* An end to the first half of 2024 which went fairly good for the US major indices but not at all what it seems for most investors outside of the mega tech stocks

* Nike plunged -19.99%, First Solar -9.84%, SMCI -8.26%, AAPL -1.63%, MSFT -1.3%

https://x.com/unusual_whales/status/1806779672484892743

* But as with other periods of major corrections, its the 2nd half that we should be concerned about

https://x.com/SuburbanDrone/status/1806845157255307614

* Lithium stocks continued to be on the backfoot, we should expect mini X-mas trees within a larger X-tree chart that is unfolding. My warning on lithium stocks has stretched back since the end of last year. More can be learnt from my EV/Lithium thread.

Column 1 Column 2 Column 3 0 STOCK INDICES [US 28 Jun 24] Overnight % 1 DOW -0.12% 39,118 2 S&P500 -0.41% 5,460 3 NASDAQ -0.76% 17,723 4 DXY -0.05% 105.85 5 US 2 YR 0.62% 4.749 6 US 10 YR 1.13% 4.392 7 AUD 0.38% 0.6670 8 GOLD -0.04% $ 2,326 9 SILVER 0.58% $ 29.14 10 BTC -1.81% $ 60,948 11 12 13 GOLD Overnight % 14 GDX -0.88% 15 GDXJ -0.66% 16 NEWMONT GOLDCORP(NEM) -0.01% 17 BARRICK GOLD (GOLD) -0.97% 18 AGNICO EAGLE MINES (AEM) -1.48% 19 SILVER 20 SIL -0.89% 21 SILJ 0.04% 22 PAN AMERICAN SILVER(PAAS) -1.63% 23 LITHIUM 24 SPROTT LITHIUM MINERS (LITP) -3.11% 25 GLOBAL X LITHIUM (LIT) -1.57% 26 ALBEMARLE (ALB) -0.78% 27 SOQUIMICH (SQM) -1.76% 28 LITHIUM AMERICAS (LAC) -3.60% 29 PIEDMONT LITHIUM (PLL) -0.70% 30 ARCADIUM LITHIUM -1.47% 31 PATRIOT BATTERY METALS -0.39% 32 COPPER 33 GLOBAL X COPPER MINERS(COPX) 0.09% 34 BHP 0.62% 35 RIO 0.17% 36 SOUTHERN COPPER (SCCO) 0.01% 37 FREEPORT MCMORAN (FCX) 0.58% 38 FIRST QUANTUM MINERALS (FQVLF) -9.82% 39 TECK RESOURCES (TECK) -0.19% 40 OIL 41 XLE 0.39% 42 EXXON (XOM) 0.19% 43 CHEVRON )CVX) 0.06% 44 OCCIDENTAL (OXY) 0.48% 45 CONOCOPHILLIPS (COP) 0.36% 46 MARATHON OIL (MRO) 0.31% 47 HALLIBURTON (HAL) 0.51% 48 COAL 49 RANGE GLOBAL COAL (COAL) 1.58% 50 PEABODY ENERGY (BTU) 2.45% 51 ALPHA METALLURGICAL (AMR) 1.77% 52 ARCH RESOURCES (ARCH) 2.22% 53 WARRIOR MET COAL (HCC) 2.10% 54 URANIUM 55 GLOBAL X URANIUM (URA) -2.13% 56 NICKEL 57 SPROTT NICKEL MINERS (NIKL) 0.92% 58 RARE EARTHS 59 OPTICA RARE EARTHS (CRIT) -0.33%

S&P Surges To Best Election Year H1 Since 1976 As Rate-Cut Hopes & Macro Data Collapse

BY Zero Hedge

SATURDAY, JUN 29, 2024 - 06:00 AM

First things first, the market is starting to aggressively price in a Republican/Trump victory in November after last night's farce

Goldman's 'Republican / Democrat' stock baskets massively outperformed today...

Source: Bloomberg

Overall activity levels today were "explosive" according to Goldman's trading desk with volumes +32% vs. the trailing 2 weeks with market volumes up just +1% vs. the 10dma (mkt wide activity obv backloaded today)

Goldman said its floor is -3% better for sale, with both HFs and LOs tilted that way

Treasury yields exploded higher intraday today with some suggesting this is also pricing in a Trump victory (and other pointing out that hedgies are record short the ultras). Of course, it's just as likely some qtr-/mth-end rebalance flows...

