Bullion Banks Have "No Way Out" From Big Gold Shorts

by Tyler Durden

Sat, 08/08/2020 - 09:20

TwitterFacebookRedditEmailPrint

Authored by Alasdair Macleod via GoldMoney.com,

There appears to be no way out for the bullion banks deteriorating $53bn short gold futures positions ($38bn net) on Comex. An earlier attempt between January and March to regain control over paper gold markets has backfired on the bullion banks.

Unallocated gold account holders with LBMA member banks will shortly discover that that market is trading on vapour. According to the Bank for International Settlements, at the end of last year LBMA gold positions, the vast majority being unallocated, totalled $512bn — the London Mythical Bullion Market is a more appropriate description for the surprise to come.

An awful lot of gold bulls are going to be disappointed when their unallocated bullion bank holdings turn to dust in the coming months — perhaps it’s a matter of a few weeks, perhaps only days — and synthetic ETFs will also blow up. The systemic demolition of paper gold and silver markets is a predictable catastrophe in the course of the collapse of fiat money’s purchasing power, for which the evidence is mounting. It is set to drive gold and silver much higher, or more correctly put, fiat currencies much lower.

This is only the initial catalysing phase in the rapidly approaching death of fiat currencies.

Introduction

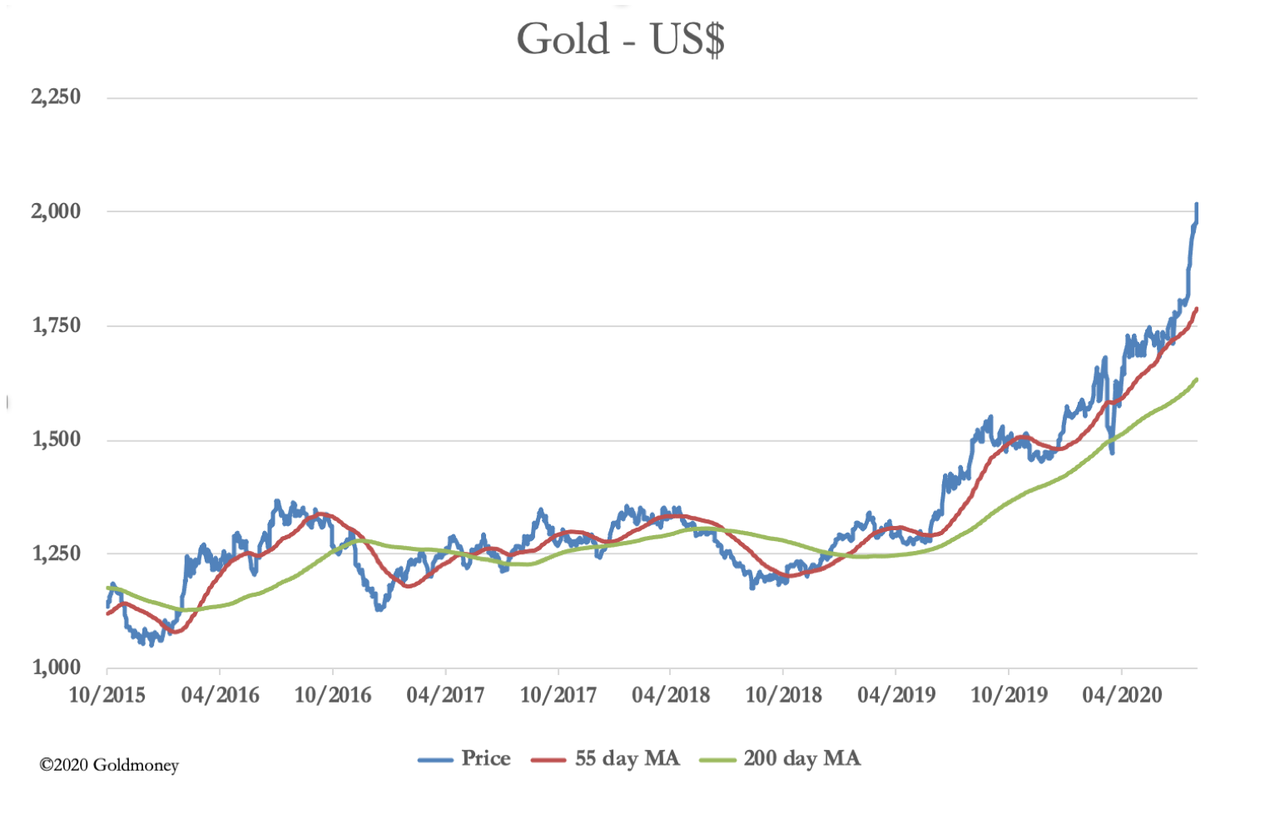

Measured in dollars, the current bull market for gold started in December 2015, since when the price in dollars has almost doubled. Other than the odd headline when gold exceeded its previous September 2011 high of $1920, only gold bugs seem to be excited. But in our modern macroeconomic world of government-issued currencies, which has moved on from the days when gold operated as a monetary standard, it is viewed as an anachronism; a pet rock, as Jason Zweig of the Wall Street Journal called it in 2015, only a few months before this bull market commenced.

