After a stellar run in Commonwealth Bank’s (ASX:CBA), where the stock has been acting like something of a safe haven for international and domestic investors, it could be that FY26 brings with it a different story.

CBA has been called overpriced (it’s the world’s most expensive bank stock,) analysts have called the bank’s +44% YoY returns everything from ‘defiant’ to ‘irrational,’ and the stock’s outperformance has gone against pretty much every broker in Australia.

Indeed, Market Index data on Thursday 3 July continues to show that not a single covered broker rates the stock a buy. Ten brokers, however, rate the stock a sell.

And yet – it’s been one of the best stocks to be involved with in recent history.

The reasons, upon closer inspection, aren’t too surprising.

It’s more than likely CBA’s rise in the recent past has been a combined effect of investment outflows from Hong Kong and China, and then in more recent history, the US.

It was well reported earlier this year Trump’s brand of volatility was likely to send more skittish investors rushing to Australia, benefitting from the same psychology that has benefitted European stock markets in recent history (read: a loss of faith in the near-term stability of the US economy.)

And when it comes to Australia, there’s two mammoth companies that dwarf the rest. One is Commonwealth Bank, and the other is The Big Australian (Miner).

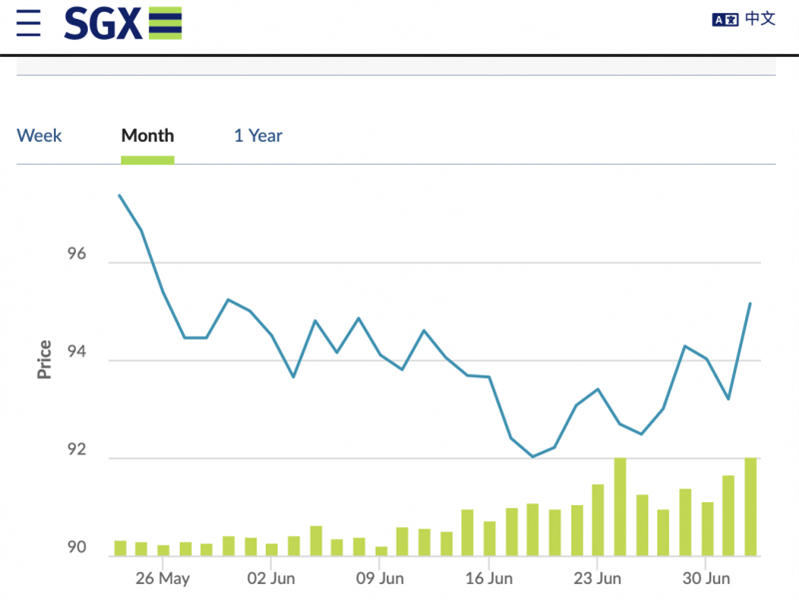

But there’s also something else to consider, which could explain why BHP (ASX:BHP) shares are up approaching +4% on Thursday. And it isn’t just the fact SGX iron ore futures are back above US$95.00/tn.

Great materials rotation?

For many market-watchers, it doesn’t appear CBA has much further to run.

Others, meanwhile, have a more decisive view: they’re expecting a correction for the CBA price.

Worth considering, though, is that a lot of Commonwealth’s gains have come from super funds in recent history.

To be sure, every broker who’s been rating the stock a sell despite it’s clearly attractive 1Y performance are probably hoping the same thing. And it does make a kind of sense that surely, something has to give.

Then again, with the US President taking unprecedented action, it mightn’t be true to say that the market is necessarily being irrational right now.

But with financials driving much of the ASX200’s +10% gains across FY25, and the materials sector being smashed through that period, many are waiting for a re-embrace of the materials sector – namely, BHP – across portfolios small and large.

And it wouldn’t be the first time the Australian market has seen this juggle between BHP and CBA.

It comes down to China

But with China still in the doldrums, it’s likely that the market will only perceive a real risk of CBA investors pulling out of the bank and going back to the miners once Chinese economic data starts to recover.

The question of whether or not it will, however, remains open – something I spoke about in this week’s podcast. The Australian government, in its latest resources quarterly, outlined it expects iron ore to continue to fall.

And with the AUD still under US 70c – where it has sat since February of 2023, when Chinese economic data began flowing again after lockdowns – it could be safer to keep cash in CBA for a while yet.

Join the discussion: See what’s trending right now on HotCopper, Australia’s largest stock forum, and be part of the conversations that move the markets.