Nickel Monthly News For The Month Of July 2019

Jul. 31, 2019 12:31 PM ETAAUKF, AMMCF, AXNNF...1 Comment

Summary

Welcome to the nickel miners news for July. The past month saw nickel prices rise sharply and LME inventories fall again and remain near a ~7 year low. Most other base and EV metals declined but nickel is rising, most likely due to the very low inventory levels and strong demand boosted by the EV sector.

- Nickel spot prices were up sharply in July, and the LME inventory was lower and remains near a 7 year low.

- Nickel market news - Forecasters are generally bullish on the outlook for nickel.

- Nickel company news - Anglo American to return up to $1 billion to shareholders.

- This idea was discussed in more depth with members of my private investing community, Trend Investing. Get started today »

Nickel price news

As of July 25, the nickel spot price was US$6.35/lb, up sharply (13%) from US$5.62 last month.

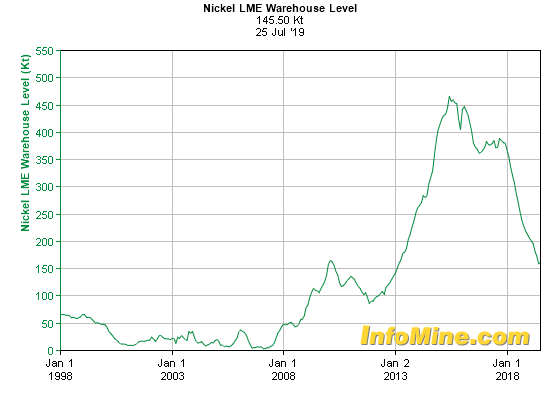

The following charts show that the excess nickel inventories since 2013 have been worked off now and nickel prices are finally starting to respond higher. It may still take a few months to play out, but 2020 should be a good year for nickel (assuming China does ok).

On March 2018 I "Top 5 Nickel Miners To Consider Before The Nickel Boom" stating:

2016 was lithium's year, 2017 was cobalt's year, and 2018-2020 are likely to be nickel's years as nickel inventories decline and nickel prices finally start to rise. Strong Chinese and global stainless steel demand and ever increasing demand from electric vehicles [EVs] using higher nickel content batteries NMC (8:1:1).

InfoMine.com

Nickel 30 year price chart

Source: InfoMine.com

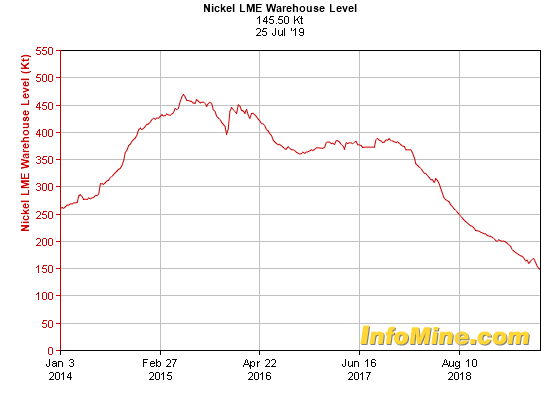

London Metals Exchange [LME] nickel 5 year inventory

The chart below shows LME nickel inventory was lower in July at a ~7 year low.

Source: InfoMine.com

10 year nickel inventory - Nickel at a ~7 year low

InfoMine.com

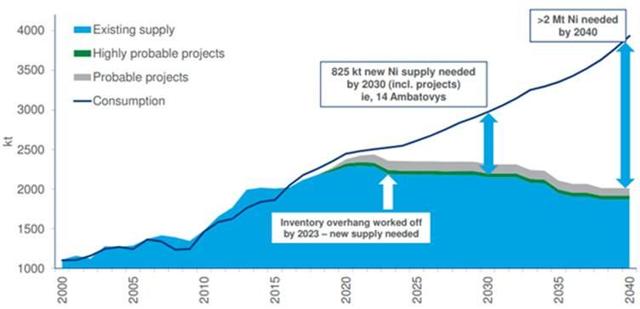

Nickel demand v supply

The chart below shows nickel is forecast to be in deficit after ~2020-2022 (or at least require new supply to come online).

