Lithium is a fully charged opportunity

While the lithium sector continues to exhibit significant volatility, the structural outlook for lithium remains positive.4 HOURS AGOCritically, the structural outlook for lithium remains intact, which should support attractive long-term lithium prices and, by extension, significant cash generation from lithium producers.

Therefore, current weakness in the lithium sector should be seen as an attractive buying opportunity for investors.

Cyclical pressures, not structural

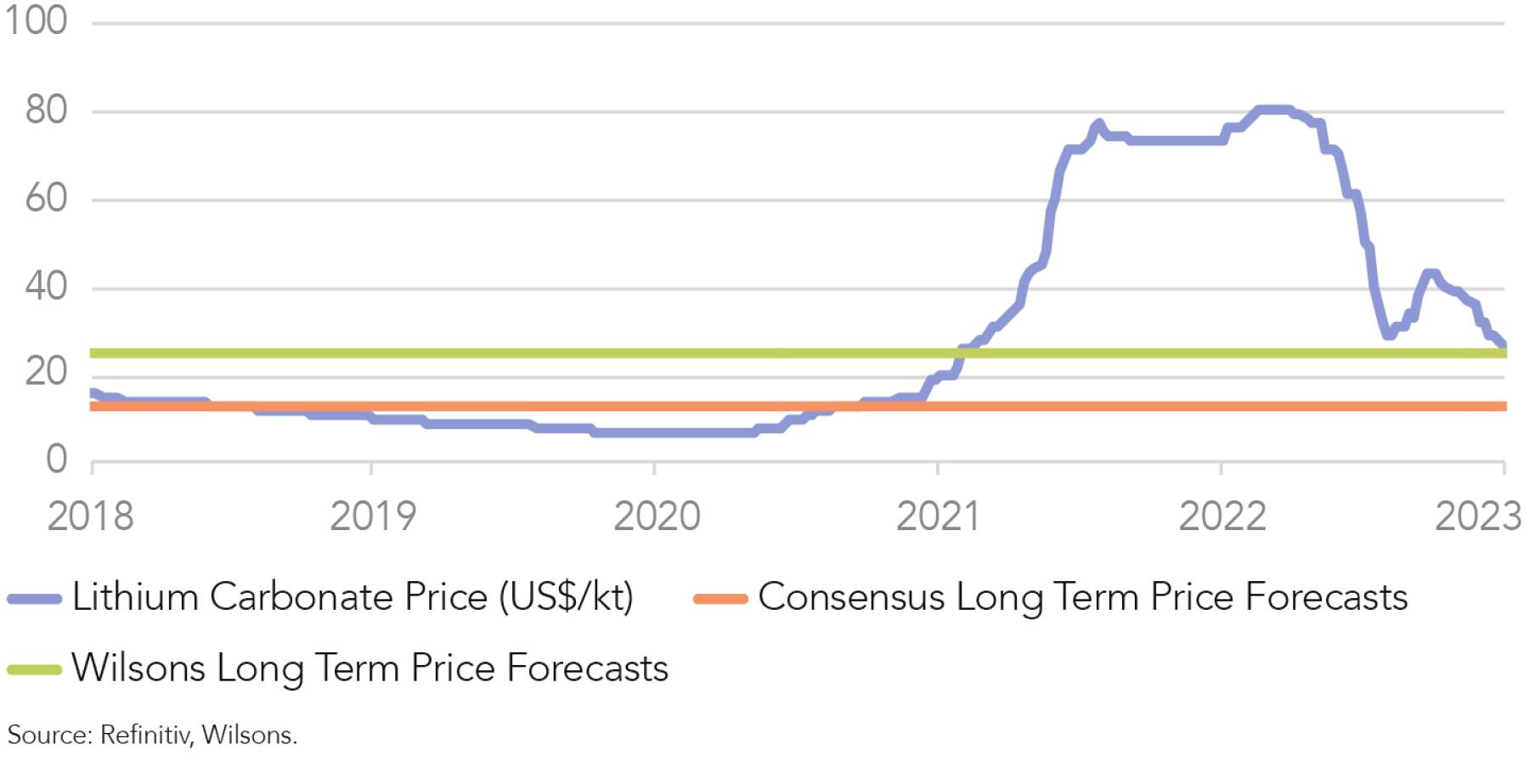

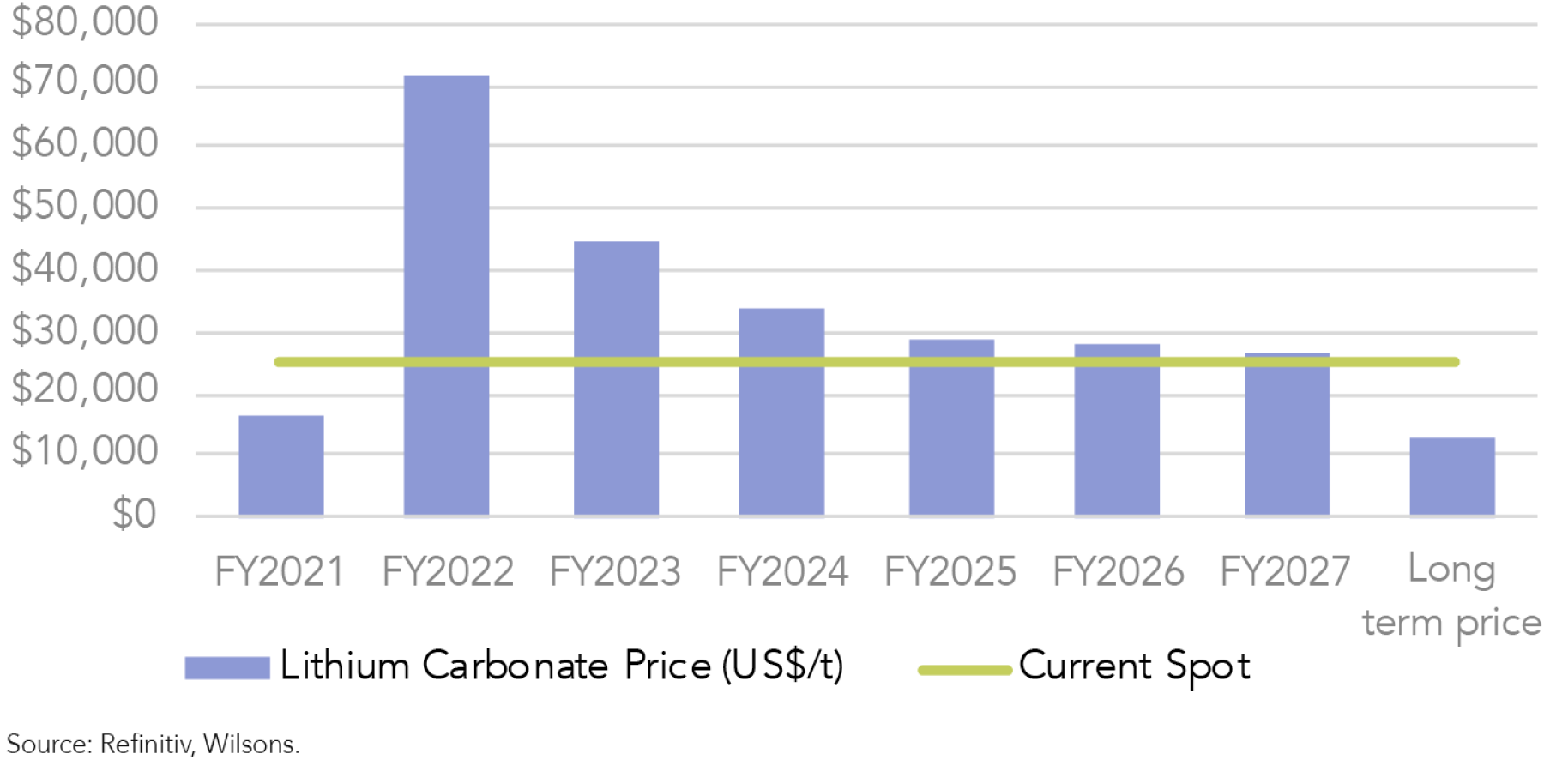

Lithium prices have come under pressure in recent months on the back of headwinds that are cyclical (not structural) in nature, which has weighed on share prices of the ASX listed miners, including our positions in Mineral Resources (ASX: MIN) and Allkem (ASX: AKE). The lithium carbonate spot price hit an all-time high of about $80 per kilogram of LCE (lithium carbonate equivalent) in November 2022, before falling back to its current price of ~$25 per kilogram of LCE.

Never miss an updateGet the latest insights from me in your inbox when they’re published.FOLLOW

The fall in price has primarily been driven by cyclical concerns around the pace of China’s electric vehicle (EV) uptake and the potential for oversupply as new projects come online.

However, the structural drivers are still intact, and the current sell-off appears overdone. Demand growth over the next decade should remain strong and supply will underwhelm consensus, in our view.

Figure 1: Spot lithium price has fallen closer to the long-term consensus forecast in the past month

China’s macro weakness a temporary issue

The underwhelming recovery of the world’s second largest economy and largest EV market has weighed on sentiment towards the lithium sector.

