Over the last week, the floodgates have AGAIN opened up on the ‘inevitable’ demise of China’s economy.

But is that warranted? Is Australia’s iron ore industry set to implode?

Let’s examine the latest data, its impact on major mining firms, and what it means for the broader commodity market.

Never miss an updateGet the latest insights from me in your inbox when they’re published.

But before we do that…

Cast your mind back to the Evergrande panic from this time last year… It marked the culmination of bearish sentiment in China’s economy.

Imminent fears of a liquidity crisis in the country’s real estate market sprouted after the country’s second-largest development company folded under heavy debt.

According to the media, this was set to become China’s ‘Lehmann Brothers moment.’ An event akin to the sub-prime crisis that manifested into a global financial recession in 2008.

I disagreed and challenged that narrative, as you can read here.

And as we now know, fears of a broader economic collapse never materialised in 2023. In fact, to most pundits’ surprise, China finished last year with an impressive 5.2% GDP growth.

But the bears are back!

And once again, western media is out in force looking to make its king hit on China’s economy. They justify the threat due to the country’s maligned real estate market.

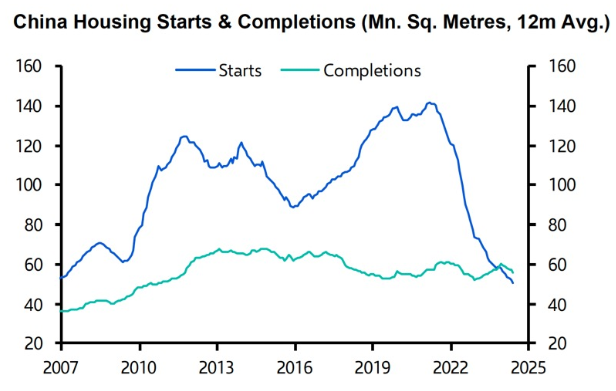

Over the last month, a big deal has been made over the lack of new housing starts... But this is old news. As you can see, new constructions (blue line) fell precipitously during the 2022 pandemic lockdowns and have failed to recover since:

Source: Capital Economics

Source: Capital EconomicsBut the market has likely priced in any calamitous fallout from this event… That includes iron ore miners, steel makers, and Chinese property developers.

But again, the media forgets (or doesn’t understand) that markets are forward-looking.

But here’s another important consideration…

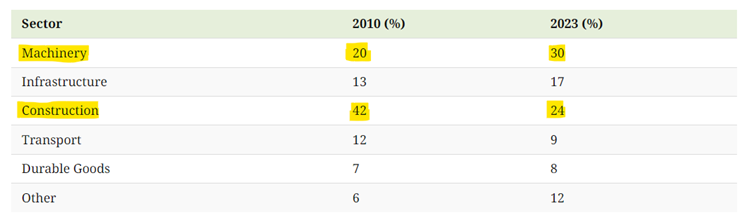

While Chinese real estate construction remains an important driver of steel demand, it’s not what it used to be.

You see, during China’s rapid growth phase in the early 2000s, construction (including housing, office, and industrial buildings) accounted for almost half the country’s steel demand…. Today, it’s less than a quarter, or just 24%.

Interestingly, machinery construction is now the single biggest driver of steel demand in China.

That includes machinery for mining, agriculture, tools and the millions of parts shipped worldwide for vehicle manufacturing.

Yet, the media remains fixated on the decade-old idea that iron ore demand depends exclusively on China’s real estate market.

The reality couldn’t be any different; demand drivers within China’s steel industry is today far more diverse compared to the country’s growth phase from the early 2000s:

Source: Visual Capitalist/BHP

Source: Visual Capitalist/BHPBut with that said, we can’t ignore the carnage happening across the world’s largest iron ore producers.

Fortescue [ASX: FMG]has fallen 25% over the last four weeks or almost 40% year-to-date. Meanwhile, the Brazilian iron ore giant, Vale, has shed around 22% in 2024:

Despite real estate’s diminishing role in Chinese steel demand, the stock market is pricing in ongoing risk.

And with Chinese steel makers announcingoutput cutslast week, the situation is starting to bite especially hard for the miners. The iron ore spot price threatens to break decisively below the key psychological level of US$100/tonne.

Time to brace for more carnage?

Iron ore serves as a critically important barometer for the broader resource market... The canary in the coal mine if you like.

Given the deep selling that’s taken place over the last week or more, there’s valid cause for concern.

On the surface, it’s difficult to be optimistic… Australia’s largest mining firms have reacted severely to poor news on China’s economy.

Since steelmakers have announced significant cutbacks, it’s easy to accept that iron ore will fall further. But it might not be so simple.

Western media holds a very superficial view of China’s economy… The narrative is overwhelmingly bearish and usually defaults to weakness in the country’s real estate market.

But consider this: China holds a long track record of manipulating commodity prices to its advantage.

It’s hard to criticise that strategy. If you’re a major buyer, why not do all you can to limit the price you pay? To hell with the World Trade Organisation and its agenda of serving the interests of Western members!

As the world’s biggest consumer, China can manipulate iron ore prices and fulfil its longer-term objectives.

Given this authoritarian state’s broad reach across Chinese-owned entities, including steelmakers, it can easily collude with them to drive down iron ore prices whenever it is strategic to do so.

Curbing steel production could be part of a coordinated plan by authorities and subservient steel makers to undermine the price of iron ore.

However, once the CCP deems prices sufficiently depressed, I believe it will shift gears and ramp up stockpiling efforts, just as it did throughout the pandemic years.

And that was despite minimal demand for steel at the time.

Paradoxically, today’s bearish sentiment in the iron ore market could signal long-term strength as China attempts to decrease prices and secure more supply.

But again, that’s not something you’ll read in the mainstream.

Take this from a recent Reuters report:

“The strength in China’s iron ore imports this year stands in stark contrast to the weakness in steel production and demand, setting up a dilemma as to how the contradiction will be resolved.”

Nothing happens by chance in China, which extends to its access to raw materials, chiefly energy and iron ore.

From here, you should beobserving iron ore imports.

Strong imports (in the face of falling steel production) will confirm my suspicions:

The CCP is helping drive down iron ore prices and perhaps positioning for stronger future demand.

Again, that seems like a paradox, given all the negative news about China’s economy in the media.

Yet, it’s precisely what a forward-looking authoritarian government will seek to achieve... China has every reason to pile pressure on iron ore prices if it aims to increase stockpiles in the months ahead.

If I’m right, that limits the downside risk for iron ore miners. Once prices have fallen sufficiently, China will be ready to buy up big.

But at what point will we hit that support?

For now, US$100/tonne remains in play despite prices dipping slightly below recently.

That price held during the April lows after panic first set in after the initial announcements of steel cuts among China’s major steel firms.

But if it fails, we could see a sharp fall to around US$85/tonne, the low from October 2022. That marked peak pessimism during China’s pandemic lockdown.

Another key psychological level, red circle below:

I said it 12 months ago in the wake of the Evergrande collapse, and I’ll repeat it today... I don’t believe the iron ore market is about to fall off a cliff like many in the West fear.

(20min delay)

(20min delay)