Energy News Bulletin (paywall / subscriber only) posted today 26/03

Having delivered Zimbabwe's first hydrocarbon discovery, Australian junior Invictus Energy is not just charting its next steps but also those of the country's new energy sector.

Invictus operates SG 4571, EPO 1848 and EPO 1849 with an 80% stake, while junior partner One Gas Resources holds the remaining 20%. The three licences cover 360,000 hectares of the frontier Cabora Bassa Basin.

While the company spud its first well on SG 4571's Mukuyu gas-condensate field in 2022, identifying 13 hydrocarbon-bearing zones, drilling difficulties prevented it from declaring a discovery.

A year later, however, the company enjoyed success at the Mukuyu-2 follow-up well, announcing a gas discovery from its sidetrack in December 2023. This discovery was followed by a Wood Mackenzie report in January, which recognised the Mukuyu field as the second-largest discovery in Sub-Saharan Africa, with an estimated 230 million boe (1.3 TCF) of resources.

Invictus managing director Scott Macmillan told Energy News Bulletin that while there was "a mixture of excitement and relief" in having bagged a discovery, the experience was "tempered in a way by the market reaction, which has been very disappointing".

Mukuyu-2's success may have derisked the company's extensive portfolio, but its share price has since sunk to a three-year low. Despite depressed market sentiment, Invictus is forging ahead with testing on Mukuyu and plans to explore other plays, all while trying to secure external funding for its drilling plans.

Operational Objectives

The company is conducting a well-test design study for Mukuyu-2 while evaluating service contract bids for the test and future exploration and appraisal drilling campaigns.

However, the location of the next well will hinge on the results of last year's CB23 seismic survey. The survey targeted EPOs 1848 and 1849, with Macmillan noting that the interpretation results would allow the company to re-risk its entire portfolio and decide its next move.

The executive said that while the company was "spoiled for choice in terms of where we go next," the choice boiled down to one of three options.

The first would focus on proving Mukuyu's resources to reach the minimum threshold needed to enter development. The second is to test another play on trend with Mukuyu to the east to extend the fairway and further derisk the company's portfolio. The third option is to test the more liquids-prone Basin Margin Play in the EPOs, which the executive described as more like a typical East Africa river system.

Invictus is in the enviable position of having robust commercialisation options for both its gas and liquid plays.

Monetisation Options

With Mukuyu, Invictus has alreadysigned an MoU with Mbuyu Energy to supply a 500MW gas-to-power project.

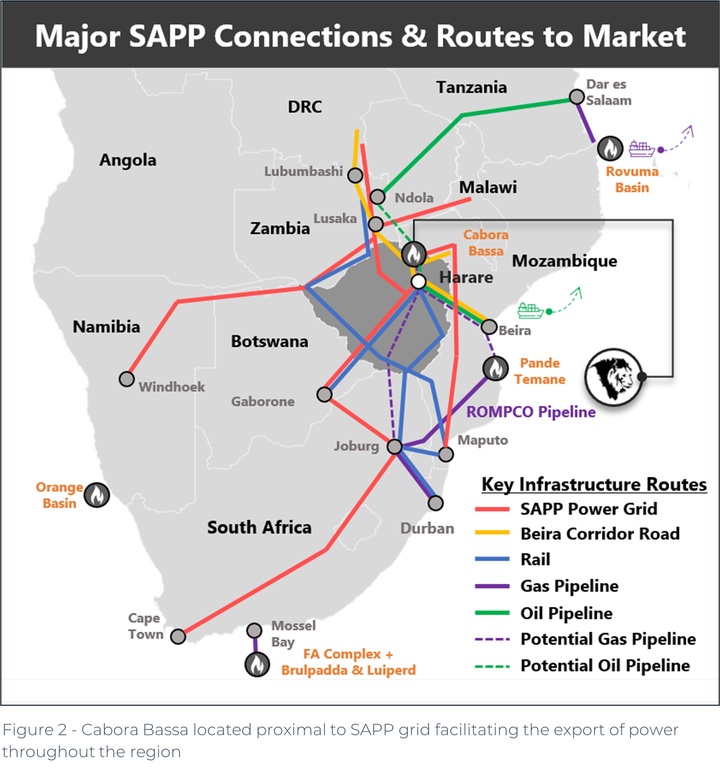

In addition to Zimbabwe's power shortages, there is scope to expand the power plant's size and supply the Southern African Power Pool (SAPP), which serves 230 million regional customers.

