I found this interesting.,,,

Citi staying in front of the curve….

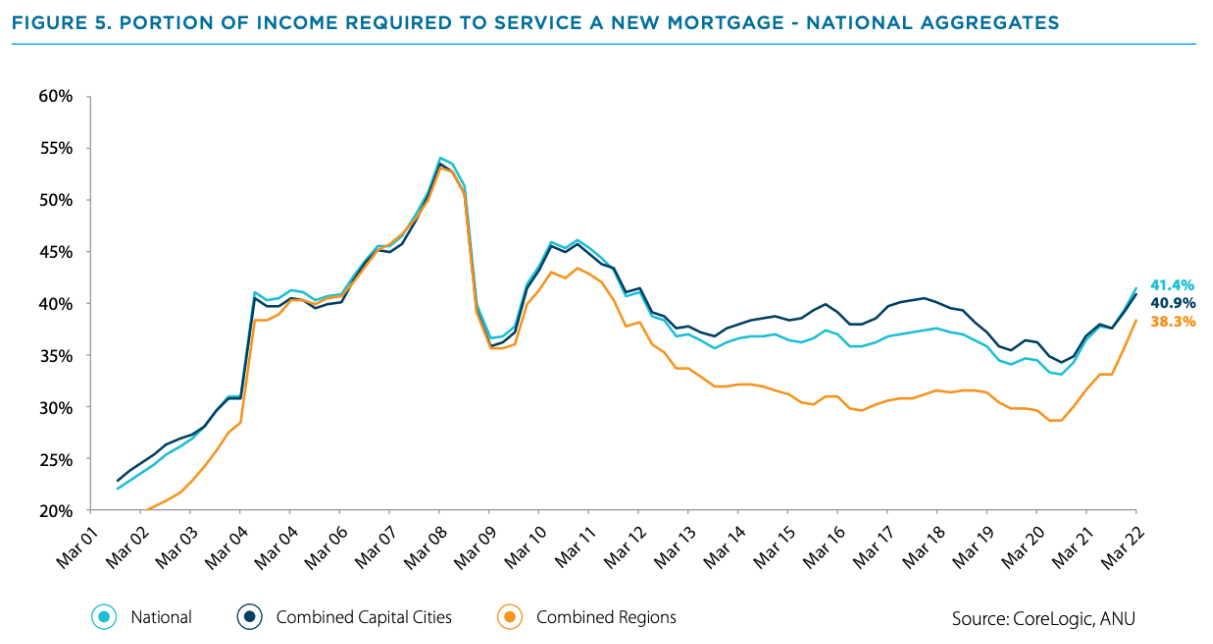

The trouble with housing: Interest rates were increased at a ninth straight meeting earlier this week. For a million-dollar loan, the increase since May 2022 in repayments is now $1,816. And with the RBA arguing more interest rate increase(s) are needed, it sounds like they are getting hawkish right at a time when many other central banks are pondering or discussing the opportunity for a step-down. But the reality is - they’re going to have to keep going especially when charts like this keep trending in the wrong direction.

