Two Prime Lithium Projects Secured

HIGHLIGHTS

- Option secured for 90-days to acquire – subject to successful due diligence – two highly prospective lithium projects in prime locations:

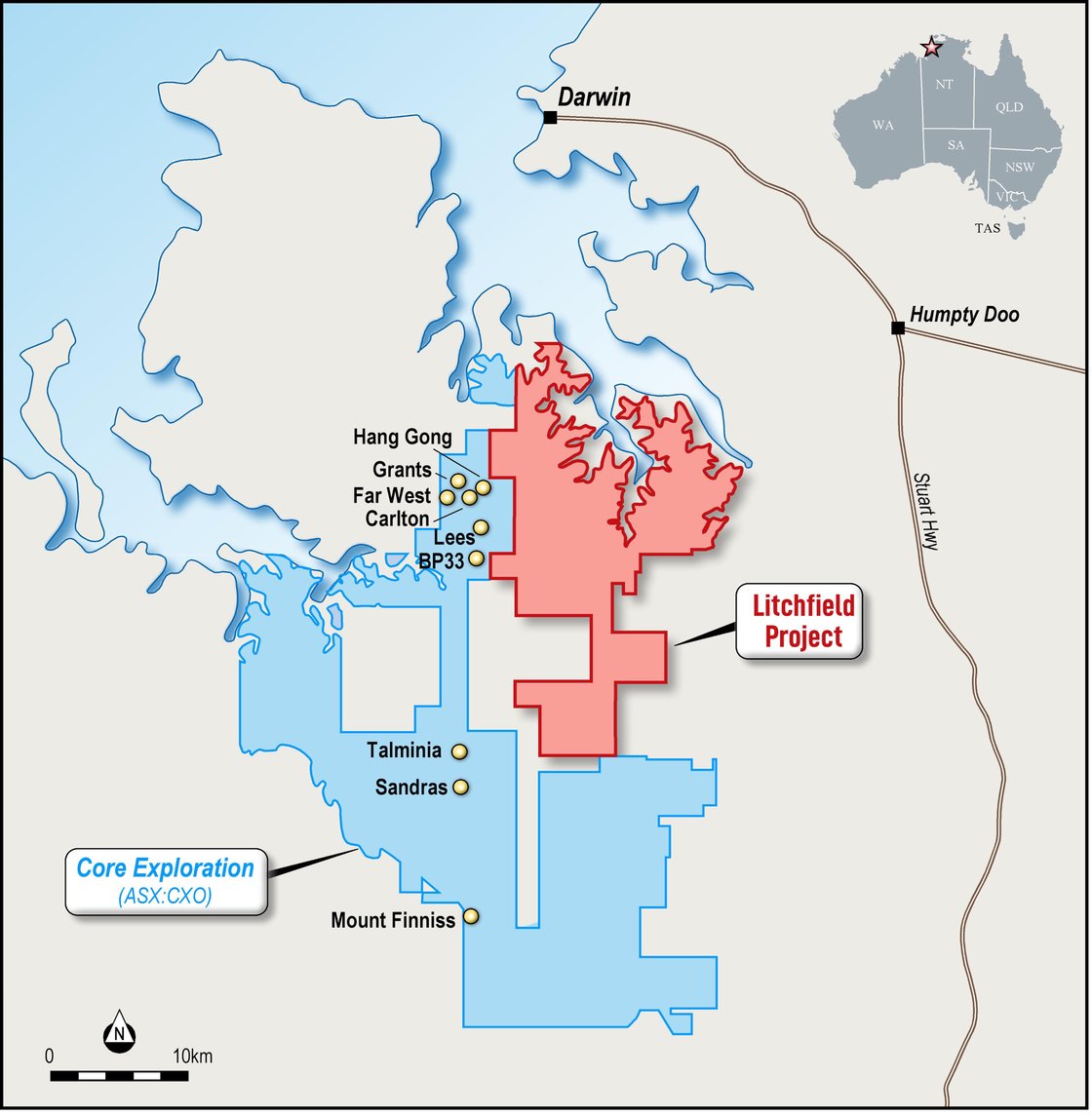

1) Litchfield Lithium Project:is contiguous toCore Lithium’s (ASX:CXO)strategic Finniss Lithium Project which has JORC compliant ore reserves(7.4Mt @ 1.3% Li2O), with production slated to commence in 2H 20221:- Analysing satellite imagery shows potential for lithium pegmatite bodies to be apparent along Litchfield’s north-west boundary; this is the primary exploration target area

2) Picasso Lithium Project(Norseman region, WA) is proximal toLiontown’s Resources’ (ASX:LTR)Buldania Project, with a JORC compliant resource at14.9Mt @ 0.97% Li2O3, and has mapped pegmatites4 that potentially host lithium mineralisation- CCZ has ample funds on hand to develop core projects moving forward; meanwhile, the drilling campaign at the Arya Prospect is about to commence

Castillo Copper Limited’s (“CCZ”)Board is delighted to announce it has entered into a 90-day option agreement to acquire – subject to due successful due diligence – two granted, highly prospective lithium projects. The Litchfield and Picasso Lithium Projects are located in prime regions in the Northern Territory (NT) and Western Australia (WA) respectively.

PRIME LITHIUM ASSETS

CCZ’s Board, following a recent strategic review, decided it was prudent to diversify the asset portfolio and acquire quality projects prospective for lithium mineralisation. In having the ability to develop projects prospective for copper and lithium, it positions CCZ strategically to potentially create significant incremental value from the transition towards renewable energy sources and surging demand for electric vehicles globally.

Management Commentary:

CCZ’s Managing Director, Simon Paull, commented:“Acquiring prospective lithium projects, which complement the copper assets, arguably provides CCZ a strong comparative advantage moving forward. In focusing on developing copper and lithium projects, the Board is positioning CCZ to potentially create significant incremental value from the transition towards renewable energy sources and accelerating demand for electric vehicles globally.”

- Forums

- ASX - By Stock

- CHN

- Castillo Copper (ASX:CCZ): Two Prime Lithium Projects Secured

Castillo Copper (ASX:CCZ): Two Prime Lithium Projects Secured

-

- There are more pages in this discussion • 14 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add CHN (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$1.29 |

Change

0.000(0.00%) |

Mkt cap ! $499.8M | |||

| Open | High | Low | Value | Volume |

| 0.0¢ | 0.0¢ | 0.0¢ | $0 | 0 |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 2 | 2538 | $1.40 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $1.00 | 539 | 2 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 2 | 2538 | 1.400 |

| 1 | 111000 | 1.360 |

| 2 | 5751 | 1.350 |

| 1 | 6500 | 1.340 |

| 2 | 22000 | 1.330 |

| Price($) | Vol. | No. |

|---|---|---|

| 1.000 | 539 | 2 |

| 1.270 | 3750 | 1 |

| 1.275 | 60699 | 4 |

| 1.285 | 3500 | 1 |

| 1.290 | 101120 | 4 |

| Last trade - 16.17pm 23/04/2024 (20 minute delay) ? |

Featured News

| CHN (ASX) Chart |

Day chart unavailable

-May-19-2021-08-21-14-86-AM.gif?upscale=true&width=1200&upscale=true&name=InvUpd-Banner%20(8)-May-19-2021-08-21-14-86-AM.gif)