* Overnight selloff, not even a crash, shows what a mini purge could look like and demonstrated what stood and what fell. Mega techs were largely sold off, small caps, BTC, all resource stocks including Gold and silver stocks, the dollar, yields, but physical Gold and silver stood still despite falling from earlier highs

https://x.com/unusual_whales/status/1819462848055333263

Crashing yields raises Recession concerns

https://x.com/i3_invest/status/1819463180319334730

Sahm Recession Indicator and Kantro indicator have both been triggered

https://x.com/intheyield/status/1819370063209603391

A result of this could well be a hastened and more sizable rate cut by the Fed soon, as the market tries to force the Fed's hand. Trump may see red with glee but if it pushes Powell to cut by more, it could help the Harris campaign, provided the bleed stops here.

https://x.com/SuburbanDrone/status/1819487676879298989

* Commodity stocks were smashed - with uranium stocks, lithium, oil and coal stocks leading the carnage, gold and silver stocks retreated as well as did copper....there was no place to hide amongst resource stocks, as this thread had warned you to avoid resource stocks altogether in the lead up to this correction.

Will the bleed stop here? Momentum is certainly to the downside. USD has breached Y147Y and closed at 146.54 so the unwinding of the yen carry trade will likely still hurt. It is also difficult to see the S&P500 surviving the 100DMA when Nasdaq has already violated it. So I believe we still have another week of pain (I won't be posting anymore after tomorrow until towards end of the month)

https://x.com/SuburbanDrone/status/1819415649807892660

As painful as this day brings for the markets, this is only just a mini correction - as I posted yesterday, it still does take quite a fall to return to Oct 2023 lows...and that is simply on fears of a recession, not even confirming and experiencing a recession when earnings crater and let alone any credit event or counterparty default risk and crisis which typically follows a sharp material correction/crash.

The outcome of this episode however is likely to cause a dent in the confidence of the perpetual bulls and market deniers of irrational exuberance amidst lofty market valuations. And psychology is what the markets are about, you will likely see that market participants jolted by this move will rein in their optimism, stay guarded and not chase stocks as readily as before. But a rebound typically happens after, and whether they will chase up another Melt-Up or sell into the rebound remains to be seen.

So it will be time during the weekend for folks to seriously ponder over their positioning.

Currency markets matter, stay tune and watch what happens with AUD and JPY. A weakening AUD is a Risk Off signal and a strengtening of the Yen portends greater trouble ahead.

Whatever happens now, it is likely it will be a different market than it was the past 9 months with almost zero volatility and >2% contraction. We've just entered the beginning of a turbulent market environment. Navigate accordingly.