Despite almost doubling, Zweig’s view of gold is still mainstream. His comment follows the spirit of today’s macroeconomic hero, John Maynard Keynes, who called the gold standard a barbaric relic in his 1924 Tract on Monetary Reform. Keynes went on to invent macroeconomics on the back of his 1936 General Theory, and whether you profess to be Keynesian or not, as an investor you will almost certainly kowtow to macroeconomics. It has been well-nigh impossible to have a successful career in the investment industry unless you subscribed to inflationist Keynesian theories. You are required to substitute the economics of aggregates for those of the human action of individuals, upon which classical economics was based. And with it, you must unquestionably accept the state theory of money.

Well, we are now witnessing the cataclysmic ending of the Keynesian fallacy; the destruction of macroeconomics in a systemic failure centred on paper markets for gold and silver.

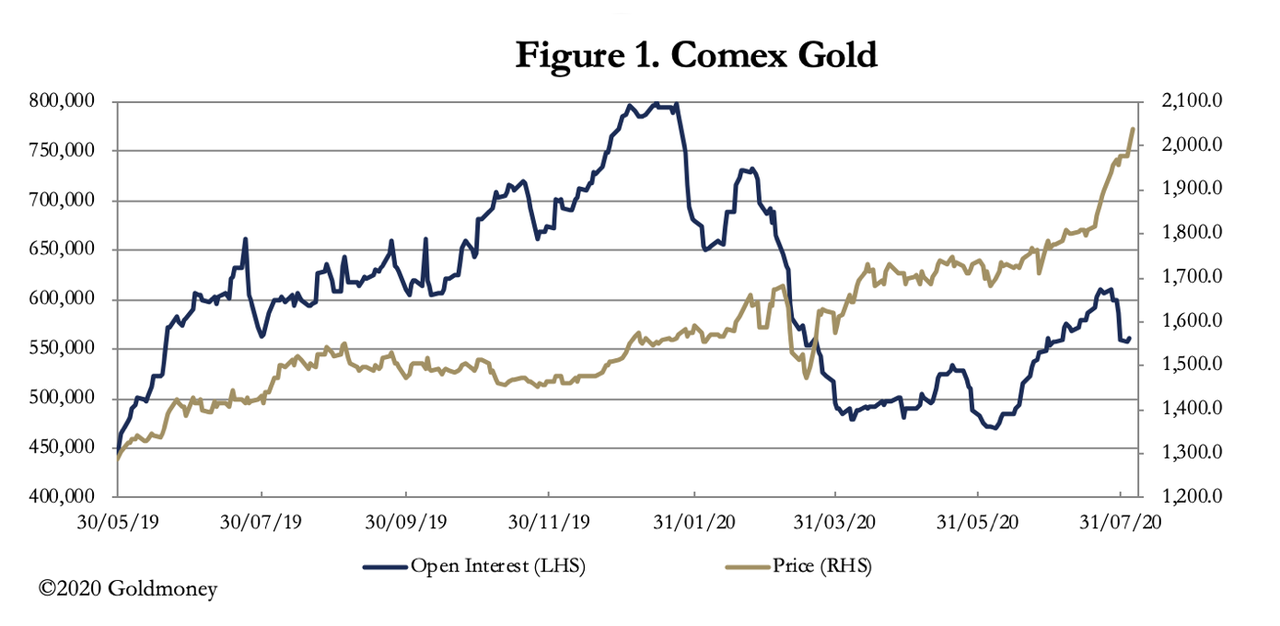

Comex open interest peaked in January, when the gold contract was being overwhelmed by global demand. Never before had open interest been this high: the previous all-time record had been in July 2016, when it hit 658,000 contracts. At that time, the market had recovered strongly from a deeply oversold condition, the price rallying from the December low in our headline chart, from $1049 to $1380. That was successfully crushed with open interest taken down to 392,000 and the gold price to $1120. However, the take-down which commenced in earnest in January this year did not succeed.