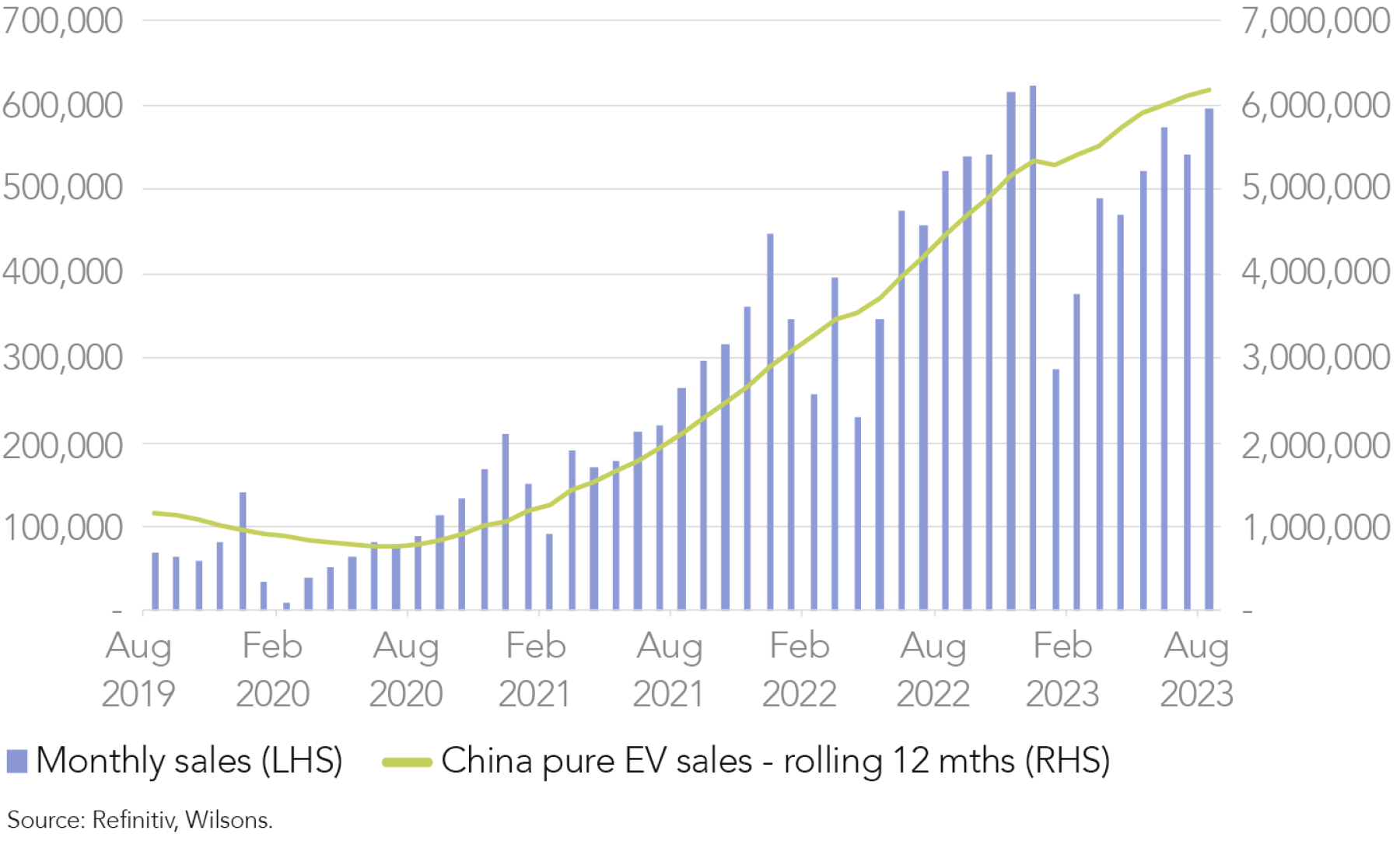

China has experienced cyclical softness in demand for EVs this year, driven by a subdued consumer backdrop, which has been exacerbated by inventory destocking by battery cell manufacturers, which we believe is nearly over.

Despite the immediate challenges in China, the long-term structural demand story for EVs remains strong.

China’s recent renewal of a tax break extension for EV purchases to 2025 should help to steady sector growth over the medium-term, while the headline data looks increasingly positive with China recording a record month of EV sales in August, with sales increasing +35% YoY, signaling the worst is over for the sector.

The prospect of further fiscal support aimed at stimulating Chinese household demand also presents a potential catalyst for the EV sector and the lithium price over the coming months.

Figure 2: China EV sales are at record levels : we expect sales to continue to grow over the next decade

Supply perfection improbable

Oversupply is a concern for the market. The most common bear case towards the lithium sector is that the market will be flooded with new supply as prospectors/explorers/miners ramp up their investments, incentivised by elevated spot prices.

However, given... the significance of demand over the next decade, stemming from the rapid transition to EVs, it is difficult to see a scenario where overall supply can keep up with the scale of expected demand this decade, with industry heavyweight Albemarle estimating that ~100 new projects will be needed by 2030 to support demand.

