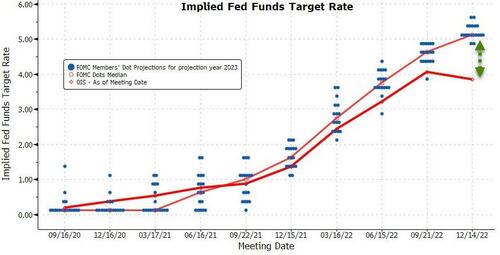

What Wall St had expected did not materialise as Powell persisted with the 'higher for longer' message and in fact indicated that there would be no rate cuts next year and that while projecting higher terminal rates at 5.1pc next year also did not rule out requiring to raise them if necessary. So Wall St had to re-calibrate their expected dot plot once again but it wasn't enough to spook the market big time. Equities took a sharp fall into the conference call from an earlier bullish start and see-sawed with little to show for at the end of the session. At the close, Dow dropped -142pts to 33,966 , the S&P500 dipped -0.61% to just below 4k at 3995 while Nasdaq -0.76% to 11170.

The reason that explained why the market was not spook is probably because Fed chairman Jerome Powell said the US economy could still avoid a recession and that a soft landing was still achievable, especially if inflation continued to fall.

“I don’t think it would qualify as a recession because you have positive growth. It’s slow growth, it’s below trend, it’s not going to feel like a boom,” Mr Powell said, “I don’t think anyone knows whether we are going to have a recession or not.”

It is quite clear the market only want to listen to the part they want to listen, the Fed's action to stay resolutely hawkish to keep rates high over 2023 is more likely to tilt the US economy into recession, it is only a question of when - at the end of Q2 or towards Q3-Q4 of next year.

The Fed's dot plot remains higher than what the futures suggest.

DXY took a bid during the conference call but whimpered to close at 103.5 down -0.4% as 10yr yield also slumped -0.73% to 3.48pc after rising to 3.56pc earlier. Despite that Commodities, with exception of Oil, was rather muted. spot Gold fell $3 to $1807 , Silver +0.8% to $23.89, Copper +0.4%. GDX fell -0.44% while GDXJ -1.04%. WTI Crude gained +3% to $77 but XLE dipped in late session by -0.65%. Lithium stocks were markedly lower, LIT -1.12%, ALB -5.38%, SQM -4.2%, LAC -1.24% and PLL -2.03%.

We'll see what happens tonight with the big options expiration day. And some time for the market to digest the implications of the Fed's projections.

My take is that the market is in denial. Interest rates may stop rising by mid next year but it is inconceivable that businesses can continue growing when the tightest of monetary conditions remain (based on the Fed's plan) throughout 2023.

Another Big Reversal FOMC Day: Markets Call Hawkish Fed's Bluff

BY Zero Hedge

THURSDAY, DEC 15, 2022 - 08:00 AM

The day started off with a drop in import and export price inflation. But that was just a side-show as stocks limped higher into the main event.

Then The Fed and Powell's presser smashed the vase of fantasy on the ground of reality with a hawkish statement and projections and an even more hawkish Powell.

- POWELL: LABOR MARKET REMAINS EXTREMELY TIGHT

- POWELL: A RESTRICTIVE POLICY STANCE LIKELY NEEDED FOR SOME TIME

- POWELL: NEED SUBSTANTIALLY MORE EVIDENCE OF LOWER INFLATION

- POWELL: FED STILL HAS SOME WAYS TO GO ON RATE HIKES

- POWELL: STANCE ISN'T YET RESTRICTIVE ENOUGH EVEN W/ TODAY'S MOVE

- POWELL: NO RATE CUTS UNTIL CONFIDENT INFLATION MOVING TOWARD 2%

- POWELL: WILL HAVE TO HOLD RESTRICTIVE RATES FOR SUSTAINED TIME

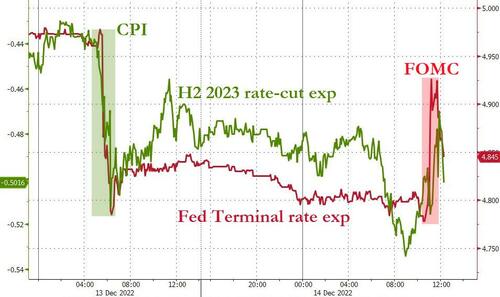

All of which sent rate-hike expectations surging, but they gave back some of that hawkishness as Powell spoke...

Source: Bloomberg

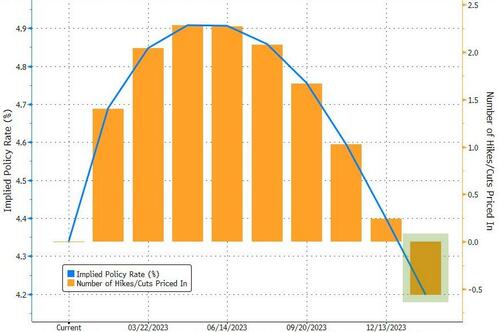

The market is now pricing in rates being lower than current rates by Jan 2024...

