Thanks afternoon crew.

End-of-day summary:

Rising expectations for a July interest rate cut helped Aussie shares shrug off soft US leads and climb to within 2% of an all-time high.

The ASX 200 rallied 43.5 points or 0.52% to its 10th gain in the last 11 sessions.

Gold miners, energy producers and healthcare providers led an advance that lifted all but two sectors (industrials and consumer discretionary). The big four banks added their weight to the rise as CBA pushed into record territory.

The odds on a July rate cut climbed above 50% following yesterday's rate cut, according to CommSec. That compares to market pricing below 20% a week ago. Financial markets repriced the likelihood of a third cut this year after RBA Governor Michele Bullock said the central bank debated cutting official rates by 50 basis points this week, before opting for a 25-point cut.

Wall Street's six-session winning streak ended overnight as rising treasury yields encouraged profit taking. The S&P 500 dipped 0.39%.

- Forums

- ASX - Day Trading

- Day traders' after-market lounge May 21

Day traders' after-market lounge May 21

Featured News

Featured News

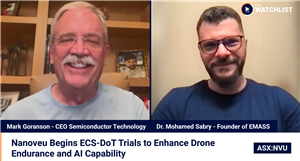

The Watchlist

WCE

WEST COAST SILVER LIMITED

Bruce Garlick, Executive Director

Bruce Garlick

Executive Director

Previous Video

Next Video

SPONSORED BY The Market Online