Column 1 Column 2 Column 3 0 STOCK INDICES [US 2 Aug 24] Overnight % 1 DOW -1.51% 39,737 2 S&P500 -1.84% 5,346 3 NASDAQ -2.45% 16,773 4 DXY -1.15% 103.22 5 US 2 YR -7.00% 3.874 6 US 10 YR -4.80% 3.785 7 AUD 0.18% 0.6510 8 GOLD -0.15% $ 2,442 9 SILVER 0.13% $ 28.56 10 BTC -4.24% $ 62,120 11 12 13 GOLD Overnight % 14 GDX -2.12% 15 GDXJ -2.69% 16 NEWMONT GOLDCORP(NEM) -2.10% 17 BARRICK GOLD (GOLD) -1.81% 18 AGNICO EAGLE MINES (AEM) -1.27% 19 SILVER 20 SIL -3.74% 21 SILJ -4.50% 22 PAN AMERICAN SILVER(PAAS) -5.02% 23 LITHIUM 24 SPROTT LITHIUM MINERS (LITP) -3.71% 25 GLOBAL X LITHIUM (LIT) -1.74% 26 ALBEMARLE (ALB) -6.63% 27 SOQUIMICH (SQM) -3.88% 28 LITHIUM AMERICAS (LAC) -5.88% 29 PIEDMONT LITHIUM (PLL) -1.71% 30 ARCADIUM LITHIUM -5.92% 31 PATRIOT BATTERY METALS -3.51% 32 COPPER 33 GLOBAL X COPPER MINERS(COPX) -1.25% 34 BHP -0.46% 35 RIO 0.28% 36 SOUTHERN COPPER (SCCO) -2.67% 37 FREEPORT MCMORAN (FCX) -3.84% 38 FIRST QUANTUM MINERALS (FQVLF) -3.02% 39 TECK RESOURCES (TECK) -4.20% 40 OIL 41 XLE -2.58% 42 EXXON (XOM) -0.06% 43 CHEVRON )CVX) -2.67% 44 OCCIDENTAL (OXY) -2.88% 45 CONOCOPHILLIPS (COP) -2.45% 46 MARATHON OIL (MRO) -2.77% 47 HALLIBURTON (HAL) -4.27% 48 COAL 49 RANGE GLOBAL COAL (COAL) -1.82% 50 PEABODY ENERGY (BTU) -2.57% 51 ALPHA METALLURGICAL (AMR) -6.47% 52 ARCH RESOURCES (ARCH) -4.59% 53 WARRIOR MET COAL (HCC) -4.33% 54 URANIUM 55 GLOBAL X URANIUM (URA) -6.23% 56 NICKEL 57 SPROTT NICKEL MINERS (NIKL) -1.52% 58 RARE EARTHS 59 OPTICA RARE EARTHS (CRIT) -2.96%

Market Ka-Mauling

by Tyler Durden

Saturday, Aug 03, 2024 - 06:00 AM

This was the week when - like Biden's dementia - economic weakness became too much for the mainstream to ignore and while Powell hinted at cuts to come, the market demands more (again) and stocks won't be satisfied until they get them.

Source: Bloomberg

"Growth scares" now dominate the narrative (maybe growth's demise is not so 'transitory')...

Source: Bloomberg

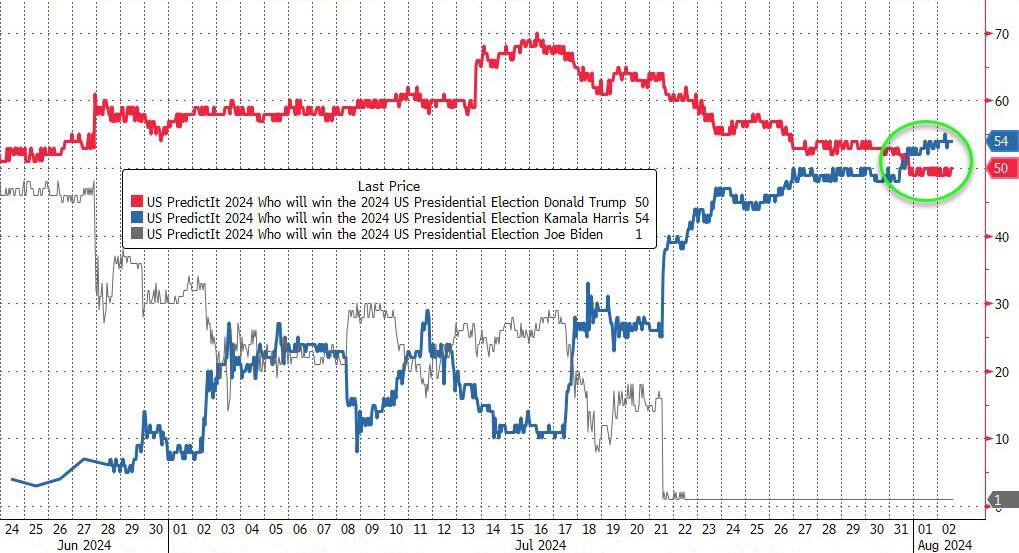

...as Kamala overtakes Trump in the prediction markets...

Source: Bloomberg

The economic weakness prompted the market to bet large on bigger (and sooner) rate-cuts - now pricing in 116bps of cuts in 2024 (and 100bps more in 2025)...

