That time when everyone had a stake in a nickel mine – until it all went bust

The god of earthquakes has a connection with the dry and dusty landscape of WA, given the land-shaking impact that Poseidon had on Australian sharemarkets in 1970.

By JOHN MOSESFrom SportJune 13, 20243 MINUTE READ11The Australian is turning 60 and we invite you to celebrate with us. Our first special series to mark the event is: Six Decades in Six Weeks, counting down to the 60th birthday of the masthead on July 15. Every day for the coming weeks we will bring you a selection of The Australian’s journalism of the past 60 years. See the full series here.

The Poseidon bubble made many sharemarket punters rich but sent more broke, as the miner’s stock price went from $1 to $280 – then collapsed.

POSEIDON SANK MANY AN INVESTOR

- By John Moses, who recalled 1969-70 for our 20th anniversary

Poseidon, one of the gods of Greek mythology, is generally accepted as having been underlord of the sea. His connection, therefore, with the dry and dusty landscape of Western Australia is a touch tenuous. But in another manifestation, he was also god of earthquakes, a “land shaker”. That seems more like it, given the impact that Poseidon had on Australian sharemarkets in 1970.

For a time, thousands of Australians gave up gambling on horses to punt on the stockmarket. They found, in the event, that dealing with brokers rather than bookmakers had about the same results: win some, lose some – usually the latter.

The speculative fever of the time provoked a select Senate commission of inquiry which, some years later, was to help create regulatory organisations such as the National Companies and Securities Commission and also a climate in which investors at large would never again go on the kind of spree which brought fortunes to some but financial disaster to most.

The run on Poseidon had begun in October 1969, when the shares were being quoted at $1. On the basis of optimistic reports about a major nickel strike at Windarra, in WA, its shares moved quickly to $20. By December, they hit the magic $100 in Perth, and $96 in the eastern states. It was unstoppable. As 1970, dawned Poseidon soared through the $200 barrier and reached $280 by February.

****

Such was the volatility of the market, and what appeared to be the opportunity to make quick fortunes, that stock exchanges were besieged by amateurs seeking investment advice. A Sydney schoolboy, bankrolled by his father, turned $1500 into thousands. In less than a month, 400,000 people phoned the Sydney Stock Exchange seeking the latest prices, and an enterprising shipping organisation advertised a Pacific cruise on which would-be investors could hear daily lectures about the stockmarket and how to make money from it.

****

In July, Poseidon’s latest quarterly report came out, still leaving investors guessing about the size and value of its ore body. And although it was generally optimistic – mining to begin in just over two years, with an expected life for the mine of 15 years – its share price slumped to $89. A week later, the Senate select committee began its hearings, in some difficulty. There were few people willing to come forward with evidence about malpractice and rip-offs. Said the chairman, senator Sir Magnus Cormack: “It’s like walking into a previously undisturbed area. All the rabbits are fleeing. They hear the first footfall and when you get there the bastards have disappeared forever. Now we have to send the ferrets down the burrows after them.”

****

In 1974, the committee reported, among many other matters, on Poseidon. It concluded there had been leakages of information, that the company’s geologists had misused their official position for private profits, and that in seeking information it could not rely on letters, public announcements, sworn testimony, statutory declarations or affidavits to reveal the truth of the Poseidon affair.

Turning to the financial community, the committee said that some of the techniques used by brokers and promoters during the boom were hangovers from the South Sea Bubble, amounting to “a diversion of funds from productive to speculative ends, or from the pocket of the public to the pockets of promoters, brokers and others”. By the time the report came out, the boom was over.

One vivid image remains from that time. In 1970, as it extended its exploration program, Poseidon built over its first drill hole a three-sided galvanised iron structure to shelter a box with a hole in the lid. Symbolically, and appropriately, it was – and probably still remains – the deepest outdoor dunny in the country.

- Forums

- ASX - By Stock

- LKE

- Is the bottom in?

