thought I'd post some important commodity information relevant to redbacka's weekly updates. you can stop posting redbacka, but you won't stop reading .... (;o)

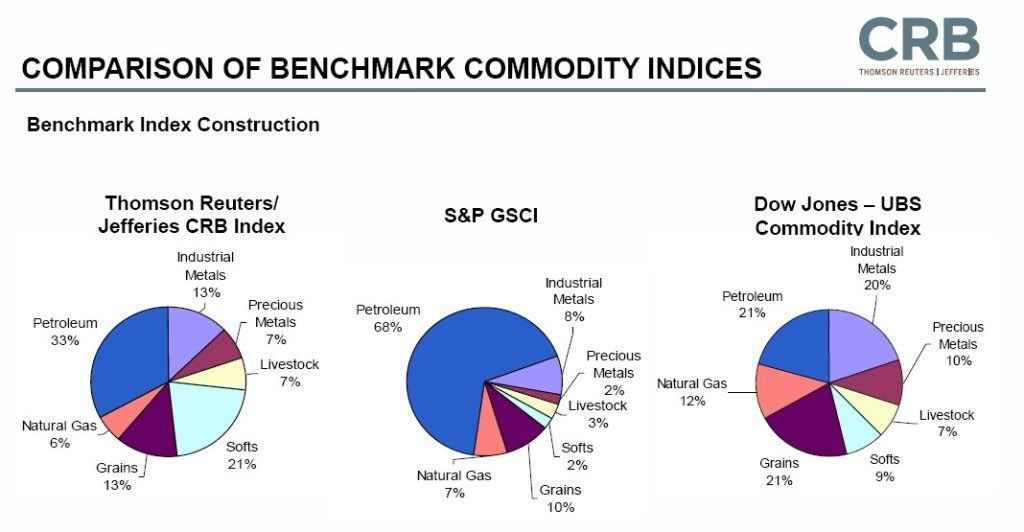

Main commodity indexes are CRB, GNX (GS GSCI) and DJAIG

Differences in weightings between the 3 are explained thus -

Source: THOMSON REUTERS/JEFFERIES CRB INDEX, page 14

Importantly of note, the DJAIG index is the more balanced of the 3, showing to me greater impacts on AUS and the AUD (it is a commodity currency no?)

DJAIG

This indicates a spike in prices is possible, but could be rolling over if channel support does not hold.

This delfation is leading from the OIS and Libor rates falling. OIS 3month is lower than OIS 1month, meaning the financial sector is itself in backwardation (cheaper to borrow for a longer term). This could be due to a lack of demand for lending, or a lack of competition, or importantly a lack of immediate expectation (of returns).

Rising OIS/Libor is due to increased demand and intends to control speculation and lending. Falling OIS is to encourage speculation and lending.

OIS 3month - libor looks like it;s about to follow suit

So we could be in a deflationary period as of now. Investors might draw down capital gains rather than borrow additional funds if this is the case, depending on available remaining liquidity. More likely if they are already all-in.

- Forums

- ASX - By Stock

- XJO

- monday trading..

XJO

s&p/asx 200

Add to My Watchlist

1.37%

!

8,757.2

!

8,757.2

monday trading.., page-51

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

8,757.2 |

Change

118.200(1.37%) |

Mkt cap ! n/a | |||

| Open | High | Low |

| 8,639.0 | 8,776.4 | 8,639.0 |

Featured News

| XJO (ASX) Chart |