One of the most ardent supporters of ASX lithium stocks, as well as the bull case for lithium minerals in general, Macquarie, has drastically pared back its forecasts for lithium prices in the short to medium term, while maintaining its long-term forecasts.

The Macquarie Commodities Strategy team’s latest lithium outlook predicts the market for lithium minerals will “remain in surplus for several years”. Their price forecasts for calendar year (“CY”) 2024 to 2026 have been slashed by 61-74% for Spodumene, 44-71% for lithium carbonate, and 63-73% for lithium hydroxide.

The pricing of the three major lithium minerals are inextricably linked, but just in case you’re wondering, spodumene tends to be the main lithium mineral produced by Australian “hard rock” miners such as Pilbara Minerals (ASX: PLS), IGO (ASX: IGO), Mineral Resources (ASX: MIN), Core Lithium (ASX: CXO), and Liontown Resources (ASX: LTR), whereas lithium carbonate tends to be more important for lithium producers targeting brines in South America, like Allkem (ASX: AKE). Both spodumene and lithium carbonate can be processed into lithium hydroxide which is a precursor material in the electric battery manufacturing process.

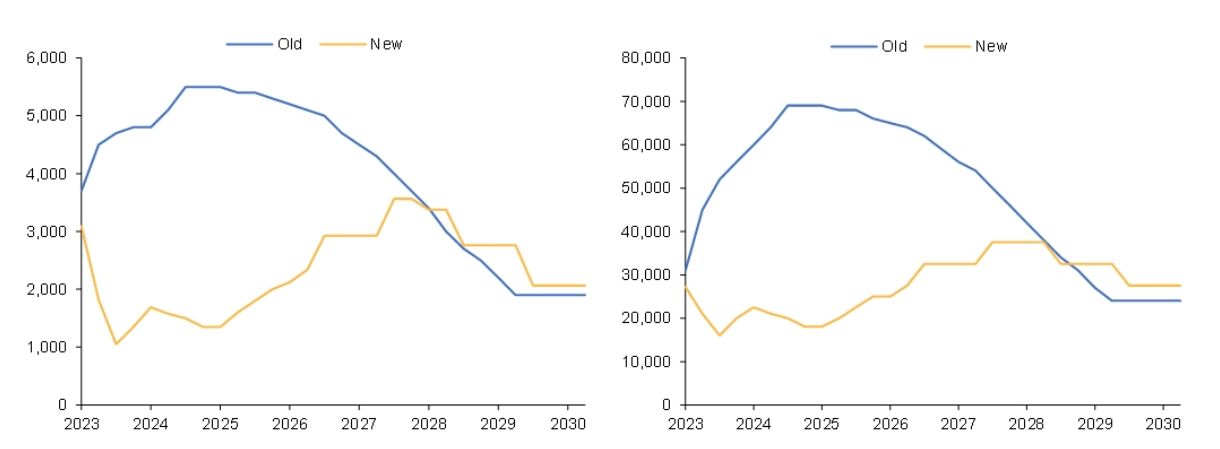

Macquarie Commodity Strategy team Spodumene, 6% Li2O, US$/t (left) and 99.5% Li2CO3, battery grade, US$/t (right) old and new price outlook. Source: Macquarie Strategy, Macquarie Research, Dec 2023

Longer term, Macquarie notes its lithium price forecasts are largely unchanged. In fact, they’ve actually upgraded their forecasts for spodumene prices from CY27 to CY29 by 9-19%, by 12-15% for lithium carbonate, and by 10-12% for lithium hydroxide.

Putting some actual prices to the changes, Macquarie is now predicting a spodumene price of US$1,416/t in CY24, US$1,450/t in CY25, and US$2,050 in CY26. For lithium carbonate, they’re forecasting US$19,875/t in CY24, US$19,000/t in CY25, and US$25,000/t in CY26. FYI, the current spot price for spodumene is US$1,410/t, and the current spot price for lithium carbonate is US$14,155/t.

So, to put Macquarie’s forecasts into perspective, they expect the spodumene price to remain roughly where it is for a couple of years, before recovering by as much as 45% in CY26. Macquarie expects spodumene prices to peak in CY28 around US$3,469 (roughly 146% higher than the current price), before settling back to around US$2,063 by CY30.

For lithium carbonate, Macquarie’s US$19,875 forecast suggests a 40% rebound in CY24, building to a peak of US$37,500 in CY28 (roughly 164% higher than the current price), before settling back to around US$27,500 in CY30. So, based on the data, it’s fair to say that Macquarie remains a long-term lithium bull.