Source: Wood Mackenzie

Note: Some others such as BMI have been forecasting a nickel surplus by 2020 due to increased Indonesian production and reduced Asian demand.

As a reminder the November 2017 McKinsey report stated: "If annual electric vehicle [EV] production reaches 31 million vehicles by 2025 as expected then demand for high-purity class 1 nickel is likely to increase significantly from 33 Kt in 2017 to 570 Kt in 2025." That is a 17 fold increase in just 8 years, albeit only on Class 1 nickel.

Nickel Market News

On July 6 **promotion blocked** Media reported (audio): "Battery materials will bounce back - Benchmark Minerals (Andrew Miller)."

On July 24 Mining.com reported:

Cobalt, nickel, other battery metals face supply crunch by 2020s — report. Growing global demand for batteries that power electric vehicles (EVs) and high tech devices is set to cause a supply crunch of lithium, cobalt and nickel by the mid-2020s, global consultancy Wood Mackenzie predicts. WoodMac expects global sales of EVs to account for 7% of all passenger car demand by 2025, 14% by 2030 and 38% by 2040. Battery pack sizes continue to trend larger through the medium term, resulting in overall greater battery demand. We have seen the first announcements of the commercialization of NMC 811 cells in EVs,” says Gavin Montgomery, WoodMac research director. “We expect to see an increased nickel demand at the expense of cobalt, and to a lesser extent, lithium”. Gavin Montgomery, WoodMac Research Director. Not surprisingly, Montgomery notes, China was the first market mover, but a number of other nations and companies are moving towards mass production of 811 cells before the end the year. The firm also suggests that investment in new nickel projects are needed now as mines can take up to 10 years to develop.

reported:

Nickel cools off as investors settle their nerves. After rallying to one year highs earlier this month on the back of supply concerns, nickel prices have begun to cool off from their summer surge..... “Analysts expect nickel prices to rise in the near-term amid backstopped Chinese demand and tapering supply deficits,” a July commodity forecast report from FocusEconomics reads. “Recent events suggest that demand could stoke price pressures; short-term growth forecasts for China have begun to stabilize and, notably, calmer heads appear to be prevailing in US-China trade talks. As it stands, we see prices edging up through year end and averaging US$12,904 in the fourth quarter.

Nickel Company News

Producers

Vale SA (NYSE:VALE)

Vale plans a US$1.7B Voisey's Bay expansion plan to boost their nickel production.

On July 16, Vale SA announced:

Vale informs on agreement with Minas Gerais Public Ministry of Labor.....From now on, the relatives of the fatal victims of the rupture dam B1 of the Córrego do Feijão Mine in Brumadinho, can be qualified to receive indemnity.

On July 22, Vale SA announced:

Production and sales in 2Q19. Nickel sales volumes were 57,500 t in 2Q19, 14.3% higher than in 1Q19 due to the drawdown of regional inventories partially offsetting the lower production that decreased vs. 1Q19.

On July 23, Vale SA announced:

Vale on the partial return of dry processing operations at the Vargem Grande complex. All operations of the Complex were suspended by ANM on February 20th, 2019, to prevent occasional triggers that could affect dam stability as a result of ongoing activities at the Complex.

Norilsk Nickel (LSX: MNOD) (OTCPK:NILSY)

No significant news for the month.

Investors can read my article "An Update On Norilsk Nickel."

BHP Group [ASX:BHP] (NYSE:BHP)

In 2017 BHP announced a US$43.3m investment in its Nickel West project to enable conversion to nickel sulphate.

On July 23, BHP Group announced:

BHP to invest US$400m to address climate change. BHP today announced a five-year, US$400m Climate Investment Program to develop technologies to reduce emissions from its own operations as well as those generated from the use of its resources. BHP CEO Andrew Mackenzie said: “Over the next five years this program will scale up low carbon technologies critical to the decarbonisation of our operations. It will drive investment in nature-based solutions and encourage further collective action on scope three emissions.”

