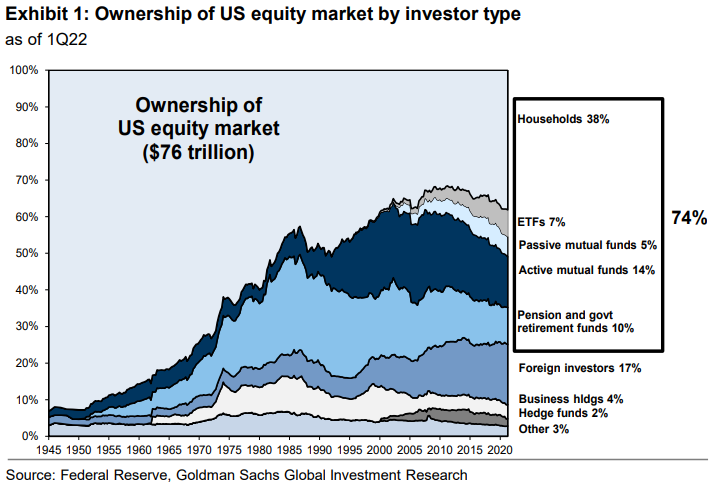

...wow US households own the majority of US stocks- they're about to get creamed!

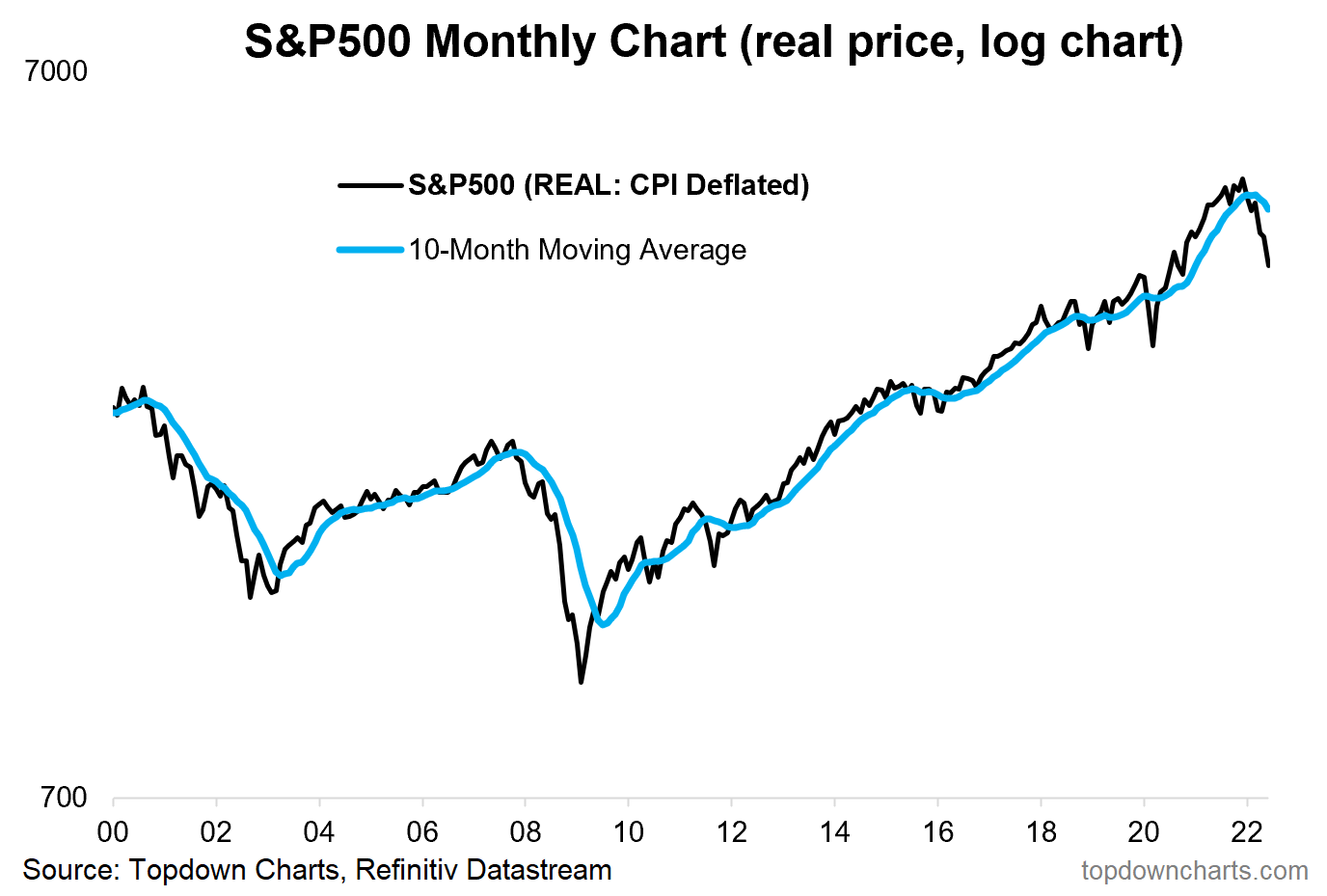