Source: Bloomberg

If you feel like you've heard this story before, you have... twice!

Source: Bloomberg

...and neither time did things work out as the market had hoped...

Source: Bloomberg

...and that smashed Treasury yields lower on the week, with 2Y yields crashing almost 30bps today alone and down a stunning 50bps on the week!

Source: Bloomberg

Today was the biggest drop in 2Y yield since Dec 2023 (Powell pivot) and the biggest weekly drop since March 2023 (SVB collapse).

The entire curve (ex-30Y) is now below 4.00%...

Source: Bloomberg

And the yield curve has disinverted (2s30s now at its steepest since July 2022)...

Source: Bloomberg

Stocks did not love the dovishness as the 'soft landing' narrative morphed into 'growth scare' and 'we are gonna need a bigger boat'-gull of rate-cuts. Small Caps (the most sensitive to the economy) collapsed this week, but while they were the worst of the bunch, all the US majors puked bigly...

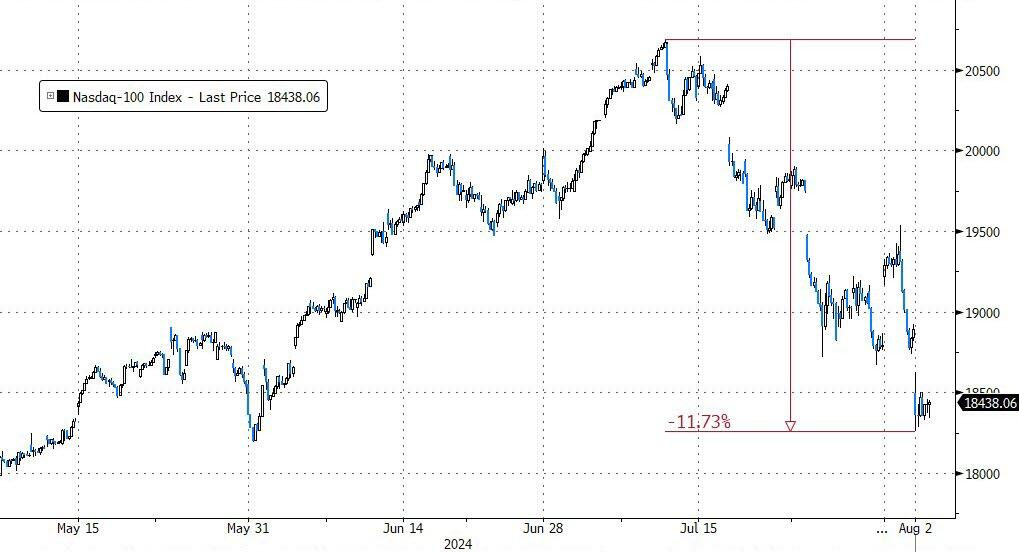

This was the Russell 2000's worst week since March 2023 (SVB collapse), and the fourth weekly drop for Nasdaq in a row.

The S&P 500 found support at its 100DMA today...

But NASDAQ broke below its 100DMA...

And The Nasdaq is now officially in correction...

Magnificent 7 stocks are now down an incredible $2.3 trillion market cap from their record highs...

Source: Bloomberg

"Most Shorted" stocks were clubbed like a baby seal this week, erasing all of early July's short-squeeze...

