...being a bear can feel rather isolated now.

...but when everyone starts putting risks in the garbage bin, such complacency can only suggest even greater risks ahead. The BIG question is when.

....it takes some discipline to not follow the herd because no one wants to be left out not making money when most are. But I cautioned on this thread in Q4 2019 that something feels uneasy to me about the level of complacency, and a quarter later we saw that huge Covid crash. We just only need an adverse catalyst to spark a market correction mayhem, and the decline would be greater the larger the unabated climb.

....if you recall, my opined position was being neither Bull nor Bear, i.e sideline. Now IMO is nothing more stale bulls making some recovery (and hopefully they know how to sell into strength) and new entrants doing short term profitable trades being nimble to cut losses quick.

"When you start shooting the bears, it's kind of a classic signal."

https://x.com/jessefelder/status/1811751213865861271

Kolanovic Departure Triggers an Echo on Wall Street From 1999

- Charles Clough leaving Merrill then was a sign of dot-com top

- Traders wonder if stock market history is repeating itself

By Alexandra Semenova

July 12, 2024 at 8:00 PM GMT+10

It’s been about 25 years since Wall Street had a serious bear hunt. And it appears another one is starting up now.

Early on Aug. 27, 1999, the finance world was rocked by the resignation of one of its most committed pessimists, Charles Clough, Merrill Lynch & Co.’s chief investment strategist. Clough’s opinion was highly regarded, but he’d committed the stock market’s cardinal sin, remaining bearish in the face of a relentless rally — in this case, the dot-com frenzy that sent the S&P 500 Index soaring 220% from the start of 1995 to the end of the century.

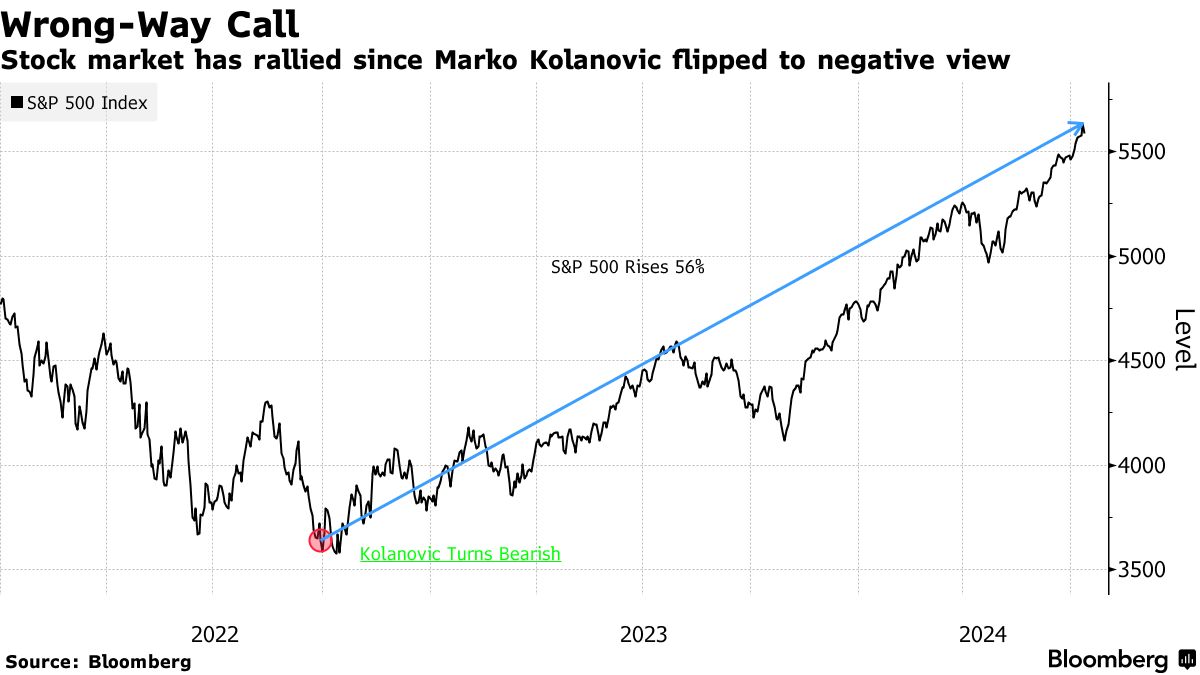

That may feel like a long time ago, but on Wall Street, as in Shakespeare, the past is often prologue. And so, the abrupt exit of Marko Kolanovic last week after 19 years at JPMorgan Chase & Co. is reminding many traders, bankers and analysts of Clough’s adieu. Once again, a prominent strategist was taken down after his warnings of an imminent equities crash never materialized and the S&P 500 continued to hit fresh highs over and over again.

