The Dow was lower by 430pts at its low before recovering in the final hours to close 177 pts down and the S&P500 is hanging 4400 by its teeth. There was some buying of monsters of tech helped boost the indices while financials and pharma were sold down. The reaction was obviously due to market pricing in a short sharp rate rise and even an eventual rate cut as the 10-2 year yield is gradually moving into inversion. Tech reacted accordingly and Gold liked that too because rates not likely to go up pronouncedly and protractedly. Financials do not like that as that won't help their margins.

AUD physical Gold , my preferred safe haven, has performed well under this circumstance, thanks largely to the lower AUD. Returns are not flash at under 6% but they are more stable than gold equities that experience the wild rollercoaster ride every other day. When the zigzag stops, gold equities could start to look interesting if USD Gold can sustain itself at this level (preferably independent of what happens in Ukraine).

Ukraine Sparks Market Mayhem As Traders See Fed Panic Ahead, Price-In Rate-Cuts Next Year

BY Zero Hedge

TUESDAY, FEB 15, 2022 - 08:00 AM

Clown market exposed once again...

Ukrainian leader Volodymyr Zelenskiy spooked markets with what turned out to be a sarcastic comment about the rest of the world predicting a date for a Russian attack, which he said should be a day of unity instead.

BREAKING: THE SIMPSONS TO HIRE ZELENSKY AS KRUSTY THE CLOWN REPLACEMENT pic.twitter.com/r9HsTIjKuB

— Newsquawk (@Newsquawk) February 14, 2022

Earlier in the day, St.Louis Fed's Jim Bullard was on CNBC for what many expected to be a mea culpa walkback of his hawkish comments. Instead he doubled down on the need for accelerating, front-loading rate-hikes and QT and warned "The Fed's credibility is on the line."

That sent the odds of a 50bps hike in March jumping higher...

Source: Bloomberg

But, the market is now predicting The Fed's tightening cycle will be swift, aggressive, and over very quickly.

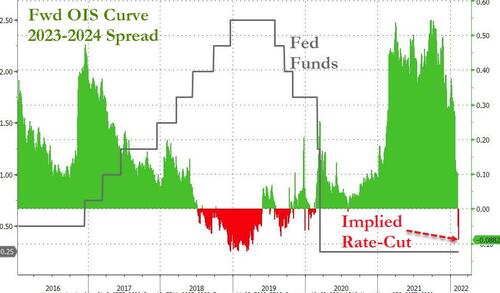

At the same time as rate-hike odds this year soar, the forward-OIS curve is increasingly inverted, pricing in a rate-cut next year...

Source: Bloomberg

In fact, as Bloomberg's Ed Bolingbroke notes, in the eurodollar futures markets, the spread between the December 2023 and December 2025 contracts has dropped further into negative territory on Monday - implying a near-25 basis point cut in the federal funds benchmark over this 24-month timeframe.

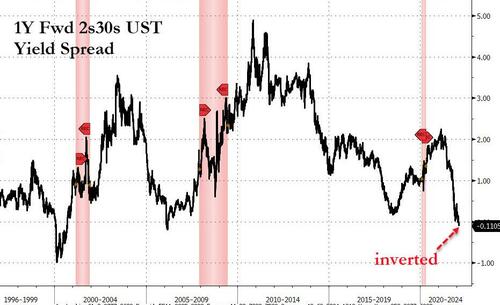

Which makes sense given that the forward Treasury curve implies a 2s30s inversion one year out, signaling recessionary fears being priced in...

Source: Bloomberg

Stocks were a shitshow of vertical buying and selling panics. Mounting tension overnight sent futures down hard, then they ripped higher on Lavrov's "diplomatic" comments. Stocks dumped after Bullard's hawkish comments, then were bid into the European close. Then Zelenskiy joked about Putin invading on Wednesday and stocks puked again, only to rebound when it was made clear he was being ironic, leaving Nasdaq around unchanged and the red of the majors in the red

VIX continues to play catch-up to credit's anxiety...

Source: Bloomberg

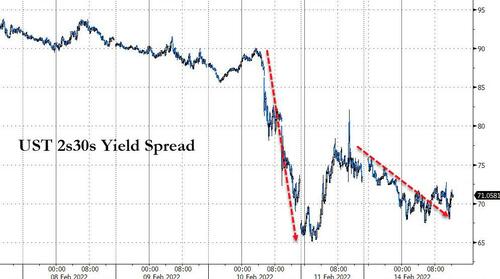

Bonds were just as choppy, triggered one way by Bullard and the other by Zelenskiy and so on wit the short-end underperforming on the day (2Y +8bps, 30Y+5bps). 10Y tested 2,00% but could not hold it...

Source: Bloomberg

The yield curve flattened on the day though, building momentum towards an implied Fed policy error...

Source: Bloomberg

The dollar rallied back to 2-week highs, just above the pre-FOMC levels...

Source: Bloomberg

Notably the dollar broke back above its 50DMA...

Source: Bloomberg

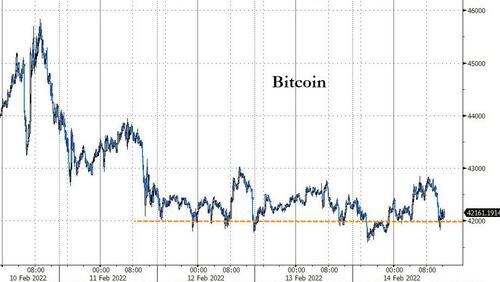

Bitcoin has traded in a relatively narrow range for the last three days, pumping-and-dumping each day and finding support at $42k...

Source: Bloomberg

Notably, Bitcoin is finding support (in a downtrend) at its 50DMA...

Source: Bloomberg

Gold ripped back up to $1875 - 3 month highs...

Oil dumped and pumped on every headline of tensions easing and escalating...

But we're still waiting for that imminent invasion...

In Ukraine, waiting for the Russian invasion pic.twitter.com/BvN8jkLUBT

— Sharmine Narwani (@snarwani) February 14, 2022

Finally, something odd happened in the gold/bond futures markets today.

A major spike in TY futs volume around 1130ET marked the lows in gold futures. Then a major spike in gold futures around 1330ET market the highs of the day in TY futs...

- Forums

- ASX - General

- Its Over

Its Over, page-11691

-

- There are more pages in this discussion • 12,638 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

I88

INFINI RESOURCES LIMITED

Charles Armstrong, MD & CEO

Charles Armstrong

MD & CEO

Previous Video

Next Video

SPONSORED BY The Market Online