Source: Bloomberg

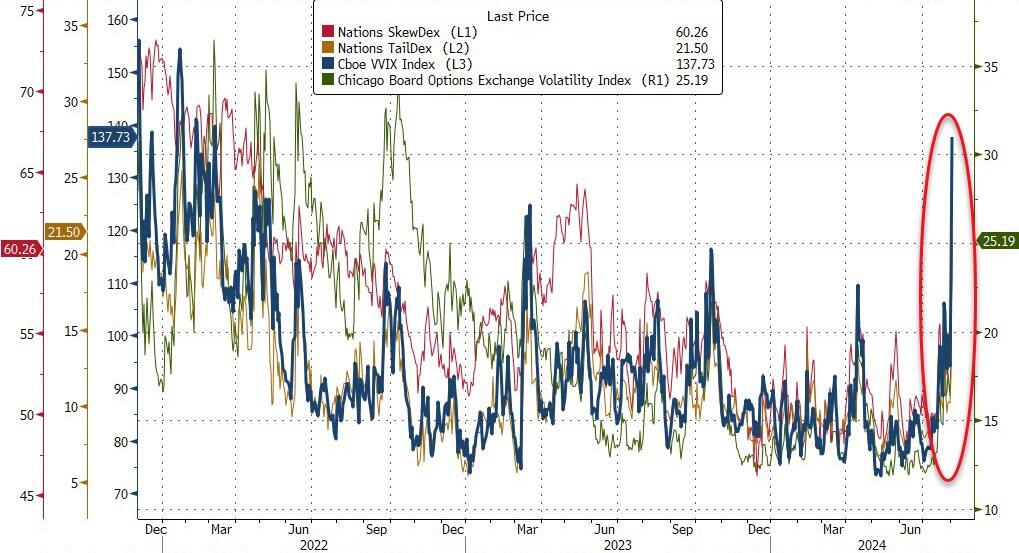

The options markets shit the bed with VIX exploding to almost 30 at its peak today (highest since Oct 2022) and VVIX smashing above the critical scare level of 100 (to its highest since March 2022)...

Source: Bloomberg

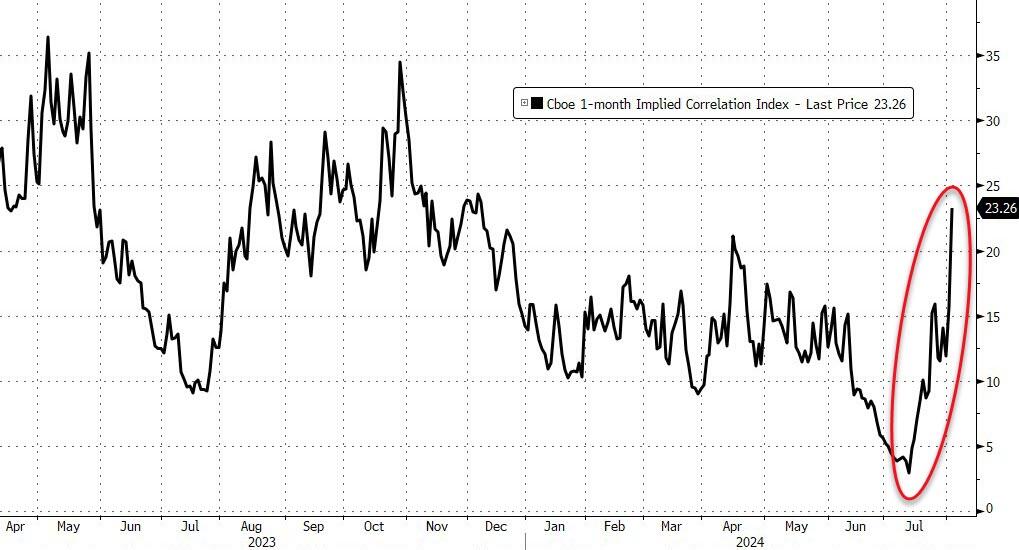

And the "correlation 1" move in markets this week sent implied correlation dramatically higher...

