||

| Open | High | Low | Value | Volume |

| 0.0¢ | 0.0¢ | 0.0¢ | $0 | 0 |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 443276 | 1.5¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 2.0¢ | 40000 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 443276 | 0.015 |

| 1 | 3000000 | 0.009 |

| 1 | 45000 | 0.005 |

| 0 | 0 | 0.000 |

| 0 | 0 | 0.000 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.020 | 40000 | 1 |

| 0.021 | 425000 | 2 |

| 0.028 | 49999 | 1 |

| 0.029 | 78000 | 2 |

| 0.030 | 22000 | 2 |

| Last trade - 16.12pm 08/11/2024 (20 minute delay) ? |

Featured News

| HCT (ASX) Chart |

Day chart unavailable

The Watchlist

EQN

EQUINOX RESOURCES LIMITED.

Zac Komur, MD & CEO

Zac Komur

MD & CEO

SPONSORED BY The Market Online