https://seekingalpha.com/article/4272885-buy-uranium-shares-july-15SummaryThe Trump Administration has until July 15 to decide what measures are to be taken regarding uranium.

The Department of Commerce Section 232 proposes a 5% quota of domestically-mined uranium be purchased by nuclear facilities and then yearly increases of 5% with no limit indicated.

US uranium producers stand to benefit from the imposition of quotas and/or tariffs on imported uranium.

The Administration is not required by law to do anything. It could impose quotas and/or tariffs on imported uranium.

If nothing is done, the US will continue to be more than 98% dependent on foreign suppliers of this strategic commodity.

Investors should be paying attention to what the US administration is going to decide regarding uranium imports. At the present time, the US is dependent onforeign suppliersfor over 98% of its demand for uranium. Uranium is a strategic commodity and nuclear energy accounts for over 19% of theelectricity produced in the US.

American domestic production decreased significantly from 2017 to 2018.Uranium production in 2018was only 1.47 Mlbs.

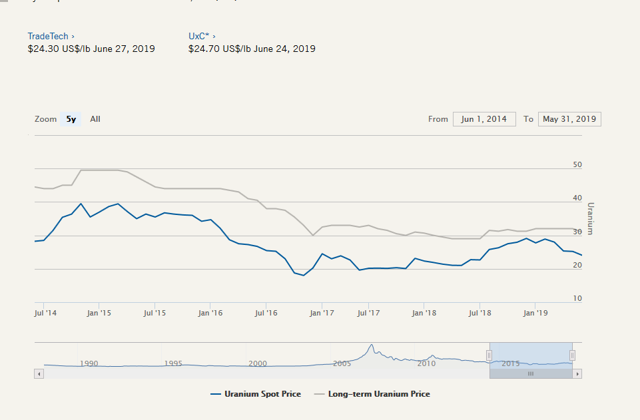

The spot pricefor uranium as of 27 June 2019 was $24.30. The long-term price is just a bit over $30.00.

For American suppliers, import restrictions could potentially mean a US price for uranium of $55 a pound. It is not clear how a two-tier price system could be implemented. The share prices of Energy Fuels (NYSEMKT:UUUU) and Ur-Energy (NYSEMKT:URG) have already benefited from future prospects for a price rise for American suppliers. See below.

Apetitionwas submitted by Energy Fuels and Ur-Energy Inc., and the report of the Department of Commerce was submitted to the President on April 14, 2019. The President has 90 days to make a decision. So the decision should be made by July 15, 2019. The petition requested that US domestic demand should be supplied by domestic companies at least by 25%. The report asks for only 5% initially with increases of 5% annually. At the present time, these figures are not definite as afinal decisionhas yet to be made, and the Administration is still considering what action is to be taken if any. TheBloomberg reportis based on unofficial information.

Annual American uranium consumption by nuclear reactors that supply electricity (104) is about 55 Mlbs. Future forecasts for global uranium demand indicate that mines will have to supply about 90% of the demand by 2020. So the prospects of uranium demand are positive.

The US suppliers, Ur-Energy and Energy Fuels, have production facilities that can be brought into production within 6-12 months. At present, the onlyoperating American millis the White Mesa Mill in Utah. Yellowcake is produced at only seven facilities.

Besides Ur-Energy and Energy Fuels there is another US uranium company, Uranium Energy Corporation (UEC), that has a fully-licensed production facility in Hobson, Texas, which could start production very quickly. UEC also has a fully-permitted project in Reno Creek, Nevada.

Azarga Uranium still has to complete permitting of its Dewey-Burdock project in Colorado. Hearings for the final permits are scheduled for October and November 2019.

The conclusion to be drawn from this brief examination of the US uranium situation is that the stocks of these companies are very interesting. A keen market observer like Heinz Isler is keeping an eye on these companies.

Ur-Energy has made recent stock price gains.

The same is true for Energy Fuels although a bit of profit-taking took the price down somewhat.

UEC has not yet seen a significant rise in price, but this is likely to change once the Administration makes known its decision. This is because the Hobson facility can start production very quickly.

The bottom line is that investors can anticipate the announcement of the Trump administration and buy uranium stocks now or wait until after the announcement and probably pay more for stocks. It is possible that the Administration will decide to impose hefty tariffs as well as put quotas on the percentage domestically-mined uranium to be purchased by nuclear facilities. In any case, it is clear that the uranium supply in the US is an issue of strategic importance and that the US is dependent on foreign countries, including Russia, for its uranium supply. The conclusion is that US uranium producers are very probably going to receive support from the Administration and that their production is going to increase significantly in the very near future. July 15, 2019, is going to be a decisive date for the US uranium industry.

- Forums

- ASX - By Stock

- LOT

- Buy Uranium Shares Before July 15

Buy Uranium Shares Before July 15

-

- There are more pages in this discussion • 8 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add LOT (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

25.5¢ |

Change

0.015(6.25%) |

Mkt cap ! $535.8M | |||

| Open | High | Low | Value | Volume |

| 25.0¢ | 25.5¢ | 24.5¢ | $1.917M | 7.669M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 230221 | 25.0¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 25.5¢ | 197946 | 7 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 2 | 226221 | 0.250 |

| 13 | 887157 | 0.245 |

| 18 | 977473 | 0.240 |

| 19 | 993896 | 0.235 |

| 34 | 1097523 | 0.230 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.255 | 163208 | 5 |

| 0.260 | 373928 | 7 |

| 0.265 | 536381 | 12 |

| 0.270 | 231843 | 8 |

| 0.275 | 63170 | 3 |

| Last trade - 16.10pm 08/11/2024 (20 minute delay) ? |

Featured News

| LOT (ASX) Chart |

The Watchlist

EQN

EQUINOX RESOURCES LIMITED.

Zac Komur, MD & CEO

Zac Komur

MD & CEO

SPONSORED BY The Market Online