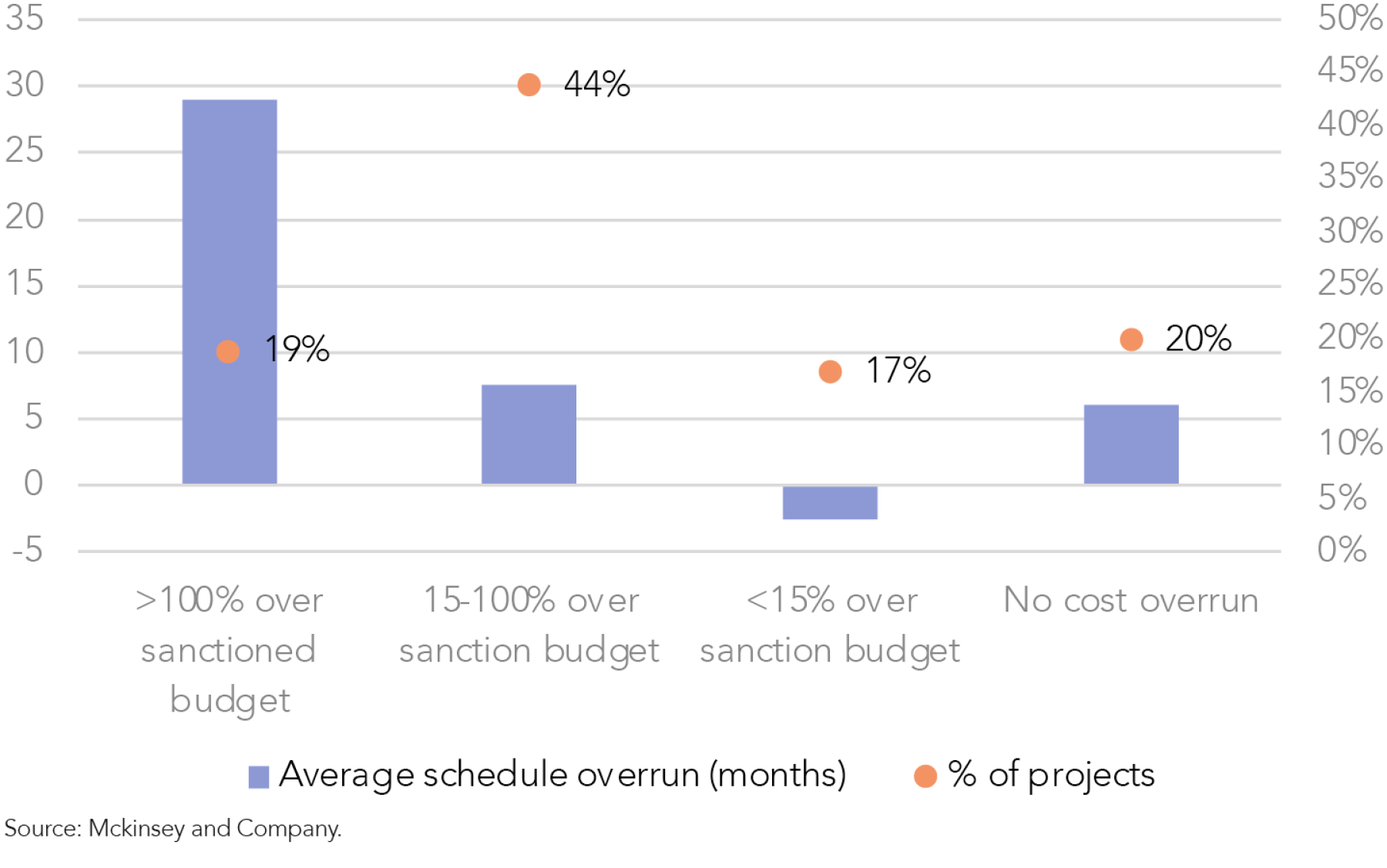

While a significant amount of new supply is forecast this decade, significant risks loom over consensus supply expectations. This is due to the growing prevalence of cost overruns and delays across lithium projects. Increases to growth/sustaining CAPEX combined with longer build timelines across the sector could put upward pressure on the lithium cost curve, which is likely to support higher commodity prices, all else equal.

Supply issues for lithium projects are likely to remain as:

- Supply Delays Common: Mining projects commonly experience delays ranging from 7 months to 2.5 years, with little room in supply forecasts for such setbacks. A Mckinsey study suggests that just around 20% of mining and metal projects are completed within their designated timelines and budgets.

- Labour Shortages: Persistent shortages in skilled labor continue to impact the industry.

- Industry Immaturity: The lithium sector, unlike traditional resources like iron ore and copper, lacks the established knowledge and intellectual property needed for rapid supply expansion, intensifying the challenges.

- US Inflation Reduction Act (IRA): ~60% of new supply is expected from countries without a US FTA (free trade agreement), and will be challenged to qualify as ‘IRA compliant’. Therefore, the increase in US demand will not be met with eligible supply. The US is expected to be the third largest market for lithium hydroxide by 2030.

