Thanks @shovel40, @Fiji1, @uncleBuck, Johnl and morning crew.

Half-time wrap:

The share market recouped most of yesterday's loss after Wall Street shrugged off a sovereign credit downgrade and Australian investors looked ahead to a likely interest rate cut this afternoon.

The ASX 200 rallied 40 points or 0.48% by mid-session. Banks, tech companies and healthcare providers provided momentum. The energy sector and a handful of defensive assets sat out the rise.

Buyers returned after a fleeting spike in treasury yields failed to prevent a sixth straight gain for US stocks overnight. The S&P 500 swung from an early loss of more than 1% to a slim gain of almost 0.1% as treasury yields subsided.

Wall Street's initial swoon was triggered by news late Friday that ratings agency Moody's had lowered the US's credit rating from Aaa to Aa1, citing the nation's swollen debt burden.

The Reserve Bank met this morning and was expected to announce a quarter percentage point rate cut when it updates the market at 2.30pm AEST.

Personal trading: Scalped fleeting bounces in RMD and COL. Less success with NEM and OFX as yet.

- Forums

- ASX - Day Trading

- Afternoon trading May 20

Afternoon trading May 20

-

- There are more pages in this discussion • 85 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

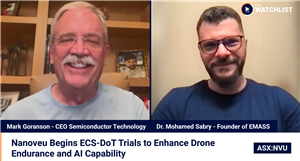

NVU

NANOVEU LIMITED

Mark Goranson & Dr. Mohamed Sabry, CEO Semiconductor Technology & EMASS Founder

Mark Goranson & Dr. Mohamed Sabry

CEO Semiconductor Technology & EMASS Founder

Previous Video

Next Video

SPONSORED BY The Market Online