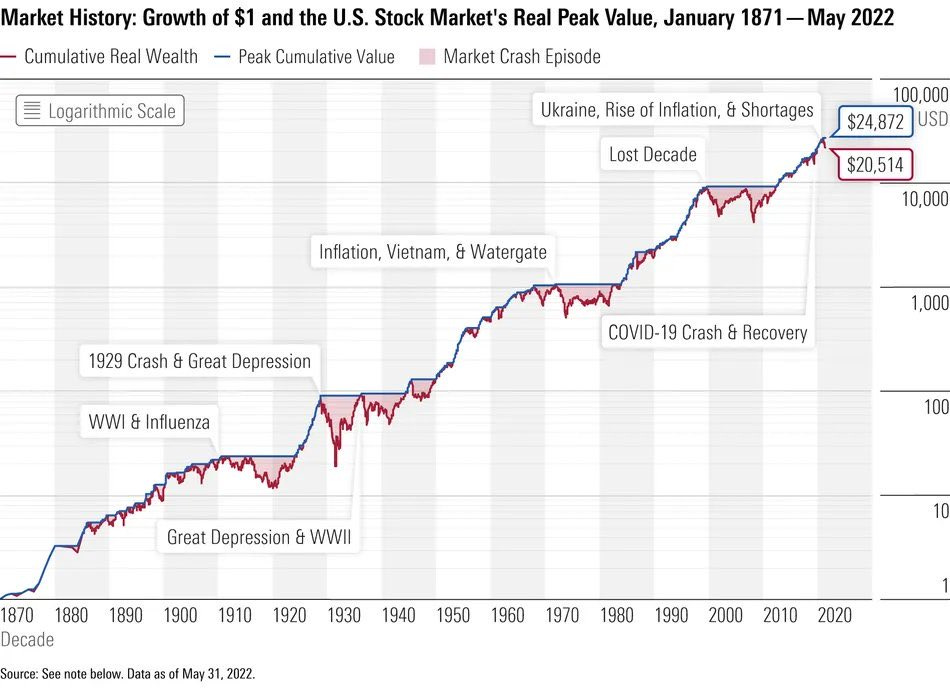

1. Happy New Month! Pretty much a round trip for the S&P 500 index in inflation adjusted terms at this point. Up the escalator, down the elevator.

