* Stocks fell overnight before release of NVIDIA's results; in after hours, NVIDIA beat revenues and EPS estimates as its forward guidance although some parts of it were below the most optimistic of forecasts and given lofty expectations, NVIDIA fell >-8% in after hours despite announcing a $50B stock buyback.

https://x.com/SuburbanDrone/status/1828905116482621588

https://x.com/unusual_whales/status/1828885078577164384

* Semis and consumers set the tone, after SMCI sank -19% , now topping close to -30% price crash in a week (following Hindenburg accounting manipulation allegations, it delayed filing its annual report), Abercrombie &Fitch sank -17% on earnings release

* Resource stocks were broadly lower except coal stocks; copper stocks corrected most, gold, silver, uranium, lithium stocks all lower

* Crypto space was and still in a sea of red since last evening, which gave me the signal that not all is good.

Column 1 Column 2 Column 3 0 STOCK INDICES [US 28 Aug 24] Overnight % 1 DOW -0.39% 41,091 2 S&P500 -0.60% 5,592 3 NASDAQ -1.14% 17,552 4 DXY 0.50% 101.06 5 US 2 YR 0.05% 3.867 6 US 10 YR 0.15% 3.839 7 AUD -0.01% 0.6784 8 GOLD -0.79% $ 2,504 9 SILVER -2.78% $ 29.14 10 BTC -3.97% $ 59,395 11 12 13 GOLD Overnight % 14 GDX -2.19% 15 GDXJ -2.50% 16 NEWMONT GOLDCORP(NEM) -1.68% 17 BARRICK GOLD (GOLD) -2.44% 18 AGNICO EAGLE MINES (AEM) -1.29% 19 SILVER 20 SIL -3.22% 21 SILJ -3.31% 22 PAN AMERICAN SILVER(PAAS) -4.10% 23 LITHIUM 24 SPROTT LITHIUM MINERS (LITP) -3.51% 25 GLOBAL X LITHIUM (LIT) -1.63% 26 ALBEMARLE (ALB) -1.10% 27 SOQUIMICH (SQM) -0.98% 28 LITHIUM AMERICAS (LAC) -3.79% 29 PIEDMONT LITHIUM (PLL) -4.05% 30 ARCADIUM LITHIUM -2.95% 31 PATRIOT BATTERY METALS -4.04% 32 COPPER 33 GLOBAL X COPPER MINERS(COPX) -3.47% 34 BHP -2.25% 35 RIO -1.56% 36 SOUTHERN COPPER (SCCO) -4.54% 37 FREEPORT MCMORAN (FCX) -3.02% 38 FIRST QUANTUM MINERALS (FQVLF) -3.96% 39 TECK RESOURCES (TECK) -3.66% 40 OIL 41 XLE -0.62% 42 EXXON (XOM) -0.99% 43 CHEVRON )CVX) -0.65% 44 OCCIDENTAL (OXY) -0.11% 45 CONOCOPHILLIPS (COP) -0.25% 46 MARATHON OIL (MRO) -0.25% 47 HALLIBURTON (HAL) -1.98% 48 COAL 49 RANGE GLOBAL COAL (COAL) -0.73% 50 PEABODY ENERGY (BTU) 1.21% 51 ALPHA METALLURGICAL (AMR) 0.71% 52 ARCH RESOURCES (ARCH) 2.72% 53 WARRIOR MET COAL (HCC) 0.00% 54 URANIUM 55 GLOBAL X URANIUM (URA) -3.47% 56 NICKEL 57 SPROTT NICKEL MINERS (NIKL) -0.98% 58 RARE EARTHS 59 OPTICA RARE EARTHS (CRIT) -2.84%

AFR:

Nvidia, the chipmaker at the heart of the artificial intelligence boom, gave a revenue forecast that fell short of some of the most optimistic estimates, stoking concern that its explosive growth is waning.

Third-quarter revenue will be about $US32.5 billion, the company said on Wednesday (Thursday AEST). Though analysts had predicted $US31.9 billion on average, estimates ranged as high as $US37.9 billion. The company also signalled that it was working through production snags with its highly anticipated new Blackwell chip, weighing on the shares in late trading.