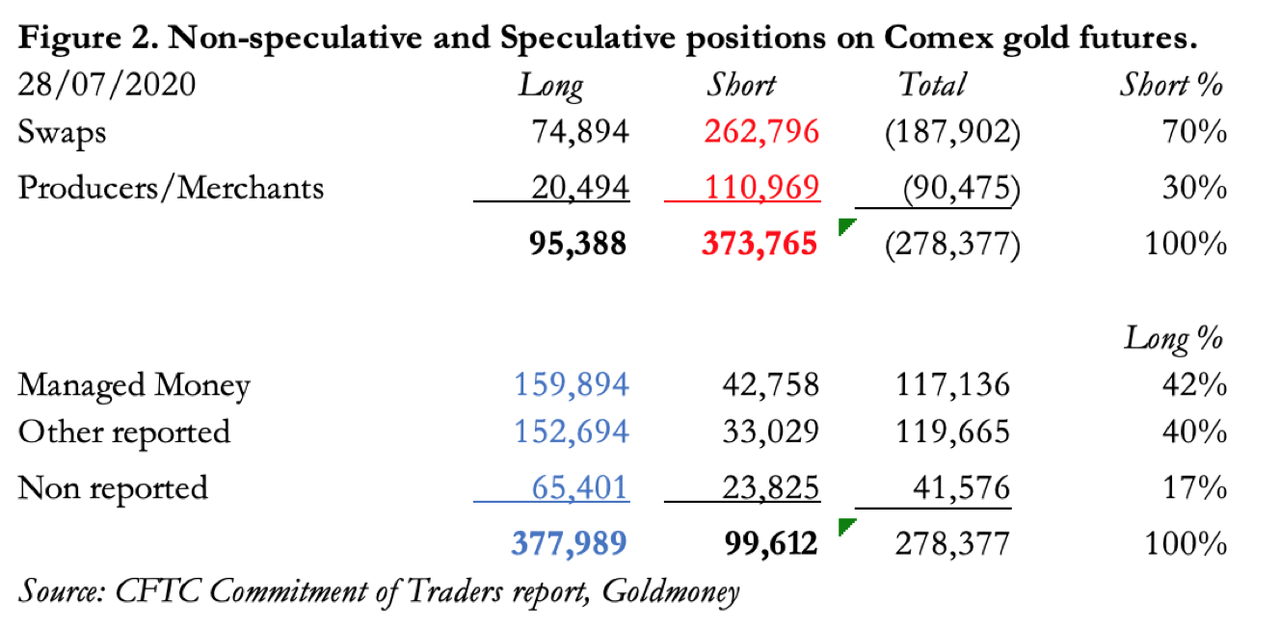

The swaps are bullion bank trading desks, which typically take positions across more than one derivative market, notably London forwards settling unallocated accounts. Together with the Producers and Merchants category, they almost always run net short positions on Comex. Producers, miners and their agents acting for them, hedge against falls in the gold price and make up the bulk of the short positions in their category. Merchants, typically jewellers and buyers for industrial and other purposes, hedge against price rises by holding long contracts.