Source: @topdowncharts

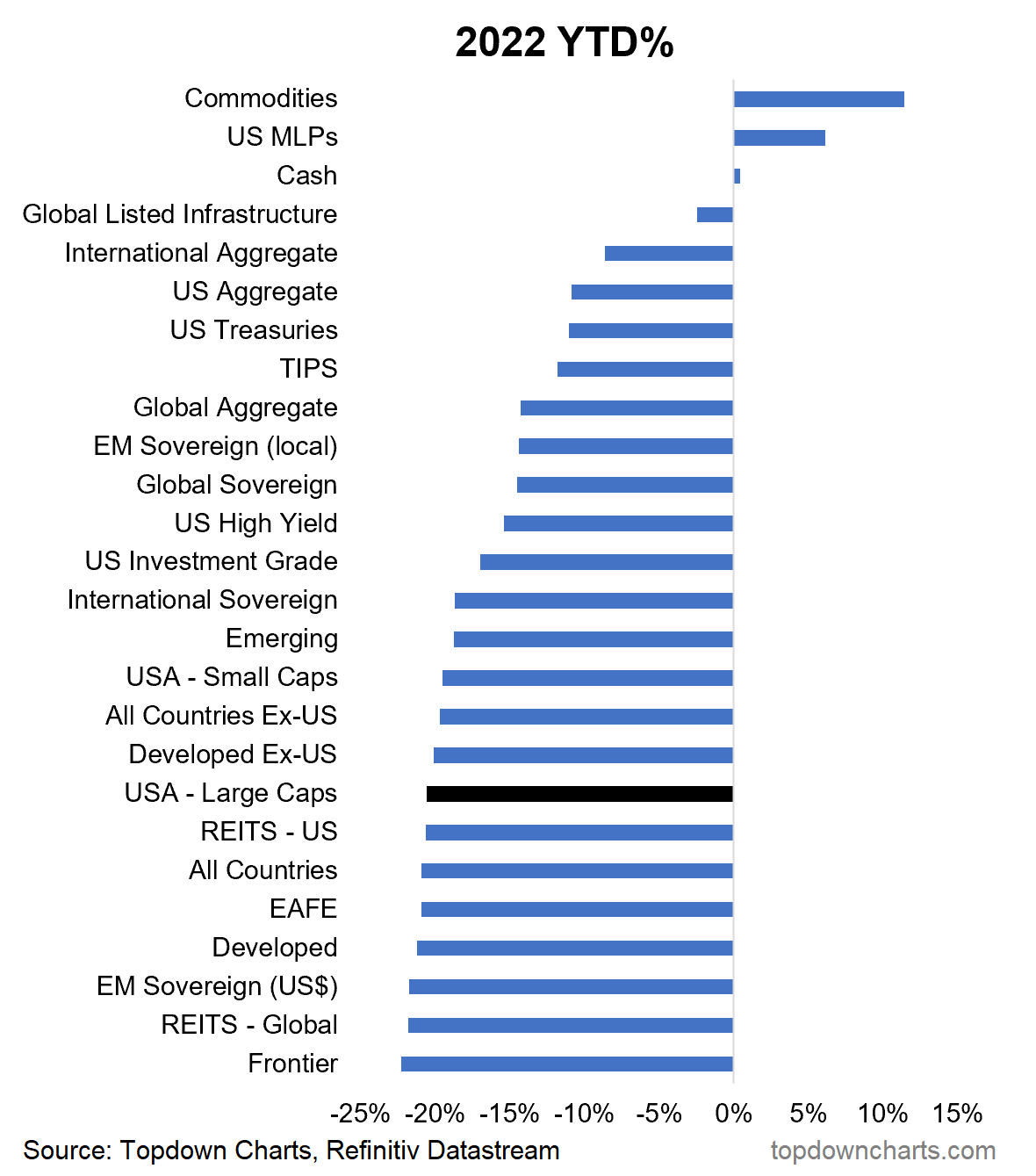

2. YTD Returns in Context: H1 2022 was one of the worst first halves of the year in history for the S&P500, but it was not a lonely journey...

Basically nothing worked outside of cash and commodities.

Source: Asset Class Returns

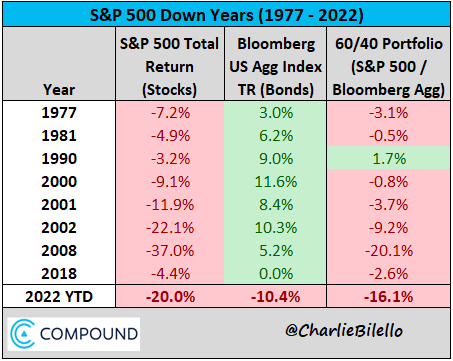

3. Stocks vs Bonds: Interesting table to reflect on — over the period covered in this table, 60/40 always bet 100% stocks when stocks were down for the year, albeit “YMMV” with regards to *absolute returns*.....

Source: @charliebilello

4. Bond Yields as Seen by Stocks: Seems like "equities for rising rates" had their doubts on how far 10-year yields could go. Looks like the ceiling may be in for bond yields?