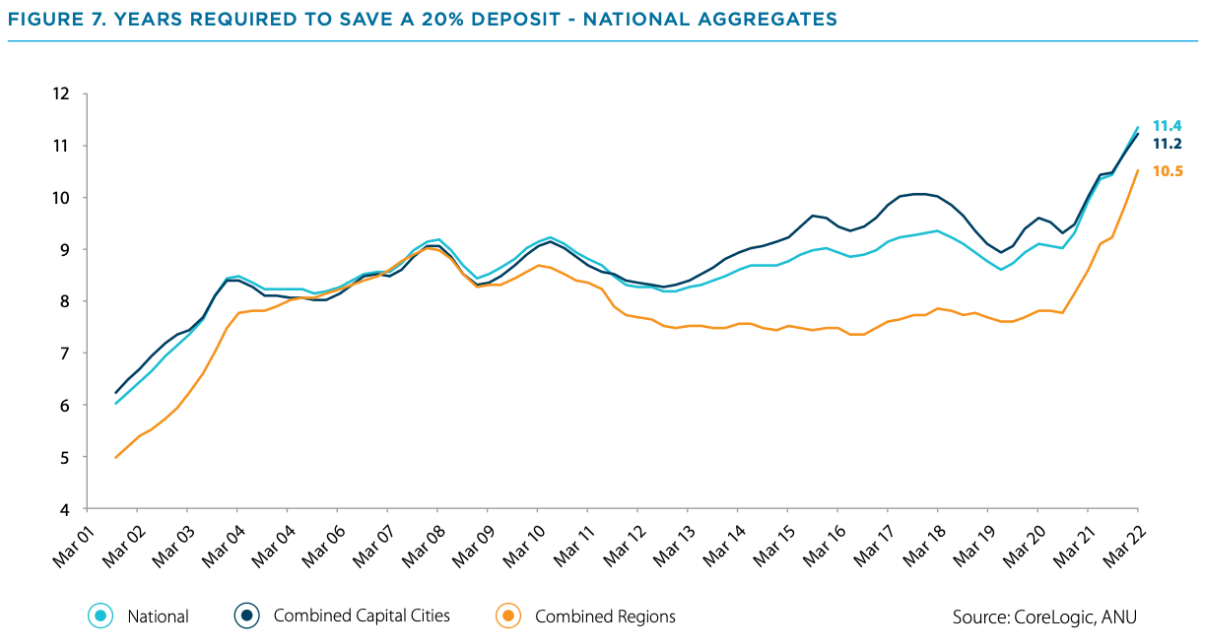

Source: CoreLogic (March 2022)

The above chart just basically says it now takes 11 years (nationally) to save for a 20% deposit. 11. Whole. Years. And that’s before we talk about paying off the loan.

Source: CoreLogic (March 2022)

Broker watch

So given all the above, why in the world would Citi then upgrade REA Group (ASX: REA) and Domain (ASX: DHG) to buy ratings now? I’ll let analyst Siraj Ahmed explain.

"While we see near-term conditions as tough and are below consensus for FY23e, we upgrade both REA and Domain to Buy as we see the risk-reward as more compelling from a 12-month perspective especially post recent cost reduction by both companies. Further, Citi’s quantitative analysis indicates that housing exposed stocks bottom approximately 6 months before house prices (assuming those bottom out at the end of 2023)."

Of course, the question then shifts to the housing recovery. Citi’s analysis suggests a 6% pop nationally in 2024. But can the two major players take advantage of the increase by passing on price increases for listings?

Yes, says Ahmed, especially if REA pushes through with a plan for subscription-centric listings.

- Forums

- ASX - By Stock

- REA

- Ann: Notice of Release of Half-Year Results to the Market

REA

rea group ltd

Add to My Watchlist

0.15%

!

$232.97

!

$232.97

Ann: Notice of Release of Half-Year Results to the Market, page-4

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

$232.97 |

Change

-0.360(0.15%) |

Mkt cap ! $30.77B | |||

| Open | High | Low | Value | Volume |

| $234.38 | $235.44 | $231.68 | $24.85M | 106.6K |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 1000 | $232.00 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $233.35 | 164 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 150 | 231.440 |

| 1 | 38 | 231.310 |

| 1 | 20 | 231.010 |

| 3 | 1150 | 231.000 |

| 1 | 4 | 230.700 |

| Price($) | Vol. | No. |

|---|---|---|

| 234.380 | 85 | 1 |

| 236.000 | 5 | 1 |

| 236.080 | 60 | 1 |

| 236.600 | 21 | 1 |

| 237.000 | 1000 | 1 |

| Last trade - 16.10pm 25/07/2025 (20 minute delay) ? |

Featured News

| REA (ASX) Chart |

The Watchlist

P.HOTC

HotCopper

Frazer Bourchier, Director, President and CEO

Frazer Bourchier

Director, President and CEO

SPONSORED BY The Market Online