Cash preservation, US nickel project green light

NEED TO KNOW:

- Soft results reflect lower commodity prices and coal production in Australia.

- New US nickel project, Hermosa Taylor (AZ, USA), was approved for FID. Expected IRR 12%, first production FY27. $US3.5bn total CAPEX, $US2.2bn lies ahead

- Weak cash flow in 1H24. S32 is in cash preservation mode - buyback cancelled.

- Production guidance maintained, +7% in FY24. Lower operating unit cost guidance.

RESULT SUMMARY

S32 is generating trough-like earnings and returns. A combination of soft commodity prices and a period of poor operational execution has weighed on this result. New nickel project in the US given the green light – limits free cash flow recovery near term.

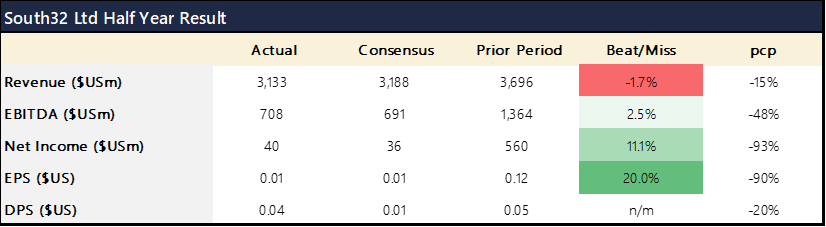

Figure 1: S32 1H24 Results SummarySource: Visible Alpha, Sandstone Insights.RESULT DETAILS