Source: @AlfCharts

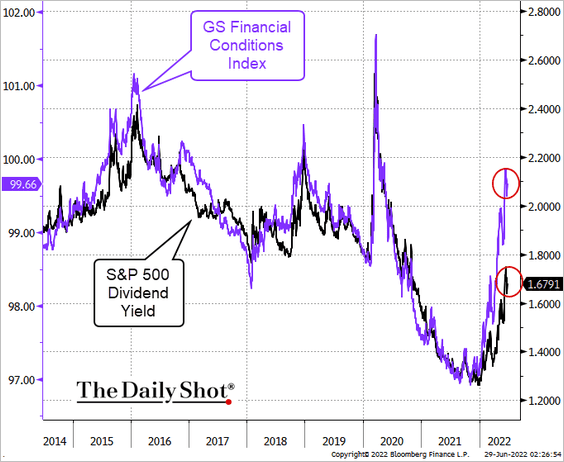

5. Financial Conditions: The key point to note on this one, as the always excellent SoberLook remarked: "tighter financial conditions require higher compensation for investors to take on risk"

i.e. valuations have to not just mean-revert, but go to a level where it compensates for the risks of excess policy tightening and global recession.

Source: @SoberLook

6. Stock Losses in Context: This one is actually low-key shocking — US equity market drawdown is equivalent of -46% of US GDP, that's massive.

(i.e. speaking of financial conditions!)

Source: @strategasasset

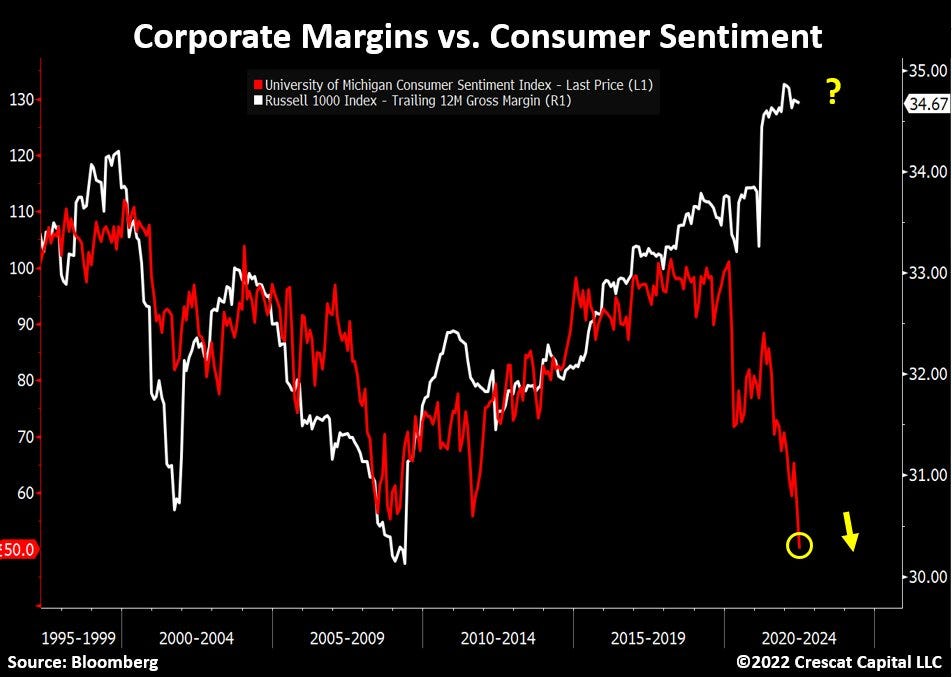

7. Easy-Peasy Margin-Squeezy: Looks like a margin squeeze is incoming...

(recession will hit demand, inflation: input costs)