ASX lithium stocks ratings & price targets downgraded

Despite being bullish on lithium minerals in the long term, the reality of lower near-term prices has taken a toll on Macquarie’s views on several ASX lithium stocks. The broker has updated its earnings forecasts to account for the abovementioned lithium price changes, the result is “material EPS cuts over the next five years”.

Here’s a summary of the changes they’ve made to a selection of ASX lithium stocks in their coverage:

(

Note: Macquarie has more ASX lithium stocks under coverage than any other major broker, so if you’re an Aussie lithium bull, it would be worth throwing some business their way to get hold of their top-notch research!)

Allkem (AKE) – FY24-FY28 earnings per share (“EPS”) estimates cut 36-90% due to lower lithium price forecasts, but higher long-term lithium price forecasts trigger a 36-90% increase in FY29-FY30 EPS estimates. Retains “Outperform” rating, price target falls to $12 from $17.

Argosy (AGY) – FY24-FY28 EPS estimates cut 16-225%. Macquarie notes the big cut here is due to AGY’s earnings sensitivity to commodity price movements as Rincon ramps up. Retains “Neutral” rating, price target falls to $0.14 from $.18.

Core Lithium (CXO) – Macquarie points out “High fixed cost base due to its small production base” and “need for additional debt or equity” remain key downside risks. Downgrades rating to “Neutral” from “Outperform”, price target falls to $0.32 from $0.60.

Global Lithium Resources (GL1) – FY26-FY28 EPS estimate cut 40-127% due to lower lithium price forecasts, but higher long-term lithium price forecasts trigger a 3-144% increase in FY29-FY30 EPS estimates. Downgrades rating to “Neutral” from “Outperform”, price target falls to $1.30 from $2.40.

IGO – FY24-FY28 EPS estimates cut 41-77% due to lower lithium price forecasts, but plenty of nickel asset analysis is also going on here. Retains “Outperform” rating, price target falls to $10 from $15.

Leo LIthium (LLL) – CY24-CY27 EPS estimate cut 50-110% due to lower lithium price forecasts, but higher long-term lithium price forecasts trigger a 20-34% increase in CY29-CY30 EPS estimates. Downgrades rating to “Neutral” from “Outperform”, price target falls to $0.50 from $1.00.

Liontown Resources (LTR) – FY26-FY28 EPS estimate cut 29-84% due to lower lithium price forecasts, notes key risks are “ramp up profile of both the open pit and underground mines” and insufficient water supplies. Lower lithium prices “could result in the need for additional debt or equity” to help fund Kathleen Valley ramp up. Downgrades rating to “Neutral” from “Outperform”, price target falls to $1.60 from $2.20.

Mineral Resources (MIN) – FY24-FY28 EPS estimates cut 23-81% due to lower lithium price forecasts, but higher long-term lithium price forecasts trigger a 1-20% increase in FY29-FY30 EPS estimates. Retains “Outperform” rating, price target falls to $76 from $85.

Piedmont Lithium (PLL) – CY23-CY26 EPS estimates cut by around 100%. CY27 estimates are also reduced. Key risk: “operating cost assumptions”. Retains “Outperform” rating, price target falls to $0.60 from $1.40.

Patriot Battery Metals (PMT) – FY26-FY28 EPS estimates cut 1-3% due to lower lithium price forecasts, but higher long-term lithium price forecasts trigger a 4-30% increase in FY29-FY30 EPS estimates. Macquarie labels PMT their top pick among ASX lithium explorers, believing it has the “greatest upside on exploration over the near term”. Key risks include “Variances in capital cost, operating cost and throughput assumption”. Retains “Outperform” rating, price target $2.10.

Pilbara Minerals (PLS) – Good news PLS fans (I know there are many of you!), this is Macquarie’s “preferred” ASX lithium producer because it has “the most un-leveraged balance sheet in our lithium coverage universe and strong management team”. Retains “Outperform” rating, price target falls to $4.40 from $7.10 (ouch!).

Sayona Mining (SYA) – FY24-FY30 EPS estimates cut 40-100% due to lower lithium price forecasts, but also due to the removal of lithium downstream processing in Macquarie’s base case. Biggest risks going forward include “impact of the onerous offtake agreement” and “variances between our estimates and actual tonnes mined”. Retains “Outperform” rating, price target falls to $0.09 from $0.17.

(20min delay)

(20min delay)