I am here pols55.

I gave a new year break. I didn’t feel that I needed to talk while so many BS was going on here. I don’t have time to answer the same crap and accusations all the time. Look at the posters with negative sentiment, most of them are not holding the stock,they are all repeating the same thing, they are all in denial of the facts. They make some assumptions and repeat it all the time.

I do research by the facts. I am an ex-businessman and business analyst. I can understand the need for transforming the business for risk mitigation purpose. That’s the essence of business. But it’s hard to understand and hard to act when you are on that steering wheel. Therefore I am trying to understand the motives which have got NSE management made this “transforming NSE” action. I also have negative thoughts about some facts of this transaction.

I have done my analysis and have come to the conclusion that the EFS is a good move like the Cooper move.

Because;

There is still huge business opportunity in Eagle Fords shales (EFS).

Being a part of such an active area is a right decision IMO. The EFS is considered as a huge proven shale oil factory. I say “factory” because many companies operating in EFS use “manufacturing approach” in their business strategies. I can see this part is the most attractive for our MD Phil who comes from the downstream business.

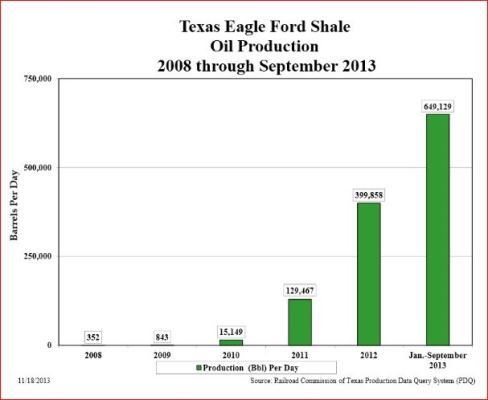

It can be seen easily on the production graph below that oil production is still significantly climbing. It's all about the technology and money invested in the area ($30 billion for Eagle Ford in 2013). Therefore I think there are still opportunities in that factory.

NSE pays a reasonable price for the EFS acreage.

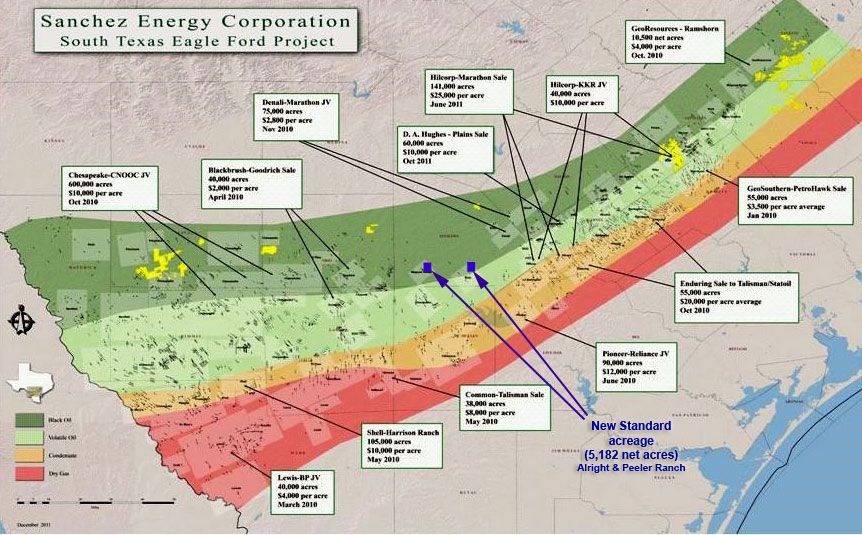

The acreage prices in EFS are still going up, NOT COMING DOWN. We gave many examples of this. I can’t argue about this anymore. US$ 5,300 + $600 commission (by performance shares) looks still cheap to me. DYOR.

See the graphic below. These prices are from 2011. The business (see the production graphics below) has been at least quadrupled since then.

The oil price will go up in the world (IMO).

That will give more advantage and create better IRR (NPV) numbers in the long term.

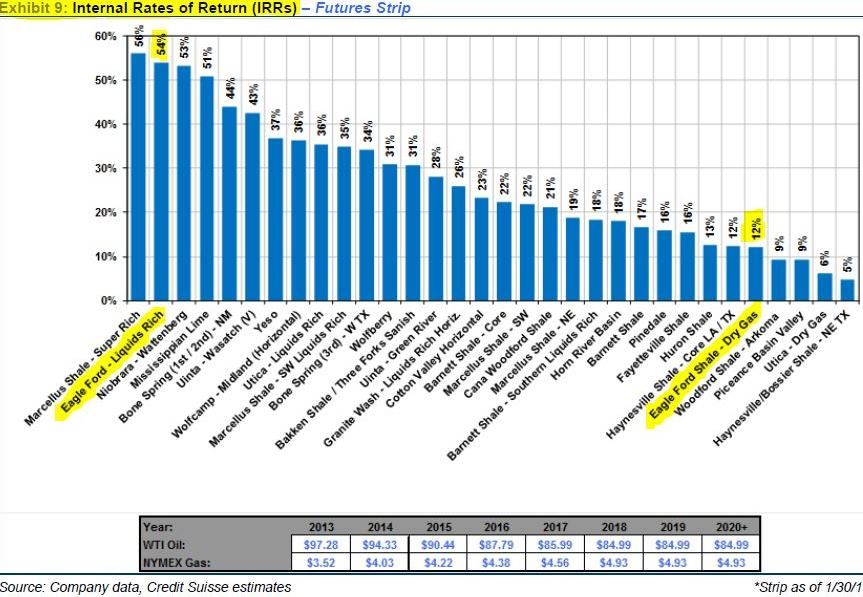

EFS is one of two best shale formation in terms of shale economics (IRR -Internal Rate of Return. It is ave. 54%)

The table below is from Credit Suisse made on 01/01/2013. See the ave. IRR. It is 54%. No need to talk about 10% or 15% IRRs here. Same poster is repeating the same thing again and again here. That’s just crap.

