Hm not bad!How Chariot outsmarted a major to get a mountain of lithium. Literally, a mountain

Chariot Corp’s ‘surround and conquer’ tactic wrested key land at Black Mountain from a lithium giant. All it cost was $4 million, royalties and someone’s finger.

Reuben Adams3 min readNovember 21, 2023 - 8:15AM*Chariot is looking out a mountain - OK, not this mountain, but still - of lithium. Picture: Getty ImagesLate October one of the biggest lithium IPOs of 2023, Chariot Corp (ASX:CC9), hit the bourse with a market cap of $67.5 million at 45c a share.

And things have rolled on like a juggernaut from there.

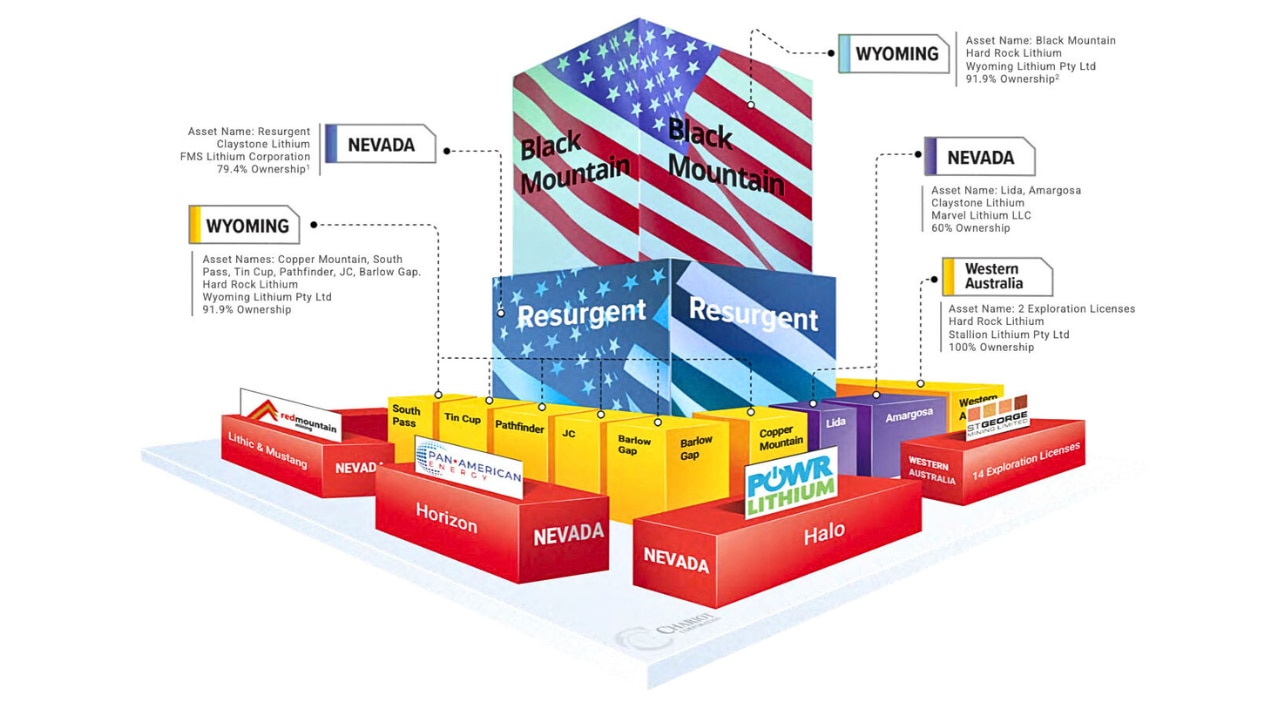

CC9 has one of the largest lithium exploration landholdings in the United States, plus a bunch of JVs, farm outs and optioned projects:

Chariot Corp has a huge lithium footprint. Picture: CC9Overwhelmed? Don’t be. The focus is the 2sq km Black Mountain in Wyoming, an emerging hard rock province quickly gaining in popularity.