Source: Bloomberg

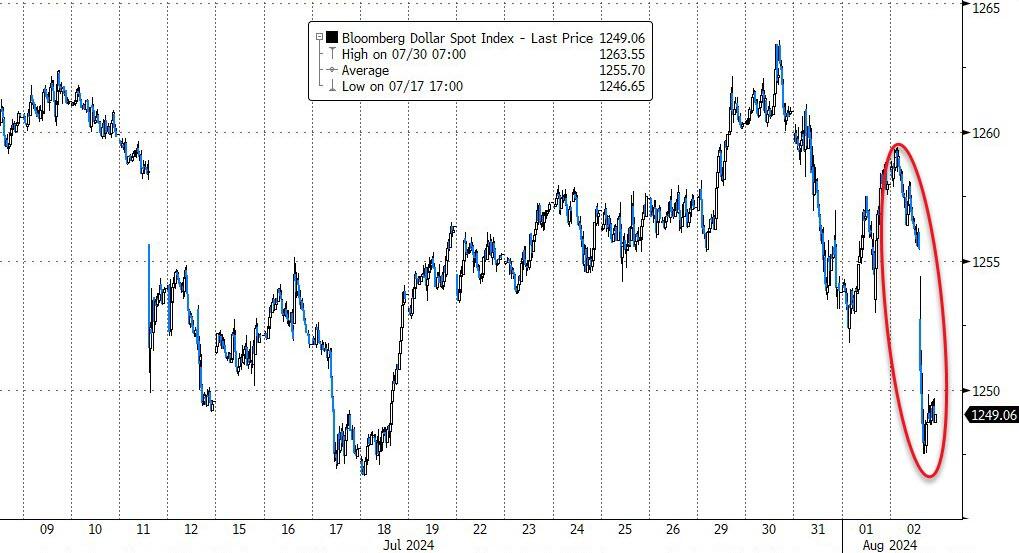

The dollar dovishly tanked this week, back to July's lows...

Source: Bloomberg

..as Yen soared (carry unwinds) to its strongest close against the greenback since January...

Source: Bloomberg

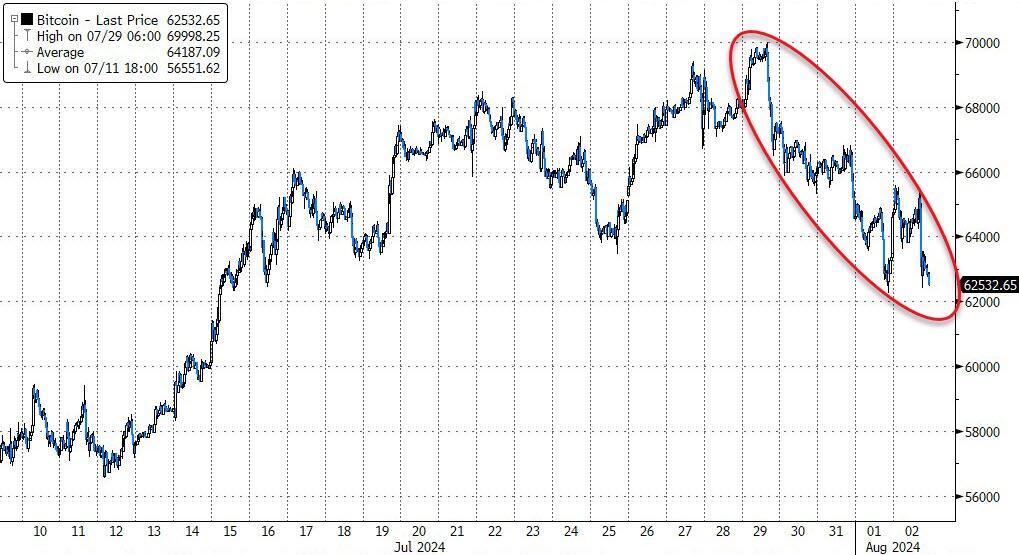

Bitcoin had a tough week, tumbling back from $70k to test down to $62k...

Source: Bloomberg

...but the entire crypto space was hit hard this week, with Solana the worst...

Source: Bloomberg

Gold tested up near record highs once again before being battered lower today (but was higher on the week)...

