Overnight saw US market's early strong rally on Goldman Sachs beat (both revenues and EPS) fizzled out. The Dow rallied 788pts before closing 215pts down , the S&P500 failed for the third time at the 3900, rising to 3902 or 1% intraday before closing down -0.84% to 3830. The Nasdaq likewise closed -0.81% lower. Goldman surge 5.9% intraday but retraced to close 2.51% up on the day on closer look at their results (they lost US$2.6B over the past year on their stock trading) and on news they would slow hiring. Apple's revelation that it would slow hiring impacted market sentiment. Goldman's better results had limited effect on XLF's -0.38% close.

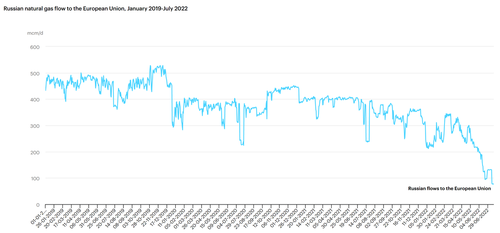

But the big news was Gazprom's indefinite cessation of gas supply to Germany's Uniper on force majeure reason (see article below) reinforcing fears that Putin would proceed to cut gas supply to Europe on the key July 22 date (Friday). DXY which went to a low of 106.89 bounced on the news to 107.4 , driving Brent Oil past $100 to $105.80. XLE closed +2.29% higher. Gold equities initial strong start fizzled as the DXY rose , with GDX and GDXJ +0.47% and 1.13% respectively. Gold is at $1707 from $1714.

As I mentioned yesterday, it is all easy to get BLINDSIDED with this bear market rallies. There are just too many negative developments out there. But if there's one thing that tells me the bottoming process is not in yet, it is that FOMO exuberance remains well and alive. The hope vs despair tussle continues until we get past the fog to the other side.

MARKET WRAP

Stocks/bonds reversed earlier strength/weakness after Bloomberg reports on Apple (AAPL) cooling its hiring hit the broader risk tone. Desks point to the lack of liquidity amplifying the tape to such headlines, although Apple was not alone after Goldman (GS) said it would be slowing its hiring too, while CNBC said year-end job cuts are also on the table at the bank. The data slate was very light aside from the July NAHB housing index falling deeper than expected, indicative of the well-documented housing slump. Bank of America (BAC) and Goldman Sachs (GS) earnings continued on the better-than-feared momentum from last week. Across the pond, the outlook for European growth and ECB pricing is facing an inflexion point awaiting a decision on the Nord Stream 1 pipeline, with fears rising Monday after reports Gazprom had declared a force majeure to various European customers from July 14th onwards. JPM reckon that if the pipeline remains shut, that could limit the ECB from hiking beyond 0.25% by year-end, as opposed to 1% (where markets are currently priced) if the pipeline resumes operations.

US

NAHB HOUSING MARKET: NAHB housing market index fell to 55.0 in July, its lowest since May 2020, from 67.0, way beneath the expected 65.0. Looking into the report, Pantheon Macroeconomics note, “homebuilders have been in denial about the extent of the drop in demand, despite mortgage applications falling by more than a quarter over the first half of the year, with no end in sight to the decline. Now, they are acknowledging reality. Buyers are disappearing in the face of the surge in rates, and inventory is too high." As such, the supply of existing homes is now going higher, allowing buyers a choice for the first time since the initial pandemic fall in sales. Looking ahead, PM adds, "sales have much further to fall, and home prices will follow volumes. Pretty soon, anyone who has bought a home in recent months will be sitting on a loss.”

Gazprom Declares Force Majeure, Will Halt Gas Flows To Germany Indefinitely

BY Zero Hedge

MONDAY, JUL 18, 2022 - 10:51 PM

Already days before the July 22 European "Doomsday" when the scheduled Russian 10-day maintenance of the crucial Nord Stream pipeline to Germany is slated to end - but which was thrown into deep doubt given Gazprom recently said it can no longer guarantee its "good functioning" due to crucial turbines being previously held up in Canada related to sanctions - the Russian energy giant has declared Force Majeure to one major European customer.