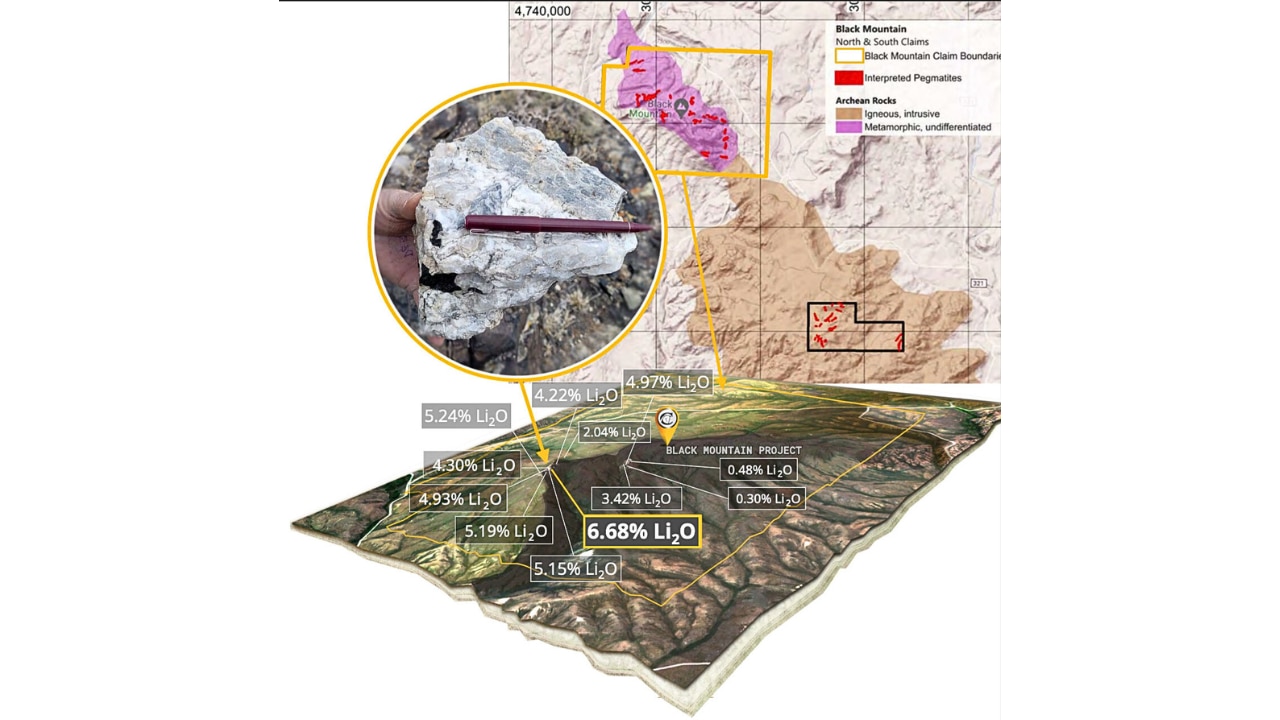

This project has never been drilled - until now - despite 60cm long spodumene crystals (around 6-7 per cent lithium) being observed back in 1997 and subsequent early-stage exploration returning assays up to 6.68 per cent Li2O from rock chips. That’s high grade.

Black Mountain looks to have rich reserves of lithium. Picture: CC9“It looks like Liontown’s (ASX:LTR) Kathleen Valley before it was drilled,” CC9 managing director Shanthar Pathmanathan said.

“It has 40 outcropping pegmatites in a 1.5km long strike across the mountain. We think they go deep down but we won’t know until we drill.”

Meanwhile, the property has already attracted to attention of a few strategics, including a carmaker (“I can’t go into more detail than that,” Pathmanathan says) and one of the largest iron ore/mining companies in the world.

“Again, we can’t disclose who that it is, but it is a well-known global mining company interested in lithium.”

Full points for effort

The story how CC9 got its hands on Black Mountain is wild

A couple of lithium majors were already examining the Black Mountain project when it came across Pathmanathan’s desk.

“I was sitting in my driveway in Perth, got the call, and the vendor — who is now working with us as COO – told me that a couple of lithium majors were already looking at it,” he said.

But the property around these claims was all open, so CC9 sent a crew up in the middle of the bitterly cold Wyoming winter on a staking mission.

“While we were bidding on these claims, we sent a crew in negative 25 degrees Celsius to stake around the two claims getting auctioned,” Pathmanathan said.

“We staked 89 claims. It was a bold move; someone lost their finger through frostbite it was that cold.

“But the two claims are in the middle of the mountain. We had 89 claims around those two – for us, it was like a donut and the hole was missing.”

A billion-dollar capped NASDAQ-listed lithium major won the auction for those two claims in the middle of the mountain, but backed out of the deal on discovering CC9’s strategy.

“There is a lot of spodumene in those two claims, so we definitely wanted them,” Pathmanathan said.

“We then paid $US4 million plus a royalty for those two - a rich price, but it is the last piece of the jigsaw puzzle for us at Black Mountain.”

A maiden 4900m drill campaign to test the central portion of the Black Mountain pegmatite dike swarm, comprising a 1000m long by more than 100m wide zone of LCT pegmatite sub-crop and outcrop, is now under way.

Initial results are due in January.

A conviction play, all the way

As a former oil and gas investment banker at Macquarie, Pathmanathan lived through the heady days of oil.

Now, he says, US lithium is like “buying oil properties in the US, 200 years ago.”

“I’ve had a conviction on lithium since I left oil,” he said.

“I also believe in having conviction and investing through downturns – that’s where you make your money.

“I built this company from scratch. This is not nearology, we have spent $14.8 million to this point to put this package together, and sold off the rest.

“We now have the largest lithium exploration landholding in the United States. This is ‘pioneers of the world’ type days.”

- Forums

- ASX - By Stock

- Chariot CC9 Article

CC9

chariot corporation ltd

Add to My Watchlist

9.26%

!

4.9¢

!

4.9¢

Hm not bad!How Chariot outsmarted a major to get a mountain of...

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

4.9¢ |

Change

-0.005(9.26%) |

Mkt cap ! $5.848M | |||

| Open | High | Low | Value | Volume |

| 5.6¢ | 5.7¢ | 4.9¢ | $21.37K | 401.3K |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 111700 | 4.8¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 5.4¢ | 2274 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 111700 | 0.048 |

| 1 | 6600 | 0.040 |

| 0 | 0 | 0.000 |

| 0 | 0 | 0.000 |

| 0 | 0 | 0.000 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.054 | 2274 | 1 |

| 0.060 | 25002 | 1 |

| 0.064 | 15796 | 1 |

| 0.070 | 155096 | 1 |

| 0.075 | 432 | 1 |

| Last trade - 15.31pm 23/06/2025 (20 minute delay) ? |

Featured News

| CC9 (ASX) Chart |