....the reflexive rally panned out to script but fell short of the 4200 mark where we get a big wall of resistance. US market saw the green light to push higher when Core PCE was not higher than estimates, it was spot on and when buying began FOMO triggered more buying. But market participants forgot or perhaps unaware that bear markets do not go down in a straight line , it is usually accompanied by many bear rallies sometimes even large ones. After 7 consecutive weeks for falls after falls, you'd wonder when the rebound would materialise and when it finally did after being substantially oversold, it skyrocketed to produce the best week since 2020 , except that now it is getting overbought. I think we are getting into a period similar to when inflation became a concern but with market hopeful on the 'inflation is transitory' narrative, except that the market narrative has now shifted to peak inflation and while cognisant of the spectre of a recession, believed that the Fed would be more dovish in their assessment and may even pause their rate hikes in September. The market remains in denial of a Recession just as it did with denial of Inflation being protracted. So on such narrative, market participants believing we've reached the bottom, ploughed into the market.

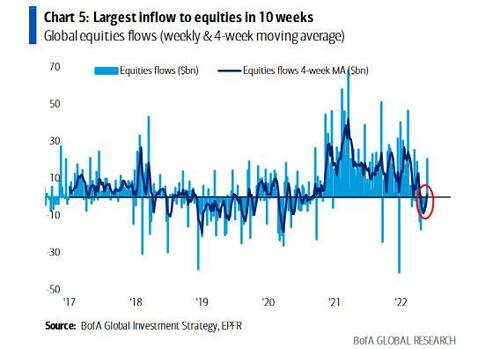

This week saw $20.6BN in cash piled into to equities, the most in 10 weeks, as well as $0.8bn into gold, 28.2BN to cash, funded by another $5.8BN pulled from bonds.

Bear market rallies excel at blindsiding us into believing that the market has bottomed. Indeed, Michael Hartnett who issued his latest warning that his new "bull case" for the market is 3,600 and while he would “sell-any-rips”, he warned that "the tape remains very vulnerable to a bear market rally."

Soaring Stocks Break 100-Year-Record Losing-Streak Amid Macro Meltdown

BY Zero Hedge

SATURDAY, MAY 28, 2022 - 06:00 AM

US Macro data has disappointed for 6 straight weeks with May set to see the biggest plunge in reported data relative to expectations since the collapse in April 2020 when the economy was effectively shuttered down by the government...

Source: Bloomberg

But it appears that bad news is good news once again (with ugly data, FedSpeak, and the Minutes all being interpreted as 2x 50bps hikes then pause in Sept... which just seems too easy) as after seven (or eight for The Dow) straight weeks lower for the Nasdaq and S&P, this week saw stocks 'dead cat bounce', soaring higher led by Nasdaq (the worst performer on the downside swing). Nasdaq is up 10% off last Friday's lows, Small Caps and S&P +9% and Dow +8%...

Just look at today's moves, Nasdaq +3%, S&P up over 2% all triggered at 0830ET when Core PCE came in as expected (and headline PCE was hotter than expected?!) and then extended gains on the terrible UMich print with inflation expectations hovering at 40 year highs...

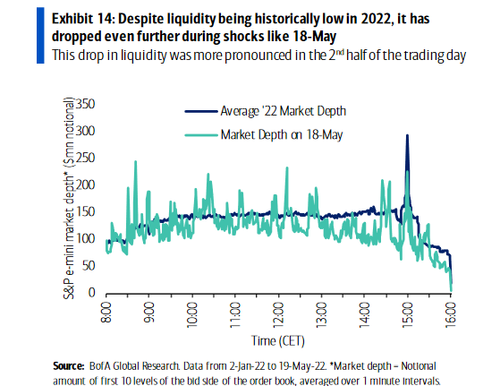

Explained by the total and utter lack of liquidity in markets...

The ramp this week lifted all but the Nasdaq into the green for the month...

