* a lot of things don't make sense anymore- after a few days of cold morning, it was a warm change today, and I read India is in 50C! the same can be said about the fickle market

* no major macro data but market fell as sentiment has probably soured (probably as more people see about how elevated NVIDIA has become > entire market cap of Germany (as well as Canada), not both.

* Dow tumbled -411pts to 38,441 (-3% the past week), S&P500 down -0.74% to 5,266, Nasdaq -0.58%

* NVIDIA higher +0.81%, AAPL +0.16%, Tesla -0.32%, AMD -3.77%, Meta -1.16%, SMCI -4%

* US yields have been climbing higher again, US 2yr 4.97pc US 10yr 4.61pc

* DXY back above 105 at 105.11 while AUD rally fell off the perch to 66.13c

* Tough day for Gold as it scales back to support at $2338, GDX -2.52%, GDXJ -2.39%; Silver made another crack at $32.20s before falling to $31.97, its strength in clear departure from Gold's downside move illustrates that it could be just hours or day before a break above $32.40-32.50 for the next big upside move.

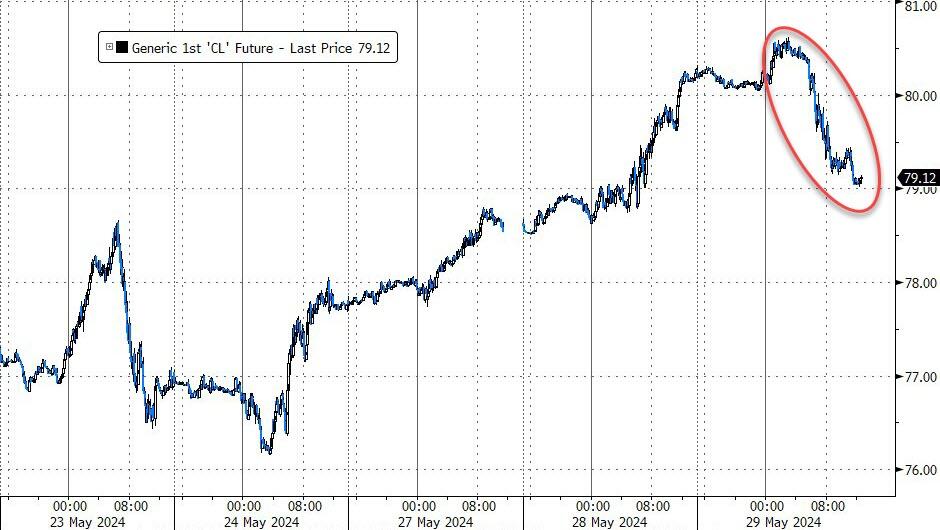

* WTI Crude fell -1.3% to $78.92; other than Marathon Oil's jump by +8.43% triggered by Chevron's proposed takeover, oil stocks were broadly lower, XLE -1.77%

* Lithium stocks fell hard: LIT -1.52%, ALB -3.39%, SQM -5.30%, LAC -7.44%, PLL -1.45%, ALTM (Arcadium) -4.6%, Patriot Battery -1.11%; Scotiabank downgraded ALB citing deeply negative free cash flow (FCF) for 2024 and moderately negative FCF in 2025 and 2026 [ as I mentioned winter hibernation for lithium sector for 1-2 years].

Bond Yields Soar As Rate-Cut Hopes Plunge; Stocks, Oil, & Gold All Sold

BY Zero Hedge

THURSDAY, MAY 30, 2024 - 06:00 AM

A quiet macro day in the US - mixed bag of regional Fed survey data (Richmond Manufacturing good, Richmond Biz Conditions bad, Dallas Services bad) and plunging mortgage apps) - followed a hotter than expected inflation print in Germany, which sparked a further hawkish shift lower in rate-cut expectations with 2024 falling back to a 50-50 coin toss for 2 cuts or 1; and 2025 tumbling to less than 3 more cuts...

