Market highlights

ASX futures down 13 points or 0.2% to 7659 near 7am AEDT

Iron ore’s bearish 2024

- AUD -0.3% to 65.60 US cents

- Bitcoin -3.5% to $US68,204 at 8.25am AEDT

- On Wall St at 4pm: Dow -0.5% S&P -0.7% Nasdaq -1%

- In New York: BHP -0.7% Rio +0.2% Atlassian -4.1%

- Tesla +0.7% Microsoft -2.1% Apple -0.2% Nvidia -0.1%

- Alphabet -1.5% Amazon -2.4% Meta -1.6%

- Super Micro -5.5% Crowdstrike -3.9% AMD +2.1%

- VIX +0.1% QQQ -1.2% TLT -0.03%

- Stoxx 50 -0.1% FTSE -0.2% DAX -0.03% CAC +0.04%

- Spot gold -0.3% to $US2155.90/oz at 4.59pm in New York

- Brent crude -0.1% to $US85.31 a barrel

- Iron ore -3.5% to $US99.60 a tonne

- 10-year yield: US 4.31% Australia 4.13% Germany 2.44%

- US prices as of 4.59pm in New York

The spot price of iron ore traded in Singapore closed below $US100 a tonne to its lowest in more than seven months, taking the year-to-date drop to more than 26 per cent.

In a note, Liberum Capital’s Tom Price said “we’re usually constructive on iron ore’s demand and price outlook during December to May, sometimes even short-term bulls” but not this year.

Mr Price said the slide to start 2024 “is now looking weaker” than a year ago. While industry checks confirm a “downbeat mood”, he said the sell-off has been more bearish than expected.

“There’s no corresponding shift in trade, inventories or steel output rates,” Mr Price said. “It follows that we suspect speculators are withdrawing; not even waiting” for Chinese steel mills to complete their seasonal restocking in May.

The spot price for iron ore slid 3.5 per cent to $US99.60 a tonne in Singapore on Friday, to end the week 13.5 per cent lower. It ended 2023 at $US135.31.

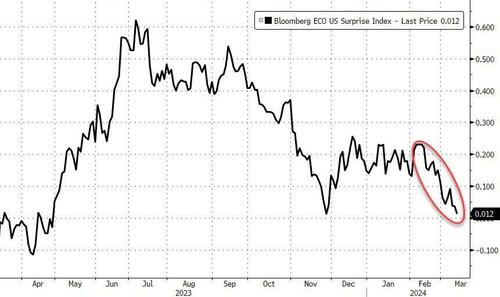

An ugly week on the macro side - hotter than expected inflation, slower than expected growth, weaker than expected labor market data...

Source: Bloomberg

...but the inflation issues sent rate-cut expectations reeling (now less than 3 cuts priced in for 2024)...

Source: Bloomberg

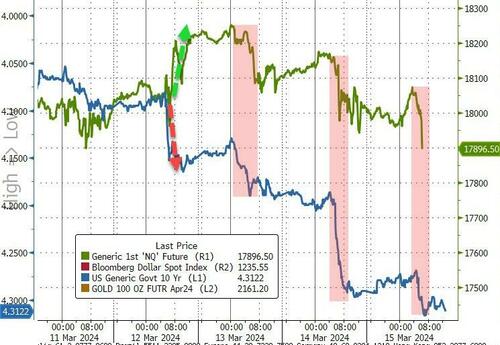

And as rate-cut expectations fell, Treasury yields rose... non-stop... all week with the belly of the curve underperforming (5Y yields up 28bps on the week)...

Source: Bloomberg

Yields all ended back up near their year-to-date highs...

Source: Bloomberg

Higher yields were initially shrugged off by stocks but as they kept rising, there was no arguing...

Source: Bloomberg

Small-Caps and Big-Tech were the week's biggest losers...

Banks were not pretty this week as The Fed's BTFP facility expired...

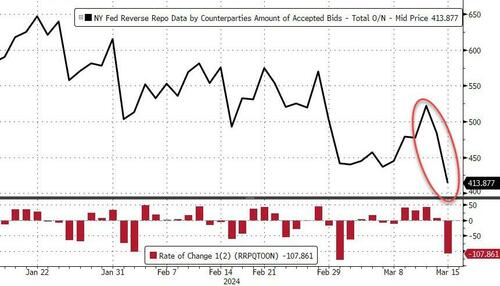

...and liquidity was sucked hard out of the RRP. $108BN drawn down in the last two days to fresh cycle lows...

Source: Bloomberg

Anti-Obesity drug stocks dared to end red...

Source: Bloomberg

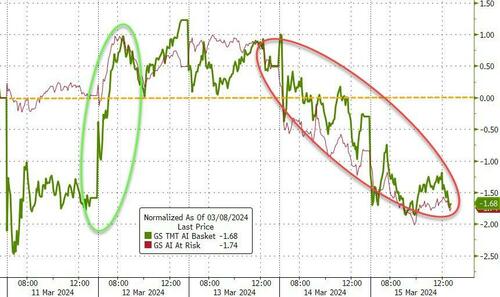

AI stocks also pumped and dumped on the week...

