Technology

Goldman Trading Desk Says It’s Time to Buy the Dip in AI Stocks

- ‘There’s too much pessimism around AI’: Goldman’s Mourad

- Bank sees AI companies’ earnings doubling in next 12 months

Artificial intelligence-related stocks have taken a beating recently, but with lower interest rates on the way and fundamentals remaining strong, Goldman Sachs Group Inc.’s trading desk thinks it’s time to buy the dip.

“We expect lower interest rates could support IT projects, economic policy to become less uncertain after the election, and tangible progress with AI products to be presented in upcoming conferences,” Faris Mourad, vice president of Goldman’s US custom baskets team, wrote in a note to clients on Thursday.

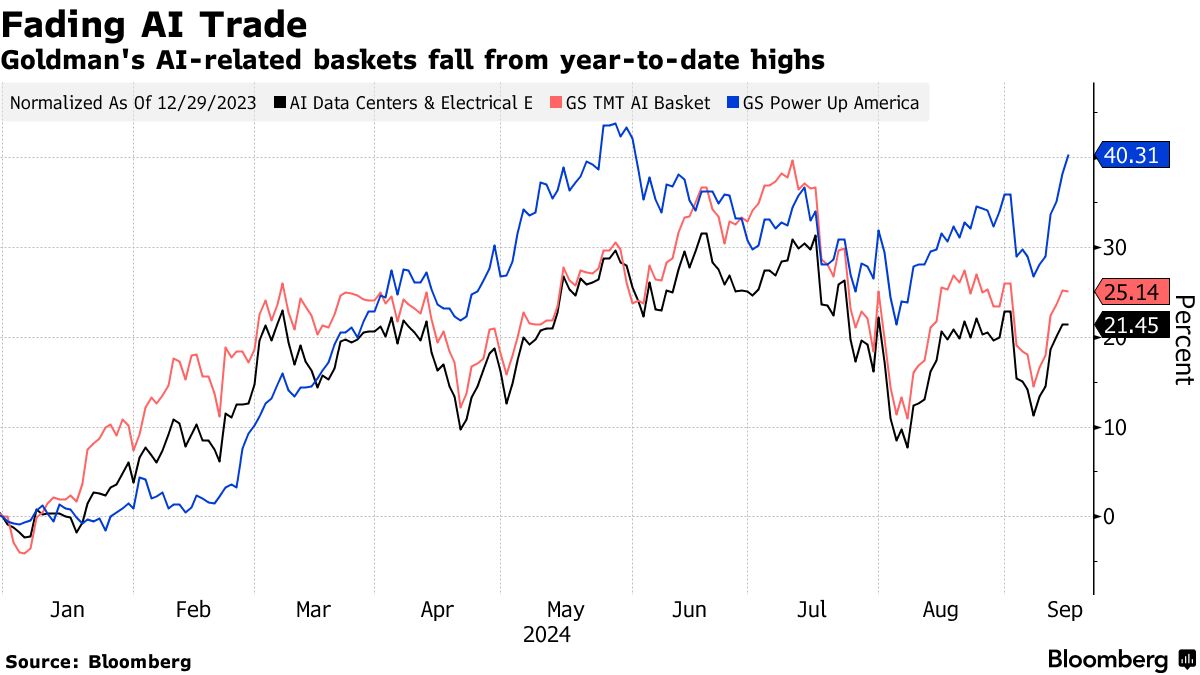

Goldman’s Broad AI basket — which includes companies like Nvidia Corp., Microsoft Corp., Apple Inc., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc. and Oracle Corp. is down 11% from its 2024 high reached on July 10. The weakness goes beyond the selloff in Magnificent 7 stocks. Earlier this year, Goldman launched two baskets focused on booming demand for data centers and power to drive AI development. But since mid-July, the AI data centers basket is down 8%, and the Power Up America basket has lost 5%.

Traders’ expectations for a half-point interest-rate cut from the Federal Reserve at its meeting concluding Wednesday has fueled a rotation from megacap technology stocks into economically sensitive corners of the market. In addition, the latest earnings season showed that corporate spending on AI isn’t paying off as soon as investors had hoped.

While that has sparked fear in some investors, to Goldman it’s a buying opportunity.

“There’s too much AI pessimism,” Mourad wrote. “AI (baskets) are cheap to year-to-date earnings trends, they may require fresh bad news to go down further, which we think is unlikely.”

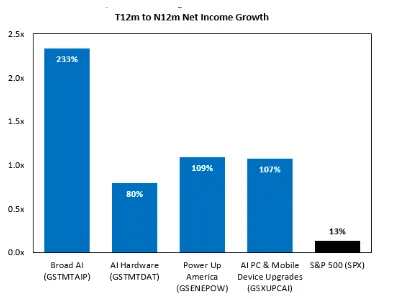

Fundamentals play a key role in Goldman’s thesis. The bank expects net income from AI companies to roughly double in the next 12 months. It also sees more growth in power generation tied to the technology.

Goldman Sachs FICC & EquitiesSource: Goldman Sachs FICC & Equities

“The power theme outperformance this year is driven primarily by the earnings growth of this space as US independent power producers and regulated utilities provided positive updates on data centers this last earnings season,” Mourad wrote.

For example, independent power producer Vistra Corp. has gained 131% this year, and Constellation Energy Corp. has risen 69%. Both are in the Power Up basket and typically trade in line with AI-related sentiment. Granted they’ve lost some steam since hitting highs in late May. But both recently reported earnings that exceeded expectations, and capital investments around AI will keep pushing power stocks like these higher, according to Goldman.

“We continue to see data centers as the single largest driver of power demand growth in the US,” Mourad wrote.

- Forums

- ASX - By Stock

- Buy and Hold

APX

appen limited

Add to My Watchlist

1.77%

!

$1.15

!

$1.15

Technology Goldman Trading Desk Says It’s Time to Buy the Dip in...

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

$1.15 |

Change

0.020(1.77%) |

Mkt cap ! $304.6M | |||

| Open | High | Low | Value | Volume |

| $1.13 | $1.19 | $1.12 | $10.23M | 8.819M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 113588 | $1.15 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $1.16 | 1000 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 113588 | 1.150 |

| 6 | 140767 | 1.145 |

| 15 | 126625 | 1.140 |

| 4 | 83108 | 1.135 |

| 7 | 67368 | 1.130 |

| Price($) | Vol. | No. |

|---|---|---|

| 1.160 | 1000 | 1 |

| 1.165 | 57200 | 5 |

| 1.170 | 59931 | 7 |

| 1.175 | 30570 | 5 |

| 1.180 | 153333 | 12 |

| Last trade - 16.18pm 26/06/2025 (20 minute delay) ? |

Featured News

| APX (ASX) Chart |

The Watchlist

3DA

AMAERO LTD

Hank Holland, Chairman & CEO

Hank Holland

Chairman & CEO

Previous Video

Next Video

SPONSORED BY The Market Online