Marko KolanovicSource: Bloomberg

Now some investors are wondering if the whole saga is a sign that the market is peaking.

Follow Clough’s story to its conclusion and you’ll see that he was quickly vindicated. By March 2000, the Internet bubble was starting to deflate, and on April 3 the Nasdaq Composite Index posted its largest point decline ever up to that point. It kept falling from there, ultimately losing more than half of its value by the end of 2001. It wouldn’t see its 2000 high again until 2015.

The fear is history is about to repeat itself, as the erasure of cynics is something that typically happens toward the end of market manias.

“Is Marko’s situation a classic sign of a market top?” David Rosenberg, founder and president of Rosenberg Research, asked rhetorically. “There are a lot of market topping characteristics that you can point to. And I would say this may well be one of those.”

Endangered Bears

The thing is, Kolanovic isn’t alone. Just months before the announcement that he was “exploring other opportunities,” another celebrity bear who wrongly predicted a rout, Morgan Stanley’s Mike Wilson, stepped down as chair of the firm’s global investment committee, a post he’d held for a decade. Since then, he has toned down his skepticism about the stock market’s advance.

Clough and representatives of JPMorgan and Morgan Stanley declined to comment.

In many ways, this is a story as old as Wall Street. Going against the herd in a bull market can make your clients and employer “increasingly dissatisfied with you,” said Rosenberg, who correctly sniffed out trouble in the US economy ahead of the global financial crisis as an economist at Merrill Lynch.

Consider the case of veteran strategist Gail Dudack. From 1987 to 2000, she worked at Warburg Dillon Read (since acquired by UBS Group AG). In November 1999, Louis Rukeyser, host of “Wall Street Week” on PBS, booted her off his “elves index” for being too bearish. “Elves” was his nickname for the cohort of technical analysts who appeared regularly on the program.

“When you start shooting the bears, it’s kind of a classic signal,” she said.

There’s no doubt that the stock market is showing some characteristics of a bubble, particularly in the record-setting surge by a few key technology giants expected to benefit from the development of artificial intelligence. Some on Wall Street, including Kolanovic, have pointed to froth in indexes led by those Big Tech companies. Others argue that earnings justify the market’s expansion.

Regardless of who’s right, the key is bubbles can keep inflating far beyond reason before they burst.

“Bubbles are all about momentum,” Dudack said. “They’re run by a collection of stocks. The thing is, they will work because momentum begets momentum.”

In this case, if the AI boom morphs into an AI bubble, strategists at Societe Generale SA estimate the S&P 500 can inflate another 20% or so before it reaches valuations similar to that of the dot-com peak. The index is currently trading near 5,600.

PlayPlay

3:12

WATCH: Mike Wilson, Morgan Stanley chief US equity strategist, says markets are stuck right now.

Risk Blind

This explains why so many on Wall Street seem blind to the potential risks right now. At the close of last year, the median strategist forecast for the S&P 500 in 2024 was 4,850, last month it was 5,450. Goldman Sachs Group Inc. and UBS have raised their predictions three times since the end of 2023, while Oppenheimer Asset Management, Citigroup Inc. and Deutsche Bank AG recently increased theirs.

State Street Global Advisors chief investment strategist Michael Arone just recently channeled an infamous line from ex-Citigroup CEO Chuck Prince in July 2007, when he said his bank was “still dancing” as the global financial crisis was getting started.

“A restrictive Fed won’t stop the music this time around because the economy’s moving to a new rhythm,” Arone wrote in a memo on July 8, citing AI’s potential to generate a “prolonged and unprecedented productivity miracle.”

- Forums

- ASX - General

- Its Over

...being a bear can feel rather isolated now. ...but when...

-

- There are more pages in this discussion • 1,520 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

EQN

EQUINOX RESOURCES LIMITED.

Zac Komur, MD & CEO

Zac Komur

MD & CEO

SPONSORED BY The Market Online