Figure 3: Mining project timeline delays are commonplace

Structural demand drivers still going strong

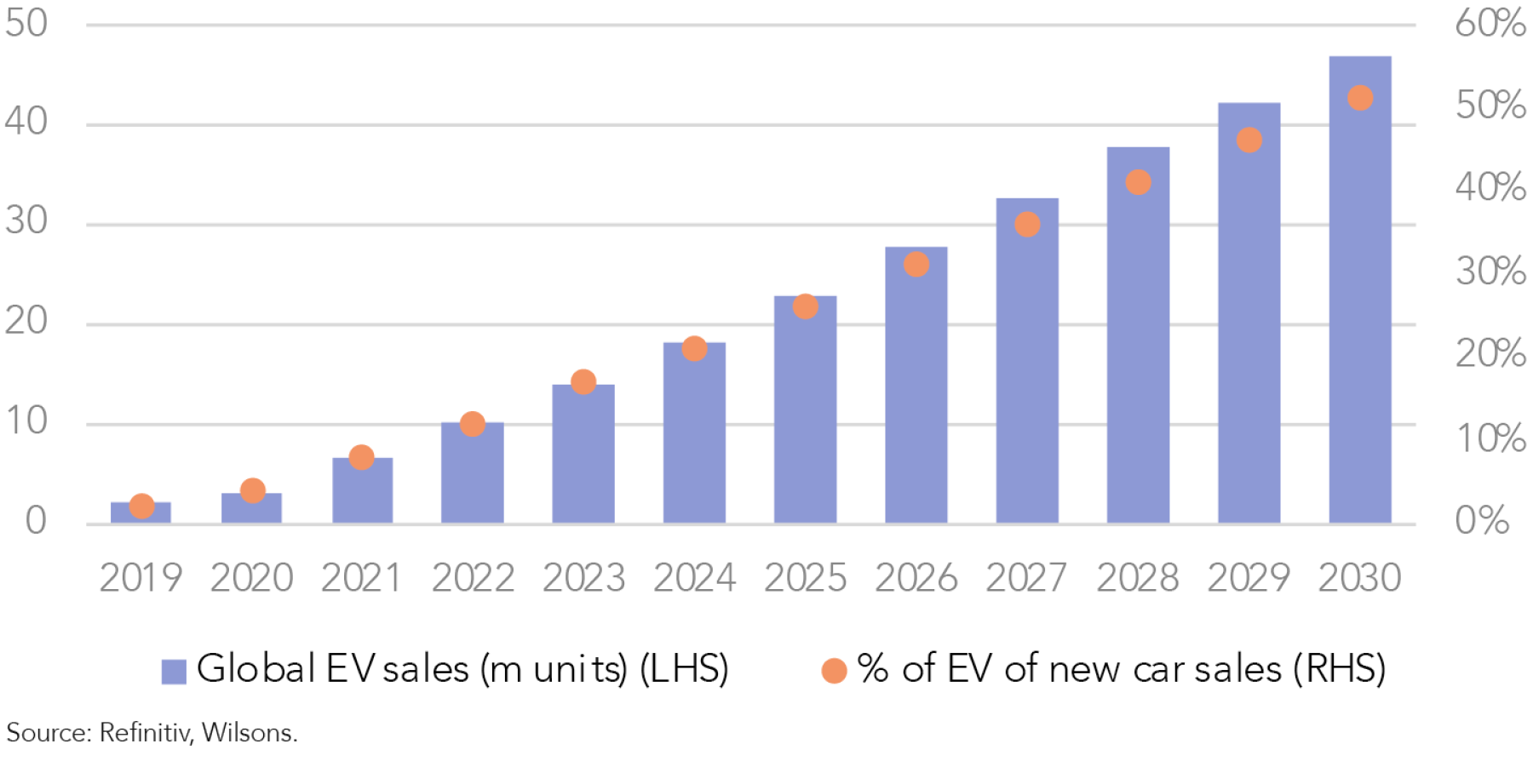

Looking past the cyclical volatility, the structural trend for lithium remains steadfast. Electric vehicle (EV) demand is poised to continue growing strongly in the latter half of this decade, in line with the targets and legislation announced by governments globally.

Global EV penetration is projected to reach 50% by 2030, with the number of EVs on the road expected to surge by 3.4 times current levels by the same year.

Figure 4: EV demand is forecast to continue to grow at a fast pace over the second half of this decade

