Good article from Matt. Really has gone to a lot of effort.

Matt BohlsenBattery Shortages Are Already A Problem, And Electric Car Waiting Lists Are Becoming The NormJun. 8, 2019 5:00 AM ETBMWYY, BYDDF, BYDDY...

42 Comments18 Likes

Summary- Reports of battery supply constraints in 2019 and electric car waiting lists. Evidence from Tesla, Audi, Hyundai, LG Chem and SK Innovation.

- Bloomberg now says electric cars will be cost competitive with ICE starting from 2022, Deloitte says as of 2021 in the UK and globally by 2022.

- Positive cycle: Cheaper electric cars boost demand ---> higher demand (sales volumes) leads to even cheaper electric cars --> even higher demand for electric cars.

- This idea was discussed in more depth with members of my private investing community, Trend Investing. Get started today »

This article first appeared on Trend Investing on April 30, 2019; therefore all data is as of that date.Electric Car Waiting Lists Are Becoming The NormWaiting lists for electric cars really only started with the launch of Tesla (

TSLA) Model 3 and the

~400,000 order waiting list that quickly followed. This was mostly due to the car being presented as an affordable electric car at a starting price tag of USD 35,000. In more recent times, even the luxury Porsche Taycan has achieved a

20,000 waiting list.

Porsche Taycan already has a 20,000 waiting list

Source

Source: The Drive

On February 19 Evans Electric

tweeted:

Current electric car waiting lists: Hyundai Ioniq EV - 1 year, Nissan Leaf - 10 months, VW eGolf - 8 months, Renault Zoe - 8 months, Kia Soul EV - 6 months, VW eUp - 6 months, BMW i3 - 3 months. There's no lack of EV demand but supply.

Note: The General Motors (

GM) Chevy Bolt also had significant

waiting lists.

The reason for the often long waiting lists has been that car companies cannot make the cars quick enough to meet demand. The bottleneck has mostly been with battery production. Battery production has been constrained due to not enough battery building capacity, and also in some cases with problems sourcing enough battery metals such as lithium, cobalt, graphite and nickel. The latter was evidenced by large price spikes in metal prices mostly in 2016 and 2017. In 2018, we saw enough new supply come online that most EV metal prices fell back, but mostly remain above their long-term averages.

Note: It would also be fair to say some conventional car manufacturers have not really been motivated to sell electric cars, and dealerships even less motivated. This is due to the current lower profit margins, and large reduction in car service revenues that dealerships prefer not to lose.

All of this happened over the past three years as electric car penetration rates rose from 0.88% in 2016, to 1.4% in 2017, and 2.1% in 2018. My key point here is that just a minor increase in market share from 0.88% to 2.1% caused havoc with electric car supply shortages, battery shortages, and some EV metals shortages.

What will happen if we rapidly move to 20% electric car market share by 2025, or perhaps a higher figure such as JPMorgan's forecast of

30% to

35% by 2025. For example, in my model (assumes 20% electric car penetration by 2025), lithium demand would increase

5.1x from end 2018 to end 2025, and cobalt demand would increase

2.6x from end 2018 to end 2025.

Reports of battery supply constraints in 2019Reports of battery supply constraints are continuing to appear, even before electric cars really take off after 2020-22.

On August 12, 2019, Clean Technica

reported:

Electric car growth produces battery shortages, carmakers can’t match production with demand. The earlier than anticipated onset of successful, fairly affordable, long-range electric vehicle [EV] demand has caught both battery manufacturers and car companies by surprise.

On April 22, Green Car Reports

reported:

Battery shortages lead to Audi e-tron production delays. According to a report last week in the

BrusselsTimes, Audi is delaying the production of its planned E-tron Sportback and slowing production of its E-tron SUV following battery shortages from supplier LG Chem.....Waiting lists for the car in Europe have reportedly expanded from 4-5 months to 6-7 months......If it's (Audi) going to fulfill all those dreams, the company will need to secure a large and reliable source of batteries and, if these hiccups are any indication, it still might not have that.

reported:

SK’s EV battery backlog surges on strong demand. South Korea's SK Innovation is struggling to expand production quickly enough to keep up with new orders for electric vehicle [EV] batteries. The firm's order backlog for EV batteries has increased by 30pc to 430GWh since the end of last year alone. The backlog has surged as much as seven fold since the end of 2017 and 13-fold since the end of 2016, the company said today. The 100GWh of orders that were added in just the past few months is equivalent to more than 21 years' worth of production at the company's present capacity.....The announced projects will boost SK Innovation's output to 39GWh/yr by 2022. But it would still take 11 years to work through the current contract backlog based on that level, leaving aside any new orders. SK Innovation has said it plans to boost capacity to 60GWh/yr by 2022, indicating more plants are in the works.