- HFs are -2% better for sale with supply in Tech & Fins outweighing demand for Cons Disc & materials

- LOs are -14% better for sale with Cons Disc the outlier for supply following NKE’s miss. Other pockets of supply include Staples, HCare & Industrials while Tech, Energy, Fins and REITs are all to buy

Source: Bloomberg

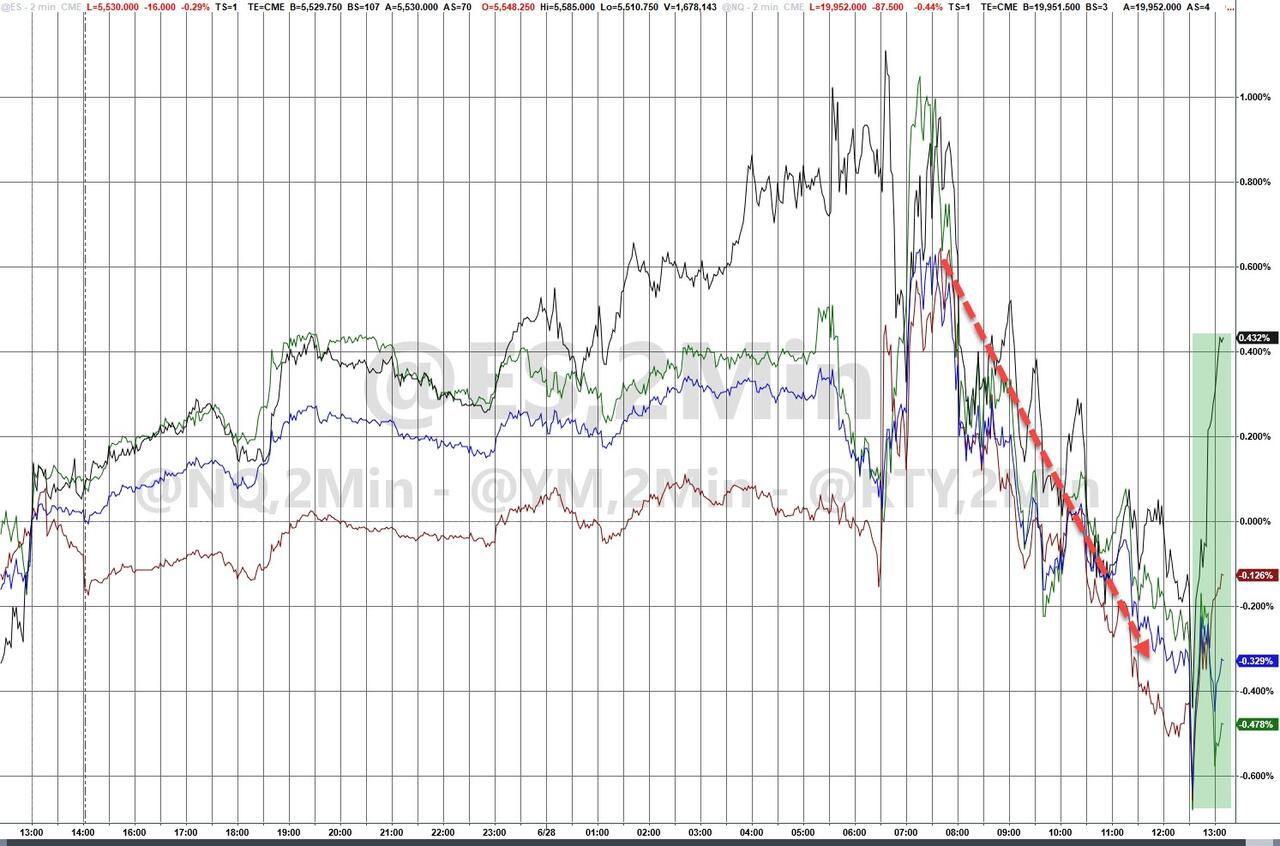

Which is more likely TBH since we saw some late shenanigans in stocks too (and the annual Russell Rebalance sparked its normal frenzy)...

