Some people just dont like to see a a company succeed.

What a simplistic argument about reporting revenues and cashflows. As long as the writeoffs for bad debts are minimal, then reporting revenues and actual cash collection is irrelevant (its all a timing issue). Advantel would have terms on its creditors, hence, like all businesses, it a matter of managing cash flows. Given that Advantel likes to use the term EBITDA in terms of performance and options excercise, its imperative, that expenses are classified correctly i.e nothing is capitalised and amortised that shouldnt be.

Who are these analysts to question the viability of the Advantel model? Anyone who thinks a 40% gp margin is not flash needs their head examined!

People need to see that this deal will open up new markets to an already profitable FNTS business. The biggest cost to the FNTS business is its cost to carry the traffic and as previously noted in the ATC press release this now becomes Advantels profit as Advantel will now carry all FNTS traffic.

These so called analysts should speak to the former secured noteholders and ask them why on earth did you convert your notes to equity? If this isnt a ringing endorsement for the viability of the company, then I dont know what is.

Id say the price will hover around here until the roadshows start having their effect. Lets not forget that the company needs to raise more money Re: FNTS aquisition, hence Im sure the company would like to get the best price possible for the placement. Assuming all goes through, we should see in September real big cash flows starting and no more need to talk about forecasts. When this happens, then is no more excuse for the market to ignore this stock.

- Forums

- ASX - By Stock

- ATC

- Article that keeps getting deleted

ATC

altech batteries ltd

Add to My Watchlist

6.45%

!

3.3¢

!

3.3¢

Article that keeps getting deleted, page-8

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

3.3¢ |

Change

0.002(6.45%) |

Mkt cap ! $66.08M | |||

| Open | High | Low | Value | Volume |

| 3.2¢ | 3.3¢ | 3.2¢ | $10.25K | 313.3K |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 4 | 1119999 | 3.2¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 3.3¢ | 141547 | 2 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 819999 | 0.032 |

| 10 | 1612745 | 0.031 |

| 15 | 4053527 | 0.030 |

| 9 | 1158387 | 0.029 |

| 2 | 135600 | 0.028 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.033 | 141547 | 2 |

| 0.034 | 831322 | 6 |

| 0.035 | 560748 | 3 |

| 0.036 | 3460288 | 1 |

| 0.037 | 373262 | 4 |

| Last trade - 11.30am 17/07/2025 (20 minute delay) ? |

Featured News

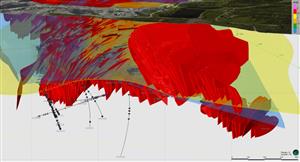

| ATC (ASX) Chart |

The Watchlist

LU7

LITHIUM UNIVERSE LIMITED

Iggy Tan, Executive Chairman

Iggy Tan

Executive Chairman

Previous Video

Next Video

SPONSORED BY The Market Online