Source: Bloomberg

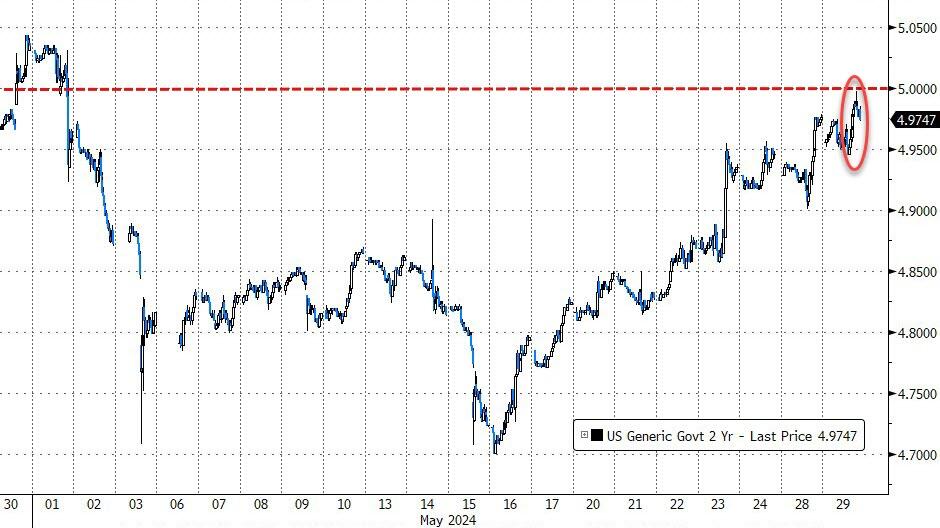

Treasury yields surged higher, led by the long-end (2Y +2bps, 30Y +7bps)...

Source: Bloomberg

...steepening the curve even more...

Source: Bloomberg

2Y Yields ramped within 0.25bps of 5.00%, erasing all the gains from payrolls and CPI...

Source: Bloomberg

And higher yields are starting to hit stocks. Today was relatively unusual for recent times with no big BTFD bounce back after almost non-stop selling from the cash close last night. Small Caps lagged on the day with S&P and Nasdaq the best looking horses in the glue factory. The cash open offered a little blip higher but that was sold into...

The Dow broke below its 50- and 100-DMA and Small Caps broke below their 50DMA...

'Most Shorted' stocks were monkeyhammered lower... again...

Source: Bloomberg

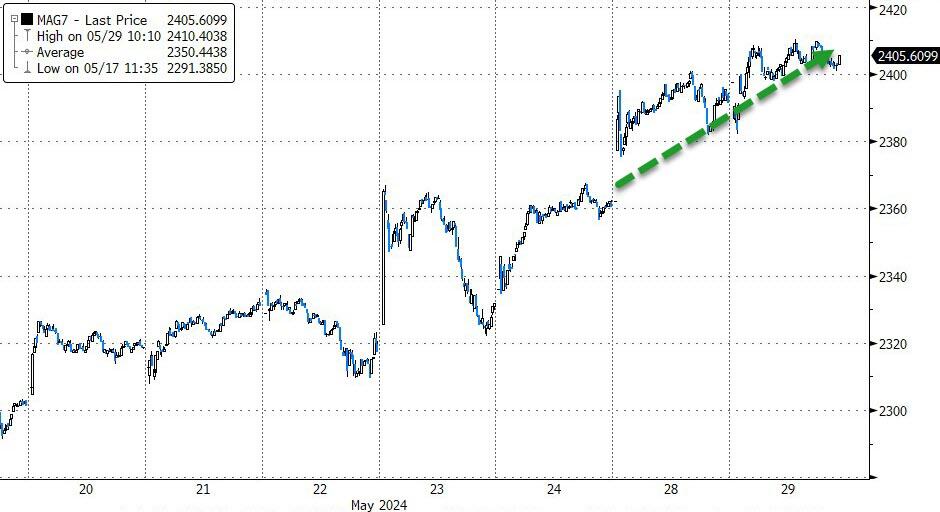

But, of course, MAG7 stocks levitated...

Source: Bloomberg

...as NVDA hit another new record high...

Since NVDA's earnings, everything but AI has been sold...

Source: Bloomberg

The dollar followed rates higher, back near one-month highs...

Source: Bloomberg

...which hit gold...