Note: The article also

states: "Carmakers including South Korea's Hyundai Motor have seen their EV sales growth constrained by an inability to procure enough batteries to meet demand."

What the experts are sayingSimon Moores (Benchmark Minerals)

On March 6, 2019, Investing News interviewed Simon Moores of Benchmark minerals, who stated: (

video - 5 minute mark)Nowhere near enough lithium companies are getting funded....The lithium in the pipeline is well behind what is needed.....Auto companies will have to do something drastic......(later)...Something has got to give.

(

video - 16 minute mark)You're going to have supply problems in the next 2 years for these battery megafactories.....The demand is not just there, it is intensifying.....there isn't enough (raw material).

Chris Berry (House Mountain partners)

On March 7, 2019, The Assay

reported an interview with Chris Berry who stated:

A generally tight lithium market for the next three years at least..... The investor disconnect in understanding between demand and spotty supply additions is as stark as any I had seen in the 20 years I was involved in financial markets.

Joe Lowry (Global Lithium)

On March 19, Joe Lowry stated on his

Twitter:

My take on supply & demand. Don't look for a price crash any time soon. Demand is robust. Hard rock and brine both have their place. The "Big 4" $SQM $ALB #Ganfeng #Tianqi will still have over 60% of supply in 2025.

Bloomberg now says electric cars will be cost competitive with ICE from 2022, brought forward from 2025On April 13 Bloomberg

reported:

Electric car price tag shrinks along with battery cost. Choosing an electric car over its combustion-engine equivalent will soon be just a matter of taste, not a matter of cost....The crossover point — when electric vehicles become cheaper than their combustion-engine equivalents — will be a crucial moment for the EV market. The crossover point, per the latest analysis, is now 2022 for large vehicles in the European Union. For that, we can thank the incredible shrinking electric vehicle battery, which isn’t so much shrinking in size as it is shrinking — dramatically — in cost.

reported:

Electric cars cheaper than petrol/diesel from 2022, as battery costs plummet... As soon as 2022, large EVs in the EU will be cheaper than their ICE equivalents... Deloitte's forecast the total cost of ownership for EVs could be on par with ICE equivalents as soon as 2021 in the UK, and globally by 2022.

76 megafactories in process but EV metal shortages will be the next problemThe lithium-ion battery megafactory count was at 66 just three months ago, and is now at

76. No doubt it will soon reach 100. This is the evidence that the supply chain is building up supply to meet surging demand for lithium ion batteries mostly from the electric vehicle sector, but also the energy storage sector.

Year 2014 End 2017 End 2018 April 2019

Number of Megafactories in planning

3265076Source: Benchmark Minerals, and Caspar Rawles

on TwitterAs per the quote below, feeding these megafactories enough, EV metals will be a huge challenge, which even at today's small electric car penetration of 2.1% has proven challenging. A battery megafactory can be built in 1-2 years whereas a new EV metal mine can take five-years plus.

On April 9, Benchmark Minerals Caspar Rawles

tweeted:

MEGAFACTORY UPDATE: the @benchmarkmin Megafactory assessment reached 1713.5GWh of planned capacity by 2028 in the March assessment. Now tracking 76individual plants. At 100% capacity cobalt demand >300k tonnes, lithium, >1.8m, nickel >1m, graphite >2m.

On April 12, Reuters

reported:

Worried about nickel supply, China battery maker BYD (

OTCPK:BYDDY) (

OTCPK:BYDDF) welcomes JV discussions. Securing enough nickel is a major worry for electric vehicle firms, an executive from Chinese electric car and battery maker BYD Co Ltd said on Thursday, adding that the company would welcome joint ventures that help guarantee supply. "The supply of nickel going forward is a big concern in everybody's mind," said Coco Liu, procurement director at BYD, at the Fastmarkets Battery Materials conference.

