ASX 200 to rise + S&P 500 enters official bull market

ASX 200 futures are trading 29 points higher, up 0.40% as of 8:30 am AEST.

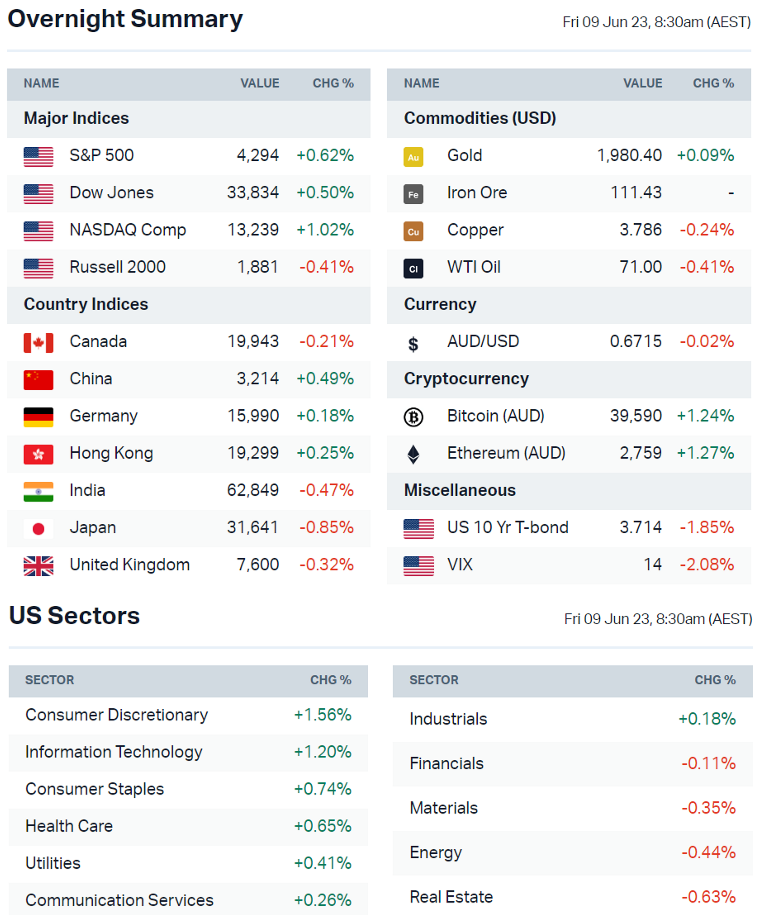

Source: Market Index

S&P 500 SESSION CHART

S&P 500 higher and closed at session highs (Source: TradingView)

MARKETS

STOCKS

- S&P 500 higher and closed at best levels, highest close since 16 Aug 22

- S&P 500 enters official bull market, up 20% from its 12 Oct 22 low

- Prior bear market saw the Index fall 25.4% over 282 days

- Goldman Sachs’ US Equity Sentiment Indicator rises to highest level since Sep 21

- CME Fedwatch Tool currently sees 71.3% likelihood of Fed pause (CME)

- CNN’s Fear & Greed Index rises to 76, highest level since February (CNN)

- Canadian and Australian surprise hikes rattles global bonds Bloomberg)

- Cboe One-Day Volatility Index has fallen at open every day since April (Bloomberg)

- Hot trades of 2023 are unraveling in markets, US dominance stays intact with stocks and dollar defying bears while bets on Yen and China equities backfire (Bloomberg)

ECONOMY

- Carvana issued an upbeat Q2 outlook, profits per unit jump (Reuters)

- Trip posted better-than-expected Q1 results, Chinese demand strong (Forbes)

- Adobe announced AI tool, Firefly to large business customers (Reuters)

- Amazon initiated Overweight at Wells Fargo, bullish on regional fulfilment model (CNBC)

- GameStop fired CEO Matthew Furlong, no reason provided (CNBC)

- US initial jobless claims jump to highest level since Oct 21 (Reuters)

- China rate-cut expectations grow as signs of weak recovery mount (Bloomberg)

- China's state banks cut deposit rates to bolster economy (Bloomberg)

- Japan Q1 GDP revised higher amid bump in business spending(Bloomberg)

- Eurozone succumbs to mildest of recessions on energy shock (Bloomberg)

- UK wage growth accelerates despite cooling labor market (Reuters)

- Taiwan exports fall for ninth consecutive month as China weighs (Reuters)

- ECB expected to end its rate hiking cycle at 3.75% (Reuters)