Source: Bloomberg

...sent oil lower with WTI back below $80...

Source: Bloomberg

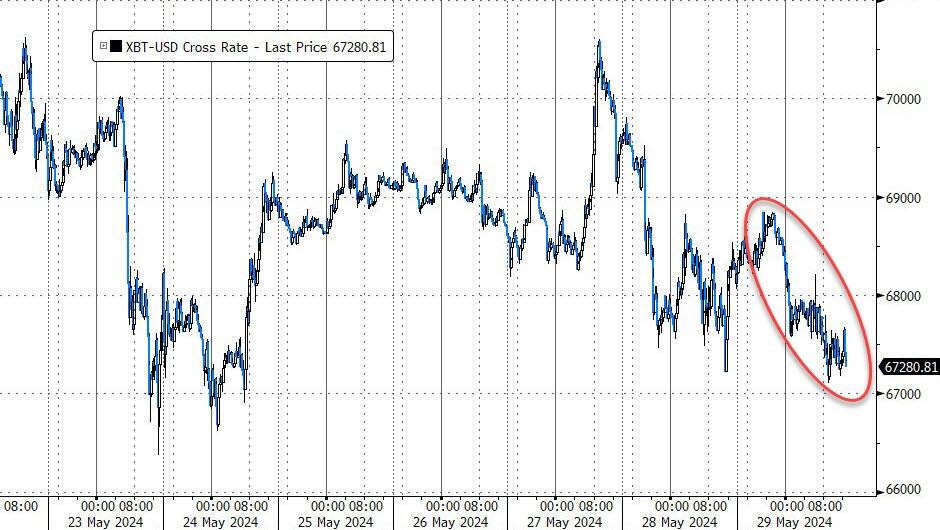

...and bitcoin also fell back below $68,000 (despite the Blackrock flows news)...

Source: Bloomberg

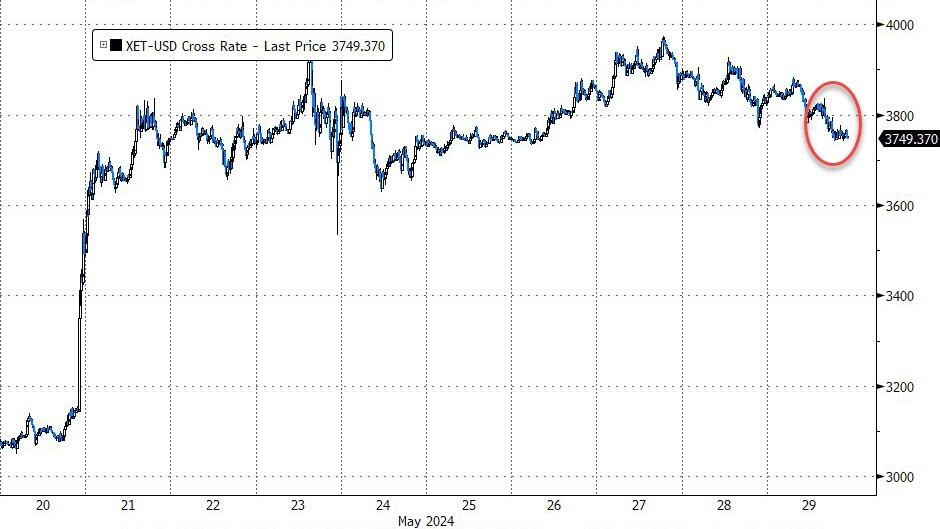

Ethereum slipped back below $3800....

Source: Bloomberg

Finally, while financial conditions remain drastically loose (especially relative to Fed rates), we note that they are starting to tighten...

Source: Bloomberg

We've seen this before a few times this year - so let's not hold our breath, but The Fed surely wants the market 'tighter' than it is before it starts actually 'easing'.

- Forums

- ASX - General

- Its Over

* a lot of things don't make sense anymore- after a few days of...

Featured News

Featured News

The Watchlist

P.HOTC

HotCopper

Frazer Bourchier, Director, President and CEO

Frazer Bourchier

Director, President and CEO

SPONSORED BY The Market Online