Source: Bloomberg

But away from politics (and today), US Macro data serially disappointed in the first half of the year, crashing to its ugliest since 2016. This was the worst start to a year for macro surprises since 2018 (and second worst since 2012)...

Source: Bloomberg

But, despite all this 'bad news', rate-cut expectations have plunged YTD, with 2024 starting the year with 160bps priced in and ending H1 with just 45bps priced in. 2025 expectations did pick up modestly, from around 70bps to 87bps...

Source: Bloomberg

The result of all that: stocks, gold, and crude (and crypto) all notably higher, bonds dumped and the dollar stronger in H1

Source: Bloomberg

Year-to-date, it has been all mega-cap tech all the time, dragging the S&P and Nasdaq up dramatically (decoupling from The Dow and Small Caps with Trannies in the red in H1)...

Source: Bloomberg

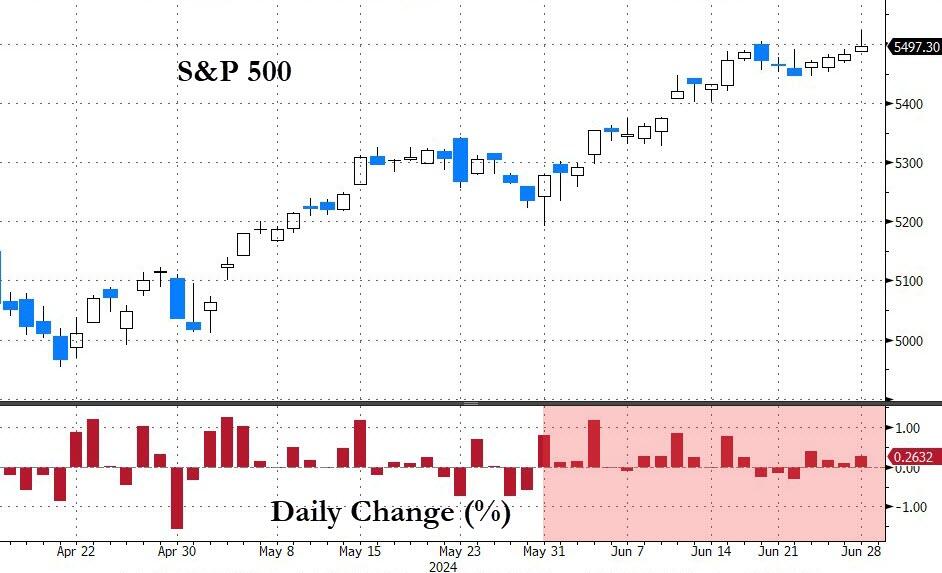

The S&P's 15% gain is the best H1 in an election year since 1976, and was set against a very low volatility means Sharpes are through the roof.

June was extremely quiet with long gamma squelching all directional moves...

Source: Bloomberg

With realized vol for the month plunging to just 6.3...

Source: Bloomberg

Breadth remain dreadful - going nowhere at all as stocks melted up in June (thanks to Mag7)...

Source: Bloomberg

Tech stocks soared in H1 with financials and energy just behind. Real Estate was clubbed like a baby seal (which is no surprise given that home sales are plunging back to or near record lows)...

Source: Bloomberg

H1 and Q2 and June were all about AI stocks, which have massively outperformed...

Source: Bloomberg

The other massive winner was GLP-1 stocks...

