...the Fed is trying to reign in repo liquidity (in a manageable way) , a little late but lets try out luck, but its still QE4ver .

A protracted QE will soon become a necessity for the markets to remain bouyant but its initial elixir qualities would start waning over time.....just like interest rates.

The truth is that the Fed first priority is to safeguard the bank and its financial system, the economy is not its top priority - and so we have it, a "healthy" propped up market but struggling economy and consumers trying to make ends meet. And they're throwing more good money (future generations would need to pay for) after speculative capital with little of it flowing into main economic activity. And this.....essentially is what the Trump vs Sanders fight will be about.

Liquidity Warning: Fed Shrinks Overnight Repos By $20BN, Term Repos By $10BN

ZeroHedge

Thursday, February 13, 2020 5:28 PM EST

With everyone (grudgingly or otherwise) now admitting that the Fed's repo and QE4 was responsible for the miraculous surge in stocks since the start of Q4 2019 (with the occasional exception of a handful of idiots), traders were especially focused on today's latest release of the next monthly schedule of repo operations to see if the Fed would, as Powell hinted before Congress, continue shrinking reducing the liquidity injection via repo. And sure enough, that's precisely what happened when the NY Fed announced that starting next week, the term repo, which this month dropped from a max of $35BN to $30BN, would be reduced by another $5 billion to $25 billion and that starting in March, term repos would be reduced by another $5 billion to just $20BN.

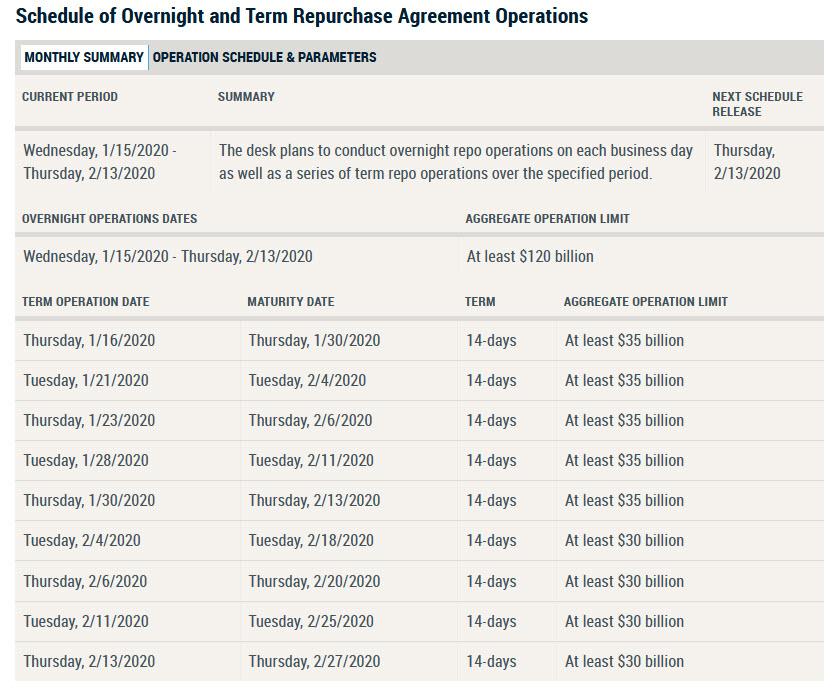

As a reminder, this is the schedule the Fed posted a month ago:

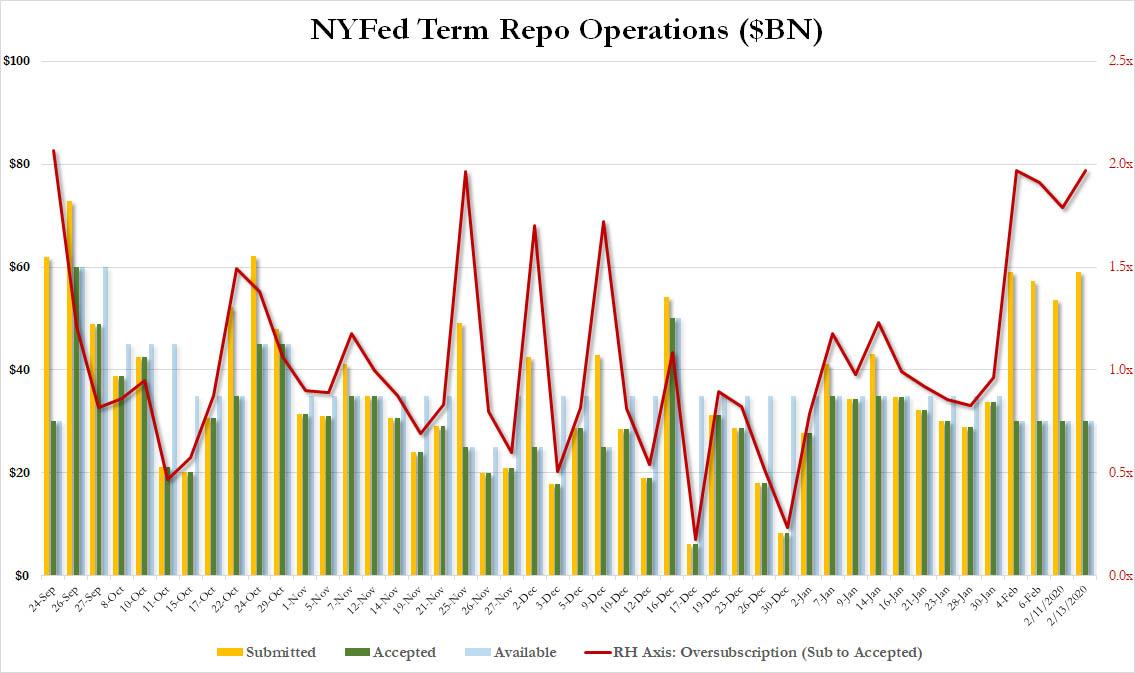

Additionally, as shown in the latest schedule below, the New York Fed announced that the maximum size of overnight repos would also shrink from the prior limit of $120 billion to $100 billion, resulting in a substantial decline in the maximum available liquidity at a time when the Fed's last four-term report have already been 2x oversubscribed, hinting at another liquidity shortage among dealers in a time when there should be no funding stress.

(Click on image to enlarge)

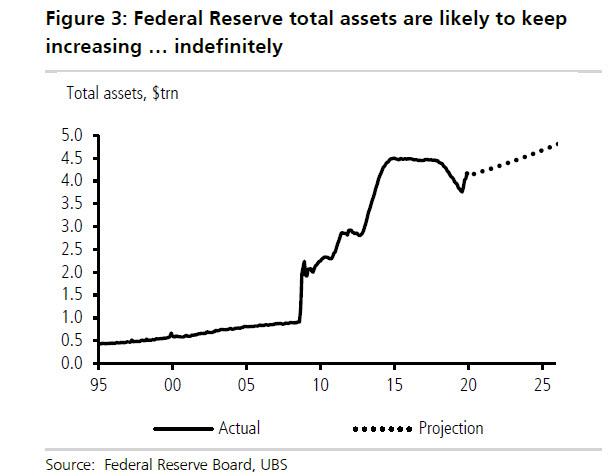

Then again, on net the total liquidity will actually increase as in March the Fed will inject at least another $60BN in liquidity via T-Bill monetizations courtsy of "NOT QE 4", and then another $60BN in April, and so on. In other words, while a modest repo shrinkage continues, this will be more than offset by permanent open market operations which will see the Fed continuing to grow its balance sheet, in the words of UBS, "indefinitely".

- Forums

- ASX - General

- Its Over

Its Over, page-2116

Featured News

Featured News

The Watchlist

EQN

EQUINOX RESOURCES LIMITED.

Zac Komur, MD & CEO

Zac Komur

MD & CEO

SPONSORED BY The Market Online