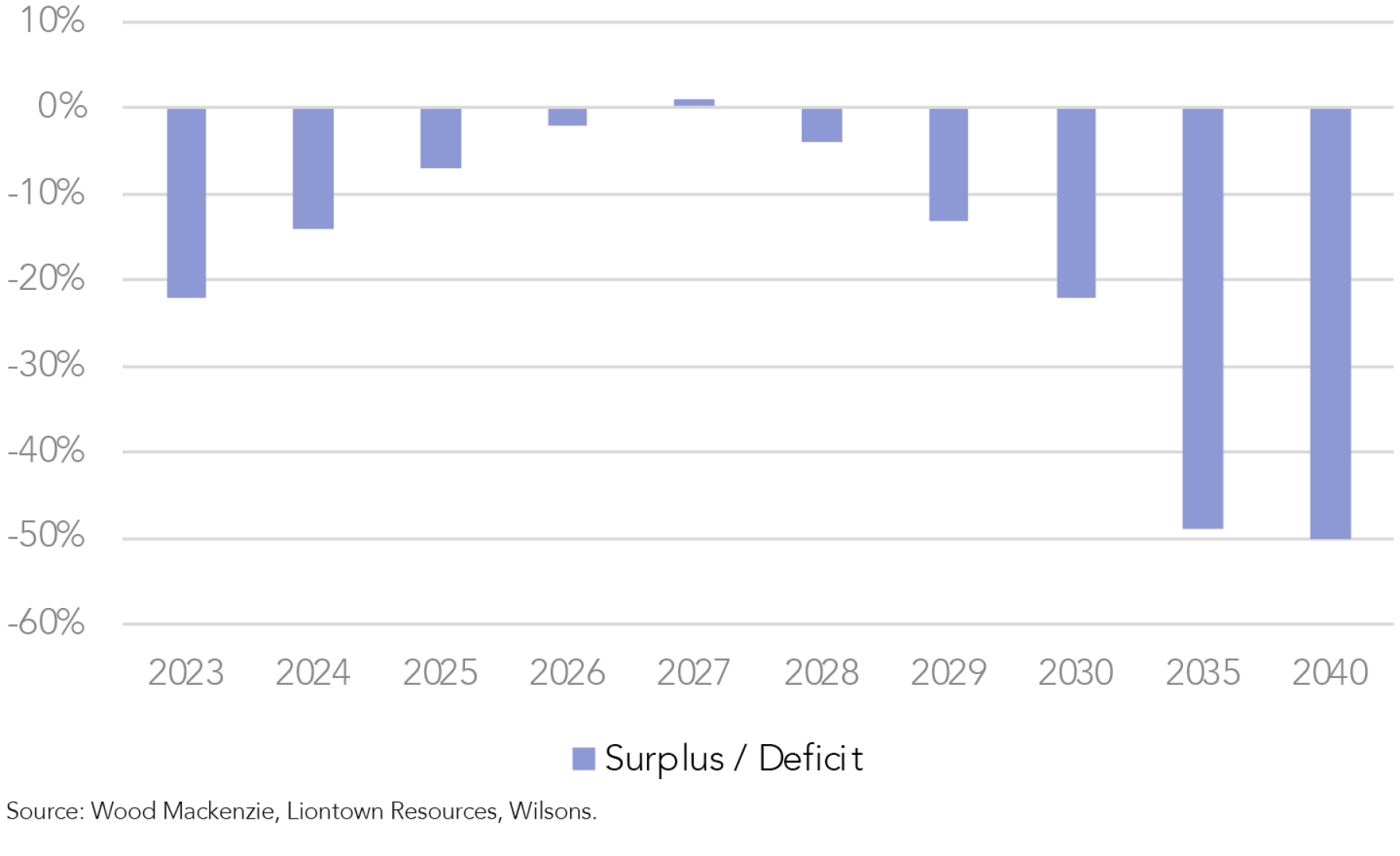

By the decade's end, the lithium market is anticipated to face a substantial deficit as demand outpaces supply. We do not think supply delays are adequately reflected in consensus expectations, which could exacerbate the forecast shortfall.

The prospect of worsening supply deficits presents upside risk to the lithium price, in our view. Should the market anticipate this deficit, prices are likely to rally as battery manufacturers rush to secure lithium reserves before the deficit materialises. Therefore, there is a risk the long-term consensus price rises over the medium term.

Figure 5: Battery grade lithium market deficit is expected to grow out to 2040, driven by significant demand and tight supply

Figure 6: There is upside risk to consensus price forecasts if a supply deficit is realised in the long term

What Are We Looking for?

We want to hold lithium miners that have 3 key characteristics:

- Production growth - firms poised to become industry leaders with reduced dependency on elevated prices to increase cash flow.

- Generating cash to fund production growth - investors in this fledgling sector are cautious about potential capital raises.

- Maintaining low production costs - a crucial factor for sustaining cash flow during challenging periods.

Allkem (AKE)