Source: Bloomberg

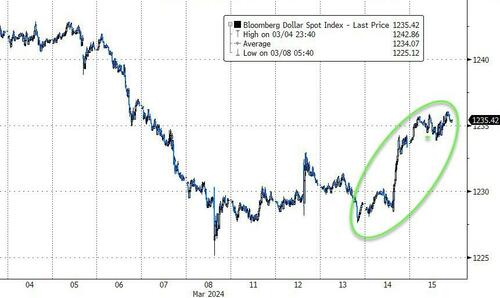

The dollar surged this week - as BoJ chatter picked up - with its best week since mid-Jan (rebounding some from last week's dollar-plungefest)....

Source: Bloomberg

The dollar's gains were gold's losses as the precious metal ended the week down 1%...

Source: Bloomberg

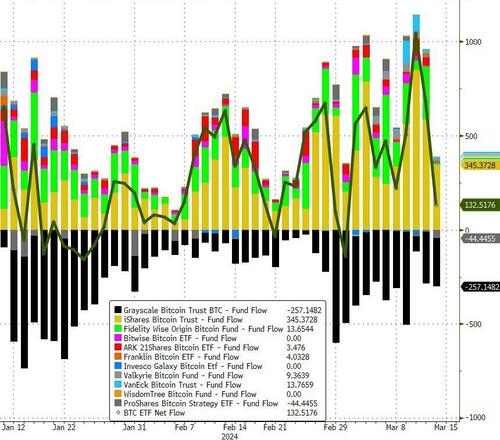

Despite big net inflows this week...

Source: Bloomberg

...bitcoin ended the week only marginally higher (up around 3%), with choppy moves (day-session dips bought overnight), but ened back above $70,000...

Source: Bloomberg

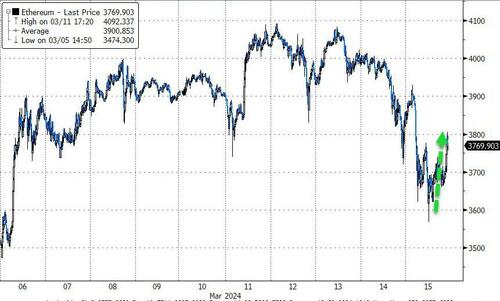

...and ethereum was a little worse, down around 3%, on the week (thanks to Democrats' letter overnight pressuring the SEC on ETH ETFs)...

Source: Bloomberg

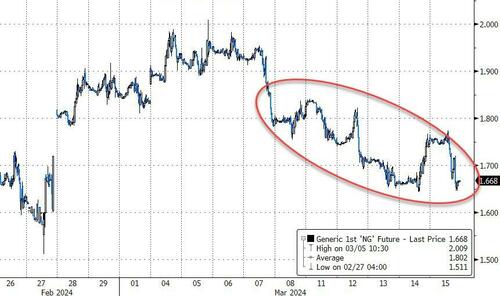

NatGas erased most of last week's gains...

Source: Bloomberg

Still there were some bright spots...

Crude surged on the week, breaking out of its range to its highest since early November...

Source: Bloomberg

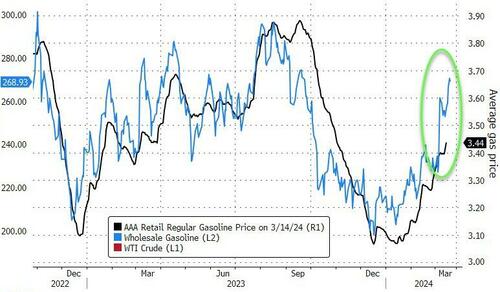

And as goes crude, so goes wholesale gasoline... and then goes pump prices...

Source: Bloomberg

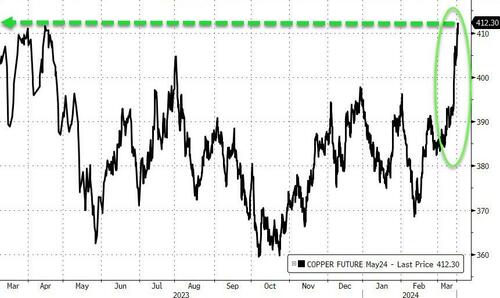

..but it was copper that really regained its legs, surging up to its highest since Feb 2023...

Source: Bloomberg

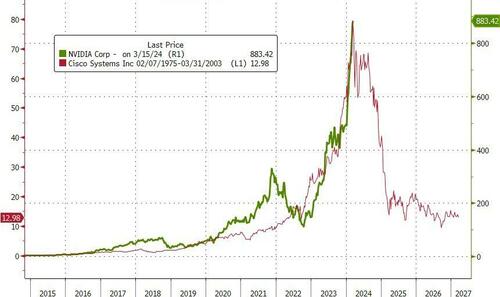

Finally, was this week's 'stalling' in NVDA 'the top'?

Source: Bloomberg

How ironic would it be if we saw peak AI just as Jensen unveils his latest and greatest at GTC on Monday?

- Forums

- ASX - General

- Its Over

Its Over, page-20751

-

- There are more pages in this discussion • 3,347 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

JBY

JAMES BAY MINERALS LIMITED

Andrew Dornan, Executive Director

Andrew Dornan

Executive Director

SPONSORED BY The Market Online