Lithium prices to rise in 2021 amid stronger downstream demand

SUZHOU, Dec 4 (SMM)—China's new energy vehicle market demand has grown rapidly, leading to stronger demand for ternary and iron-lithium materials. The global supply of nickel and cobalt raw materials is tightening, and the increase in downstream demand will support the rise of lithium prices in 2021, said SMM’s senior cobalt-lithium analyst Miranda Mei.

Mei was sharing her review of 2020 and 2021 outlook for the new energy sector and the cobalt-lithium market today on Friday, at the Shanghai Metals Market’s 2020 Nonferrous Metals Industry Chain Annual Conference held in Kempinski Hotel Suzhou.

“In the second half of 2020, the proportion of iron-lithium batteries in passenger cars increased, mainly due to the fact that the market no longer pursues high-endurance and high-energy-density models after subsidies declined, and frequent safety accidents caused by high temperatures from ternary batteries. On the other hand, lithium iron has better safety performance,” Mei said.

In addition, the emergence the CTP technology from automaker CATL and BYD's blade battery technology has also increased the system energy density of iron-lithium battery packs and improved the vehicle's cruising range. “At the same time, the cost of iron-lithium battery is also lower than that of ternary, which can meet the cost reduction needs of NEV companies,” Mei noted.

China's NEVs market has performed well in H2 2020, and annual output is expected to reach 1.2 million units. Tesla ranked first in terms of total sales in 2020 amid sharp rise in individual user demand.

Mei also shared that 70% of individual users go on insurance for NEVs in January-October 2020, and demand for batteries in the motive power market reached 75GWh in 2020, which is expected to increase 40% year-on-year in 2021.

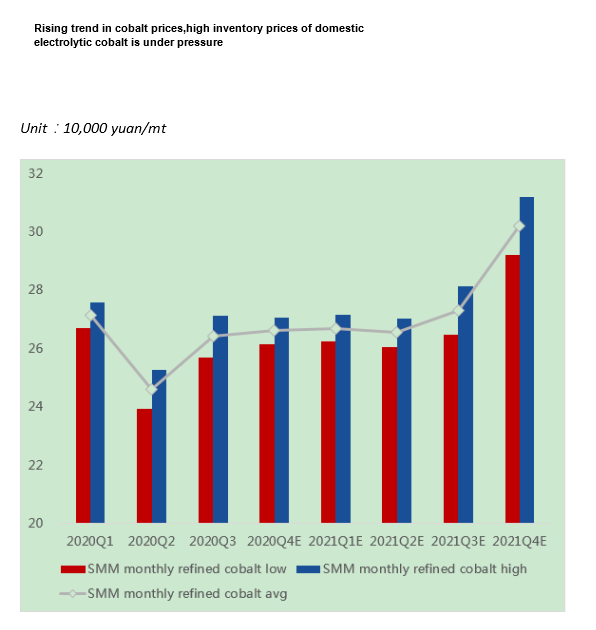

“The proportion of LFP in the pure EVs such as Tesla Model 3, Hongguang Mini, Chery EQ1 and BYD Han has increased this year. Inventories of cathode materials rose sharply in 2019-2021 and the prices faced downward trend in 2020. Stocks of cobalt sulphate declined further amid positive fundamentals. Cobalt sulphate supply has been less than demand for ternary precursor production since October.”

Mei expects the downstream ternary demand for nickel sulphate may increase significantly in 2021, and the prices of nickel sulphate raw materials will increase compared with this year. “We believe that the prices of nickel sulphate in 2021 will show a steady and strong trend.”

On the other hand, prices of lithium carbonate to bottom out in the fourth quarter of 2020, and upward trend is likely to follow in the first quarter of 2021. “The increase in supply may affect small price fluctuations,“ Mei added.

Compared with 2020, demand for lithium hydroxide in 2021 is likely to increase significantly in the second and third quarters of next year. “The increase in overseas new energy car companies such as Tesla and Mercedes-Benz will be mainly uses materials of high nickel content. It is expected that the increase in demand for lithium hydroxide will reach 50% in 2021, which will effectively alleviate the current oversupply structure and the price will gradually increase.”

https://news.metal.com/newscontent/...ronger-downstream-demand#.X8qgDnNp5TQ.twitter

- Forums

- ASX - By Stock

- Good News & Bad News

Lithium prices to rise in 2021 amid stronger downstream demand...

-

-

- There are more pages in this discussion • 2,601 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add PLS (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$2.98 |

Change

-0.030(1.00%) |

Mkt cap ! $8.974B | |||

| Open | High | Low | Value | Volume |

| $3.00 | $3.11 | $2.97 | $82.16M | 27.12M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 12 | 65571 | $2.97 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $2.99 | 7500 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 11 | 60571 | 2.970 |

| 9 | 483193 | 2.960 |

| 24 | 424025 | 2.950 |

| 9 | 70910 | 2.940 |

| 3 | 22000 | 2.930 |

| Price($) | Vol. | No. |

|---|---|---|

| 3.000 | 25026 | 2 |

| 3.010 | 24424 | 4 |

| 3.020 | 334253 | 9 |

| 3.030 | 120132 | 11 |

| 3.040 | 46200 | 5 |

| Last trade - 16.10pm 08/11/2024 (20 minute delay) ? |

Featured News

| PLS (ASX) Chart |

The Watchlist

EQN

EQUINOX RESOURCES LIMITED.

Zac Komur, MD & CEO

Zac Komur

MD & CEO

SPONSORED BY The Market Online