On April 19 - Andrew Miller tweeted: "

Top tier cathode producers reporting capacity bottlenecks for EV orders."

We are about to enter a positive reinforcement cycle with electric cars getting cheaper and more popularWe are about to enter a positive cycle as I show below:

Cheaper electric cars boost demand ---> Higher demand (sales volumes) leads to even cheaper electric cars ---> Even higher demand for electric cars etc.

Whilst the above positive cycle is just starting now on a smaller scale (E.g.: Tesla Model 3 has sold in bigger volumes than S and X), it should really start to be seen by 2021 and 2022 when we see mass manufacturing of cost competitive electric cars (to ICE cars) by the likes of Volkswagen

(OTCPK:VLKAY) and others. The dot points below also give a good guide as to the likely timing of mass electric car adoption beginning, and the exponential electric car adoption.

Volkswagen predicts EVs will go mainstream in 2022.Volkswagen will soon be the electric car leader from the ICE brigade

Source

Source: Car Buzz

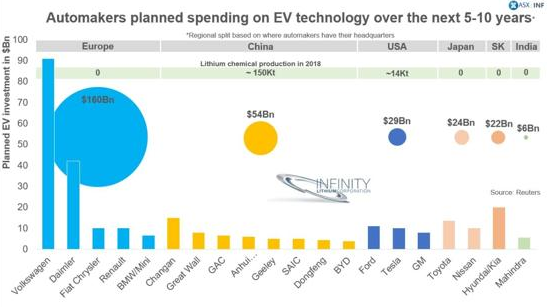

Money committed to EVs by car companies

As the chart below shows, Volkswagen is the clear leader followed by Daimler (

OTCPK DAIF

DAIF).

Source

Source: Infinity Lithium company presentation

Further readingRisks- Political - Governments may reduce or withdraw subsidies. This may have a short-term impact. China does plan to reduce subsidies about 50% in 2019 starting most likely in June. There is also talk of new Chinese subsidies as well as US subsidy extensions.

- Macroeconomic events - A global or China slowdown. Currently China is driving the electric car boom with about 50% of sales.

- Electric car sales and other electric vehicle sales may slow down from the current ~70% growth rate we saw in 2018 for light electric vehicles.

- Oversupply of batteries or the EV metals. Possible in the very short term, but if electric car sales continue to grow very rapidly, then it becomes more likely that we get supply shortages.

- Conventional car makers may stall or delay their electric car production plans. This is the largest risk in my view and has happened already in recent years. China's ZEV credit penalty scheme and Tesla taking market share from the German OEMs has shaken most ICE manufacturers into action. Perhaps Volkswagen, public demand due to cheaper electric cars, and further legislation (aka China's example) will be what drives the next wave of electric car adoption.

OTCPK:HYMLF) and others have had problems sourcing enough batteries. Tesla, Porsche, Hyundai, Nissan (

OTCPK:NSANY), Volkswagen, Renault (

OTC:RNSDF), Kia (

OTCPK:KIMTF), BMW (

OTCPK:BMWYY), and GM have all had waiting lists for their electric cars despite the current high price tags.

By 2020, BNEF forecasts there will be over 289 different models of electric cars, as almost every car manufacturer will offer an electric car variant. This will put a further massive strain on the battery supply chain, and EV metals supply chain.

By 2022 electric cars will be the same cost to buy as a conventional car, up to 10x cheaper to fuel, up to 10x cheaper to maintain, and will last much longer (~3x). The impact of this will cause an unprecedented demand surge. I am forecasting 20% by 2025, but this may prove too conservative. JPMorgan forecasts

30% to

35% of new cars to be electric by 2025.

My view is we are just approaching the beginning of a new era of mass market electric car adoption. The rate of take-up will be exponential, especially from 2022 when an electric car starts to become cheaper than an ICE car. The side effects of this will be ever increasing battery supply constraints and customers on ever increasing waiting lists to buy an electric car.

For investors willing to look beyond the past year of doom and gloom, triggered by short-term oversupply fears and the US-China trade war, the rewards can be immense.

As usual all comments are welcome.