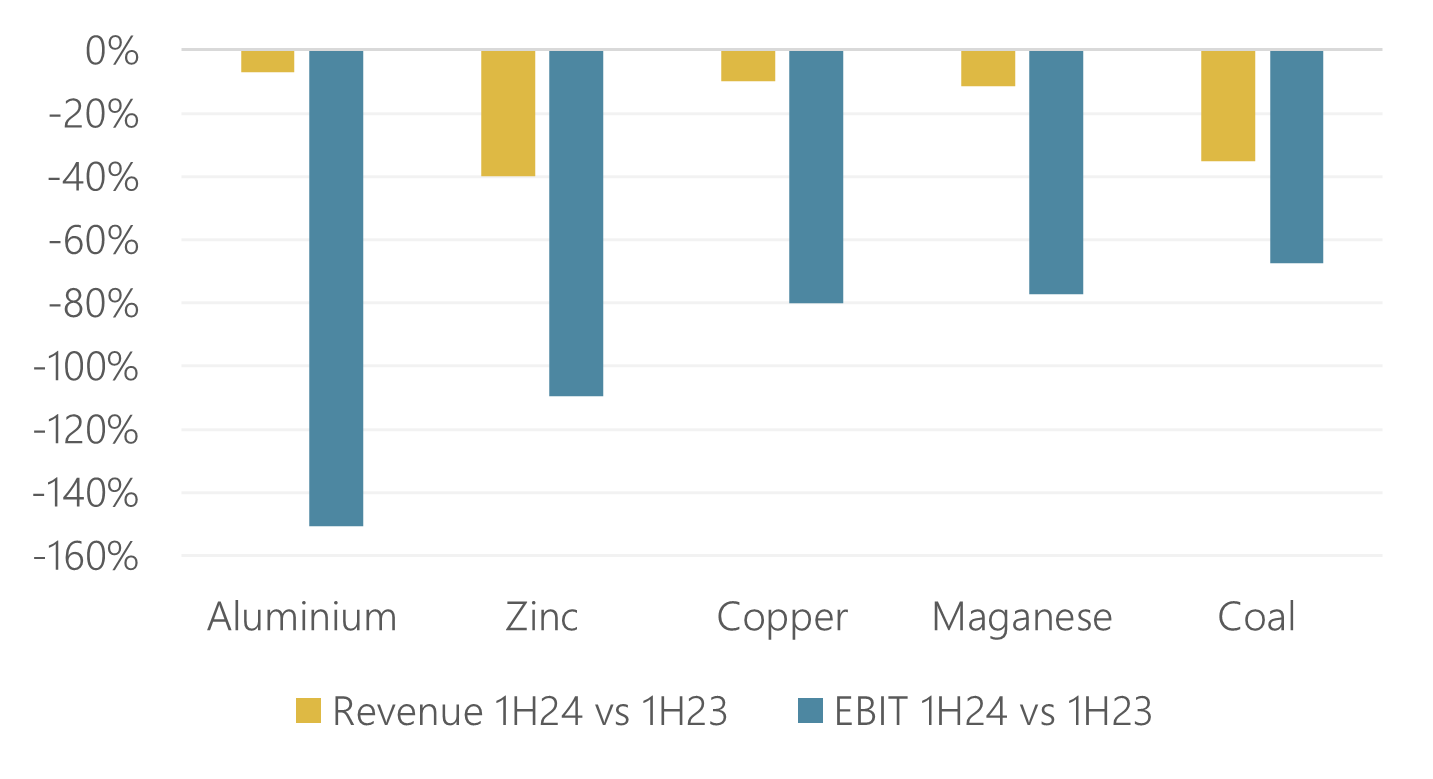

A modest EBITDA beat on depressed expectations. The result serves as a reminder of operating leverage (or de-leverage in this case) in S32. Revenue fell ~20% vs pcp, yet EBITDA fell >100%. To be sure, operational blunders and two long wall adjustments in the Wollongong (NSW) coal operations limited earnings.

Operating cash flow was poor, timing of cargo explains part of the miss. Consequently, net debt has jumped to $US1.01bn. The combination of soft cash and higher debt has seen the buy-back cancelled. There was ~$US100m left to go.

Hermosa Taylor (AZ, USA). New nickel operation given the green light in the US. At nameplate capacity in FY30, this will add 8% to Group volumes (vs FY23) for a total capex bill of $US3.5bn. Additional CAPEX from here is $US2.2bn, which is above market which was just below $US2bn. S32 is looking for a 28-year mine life, 50% EBITDA margin (equating to ~$400m EBITDA) and generating IRR ~12%. Whilst the IRR looks a little skinny, there is scope for that to creep higher as operations are optimized.

Production guidance for FY2024 was maintained.

