By the way, here are some facts about shale gas reserves, exploration and developments in China.

You may ask why we need to look at Chinese shales! Because we need to understand the dynamics behind the shale gas and oil business. Shale gas business will also be a global business in couple of years like the conventional gas business. Btw, if you pay attention here, I am not saying "shale oil" business! There is no export of US shale oil to the other parts of the world like the US shale gas for now.

There are no marine based shale oil resources in China either. Therefore China needs some shale oil resources from other parts of the world. Goldwyer project may offer a huge potential for shale oil for China through PetroChina.

(Btw, everyone needs more oil, Australia now imports most of its oil).

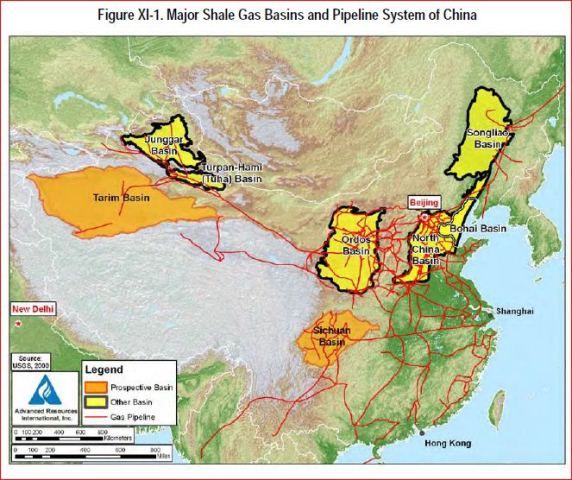

I was talking about Shell on my post above. I asked why Shell was not interested in Shale G&O business in Australia! However, we can see that Shell is the frontier company which is involved in shale gas exploration and production in China's Sichuan basin before anyone else. Shell signed a PCS (production sharing contract) with China National Petroleum Corporation (CNPC)which is the parent company of PetroChina, to develop a shale gas block in China, the first deal of its kind in the country on March 2012.

Later on, in Dec. 2012, ConocoPhillips and Sinopec signed an agreement for joint research regarding shale gas exploration, development, and production in Sichuan basin.

Now, with the new deal which Goldwyer in Canning basin and Poseidon in offshore Browse basin Projects are involved in, ConocoPhillips has signed a deal with PetroChina (owned by CNPC) for exploration, development, and production in Sichuan basin.

The game is all about getting bigger share in Sichuan basin which is the most prospective marine based basin in China.

It's my opinion that Chinese shale gas is not going to be very cheap because of the reasons below. It's even not definite that it will produce the same way the US shales produce (US shalea are less complex than China shales). No shale oil is expected to be recovered in these shales. Therefore China still needs some shale Oil and Gas connections (including experience) around the world. It's the easiest way to buy a stake in Australia as they did in all other resources areas.

Facts;

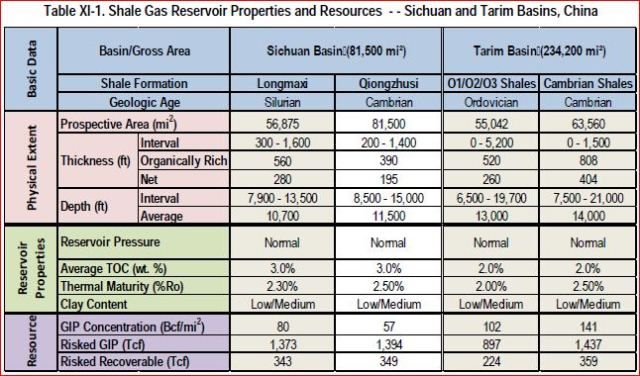

- There are no marine based shale oil resources in China. Two of the largest marine basins, Sichuan and Tarim Basins which makes China the country which have the biggest shale gas reserves in the world, have only shale gas but no oil as the Thermal Maturity (Ro) level is more than 2.5% on both basins. (It should be less than 1.5 to be in wet-gas window. Goldwyer's TM level is between 0.8% and 1.3%. This is proved with Nicolay-1 well).

- The shales in Sichuan basin is Lower Cambrian and Lower Silurian based (Ordovician age shales are just between Silurian and Cambrian).

- Ave. TOC is 3% in Sichuan basin. This is a rich TOC level.

- Thermal maturity is around 2.40%. This represents only dry gas. No shale oil in this basin.

- Depth of shales are 2,400m to 4,100m averaging around 3250m for Silurian section, and 2800m for Cambrian section.

- H2S levels often are hazardously high (1% or more), while CO2 (5%) and N2 (7.5%) also can be significant

- GIP (Gas in place) concentration is 80 BCF/mi2 in Silurian section and 57 BCF/mi2 in Cambrian section. (FYI, NSE had 47 BCF/mi2 = 18 BCF/km2 in Nicolay-1 location but said uneconomic, which is true IMO.) This is a low concentration, but can be economical in China conditions.

- Also, a significant portion of the prospective area was screened out (risked) due to structural complexity.

Tarim basin is a little bit hopeless for shale gas exploration and development for now due to the depth of the shales with TOC levels which is not very rich (ave.2%)

Images from EIA's World Shale Gas Resources Report Apr..2011

- Forums

- ASX - By Stock

- NSE

- chinese

chinese, page-105

-

- There are more pages in this discussion • 7 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add NSE (ASX) to my watchlist

Currently unlisted public company.

The Watchlist

LU7

LITHIUM UNIVERSE LIMITED

Alex Hanly, CEO

Alex Hanly

CEO

Previous Video

Next Video

SPONSORED BY The Market Online