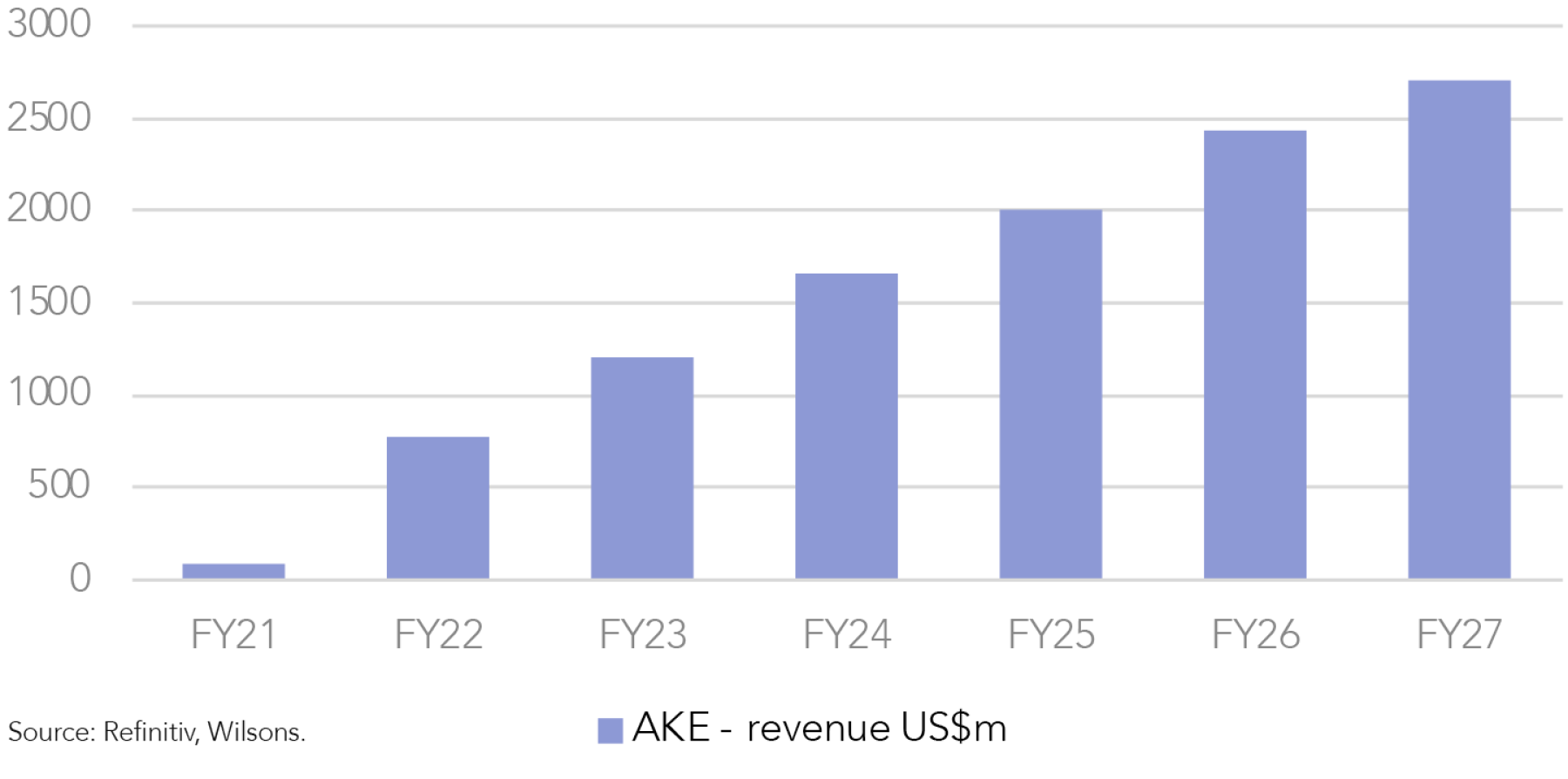

- Production is expected to triple by FY26 from FY23, from ~30kt to ~100kt. Growth will not be finished there with consensus expected production to increase by ~140kt by the end of the decade.

- Even with capex associated with growth, AKE is expected to generate a free cash flow (FCF) yield of 7.7% in FY24. AKE also has ~US$1bn of cash on the balance sheet, and in a net cash position.

- The majority of AKE’s production comes from lithium carbonate. Lithium carbonate is lower cost than hard-rock spodumene.

Other factors:

- AKE has a strong management team

- AKE will benefit from synergies from the Livent merger

- Diversified production by lithium type (both lithium carbonate and spodumene) and geography (Argentina, Australia, Canada, Japan).

Figure 7: AKE production is expected to drive revenue growth over the medium term

Mineral Resources (MIN)

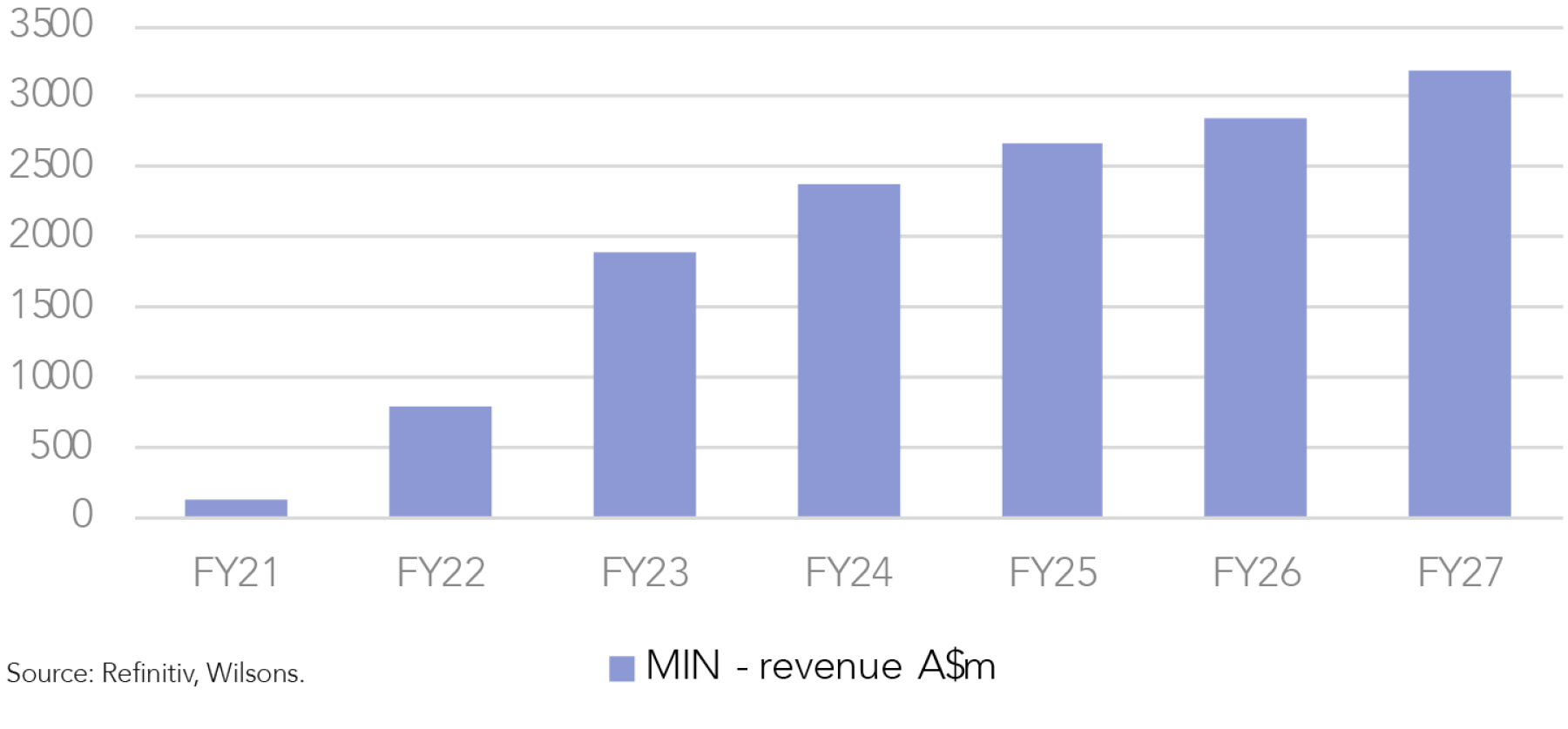

- Production is expected to double by FY25 from FY23, from ~400kt to ~800kt. Spodumene production is expected to hit over 1,000kt by FY27.