Jinchuan Group [HK:2362]

No news for the month.

OTCPK:GLCNF) [LSX:GLEN]

On July 24, Glencore announced:

2019 half-year production report. Glencore plc will release its 2019 Half-Year Production Report on Wednesday, 31 July 2019.

Sumitomo Metal Mining Co. (OTCPK:SMMYY)

No significant news for the month.

Anglo American [LSX:AAL](OTCPK:AAUKF)

On July 18, Anglo American announced: "Q2 2019 production report." The company produced 9.8kt of nickel.

On July 25, Anglo American announced: "Anglo American to return up to $1 billion to shareholders."

On July 25, Anglo American announced:

2019 interim results. Sustained business performance delivers 19% increase in underlying EBITDA to $5.5 billion. Mark Cutifani, Chief Executive of Anglo American, said: “We are building on the improvements we have embedded across our business and benefiting from our diversification as stronger prices for certain products more than offset price weaknesses elsewhere, generating a 19% increase in underlying EBITDA to $5.5 billion and a 22% ROCE. The strength of our balance sheet and disciplined capital allocation support our investment in highly attractive organic growth while delivering a 27% dividend increase, in line with our 40% payout ratio, and our intention to return up to $1 billion through a share buyback."

Eramet (OTCPK:ERMAY)

On July 24 Eramet announced: "Eramet: Operational breakthroughs, in an unfavourable price environment in first-half 2019." Highlights include:

Sherritt International (OTCPK:SHERF)[TSX:S]

- "Sales stable at €1,809m, in an unfavourable price environment and factoring in continued delivery delays in the High Performance Alloys division.

- New production records for H1 in manganese ore and alloys, nickel ore, mineral sands concentrates and titanium slag.

- EBITDA down at €307m in H1, adversely impacted by an unfavourable price effect of €144m in the Mining and Metals division.

- Positive earnings before tax of €90m, negative net income–Group share at €37m, mainly due to tax expenses in **on and Norway.

- An operational progress plan that is starting to show success and should deliver results in H2 2019: 2019 production targets confirmed: 4.5 Mt in manganese ore, 1.5 Mt in nickel ore exports; 720 kt in mineral sand concentrates.....

- Factoring in expected operational gains over the year, and with the assumption of market conditions of June 20191, more unfavourable than at the beginning of the year, forecast EBITDA for H2 should be significantly above that of H1, nonetheless leading to full year EBITDA below those of 2018."

OTC:IIDDY)

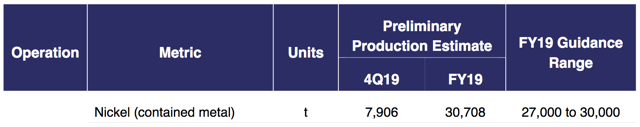

On July 4, Independence Group announced: "Nova operation exceeds fy19 metal production guidance."

Source

On July 5, Independence Group announced: "Fraser Range Project –Earn in and joint venture agreement."

Western Areas Ltd. [ASX:WSA](OTCPK:WNARF)

On July 5, Western Areas Ltd. announced: "Odysseus project update–early works completed on plan and budget."

On July 18, Western Areas Ltd. announced: "Activity report for the period ending 30 June 2019." Highlights include:

On July 19, Western Areas Ltd. announced:

- Unit cash cost of nickel in concentrate of A$2.96/lb and A$2.98 for FY19.

- Mine production of 5,423 nickel tonnes and 23,208 nickel tonnes for FY19.

- Mill production of 5,433 nickel tonnes and 21,675 nickel tonnes for the FY19.

- Highest quarter nickel sales of 5,890 nickel tonnes and 21,483 nickel tonnes for full year.

- Strong free cashflow lifting cash at bank by A$27.6m to A$144.3m (March quarter A$116.7m).

- Odysseus early works completed on time and on budget.

- Kidman proposed change of control transaction expected to realise A$33.1m for Western Areas."