However, even after this week's rally, the Tech sector within the S&P 500 is down almost 20% ytd. And the average stock in the FAAMG+T complex (mega-cap Tech) has lost about 23% of its value this year.

"Most Shorted" stocks exploded higher off Tuesday's puke, up over 15% from those lows (this was the biggest short-squeeze week since the late March meltup)

Source: Bloomberg

FANG Stocks soared this week to a critical level...

Source: Bloomberg

...it appears they "turned the machines back on..."

While Consumer Discretionary has been the best performing sector in the S&P 500 and Tech the third best, Energy has been the second best performer this week - a beneficiary, perhaps, of improving sentiment around China. All sectors were green with Utes and Healthcare having big weeks too...

Source: Bloomberg

Since the FOMC Minutes, bonds and stocks have both been bid...

Source: Bloomberg

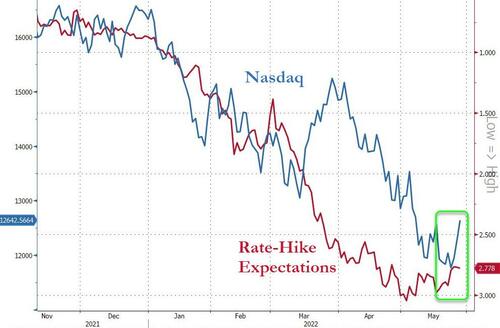

As it seems the market is now buying back into the belief that The Fed will fold like a cheap lawnchair way before it said it would. This week saw rate-hike expectations tumble and subsequent rate-cut expectations rise...

Source: Bloomberg

It seems stocks caught down to STIR pricing for rate-hikes and bounced along with dovish shift in rates...

Source: Bloomberg

Treasury yields are lower on the week with 30Y the laggard (managing to hold modestly lower) as the short-end tumbled...

Source: Bloomberg

30Y closed below 3.00%...

Source: Bloomberg

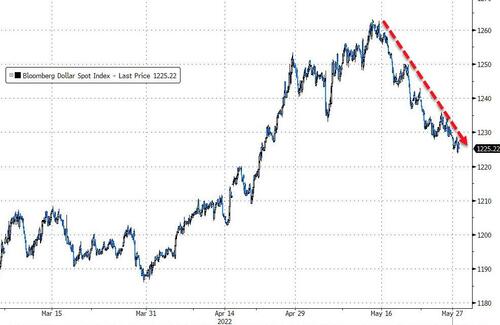

The dollar fell significantly for the second week in a row, closing at 6-week lows...

Source: Bloomberg

This is the biggest two-week drop in the dollar since June 2020

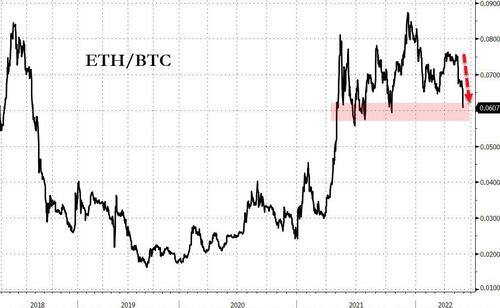

Cryptos had an ugly week (again) with Ethereum the biggest loser (and Bitcoin relatively outperforming)...

Source: Bloomberg

ETH/BTC slipped down to key support...

Source: Bloomberg

Perhaps most notable on the week was crypto's decoupling from big-tech with correlation crashing...

Source: Bloomberg

Oil prices soared this week, nearing 11-week highs (post-Putin highs) and well above Biden-SPR levels with WTI back above $115...

And as oil soars so gas prices at the pump soar-erer even more...

Gold and Silver managed gains on the week back above $1850 and $22 respectively...

Finally, we note that financial conditions bounced higher this week after the FOMC Minutes, finding support at what has been historically a 'tightness' that has sparked Fed flip-flops in the past...

Source: Bloomberg

Will The Fed even hike again?

- Forums

- ASX - General

- Its Over

....the reflexive rally panned out to script but fell short of...

-

- There are more pages in this discussion • 10,250 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)