Source: @TaviCosta

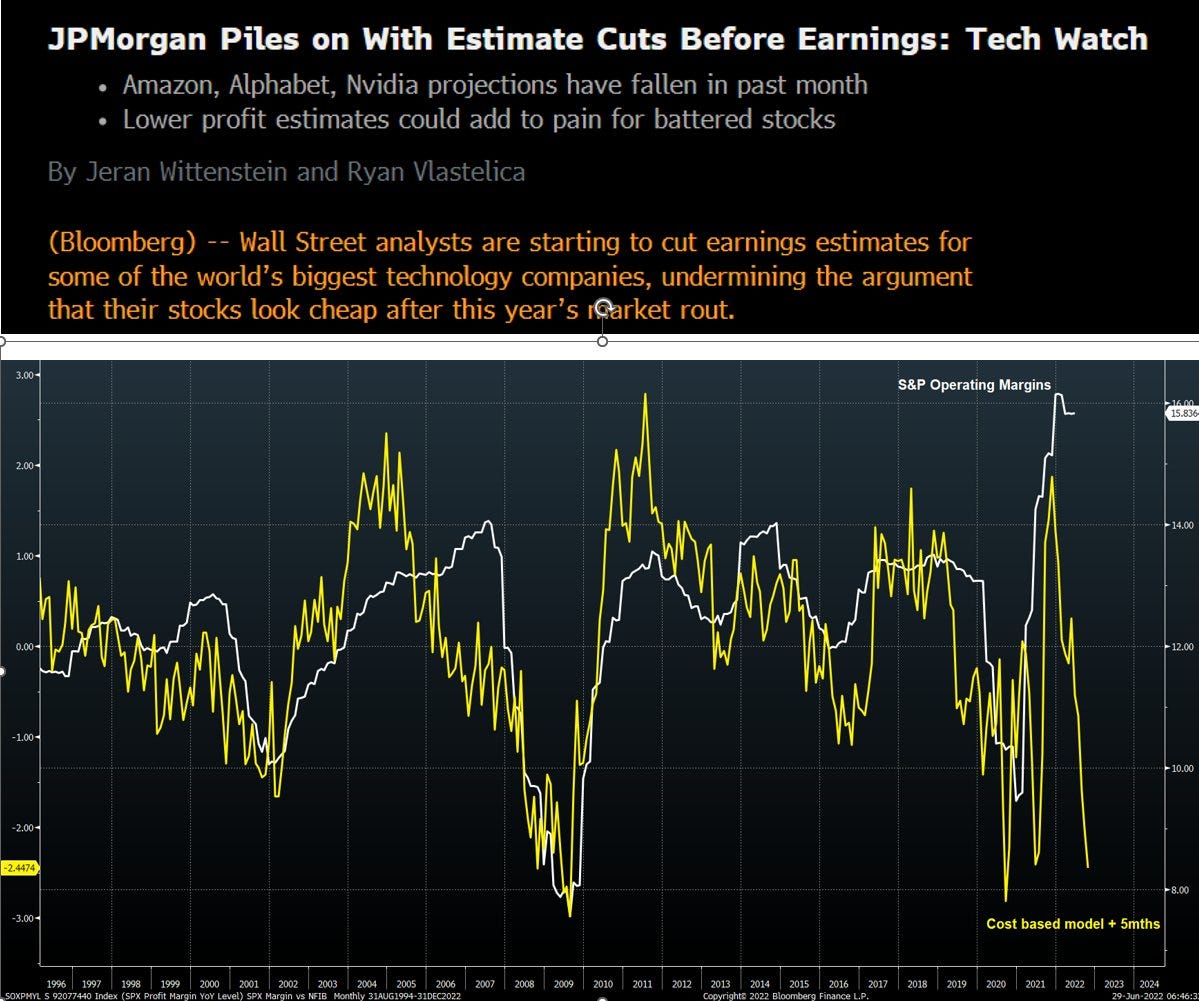

8. Earnings Outlook: Another perspective on the outlook for corporate margins, this time looking at operating margins and cost pressures -- either way you cut it, the outlook for earnings is not good...

Earnings FUD is real. Expect more downgrades.

Source: @JulianMI2

9. Who Owns the Market: Probably a few surprises in there for those who haven't seen this type of breakdown before...

Source: @Ksidiii

10. Long-Term Perspective: "Stocks for the Long-Term"*

*(n.b. beware of occasional lost-decade(s))

Source: @MikeZaccardi via @MichaelAArouet

- Forums

- ASX - General

- Its Over

Its Over, page-13460

Featured News

Featured News

The Watchlist

VMM

VIRIDIS MINING AND MINERALS LIMITED

Rafael Moreno, CEO

Rafael Moreno

CEO

SPONSORED BY The Market Online