Offtake agreement for high grade nickel sulphide product. Western Areas Ltd is pleased to announce an offtake sale and purchase agreement (“Contract”has been executed with Sumitomo Metal Mining Co., Ltd. [SMM], a major Japanese mining and refining conglomerate, for delivery of premium high-grade nickel sulphide precipitate [NSP] being produced at the Company’s Mill Recovery Enhancement Project [MREP] located at the Forrestania Nickel Operation. The NSP product is a new high-grade product stream (grading 45% -50% nickel), separate from the Company’s conventional nickel sulphide product (which grades ~14% nickel) supplied under existing offtake contracts with Tsingshan and BHP Billiton Nickel West. The Company has been supplying SMM with the product on a spot sale basis for many months.

OTCPKANRF)

Panoramic's Savannah mine and mill has a forecast life of mine average annual production rate of 10,800 t of nickel, 6,100 t of copper and 800 t of cobalt metal contained in concentrate.

On July 2, Panoramic Resources announced: "Sale of Thunder Bay North project for $9million [CAD]."

On July 11, Panoramic Resources announced: "Preliminary June 2019 quarterly statistics." Highlights include:

RNC Minerals [TSX:RNX] (OTCQX:RNKLF)

- "Development–869m, up 38% on the previous quarter.

- Ore Milled–140,806t at 1.27%Ni, 0.64% Cu and 0.06% Co, up 15% on the previous quarter.

- Metallurgical Recoveries –84.8% Ni, 91.1% Cu and 88.2% Co, Ni recovery up 19% on the previous quarter.

- Metal Production–1,518t Ni, 814t Cu and 80t Co in concentrate, Ni up 64% on previous quarter.

- Concentrate shipped–21,467dmt, up 68% on the previous quarter.

- Savannah North Development–improvement in twin decline and raise bore advance rates.

- New Equity–1 for 13 pro-rata rights issue and placement to Zeta raised $17.4M before costs.

- Lanfranchi–Black Mountain paid $1.5M to settle the outstanding balance of purchase price early.

- Group Cash–$26.6M in available and restricted cash."

On July 11, RNC Minerals announced: "RNC Minerals files Dumont nickel-cobalt project updated feasibility study."

On July 18, RNC Minerals announced: "RNC Minerals announces that Mark Selby has resigned as President and CEO; Paul Andre Huet, Executive Chairman has been appointed as Interim CEO."

Axiom Mining [ASX:AVQ] (OTC:AXNNF)

No significant news for the month.

Other nickel producers

Franco/Nevada [TSX:FNV], MMG [HK:1208], South32 [ASX:S32], Lundin Mining [TSX:LUN], Nickel Asia Corporation [PSE:NIKL] (OTC:NIKAY).

Note: First Quantum Minerals halted their nickel production from their Ravensthorpe mine in 2017 due to low nickel prices.

Nickel juniors

Poseidon Nickel [ASXOS] (OTC

SDNF)

On July 23, Poseidon Nickel announced: "Quarterly Report to 30 June 2019." Highlights include:

On July 25, Poseidon Nickel announced: "Drilling at Silver Swan successfully completed. Updated mineral resource estimate now underway for August delivery." Highlights include:

- "First stage of decline refurbishment completed.

- First Eight holes at Silver Swan intersected high grade massive sulphides.

- Silver Swan hole PBSD006A intersected high grade massive sulphide ore outside the current resource shape (15.15m @ 8.64%-True width 3.5m).

- Black Swan disseminated-PBSD001A & PBSD002 intersected 223.1m @ 1.02%Ni (80m true width) & 289m @ 0.62% Ni (true width of 75m) respectively, at 900m below the Black Swan Open Pit.

- Investigations to de-risk the mine’s operational systems completed with successful outcomes."

Garibaldi Resources [TSXV:GGI] [GR:RQM] [LN:OUX6] (OTC:GGIFF)

- 3,662m of diamond drilling completed at the bottom of the Silver Swan decline has met both strategic objectives of the drilling campaign: Inferred Silver Swan resource de-risked, set for updated estimate in early August. Strategically placed step out holes prove the Silver Swan mineralisation extends beyond existing resource boundaries.