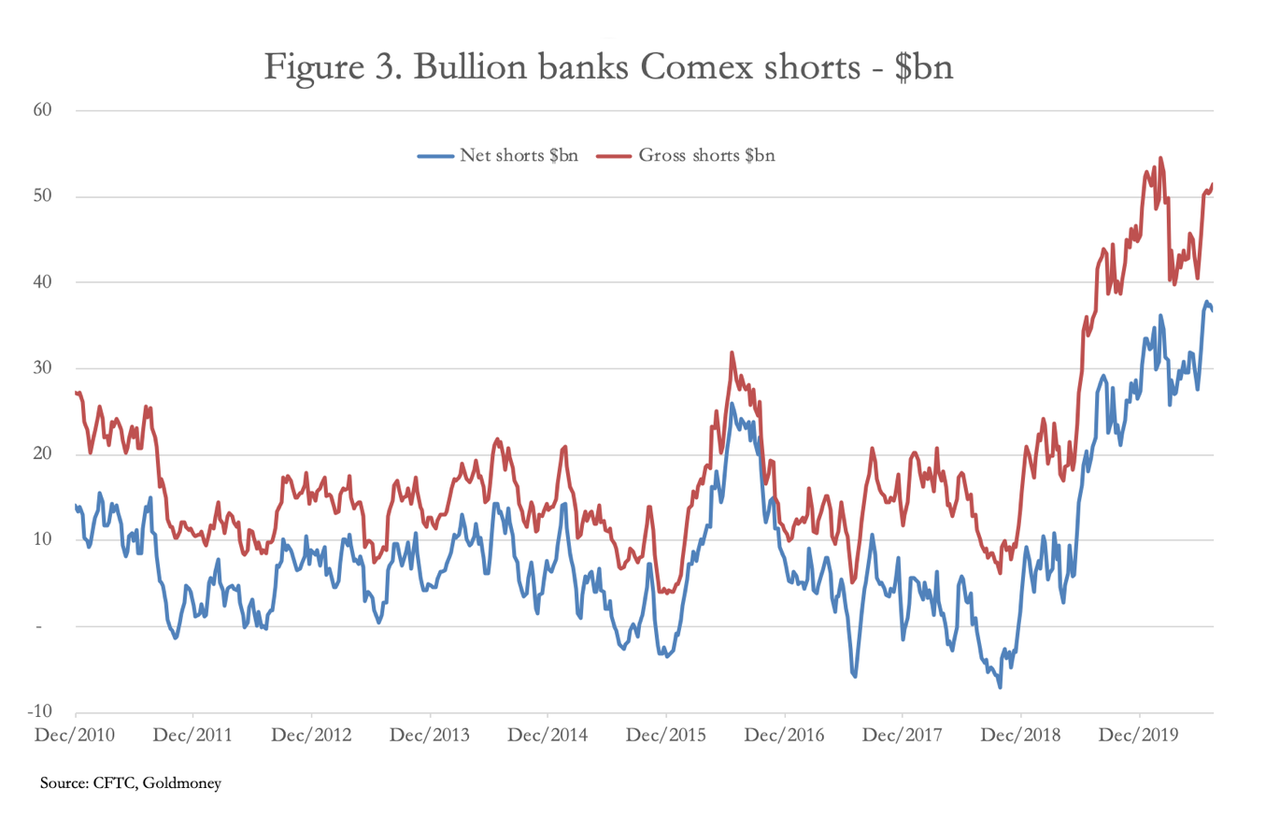

The concept of futures markets did not originally include banks in the non-speculative category, because futures markets were a means for farmers to unburden themselves from price risk, due to seasonal factors, to speculators willing to take the risk upon themselves. However, banks managed to persuade the CME to be categorised as non-speculators, on the basis they often acted as agents for producers in non-agricultural contracts. And in gold, which is what concerns us, they also ran positions in London which they wished to hedge on Comex. But as has been seen in Figure 2, the bullion banks now account for 70% of the shorts, when in the past they would typically account for significantly less. And as we show later in this article, they have no physical gold in London to hedge. The result is their gross short position of 262,796 contracts is now an uncovered commitment of $53bn spread between 27 traders. Figure 3 puts this in an historical context over the last ten years.

Bullion banks’ shorts net of longs (the blue line) are at record levels, and gross shorts are almost at record highs, only exceeded at the beginning of the year when open interest had risen to an unprecedented level of 799,541 contracts on 15 January.

On the speculator side, the dominant category is nearly always Managed Money, which is predominantly hedge fund traders. They are rarely interested in taking delivery and will close or roll their positions. They are nearly always biased to the buy-side, and over the long term have averaged a net long position of about 112,000 contracts, which we can call the neutral position. But currently, they are an unusual minority 42% of the speculator longs and are only moderately positioned above their neutral net long average.

Far from being the masters of the investment universe, hedge funds have proved to be an easy target for the bullion banks, regularly spooking them out of their long positions. And by acting in the fashion of committed macroeconomists, hedge funds have used the current strength in the gold price to take profits, reducing net longs from the previous week’s COT report by 21,362 contracts. They seem unaware of or disinterested in a bigger picture. Furthermore, at 42,758, the level of their short contracts is above average, which could contribute to the bear squeeze in the coming weeks as they realise their mistake.

The Other Reportable category is for traders that do not fit into the other three categories described above. The longs in this category are close to a previous record level, which was on 24 March at 158,963 contracts. Unusually that was recorded two business days after the market turned higher following the price collapse in early March from $1700 to $1455. We can therefore count the Other Reportable category as smart money, at least in the current climate, less likely to be shaken out of their positions by swap dealers trying to trigger stops.

