It's almost as if ZH read my mind...

Redburn Slaps McDonald's With Rare Downgrade As GLP-1 Drugs Reshape Consumer Habits

by Tyler Durden

Tuesday, Jun 10, 2025 - 06:55 PM

As we've previously noted, the shift toward "better-for-you" consumption is well underway, whether fueled by the "Make America Healthy Again" (MAHA) movement or the increasing adoption of miracle weight-loss drugs suppressing appetites. Either way, the inflection point for U.S. restaurants has arrived.

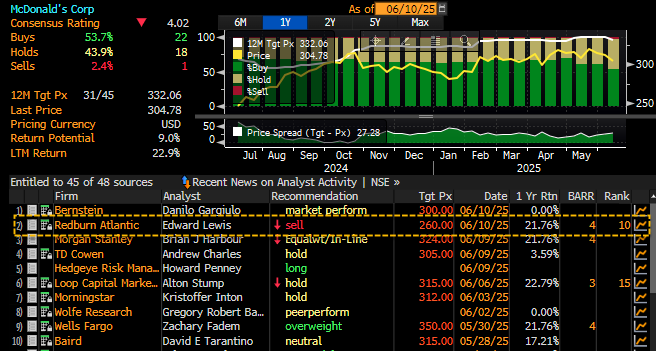

Redburn Atlantic analyst Edward Lewis became the first in recent memory to downgrade McDonald's, cutting the stock from "Buy" to "Sell" on the premise that GLP-1 weight-loss drugs will suppress consumer appetites.

Lewis now stands alone among the 41 analysts tracked by Bloomberg with a bearish stance on McDonald's. He set a Street-low price target of $260, well below the $332 average and the stock's most recent close of $304.78.

Key reasons for the downgrade:

Additional concerns:

- GLP-1 weight-loss drugs are curbing appetites and pose a long-term structural threat to the fast-food industry.

- Lewis argues these drugs will trigger broad behavioral shifts, impacting group dining and reducing habitual demand, especially among lower-income consumers.

- He warns that what looks like a "1% drag" today could compound into a 10%+ hit over time.

Also noted:

- U.S. consumers are fatigued after years of menu price inflation.

- Rising tariffs are squeezing brands with limited pricing power.

Separately, last month, we reported that Goldman analysts Leah Jordan and Eli Thompson informed clients that early indications suggest consumers are shifting and seeking "better-for-you options" at the supermarket.

- Initiated coverage on Domino's Pizza with a sell rating.

- Rated Chipotle as neutral.

- Upgraded Yum Brands to buy, citing a more reasonable valuation, conservative expectations, and strong international exposure.

"Softer snacking demand with outperformance in better-for-you options," Jordan said.

On Monday, Jordan downgraded General Mills and Conagra Brands due to several headwinds, "including increasing cost pressures (raw materials, tariffs, A&P investments) along with tepid volume demand amid ongoing consumption shifts toward fresh and increasing competition from private label and smaller brands."

Let's hope these healthy consumer shifts are here to stay amid a nationwide health crisis.

- Forums

- ASX - By Stock

- GYG

- Is GYG grossly overvalued?

GYG

guzman y gomez limited

Add to My Watchlist

0.34%

!

$29.04

!

$29.04

Is GYG grossly overvalued?, page-183

Featured News

Add to My Watchlist

What is My Watchlist?

A personalised tool to help users track selected stocks. Delivering real-time notifications on price updates, announcements, and performance stats on each to help make informed investment decisions.

(20min delay) (20min delay)

|

|||||

|

Last

$29.04 |

Change

-0.100(0.34%) |

Mkt cap ! $2.981B | |||

| Open | High | Low | Value | Volume |

| $28.70 | $29.52 | $28.56 | $4.706M | 162.2K |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 2032 | $28.88 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $29.04 | 658 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 100 | 28.560 |

| 4 | 401 | 28.500 |

| 1 | 20 | 28.400 |

| 1 | 106 | 28.100 |

| 8 | 514 | 28.000 |

| Price($) | Vol. | No. |

|---|---|---|

| 29.700 | 50 | 1 |

| 29.750 | 50 | 1 |

| 29.930 | 1000 | 1 |

| 30.000 | 605 | 6 |

| 30.080 | 350 | 1 |

| Last trade - 16.10pm 13/06/2025 (20 minute delay) ? |

Featured News

| GYG (ASX) Chart |