Asia Financial /Reuters/J. Pollard 30.4.23 said"Lithium prices surged by over 10% this week for the first time in a five-month slump, but the longer-term outlook for the mineral – sought after for electric vehicle batteries – looks mixed.

Analysts say the move by Chile, one of the world’s top producers, to nationalise its lithium sector, which could potentially curb long-term supply, may be negated by growing supply from other sources.

Data from Fastmarkets on Refinitiv Eikon showed battery-grade lithium carbonate prices rose 10.6% in China from a week earlier to 182,500 yuan ($26,380) a tonne, the first weekly increase since November 2022.

“The market eyed limited scope for further price falls after it sank below 200,000 yuan, hence they started buying,” Yang Yaohua, an analyst at Guosen Futures, said.

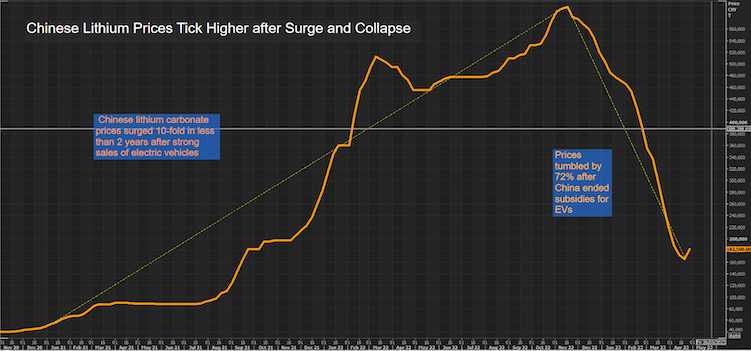

The price had surged 10-fold in less than two years to 605,000 yuan a tonne by November as supply failed to keep up with soaring demand due to robust EV sales.

But prices tumbled 72% afterChina curbed EV subsidies in January, demand faltered and inventories rose.

Global EV sales up 55% in 2022

“Demand was showing softness early in the year, but we’re still expecting a relatively tight market for the year on average and that’s because of much stronger demand from EV sales later in the year,” said Martin Jackson, head of battery raw materials at consultancy CRU.

Global EV sales jumped 55% last year to 10 million and are expected to climb another 35% this year...".

https://www.asiafinancial.com/lithium-prices-rise-10-after-five-month-slump/amp?espv=1

- Forums

- ASX - By Stock

- LLL

- General Discussion

General Discussion, page-4811

-

-

- There are more pages in this discussion • 6,153 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add LLL (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

50.5¢ |

Change

0.000(0.00%) |

Mkt cap ! $605.4M | |||

| Open | High | Low | Value | Volume |

| 0.0¢ | 0.0¢ | 0.0¢ | $0 | 0 |

Featured News

| LLL (ASX) Chart |

Day chart unavailable