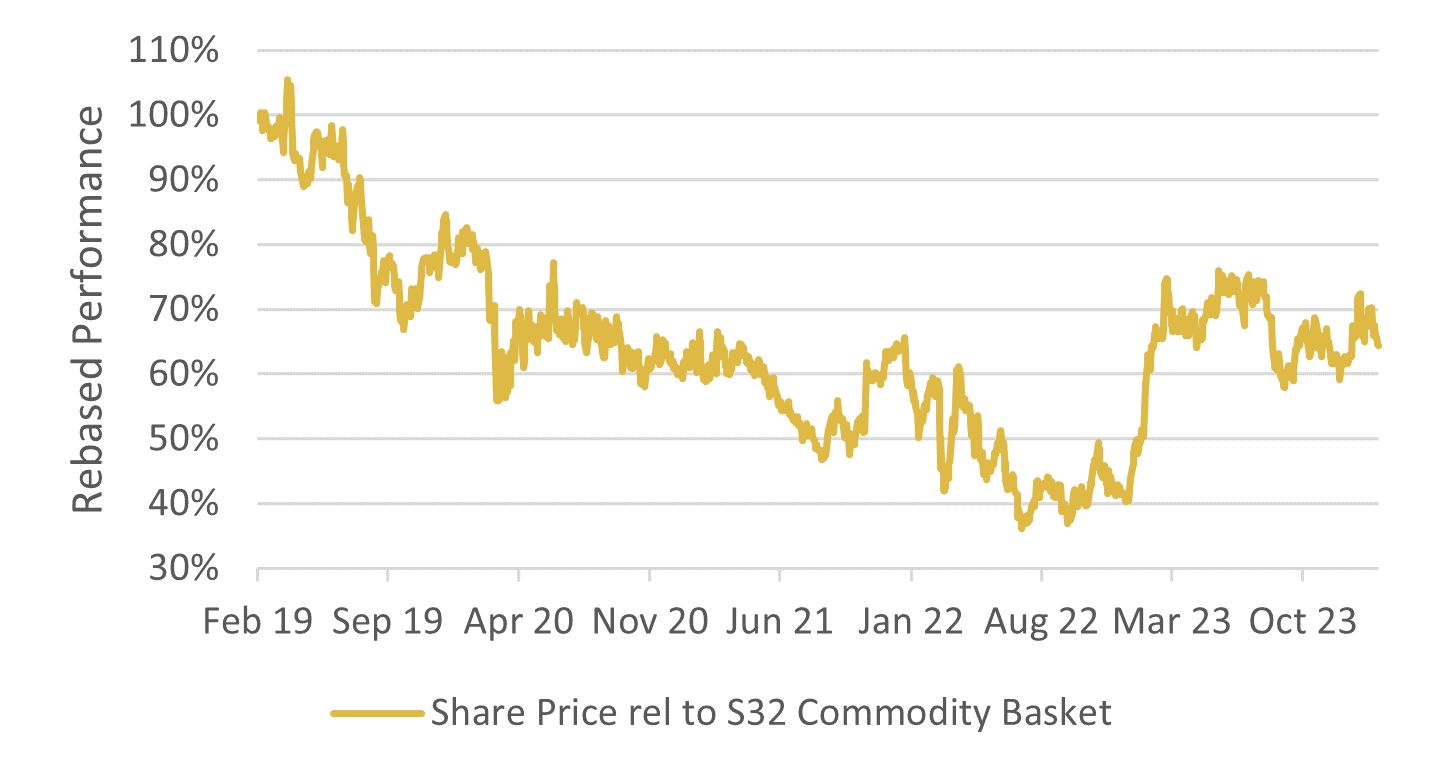

Figure 2: 1H24 S32 divisional contributionsSource: Company Data, Sandstone Insights. Aluminium include alumina.Figure 3: S32 share price has underperformed the S32 representative commodity basket.Source: LSEG, Sandstone Insights.INVESTMENT IMPLICATIONS

Without the help of a restart of the share buyback, a recovery in the share price looks heavily reliant on improved commodity prices. Improved operational execution in 2H24 can help.

Whilst the approval of Hermosa mine was expected, free cash will now be suppressed into 2027.

Yes, a buyback would be more accretive at current share prices, but the Board is thinking of value creation over 5-10 year periods. That means S32 investors are going to need to remain patient. Retain the Hold.

- Forums

- ASX - By Stock

- Ann: Financial Results and Outlook - half year ended 31 Dec 2023

S32

south32 limited

Add to My Watchlist

0.69%

!

$2.88

!

$2.88

Cash preservation, US nickel project green lightNEED TO...

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

$2.88 |

Change

-0.020(0.69%) |

Mkt cap ! $12.98B | |||

| Open | High | Low | Value | Volume |

| $2.90 | $2.92 | $2.87 | $88.55M | 30.45M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 2 | 14666 | $2.88 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $2.89 | 123171 | 6 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 5 | 13382 | 2.870 |

| 9 | 25019 | 2.860 |

| 26 | 129255 | 2.850 |

| 4 | 19850 | 2.840 |

| 2 | 110000 | 2.820 |

| Price($) | Vol. | No. |

|---|---|---|

| 2.900 | 8100 | 2 |

| 2.910 | 1130 | 1 |

| 2.920 | 1000 | 1 |

| 2.930 | 15876 | 3 |

| 2.950 | 10224 | 3 |

| Last trade - 16.10pm 20/06/2025 (20 minute delay) ? |

Featured News

| S32 (ASX) Chart |