Source: Bloomberg

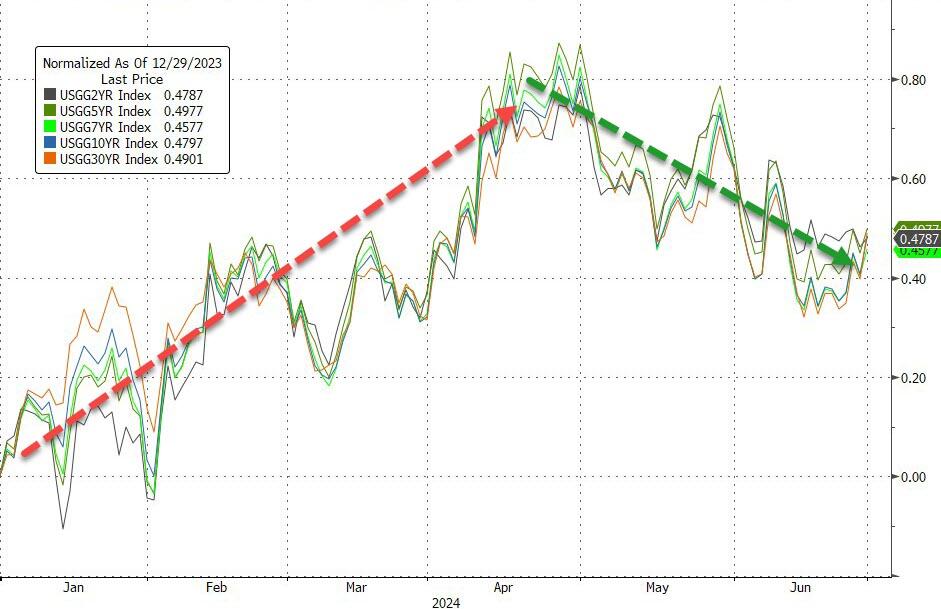

Yields were up notably in H1 2024 (10Y +47bps), following a very similar path to 2018 and 2021, with only 2022 worse since 2009. What is also notable is just how uniform the rise in yields has been - the entire curve up around 46-50bps - as Q2 saw bonds bid as macro data disappointed...

Source: Bloomberg

The dollar surged to its second strongest H1 since 2013, with a big surge in June as yen collapsed...

Source: Bloomberg

Bitcoin had its 5th best start to a year on record (2016, 2017, 2019, 2022, 2023 were better) ending H1 up 40%. Solana and Ethereum also had a great start to the year...

Source: Bloomberg

Gold surged in H1, up over 13%, its second best year since 2016 (only 2020 was better). But the last six weeks have seen the precious metal coiling...

Source: Bloomberg

Oil also had a strong H1 thanks to a rebound in geopolitical risk premium in June...

Source: Bloomberg

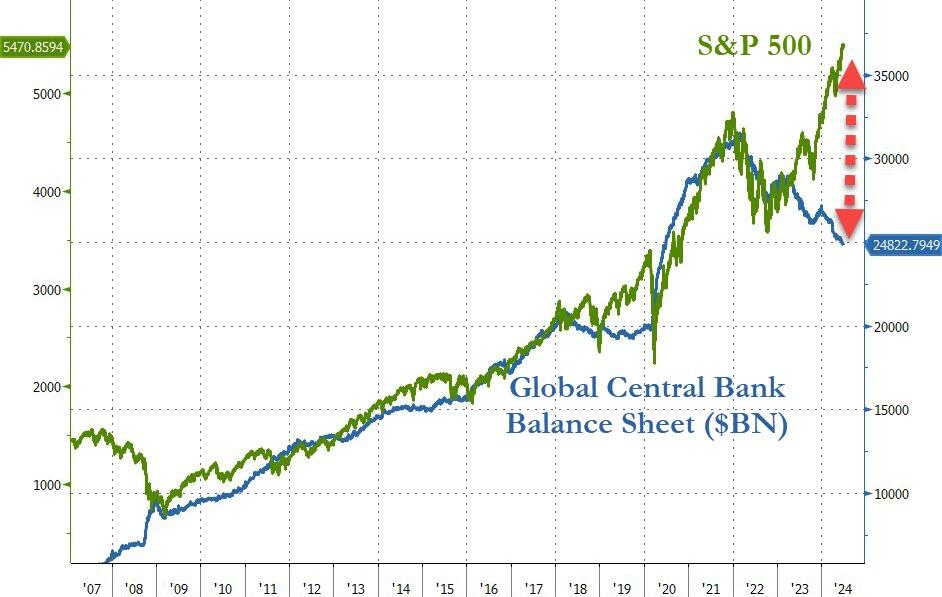

Finally, after such a strong H1, several bulge bracket bank traders are starting to sound a little nervous. Who can blame them?

Source: Bloomberg

Which happens first, 10Y yield hits 3.5% or S&P 500 hits 5,000?

...or 3,500?

Source: Bloomberg

How far would stocks have to fall before the liquidity machines ramp back up?

- Forums

- ASX - General

- Its Over

Its Over, page-22532

-

- There are more pages in this discussion • 1,175 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)