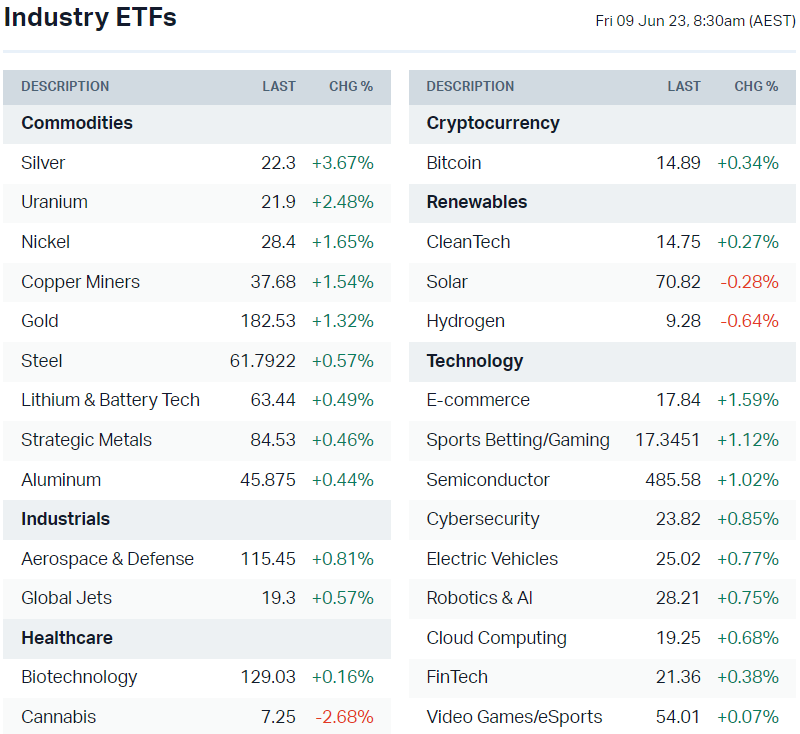

US-listed sector ETFs (Source: Market Index)

Deeper Dive

Food for thought: Sentiment, positioning and earnings

A few charts and perspectives to think about.

#1: CNN's Fear & Greed Index is now back to extreme greed levels. The Index gives a score from 0 to 100, with 100 representing maximum greediness and 0 signalling maximum fear.

CNN Fear & Greed Index chart (Source: CNN)

The Index is currently sitting at 76. It's only crossed the 75 level on two other occasions in the past year:

I've marked both of these on the S&P 500 chart below (red circle).

- 1 February 2023

- 1 December 2022

S&P 500 with Extreme Greed levels (Source: TradingView)

#2 An interesting note from Barrons: “Investors are positioned for the worst ... The only problem: They may be positioned for a bear market that already occurred. And the higher the S&P 500 goes ... the more likely it is that bearish investors will have to start buying.”

Where will idle cash go if the markets continue to rally? What about money managers that are paid to participate in markets? Can they ignore a bullish market?

#3 Another interesting perspective from Jurrien Timmer, Director of Global Macro at Fidelity: "We know from past market cycles that stocks tend to bottom well ahead of earnings, which by definition means that the first few quarters of a new bull market tend to be driven by multiple-expansion."

"October could be the low if earnings start to recover in the second half. At inflection points, price usually leads earnings by around 2-3 quarters, so this would be a bit longer than that. But the missing ingredient is still the Fed. The market has a better chance at looking past earnings valleys when liquidity conditions are easing."

Charts of the Week

This segment of the morning wrap brings you weekly technical commentary on the ASX 200 and some of the more interesting charts in the market. These are not meant as recommendations. They are for illustrative purposes only. Any discussion of past performance is for educational purposes only. Past performance is not a reliable indicator of future return. Always do your own research.

ASX 200 – No man’s land

Source: Commsec

I wrote last week of the narrowing range in the ASX 200 and the “technical” calm on the ASX 200. Whilst there is plenty going on beneath the surface, there really isn’t much happening at an index level. If anything, the index is showing signs that it wants to break lower in recent sessions but we are yet to see a clear move. For now we continue to play the waiting game.

AGL Energy (ASX: AGL) – Powering Up

Source: Commsec

It was very slim pickings today. Just 9 stocks made it onto my scan list – that is, just 9 stocks met my technical analysis screening criteria. That is a symptom of the sideways, grinding market talked about above. There just aren’t many stocks that are trending strongly right now. AGL Energy happens to be one of them and, admittedly, the chart looks pretty good: uptrend support, powered through the $9 round number, rising average volume. The questions begs, however, ‘has it run too far, too fast’. An RSI around 80 suggest that it probably has and traders might be better served by waiting for a pullback, confirmation of support, and then looking to buy the retrace. One for the watchlist.

Capricorn Metals (ASX: CMM) – Wedge pattern

Source: Commsec

The only other chart of interest worth talking about was Capricorn Metals (CMM). As can be seen, the price action has formed a wedge pattern, with longer-term uptrend support. Volumes have been picking up and the price action looks as though it wants to break higher. If that happens, another run up to the $5 round number is likely, although the bulls have already failed twice at that level so it will likely act as stubborn resistance again.

Key Events

ASX corporate actions occurring today:

Economic calendar (AEST):

- Trading ex-div: ALS (ALQ) – $0.194

- Dividends paid: Nufarm (NUF) – $0.05

- Listing: None

This Morning Wrap was first published for Market Index by Chris Conway and Kerry Sun.

- 11:30 am: China Inflation Rate

- 10:30 pm: Canada Unemployment Rate

- Forums

- ASX - By Stock

- Indices 05/06

ASX 200 to rise + S&P 500 enters official bull market ASX 200...

-

- There are more pages in this discussion • 18 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add XJO (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

8,182.2 |

Change

-73.400(0.89%) |

Mkt cap ! n/a | |||

| Open | High | Low |

| 8,255.6 | 8,255.6 | 8,139.1 |

Featured News

| XJO (ASX) Chart |

The Watchlist

NUZ

NEURIZON THERAPEUTICS LIMITED

Michael Thurn, CEO & MD

Michael Thurn

CEO & MD

SPONSORED BY The Market Online

.png)

.png)