- Balance sheet has $1.4bn of cash and net debt/EBITDA at 1x. Substantial capex costs this year, but we think the balance sheet is manageable, albeit tight. MIN shareholders will reap the rewards from FY25 onwards.

- Management needs to execute this half. We are wary that management strategy has been relatively unpredictable. Disciplined delivery will be key to unlock value. If management cannot do this over the next quarter, it will be a red flag to our investment thesis.

- MIN’s lithium projects are reasonably low cost, in line with peers such as Pilbara Minerals Ltd (ASX: PLS).

- MIN provides optionality on iron ore. Stimulus from China aimed at the domestic property sector would benefit iron ore miners.

Figure 8: MIN’s production is expected to drive revenue growth over the medium term

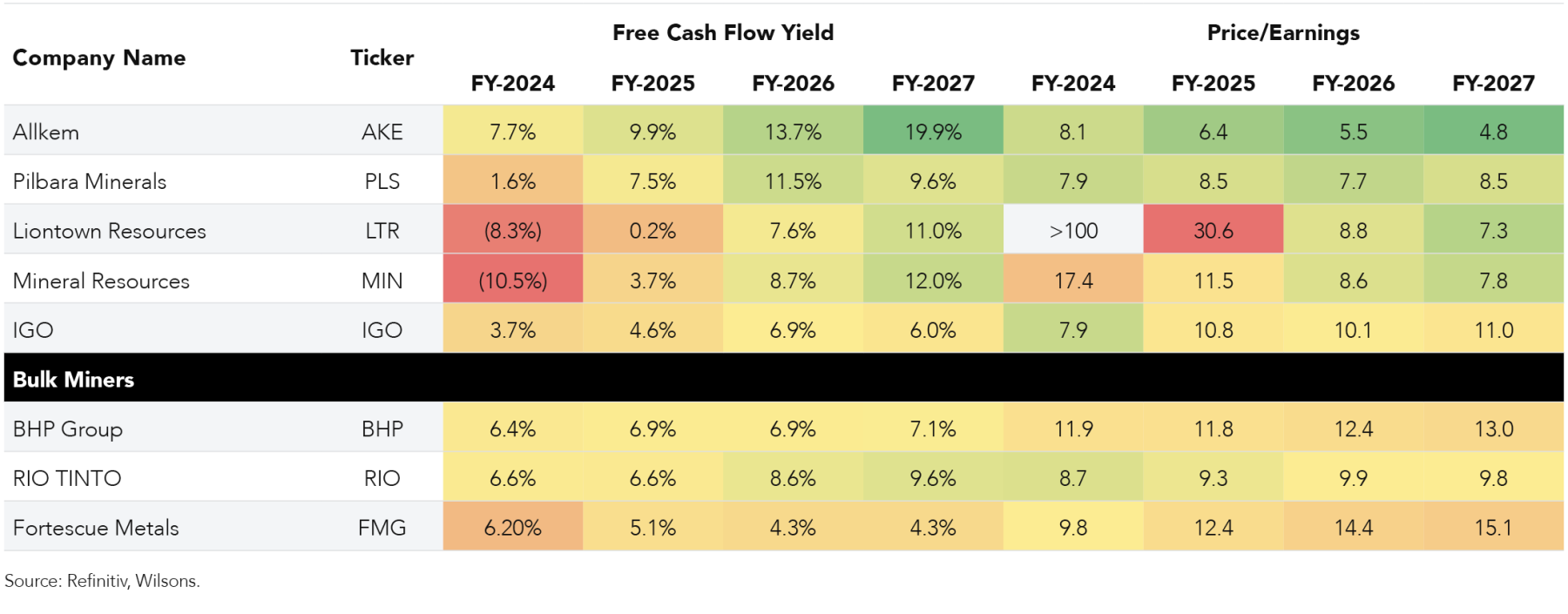

Figure 9: Fundamental metrics

Want more insights like this?

WILSONS thinks differently and delves deeper to uncover a broad range of interesting investment opportunities for its clients. To read more of our latest research, visit our Research and Insights.

- Forums

- ASX - By Stock

- Good News & Bad News

Lithium is a fully charged opportunityWhile the lithium sector...

-

- There are more pages in this discussion • 10,736 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add PLS (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$2.79 |

Change

-0.130(4.45%) |

Mkt cap ! $8.398B | |||

| Open | High | Low | Value | Volume |

| $2.89 | $2.92 | $2.79 | $56.11M | 19.76M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 43 | 231594 | $2.79 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $2.80 | 28889 | 3 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 42 | 211594 | 2.790 |

| 51 | 745923 | 2.780 |

| 28 | 265452 | 2.770 |

| 21 | 152342 | 2.760 |

| 58 | 160622 | 2.750 |

| Price($) | Vol. | No. |

|---|---|---|

| 2.800 | 28889 | 3 |

| 2.810 | 121753 | 6 |

| 2.820 | 52457 | 7 |

| 2.830 | 152075 | 3 |

| 2.840 | 174473 | 4 |

| Last trade - 16.10pm 30/07/2024 (20 minute delay) ? |

Featured News

| PLS (ASX) Chart |

The Watchlist

MTL

MANTLE MINERALS LIMITED

Nick Poll, Executive Director

Nick Poll

Executive Director

SPONSORED BY The Market Online