NSE has all of the data under US compliance but they are not allowed to provide that to the market in any form other than that which complies with ASX. They are not allowed to make predictions about future wells in any form.

We need to wait for NSE to convert the reserves, IRR, EUR, etc. data of Eagle Ford acreage converted into ASX compliant data. NSE is in the process of having all the data you are talking about converted into ASX compliant data and it will come out in a week time well before the EGM. (It was also stated on NSE’s anns. “Notice of EGM & Independent Geologist Report” on Dec.20)

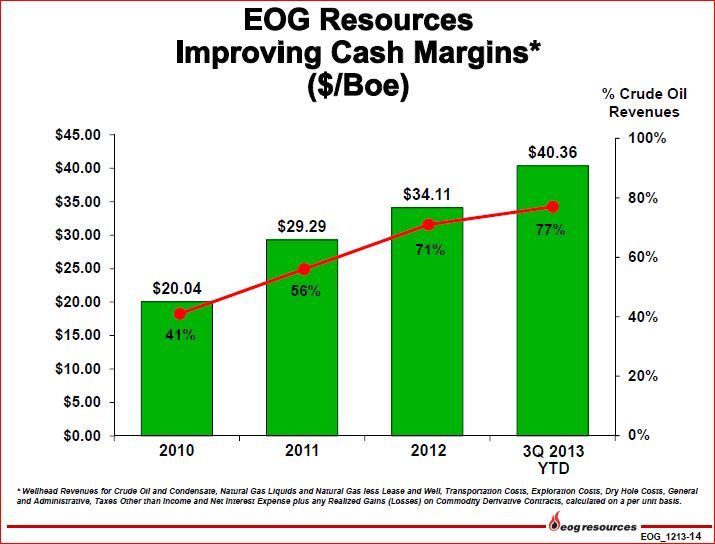

Cash margins are getting better while F&D (Finding & Development) Cost getting lower

It is also very well know that these companies at EFS area make around $40 cash margin per boe in 2013. (Wellhead Revenues for Crude Oil and Condensate, Natural Gas Liquids and Natural Gas LESS Lease and Well, Transportation Costs, Exploration Costs, Dry Hole Costs, General and Administrative, Taxes Other than Income and Net Interest Expense plus any Realized Gains (Losses) on Commodity Derivative Contracts, calculated on a per unit basis.)

Here is the proof from EOG, the biggest shale oil producer of US.

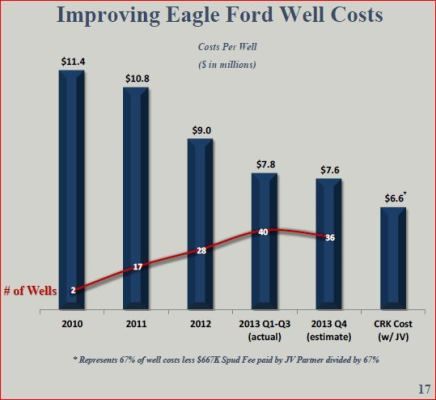

The well costs are going down dramatically in every year because of the improvements in well technology.

The well completion (spud to rig release) time is also being reduced (15-25 days). Therefore NSE's well costs will be much cheaper in the next years.

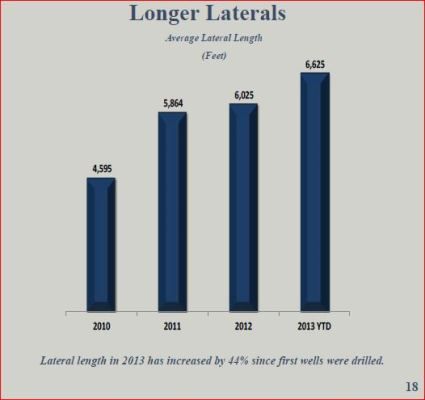

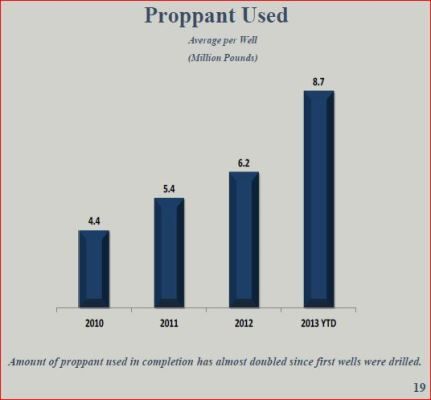

The production technology is getting better by longer horizontal lateral drilling (allows drilling of less wells on the same acreage) and more proppant usage (allows more oil recovery)

The Eagle Ford crude sells at a premium close to Brent price.

That’s another known fact but it was shadowed with a lot of BS here.

However, I still couldn't find a justifiable point for the big money and shares giving to OEH/PFE.

We are definitely giving too much. I can see we are paying a commission for the job we couldn’t do. That's already a negative mark for the management. They should have been doing the same activity which OEH/PFE guys were doing in last 8 months, instead of planning the activities (only Condon-1 though) which they would never do.

And we are giving the control of the company to these guys and MHR. That's another important negative.

Because of these two things I am not in the favour of this transaction yet. I am still at the negative side although I am trying to find the reasonable points behind the transaction.

If OEH/PFE guys could reduce their commissions to a reasonable level, I would be positive on this deal right now.

Add to My Watchlist

What is My Watchlist?