Source: Bloomberg

The market is not buying what The Fed is selling...

Source: Bloomberg

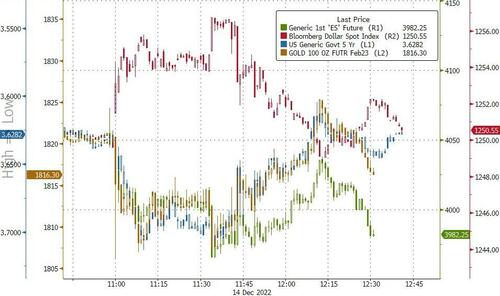

The markets did their usual thing - jerking one way on the statement, then swinging all the way during the press conference which was as usual full of contradictions...

...but markets grabbed on the remote possibility of The Fed adjusting its inflation target: Bloomberg's David Wilcox explained:

“At the presser, Powell slaps down any notion of rethinking the 2% inflation target any time in the foreseeable future. Implicitly, he leaves open the possibility of revisiting the target down the road -- perhaps at the next ‘framework review’ due to be concluded in about 2025, or perhaps the one after that. In other words, not until WAY down the road.”

Neil Dutta at Renaissance Macro agreed:

Powell even saying that there could be a “longer-run project” in looking at the inflation target is “dovish”

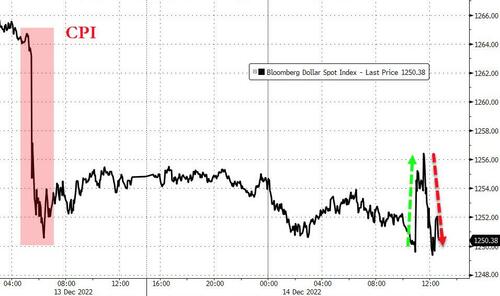

And that, along with Powell saying that we are 'getting close to sufficiently restrictive rates level" seemed to reverse everything. The Dollar spiked as everything else dumped initially; then Powell started speaking and the dollar dropped and everything else rebounded...

Simply put - the market is calling The Fed's hawkish bluff.

Stocks ended lower after dumping and pumping. Nasdaq underperformed (swinging from +1% to -1.5%) but the moves by the close were not by any means significant...

The S&P started the day back above the 200DMA, but fell back below it on the FOMC...

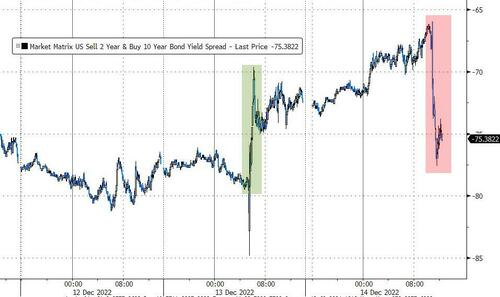

Treasury yields mostly ended the day lower in yields, despite spiking initially on the FOMC statement. The short-end notably underperformed however (2Y +2bps, rest of curve down 1-2bps)...

Source: Bloomberg

Which flattened the yield curve significantly...

Source: Bloomberg

The odds of a 50bps hike in Feb popped and dropped (now at just 25%), while the odds of a March 25bps hike rose to 60%. There's a 76% chance that The Fed will not hike in May...

Source: Bloomberg

The dollar initially rebounded on the FOMC statement then reversed on Powell's comments...

Source: Bloomberg

Bitcoin ramped back above $18,000 ahead of The Fed then was slapped back below it...

Source: Bloomberg

A huge crude build knocked oil prices (briefly), but the machines wanted it higher and so WTI topped $77 (one week highs)...

Gold initially tumbled on the FOMC statement then bounced back...

Finally, and perhaps most notably today, Powell was asked about the decoupling between financial conditions and the tightening of policy rates...

Source: Bloomberg

His response was and umm-ahh but he finally admitted that it is important that financial conditions reflect policy restraint.

“The Fed’s actually pretty hawkish here,” Former Federal Reserve Bank of New York President Bill Dudley says. He also draws attention to that (diplomatically phrased) comment from Powell at the start about the need for financial conditions to reflect Fed tightening action.

“If markets ease financial conditions, the implicit notion there was that just means we’re going to have to do more to make financial conditions tight.”

So what do you think that means for credit spreads, stock prices, and bond yields?

- Forums

- ASX - General

- Its Over

Its Over, page-15852

-

- There are more pages in this discussion • 8,061 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

TON

TRITON MINERALS LTD

Adrian Costello, Executive Director

Adrian Costello

Executive Director

Previous Video

Next Video

SPONSORED BY The Market Online