Is the bottom in?, page-1380

Featured News

Add LKE (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

5.0¢ |

Change

-0.002(3.85%) |

Mkt cap ! $86.85M | |||

| Open | High | Low | Value | Volume |

| 5.2¢ | 5.3¢ | 5.0¢ | $205.1K | 4.009M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 29 | 2017442 | 5.0¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 5.1¢ | 17000 | 1 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 29 | 2017442 | 0.050 |

| 5 | 773244 | 0.049 |

| 10 | 675611 | 0.048 |

| 5 | 368169 | 0.047 |

| 6 | 818069 | 0.046 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.051 | 17000 | 1 |

| 0.052 | 50000 | 1 |

| 0.053 | 309025 | 8 |

| 0.054 | 335947 | 4 |

| 0.055 | 931155 | 7 |

| Last trade - 16.10pm 15/11/2024 (20 minute delay) ? |

Featured News

| LKE (ASX) Chart |

The Watchlist

ACW

ACTINOGEN MEDICAL LIMITED

Will Souter, CFO

Will Souter

CFO

Previous Video

Next Video

SPONSORED BY The Market Online

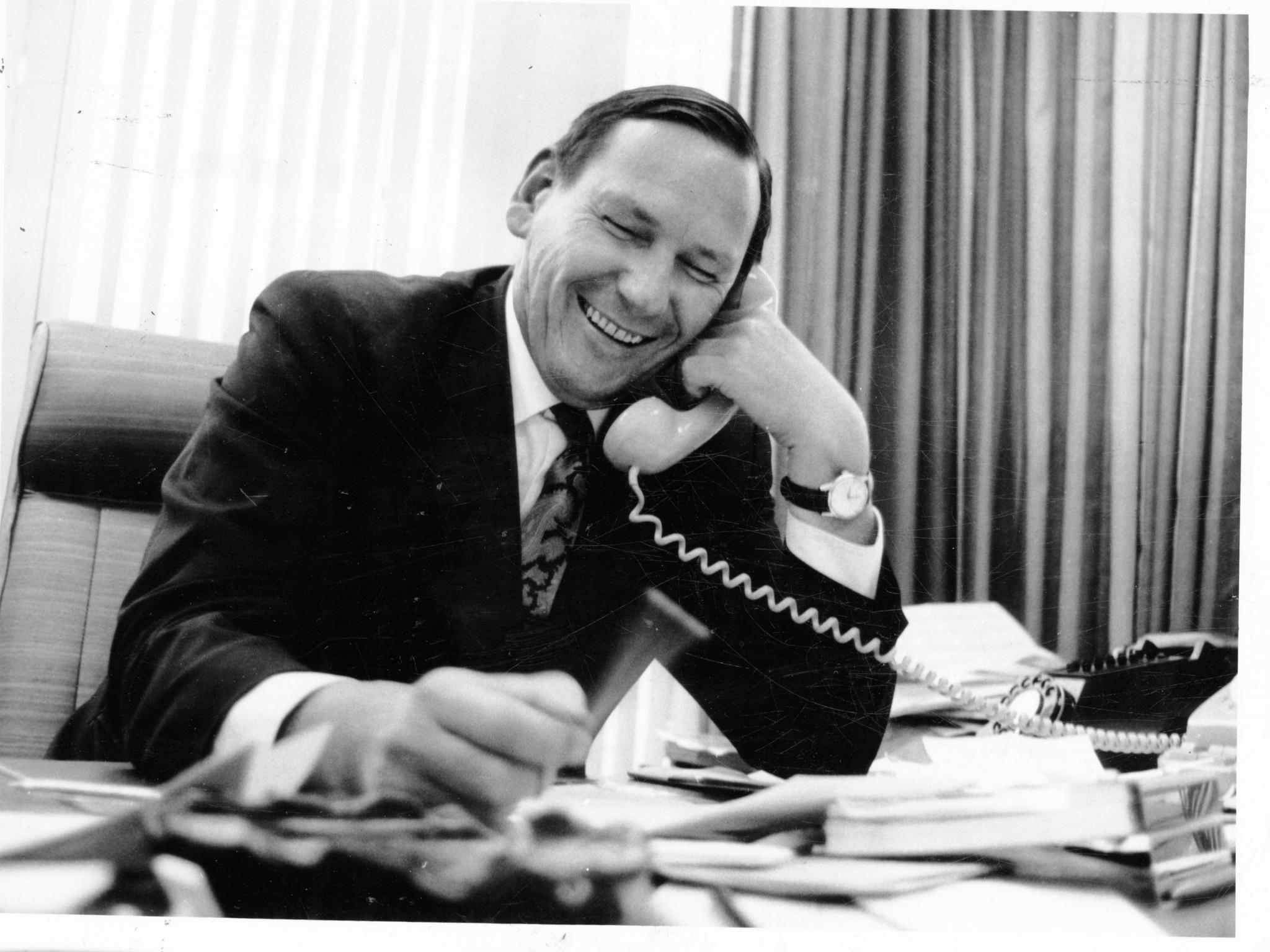

Poseidon chair Norman Shierlaw in 1970

Poseidon chair Norman Shierlaw in 1970