Macmillan said: "This allows you to use the electricity grid as a virtual pipeline. You can build a modest amount of infrastructure in terms of poles and wires to connect to your main SAPP interconnections, and then you can export it anywhere in the region."

It created a scenario, he added, where every single molecule of gas production would be consumed regardless of the resource's final size.

While unable to comment on the specifics of the MoU's notional pricing, Macmillan said: "In general terms, we're expecting what the wholesale gas price is fetching in South Africa, which is around US$12 per Gj marker and heading north from there."

Despite Mukuyu's size, its premium gas price and robust domestic and regional gas demand, Macmillan said the Basin Margin Play liquids play could not be sidelined.

The executive observed that some potential industry partners would see a stronger commercial fit with liquids projects that could be brought online faster and had a more fungible product. He said: "Having different permits affords us the opportunity to deal them separately to different groups."

Cost of Being First

Drilling Zimbabwe's first-ever wells did not come cheap, with the company having to pay a premium to mobilise equipment into a country without an active service sector. Mukuyu-1, for example, cost around US$30 million while Mukuyu-2 cost about US$24 million.

According to Macmillan, the high cost resulted from long mobilisation and logistics costs, a lack of standby rates and a "torrid time" drilling the wells. Mukuyu-1's drilling was equivalent to around one and three-quarter wells, while Mukuyu-2 was around one and a half wells.

However, the executive is confident that drilling costs can be reduced significantly thanks to its past experiences, with the results already visible in Mukuyu-2.

Macmillan said: "If you look at our drilling performance between the two, in the 12.25 inch hole section for Mukuyu-1 we drilled that in 12 days while in Mukuyu-2 we drilled that in three days. There's lots of areas for improvement."

Indeed, the company believes it can reduce the cost of future wells to US$10 million to 15 million, depending on their final depth. To this end, it is in talks with service companies now that it is no longer a "well by well proposition", which also opens the door to more attractive rates.

With Invictus eventually wanting to drill four-to six-well programs, which would allow it to amortise mobilisation costs across multiple wells and potentially bring the costs to US$10 million per well, the company's immediate future will be occupied with securing the necessary funding to deliver on its ambitions.

Indeed, Invictus revealed on March 13 that it had engaged major shareholder Mangwana Capital to field interest from multiple domestic institutional investors looking to make a strategic investment in the company.

Financing Plans

The Mukuyu-2 discovery has been a significant turning point for the company regarding financing options.

While the company had previously explored farm-out options a few years ago, attracting a range of companies, Invictus opted instead to raise funding directly from shareholders.

Macmillan said that 2021's seismic survey had shown the size of Mukuyu's potential to be enormous, leading to a sizable share price rerating. He added: "In addition to the geological and geophysical studies, we've funded two seismic studies and two wells. Our shareholders had the risk appetite and the gumption to fund what was a high-risk, high-reward play."

Mukuyu-2's success, however, means Invictus has access to several funding options beyond the traditional equity market finance it has relied on. Macmillan said: "We've now got through that discovery inflection point … [which] allows us to attract not only exploration stage funding, we can now bring more industry specific money and oil and gas funds that understand the gestation periods of these types of projects."

While these options include long-only funds, regional development banks and offtake providers, Macmillan observed that Mukuyu-2 had also opened the door to "much bigger partners, for whom it's cheaper to simply go out and buy molecules".

End of the Beginning

After several years of hard work and tens of millions of dollars, Invictus is nearly at the end of the exploration phase. The last step will be to sign the production sharing agreement (PSA) it proposed to the government some years ago.

Macmillan believes that ticking that box will unleash the investor appetite that has been distinctly missing since December's announcement. The company is upbeat about the prospects of signing the agreement in the coming months, with the executive noting that some Zimbabwean bureaucratic bottlenecks had been removed.

He pointed to the appointment of Reserve Bank of Zimbabwe (RBZ) governor John Mangudya as Mutapa Investment Fund (MIF) CEO as a positive sign. Under the proposed PSA, the sovereign wealth fund will partner in producing assets by exercising a back-in right.

Once Invictus lands the PSA, it will have wrapped up the first phase of its and Zimbabwe's oil and gas producing quest. The next phase will be about delivering on the significant promise of its assets, a sizable undertaking for the junior that will require new approaches to funding.

(20min delay)

(20min delay)