We can only conclude that swap dealers have not only ended up nearly record short, but the liquidity on Comex provided by hedge funds, which normally enables them to close their shorts, is restricted. Furthermore, mark-to-market losses come at a time when their banks’ wider operations are cutting back on risk exposure to financial commitments where they can. But these near-record losses are likely to increase significantly as central bank money-printing accelerates in an attempt to prevent an economic slump and to maintain financial asset prices. If something else does not break before, a full-scale banking crisis could evolve from the paper gold market.

The authorities can be expected to do everything to avoid a failure on Comex, because the damage to the wider market would be extremely serious. Instead, banking members of the London Bullion Market Association (LBMA) would probably be expected to bid up the gold price in the forward market in an attempt to square their books and for banks to swallow the losses. That cannot happen as will be explained in the next section.

In short, over the coming weeks, we can expect a transition phase as the crisis refocuses on London’s forward settlement market, which is the casino hidden from view.

London’s hidden liabilities

Trading in London for forward settlement is a far larger market than Comex. According to the Bank for International Settlements, at the end of 2019, the notional amount of over the counter (OTC) gold forwards and swaps outstanding stood at $512bn, which compares with Comex open interest of $120bn on the same day, noting that open interest at 786,166 futures contracts at that time was an elevated level.

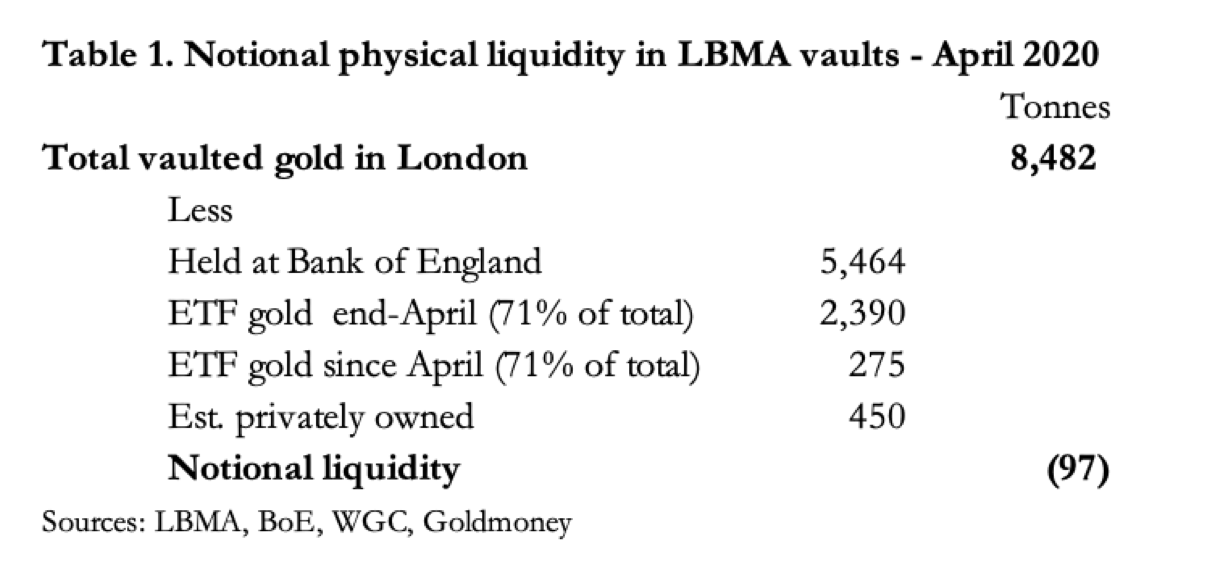

While admittedly simplistic, these figures show that there is no liquidity in London. According to the World Gold Council, total ETF physical holdings at end-April were 3,364 tonnes, of which, according to Paul Mylchreest’s Hardman report, over 70% is vaulted in London, or 2,390 tonnes in Table 1. To this figure must be added gold privately vaulted by sovereign wealth funds, institutions, family offices and agglomerating businesses on behalf of retail customers. These bullion stocks are held with the vaulting companies (Brinks, G4S, Loomis and Malca-Amit), and are likely to amount to a further 400-500 tonnes.

Since April, ETF holdings have increased by a further 387 tonnes, of which we will again assume over 70%, 275 tonnes, is stored in London (24 July – source WGC). While there are some guesses concerning underlying changes in these figures since end-April, they could easily result in a negative figure, as Table 1 suggests. Furthermore, if ETF and private demand for bullion escalate further a crisis in London is bound to emerge.

