Summary

- Nova Minerals updated on its subsidiary Company, Snow Lake Resources’ Thompson Brothers Lithium Project resource upgrade.

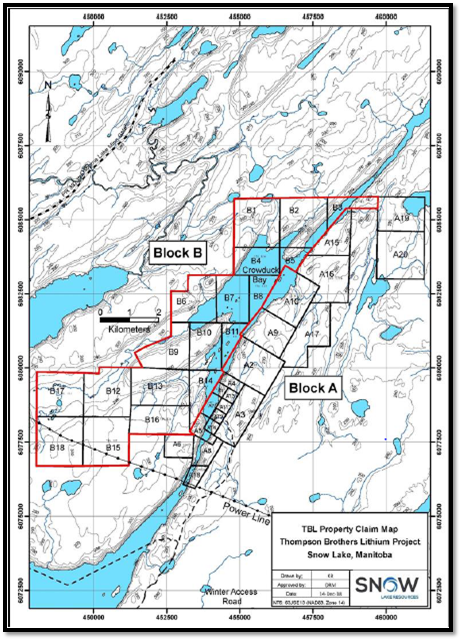

- The mineral resource is from 5% of the project area, spread over 5,596 hectares in the mining community of Snow Lake in Manitoba.

- Galaxy Resources, a lithium producer with a market cap of AU$2 billion, has similar mineral resources.

- The resource estimate is from one lithium-bearing pegmatite dyke and remains open at depth and along strike.

- Snow Lake Resources has planned to conduct a registered Initial Public Offering (IPO) in the United States.

- The Thompson Brothers Project provides mineral portfolio diversification to Nova and positions the Company to leverage the growing EV market segment.

ASX-listed mineral explorer and developer Nova Minerals (ASX:NVA, OTCQB:NVAAF, FSE:QM3) is leaving no stone unturned in its quest to diversify exposure to the mining industry and provide a hedge against uncertain market conditions. In line with this endeavour, the Company has shared an update about the Thompson Brothers Lithium Project, which is fully owned by Nova’s subsidiary firm – Snow Lake Resources.

Also read: Nova Minerals (ASX:NVA) CEO Discusses Estelle Project at Virtual Gold Conference

Map showing mineral claim area (Image source: Company update, 3 June 2021)

The Thomson Brothers Project is spread across 5,596 hectares in the mining community of Snow Lake in Manitoba, Canada. Nova controls 73.8% of Snow Lake Resources, which in turn owns a 100% interest in the Thompson Brothers Project.

Read here: Nova Minerals’ latest results paint a golden picture for Korbel Main

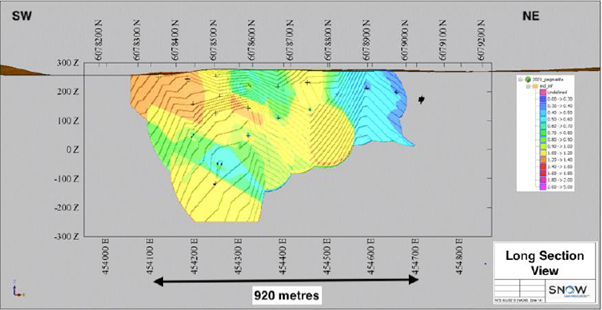

Long section view of grade distribution of mineral resource (Image source: Company update, 3 June 2021)

Good read: Nova Minerals (ASX:NVA) Makes Steady Progress at Estelle Gold Project

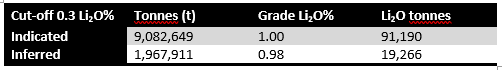

Mineral resource estimate

Updated MRE data (Data source: Company update, 3 June 2021)

Snow Lake Resources’ Maiden SK 1300 MRE report at the Thomson Brothers Project is supported by independent consultants ABH Engineering and Canmine Consultants. SK 1300 has replaced Guide 7, which was used by the mining & resource companies to report mineral resource and exploration target to the SEC. Meanwhile, Snow Lake has already announced its intention to conduct a registered IPO listing in the United States.

Interestingly, on 3 June 2021, Australia-based lithium explorer and producer Galaxy Resources Limited (ASX:GXY) also announced Mt Cattlin project’s updated Mineral Resource. Mt Cattlin has an MRE of 11.0Mt @1.2% Li2O and 151 ppm Ta2O5. Galaxy is a A$2 billion-market cap company with its MRE almost similar to that of Snow Lake Resources.

The current MRE on Thomson Brothers tenement package corresponds to a mere 5% of the project area. Hence, there is significant potential for a Mineral Resource upgrade as it remains open at depth and along strike in the north-east and south-west direction.

The current MRE is from one lithium-bearing pegmatite dyke. The dyke was identified during the drilling campaign of 2017-18, and it is close to other lithium-bearing pegmatites, which are unexplored to date.

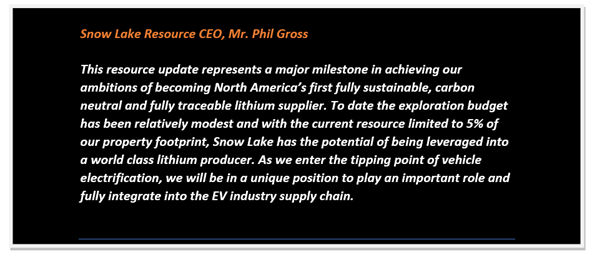

Mr Phil Gross, the CEO of Snow Lake Resources, stated that Mineral Resource upgrade was a major milestone in the project exploration and development program strengthening the Company’s stance in the growing EV industry.

To know more on Nova: Meet Nova Minerals’ (ASX:NVA) diverse and experienced management team with high growth projects and investments

Share Price

The shares of Nova Minerals gained 3.5% to A$0.145 during the early trade on the back of the MRE update. The Company has a market cap of AU$233.79 million.

Image source: Company website

Image source: Company website