From Property to Lockdowns, What to Watch in China’s Second Half

By

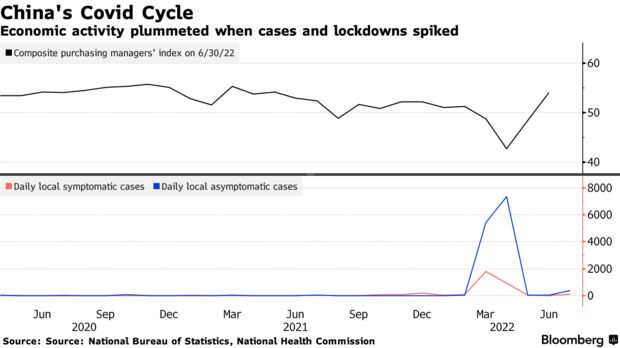

- Covid outbreaks and controls are key for growth this year

- Economists lowering forecasts closer to 3% for the year

Tom Hancock

July 19, 2022 at 7:00 AM GMT+10

China’s economic outlook for the second half of this year will be determined by the government’s shaky control over coronavirus outbreaks and the property market.

Early signs look negative. Daily covid cases have risen to the highest level since May, leading to more local lockdowns. In addition, a mortgage strike in dozens of cities is increasing households awareness of property developers’ inability to complete housing projects -- potentially triggering a further downward spiral in the vast sector.

After growth almost ground to a halt in the second quarter, the bearish outlook has economists lowering their full-year forecasts closer to 3%, well below the government’s target of about 5.5%. That is yet anther drag for a world economy grappling with the fastest inflation in decades, war in Europe and the ongoing Covid pandemic, and comes as the International Monetary Fund is set to “substantially” cut its global economic growth outlook.

Here’s what to watch in a crucial six months for the world’s second-largest economy:

Lockdowns

China GDP growth of just 0.4% in the second-quarter was the second-lowest ever recorded. The biggest cause were lockdowns in dozens of cities in the spring to stop the spread of the omicron coronavirus variant. “Nothing can be worse than the large-scale lockdowns of cities and the halt of economic activities,” said Gary Ng, economist at Natixis SA.

China is subject to a “Covid Business Cycle (CBC),” Nomura Holdings Inc. economists argued in a recent note. First, increasing cases trigger business closures. Once cases come down, government stimulus leads activity to rebound, possibly leading to a new surge in Covid cases. With new variants such as BA.5 recently detected in several cities, the pace and length of lockdowns is deeply unpredictable.

“The duration and severity of CBCs appear quite random due to the uncertain nature of Covid-19,” the economists led by Lu Ting added. “We believe markets have become overly optimistic about growth” in the second half.

On the upside, Chinese local governments are increasingly adept at maintaining factory and freight transport activity through lockdowns. President Xi Jinping has urged officials to stick with Covid Zero, but last week struck a more conciliatory tone, telling officials to “reduce inconvenience in people’s everyday life,” while enforcing the policy.

“I expect that the Chinese government will respond to a rise in Covid cases with narrower, localized lockdowns, rather than the city-wide lockdowns used in April and May, in order to avoid severe disruptions to the gradual economic recovery now underway,” Andy Rothman, an investment strategist at Matthews Asia, said in a note.

Barricades from recent Covid-related lockdowns block an entrance to a residential development in Shanghai, on July 12.

Property

The slump in China’s vast property market, which powers demand for goods and services worth around 20% of GDP, worsened in the second quarter. That was partly due due to lockdowns which hit household incomes and made them less willing to buy homes.

There are risks that the longer the property downturn goes on, the more it becomes self-reinforcing and so could continue even if lockdowns decrease. The latest warning sign is the mortgage boycott in dozens of cities, which as well as rattling the banking sector is sending a clear message to prospective house buyers that their homes may not be delivered on time.

Property Slump

China's real estate construction decline deepened in the second quarter

Source: China National Bureau of Statistics

“It is critical for the government to rebuild confidence quickly and to circuit-break a potential negative feedback loop,” Goldman Sachs Group Inc. economists said in a note last week, lowering their annual GDP growth forecast to 3.3%.

Economists are watching for signs that Beijing will take stronger measures to support housing -- that could include a large cut in mortgage interest rates, or a clear sign that bank loans to property developers are increasing.

The central bank will cut its policy lending rate by ten basis points, influencing mortgages, and cut bank reserve requirements by 50 basis points, according to TS Lombard.

Stimulus

China may approve an unprecedented amount of local government bond sales that would make 7.2 trillion yuan ($1.1 trillion) available for infrastructure investment this year, sources have told Bloomberg. That could boost employment and household spending.

The problem is that Covid lockdowns and the property market slump mean that while local governments can get extra funding from bond sales, their traditional tax and land sales revenue is slumping. That caused a 2.7 trillion yuan revenue shortfall in the first half of the year, according to UBS Group AG economist Wang Tao.

She called for the central government to consider issuing 1 trillion yuan of special bonds to support the budget. Without new support measures, China may struggle to grow 3% for the full year, she said.

“Fiscal policy is loose, but running out of room. I think there will be more stimulus” said Adam Wolfe, an economist at Absolute Strategy Research in London. Options he is watching for include a PBOC facility that lends to commercial banks at low interest rates to support government initiatives, or even direct purchases of government bonds by the central bank.

Weather is also a wild card: China has experienced record temperatures and floods in recent weeks, leading to construction halts.

Consumption and private investment

Consumption has been the main component of growth in China for most of the last decade, so it’s crucial that households get spending again. Investment by private businesses is generally larger than infrastructure investment, so business confidence matters too.

“The key thing to watch is whether China’s domestic demand - consumption and private investment in particular – can recover enough to result in substantial overall growth,” said Louis Kuijs, APAC Chief Economist at S&P Global Ratings.

But sentiment is close to record lows. A survey by China’s central bank in the second quarter showed household employment expectations at the lowest since 2009, while the share of households intending to save more rose to 58%, compared with pre-pandemic levels of 46%.

Grim Outlook

Chinese residents' expectation on future employment lowest since 2009

Source: People's Bank of China's quarterly survey on 20,000 depositors

Note: Figures above 50 signal improvement; below 50 show deterioration

“While we expect consumer spending to further normalize in the second half on easing Covid containment policies, the pace of recovery is likely to be tepid,” Standard Chartered Plc. economists said in a note.

A gauge of private sector sentiment from China’s Cheung Kong business school is close to record lows. Recession fears in major economies are set to slow exports, further weakening the outlook for private companies.

So with Xi’s growth target out of reach, economists think officials will focus on trying to limit the fallout.

“I will be looking closely to employment situation in the second half as I expect Chinese policy makers to tilt the priority from GDP target to an employment target in the next few months,” said Peiqian Liu, chief China economist at NatWest Group Plc.

- Forums

- ASX - General

- Its Over

Its Over, page-13739

-

- There are more pages in this discussion • 10,510 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)