It is here that the Bank of England might have intervened by leaning on its central bank clients to lease some of their earmarked gold – vide the 45.91 tonnes reported to be held for the GLD ETF in April. But there is a further problem: the notional lease rate has been negative since March, which means that a central bank leasing at the market rate has to pay the lessee for the privilege. This suggests that leasing can only occur if market rates are ignored and a fee is paid instead.

It is important to note that under a lease agreement, ownership remains with the lessor. Gold leased through the agency of the Bank of England is unlikely to leave the Bank’s vaults, merely credited through book-entries to lessees. Therefore, for the lessor there is no counterparty risk because if the lessee defaults, the Bank of England merely reallocates the bullion back to the lessor. But in a wider bullion crisis, the double counting of bullion “ownership” through leasing will be exposed, the liabilities falling entirely on the bullion banks. Holders of the GLD ETF should seek confirmation that none of its gold in the Bank’s vaults is so leased.

The alternative to central banks providing liquidity is unthinkable: that bullion banks obtain their liquidity by illegally using bullion held in their custody. Unfortunately, suspicions are compounded by the LBMA’s secrecy over market operations, only releasing selected information when it is no longer relevant. The LBMA’s press releases are also misleading; headlining total gold vaulted in London creates the impression of physical liquidity, which is patently untrue.

For their wealthier customers, bullion banks offer gold accounts in two forms: allocated and unallocated. They are discouraged from opening an allocated account, through expensive fees, notionally covering the vaulting and insurance of physical metal and administrative costs. The real reason is that banks prefer their customers to open unallocated accounts, encouraging them with minimal fees, because these can be fractionally reserved if they are reserved at all. In other words, a bullion bank can hold enough just enough gold to cover the random demands for withdrawals. But as Table 1 above demonstrates, not even that physical liquidity now exists.

While physical settlement involving allocated gold accounts obviously does occur, it is unallocated accounts settling through the AURUM electronic settlement system which accounts for almost all day to day London trade settlements. AURUM is the means of settlement between members of the LBMA through the London Precious Metal Clearing Limited. Transactions for settlement in unallocated form are funnelled through one of the five members who net them down into a single settlement through AURUM. The five members of LPMCL (JPMorgan, UBS, HSBC, ICBC Standard Bank and Scotiabank) all have unallocated accounts with each other, and the settlements determined by AURUM are for currency on one side and unallocated bullion on the other.

Therefore, the massive quantities of gold being settled are divorced from physical settlement, and amount to nearly all the BIS derivative estimate quoted above of $512bn in positions outstanding at the end of last year. But depositors with unallocated gold accounts undoubtedly believe they have exposure to the gold price, otherwise they would insist at the least on their accounts being allocated with their bullion bank acting as custodian. As the current crisis in paper markets evolves, loss of faith in the ability of bullion banks to settle unallocated accounts in gold will risk generating a run on these accounts and a rush to secure physical gold before prices rise further.

While the authorities in America will do everything to avoid a gold and silver crisis on Comex, any thought that it can be buried behind closed doors in London is fanciful. The same bullion banks trade both markets. A crisis in the bullion banks threatens to leave at the last count about $500bn of unallocated gold accounts in London plus a further 262,796 Comex contracts ($53bn at $2,030 – see Figure 2 above) swinging in the wind. The expansion of paper gold since the early 1980s which has put a lid on the gold price is coming to its end, and the removal of this obstacle will only serve to push the price significantly higher.

Conclusion

We appear to be witnessing the early stages of a breakdown in the paper gold markets on Comex and in London, brought forward by central banks committed to accelerating their inflationary policies in an act of macroeconomic desperation to save their government finances and their economies. The method employed is a dead ringer for an earlier experiment in France exactly three hundred years ago when John Law’s Mississippi bubble imploded, destroying his currency, the livre.

If you bind the fate of financial assets to that of your fiat currency, as John Law did, and which is now the policy of the Federal Reserve, when the bubble pops the currency goes pop as well. This outcome is so obvious that the smart money is now getting out of fiat and into physical gold and silver, as witnessed through deliveries on Comex active contract expiries and the disappearance of all physical liquidity in London.

This being the case, a gathering stampede out of paper currencies and derivative contracts into physical bullion has just started. Unless it is somehow stopped, it will destroy paper markets and with them the banks that have benefitted from them over the last forty years. The acceleration in the destruction of fiat money will gather pace in the next few months, and anyone who spouts macroeconomic nonsense instead of acting in the face of these developments will end up with nothing.

- Forums

- Commodities

- GOLD

- gold

gold, page-83042

-

-

- There are more pages in this discussion • 45,571 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)