Simply put, Gazprom declared extraordinary and extreme circumstances to void itself from all contractual obligations to this customer, thus the gas will stop flowing indefinitely, as Reuters reports in a breaking development Monday, "Russian gas export monopoly Gazprom has declared force majeure on gas supplies to Europe to at least one major customer starting June 14, according to the letter seen by Reuters." The letter is dated July 14. "It said the force majeure measure, a clause invoked when a business is hit by something beyond its control, was effective from deliveries starting from June 14," writes Reuters.

The letter invoked "extraordinary" circumstances outside the company's control, Reuters continues, citing a source saying the customer in question is Germany via the Nord Stream 1 pipeline.

And Bloomberg is also confirming:

- GAZPROM SENT FORCE MAJEURE NOTICE TO AT LEAST 3 BUYERS

- GAZPROM FORCE MAJEURE NOTICE APPLIES TO FLOWS FROM JUNE 14

- UNIPER SAYS IT HAS RECEIVED LETTER FROM GAZPROM EXPORT IN WHICH COMPANY RETROACTIVELY CLAIMS FORCE MAJEURE FOR PAST AND CURRENT SHORTFALLS IN GAS DELIVERIES

- UNIPER: WE CONSIDER THIS TO BE UNJUSTIFIED AND HAVE FORMALLY REJECTED FORCE MAJEURE CLAIM

As we've been detailing, German authorities have of late taken unprecedented steps in anticipation of an enduring Russian gas halt, essentially dimming the lights across the country - which has included everything from limiting hot water, to shutting down swimming pools, to quite literally dimming city street lights as it entered "alarm" stage over dwindling supply.

And as demonstrated in the Monday morning oil price spike (below: WTI crude futures for September), the bid for oil will remain strong the longer the force majeure holds, given utility companies and the manufacturing sector are likely to seek transition to oil from gas...

It seems this letter declaring its legal release from supply obligations going back to June 14 is in preparation for definitive action on July 22, namely that the pipeline's operations are likely to remain suspended past the scheduled reboot/supply back online designated date.

In an analysis from earlier this month (available to pro subscribers), UBS economists laid out a detailed vision of what they see happening if Russia halts gas deliveries to Europe: It would reduce corporate earnings by more than 15%. The market selloff would exceed 20% in the Stoxx 600 and the euro would drop to 90 cents. The rush for safe assets would drive benchmark German bund yields to 0%, they wrote.

“We stress that these projections should be seen as rough approximations and by no means as a worse-case scenario,” wrote Arend Kapteyn, chief economist at UBS.

“We could easily conceive economic disruptions that lead to more negative growth outcomes.”

To be sure, markets are already pricing in some of the damage beginning with the euro which starting this month traded at a fresh two-decade low and touched parity with the dollar, something it hasn't done since 2002.

Meanwhile the Paris-based International Energy Agency (IEA) is still even amid this "red alert crisis" for Europe bizarrely focused on responding to the emergency in a way "consistent with the EU’s climate ambitions"... this as Germany and other European populations are about to clearly enter an extremely difficult winter, to put it mildly.

From a fresh IEA report: After many months of warning signs, Russia’s latest moves to squeeze natural gas flows are a red alert for the EU - a snippet of which is below...

* * *

The world is experiencing the first truly global energy crisis in history. And as the International Energy Agency has been warning for many months, the situation is especially perilous in Europe, which is at the epicentre of the energy market turmoil. I’m particularly concerned about the months ahead.

The gas crisis in Europe has been building for a while, and Russia’s role in it has been clear from the beginning. In September 2021 – five months before Russia’s invasion of Ukraine – the IEA pointed out that Russia was preventing a significant amount of gas from reaching Europe. We raised the alarm further in January, highlighting how Russia’s large and unjustified reductions in supplies to Europe were creating “artificial tightness in markets” and driving up prices at exactly the same time as tensions were rising over Ukraine.

After Russia invaded Ukraine on 24 February, nobody in Europe or elsewhere could be under any illusions about the risks around Russian energy supplies. Just a week after the invasion started, the IEA released our 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas, setting out the practical actions Europe could take. It stressed the need to maximise gas supplies from other sources; accelerate the deployment of solar and wind; make the most of existing low emissions energy sources, such as renewables and nuclear; ramp up energy efficiency measures in homes and businesses; and take steps to save energy by turning down the thermostat.

- Forums

- ASX - General

- Its Over

Its Over, page-13723

-

- There are more pages in this discussion • 10,526 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)