- Updated resource estimate and extension of known resource boundaries will support finalisation of planning for restart of nickel operations at Black Swan over coming 9-12 months."

No news for the month.

Cassini Resources [ASX:CZI]

No nickel related news for the month.

North American Nickel [TSXV:NAN]

No news for the month.

Amur Minerals Corp. [LSE:AMC] [GR:A7L] (OTCPK:AMMCF)

No news for the month.

Sama Resources [TSXV: SME] [GR;8RS] (OTCPK:SAMMF)

No news for the month.

Cobalt27 Capital Corp. [TSXV:KBLT] [GR:27O][LN:OUPZ] (OTC:CBLLF)

Cobalt27 is a listed investment company that offers unique exposure to a portfolio of cobalt and nickel assets - Cobalt metal, cobalt royalties and direct cobalt/nickel properties, and one lithium royalty. Cobalt27 owns 2,905.7 tonnes of cobalt.

On July 24 Cobalt27 Capital Corp. announced:

Cobalt 27 files NI 43-101 technical report on the producing Ramu Nickel-Cobalt project. Cobalt 27 Capital Corp. is pleased to report it has filed a technical report for its recently acquired interest in the low-cost, long-life, Ramu nickel-cobalt operation (“Ramu”, prepared in accordance with National Instrument 43-101-Standards for Disclosure for Mineral Projects (“NI 43-101”

. The Ramu Technical Report is in support of the Company’s May 17, 2019 news release announcing the acquisition of Highlands Pacific Limited, whereby Cobalt 27 acquired an 8.56% joint venture interest in Ramu, an integrated producing nickel-cobalt operation, located in Madang Province, Papua New Guinea. Anthony Milewski, Chairman and CEO of Cobalt 27, commented, “We are excited to be releasing additional information on the Ramu asset so that investors can better understand the world-class nature of this operation and the nickel and cobalt exposure it provides to investors. Ramu is a first-quartile project on the global nickel cost-curve, has an extensive mine life, with potential to deliver 30+ years, and compelling exploration upside. The hydroxide product produced at Ramu is optimal for electric vehicles and battery storage markets, in fact already being sold to battery makers, enhancing shareholders’ nickel exposure at a time when global inventory levels are approaching levels not seen since the end of 2012, when nickel was trading at approximately US$8 per pound, on average.”

Note: Last month's news was "Pala Investments to Acquire Cobalt 27 for C$501 Million; Creation of Nickel 28. Offer of C$5.75 per share, comprised of C$3.57 in cash plus C$2.18 in shares of the newly established Nickel 28."

- Forums

- ASX - By Stock

- AUZ

- Nickel news

AUZ

australian mines limited

Add to My Watchlist

7.14%

!

0.8¢

!

0.8¢

Nickel news, page-565

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

0.8¢ |

Change

0.001(7.14%) |

Mkt cap ! $12.83M | |||

| Open | High | Low | Value | Volume |

| 0.7¢ | 0.8¢ | 0.6¢ | $276.3K | 39.67M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 14 | 6286393 | 0.7¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 0.8¢ | 18828269 | 16 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 11 | 5236393 | 0.007 |

| 33 | 32453326 | 0.006 |

| 8 | 2746069 | 0.005 |

| 5 | 2881000 | 0.004 |

| 4 | 3300000 | 0.003 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.008 | 17148757 | 13 |

| 0.009 | 6667323 | 14 |

| 0.010 | 6641595 | 12 |

| 0.011 | 4422100 | 12 |

| 0.012 | 2228215 | 10 |

| Last trade - 15.58pm 11/07/2025 (20 minute delay) ? |

Featured News

| AUZ (ASX) Chart |

The Watchlist

VMM

VIRIDIS MINING AND MINERALS LIMITED

Rafael Moreno, CEO

Rafael Moreno

CEO

SPONSORED BY The Market Online