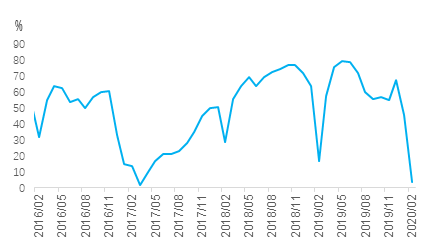

I’ve posted about EAFs and their falling profitability recently. Capacity utilisation rates have effectively dropped to near 0%.

They were unprofitable prior to Corona and the decline in rebar prices will only prolong their shutdown.

Also Mysteel reporting that days cover of scrap are declining and a lower % of scrap being used to feed into the blast furnaces.

About 20% of steel output comes from scrap inputs. Approx 1.4 metric tonnes of IO are needed to produce 1 metric tonne if steel. If scrap % lowers, then a large amount of IO is needed to substitute the lower scrap usage to maintain the same level of steel output.

Ie 20mt of less scrap say from EAF closures mean 28mt more IO to maintain same level of steel output.

It’s all very interesting but the scrap/EAF market looks to have grinded to a standstill

It’s being overlooked at the moment and quite material IMO

.............

Mysteel:

China’s blast furnace (BF) steel mills are now reducing their consumption of steel scrap in both their ironmaking and steelmaking processes to nurse what inventories they have, Mysteel Global learned Wednesday. The mills’ steel scrap inventories at hand are decreasing daily as scrap deliveries to their yards have declined, chiefly because of the Chinese New Year (CNY) holiday break and because of the outbreak of Novel Coronavirus Pneumonia, a Shanghai-based market watcher explained.

........

SHANGHAI, Feb 14 (SMM) – As the coronavirus (COVID-19) outbreak disrupted shipments from steel mills and trigger production cuts or maintenance, shortage of steel scrap may expand the cutback and result in a significant decline in crude steel output in February.

An SMM survey indicates that the amount of molten iron daily production affected by cutback and maintenance at steelmakers has increased from less than 100,000 mt on January 23 to nearly 300,000 mt as of February 13.

China has a total amount of scrap steel resources of 240 million mt in 2019, up 9% from a year earlier, showed statistics of the China Association of Metal Scrap Utilisation. But currently supply tightness still dominates the steel scrap market, according to SMM survey, as the epidemic prevented some scrap processing companies from returning operations, and transportation curbs disrupted purchases of some steel mills.

Some steelmakers have halted procurement of scrap and turned to produce scarp on their own. They also reduced the proportion of steel scrap used in raw materials, which is set to weigh on their near-term production.

A steel plant in central China has cut its monthly production of hot-rolled coils from the previous 400,000 mt to 290,000 mt, due to disrupted supply of steel scrap.

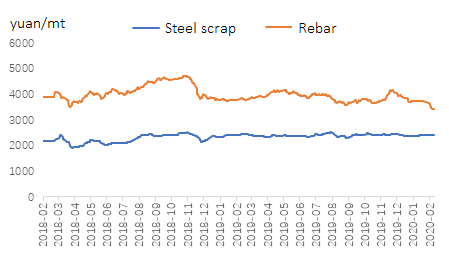

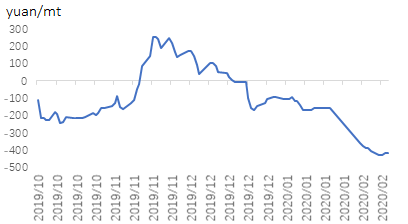

Prices of steel scrap have slipped 1.7% from the pre-holiday levels, SMM assessed as of February 13. This, compared with a drop of 8.3% in rebar prices, squeezed margins at electrical arc furnace (EAF) steelmakers. Losses at EAF steel mills have widened to 417 yuan/mt from 157 yuan/mt before the holidays, and this accounted for the recent shutdown of a slew of producers.

Steel scrap prices held relatively firm (Source: SMM)

Profits at EAF steelmakers slipped (Source: SMM)

Operating rates of scrap-using steel mills fell to low levels (Source: SMM)

With the increase in steel scrap usage in steelmaking over the recent years, steel scrap has accounted for around 20% of the crude steel production. SMM calculates that a reduction of 1% in the proportion of steel scrap in raw materials mix will cause a decline in crude steel output by 15 million mt.

SMM expects steel scrap shortage and elevated in-plant inventories will likely expand the maintenance or production cut at steelmakers.

- Forums

- ASX - By Stock

- FMG

- Iron ore price

Iron ore price, page-19481

-

- There are more pages in this discussion • 34,847 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add FMG (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$18.30 |

Change

0.030(0.16%) |

Mkt cap ! $56.49B | |||

| Open | High | Low | Value | Volume |

| $18.26 | $18.41 | $18.18 | $65.67M | 3.591M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 6 | 516 | $18.30 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $18.31 | 8098 | 18 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 12 | 9213 | 18.290 |

| 12 | 9072 | 18.280 |

| 9 | 9176 | 18.270 |

| 12 | 6024 | 18.260 |

| 11 | 10525 | 18.250 |

| Price($) | Vol. | No. |

|---|---|---|

| 18.310 | 2627 | 8 |

| 18.320 | 4159 | 14 |

| 18.330 | 9268 | 11 |

| 18.340 | 10502 | 8 |

| 18.350 | 11207 | 10 |

| Last trade - 11.46am 02/09/2024 (20 minute delay) ? |

Featured News

| FMG (ASX) Chart |

The Watchlist

CCO

THE CALMER CO INTERNATIONAL LIMITED

Anthony Noble, MD & CEO

Anthony Noble

MD & CEO

Previous Video

Next Video

SPONSORED BY The Market Online