Source: Bloomberg

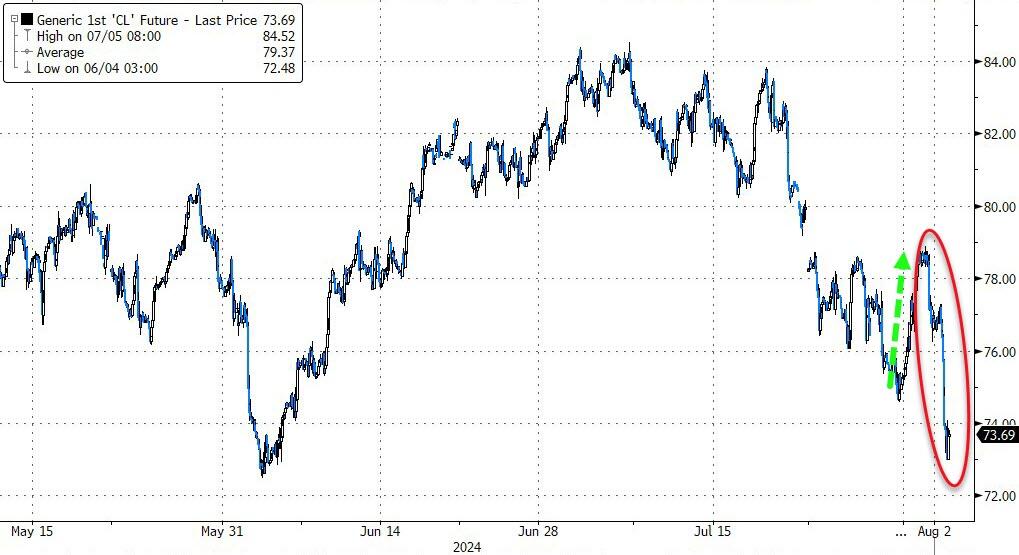

Crude oil prices plunged to two-month lows as the 'growth scare' weakness trumped MidEast geopol risk premium...

Source: Bloomberg

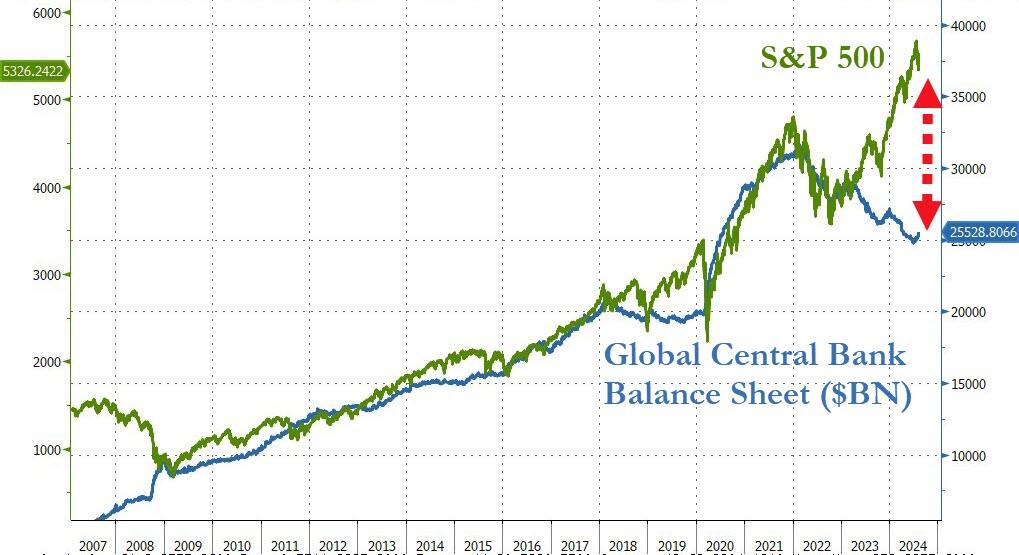

Finally, is it time for stocks to catch down to 'economic' reality?

Source: Bloomberg

How far will the world's central banks allow stocks to fall before the liquidity firehose is unleashed?

Source: Bloomberg

...well it is an election year (for Dems).

- Forums

- ASX - General

- Its Over

* Overnight selloff, not even a crash, shows what a mini purge...

-

- There are more pages in this discussion • 892 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)