NVDA Dumps And Pumps After Smashing Q2 Expectations But Guidance Is A "Mixed Bag"

by Zero Hedge

Thursday, Aug 29, 2024 - 06:37 AM

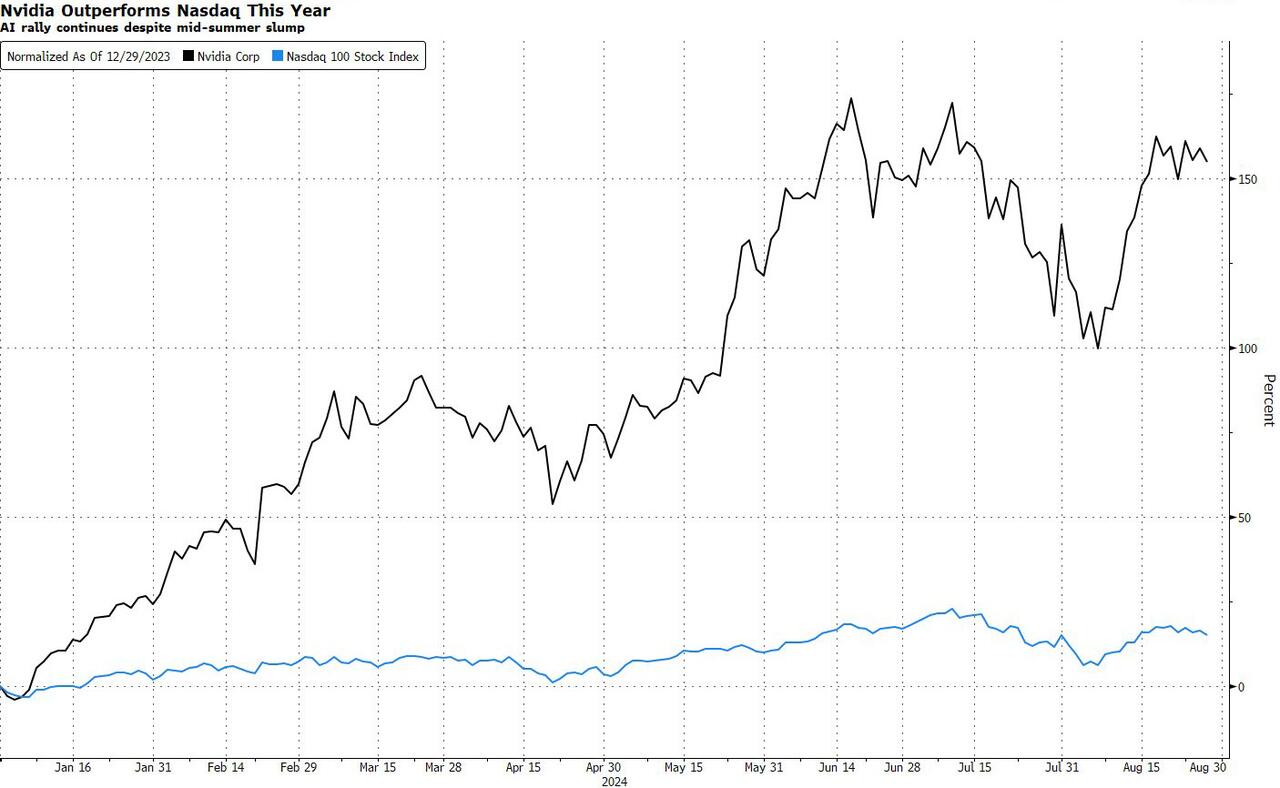

For the second year in a row, Nvidia has been the world's most important company, rising more than 150% YTD to a staggering $3.1 trillion market cap, massively outperforming the Nasdaq, and putting it within spitting distance of becoming the world's largest company (it is currently #2 behind AAPL).

And while the stock price gains have largely been driven by regular raises of the company's forward earnings expectations...

... the question arises: how much more earnings growth is there? We already laid out Wall Street's expectations for what to expect earlier, but with with whisper numbers at nosebleed levels relative to already euphoric guidance and estimates, it's no surprise why the options market is expecting a 10% swing after hours.

A quick look at the past: the company's second quarter wasn’t perfect - the company stopped short of completely denying reports that there are problems with its forthcoming Blackwell product lineup. Analyst reports have dismissed any issues as immaterial given the overall level of demand for existing products - the chip line called Hopper - but management will face questions on the topic.

As a reminder, this is what Nvidia said earlier this month: “As we’ve stated before, Hopper demand is very strong, broad Blackwell sampling has started, and production is on track to ramp in the second half. Beyond that, we don’t comment on rumors.”

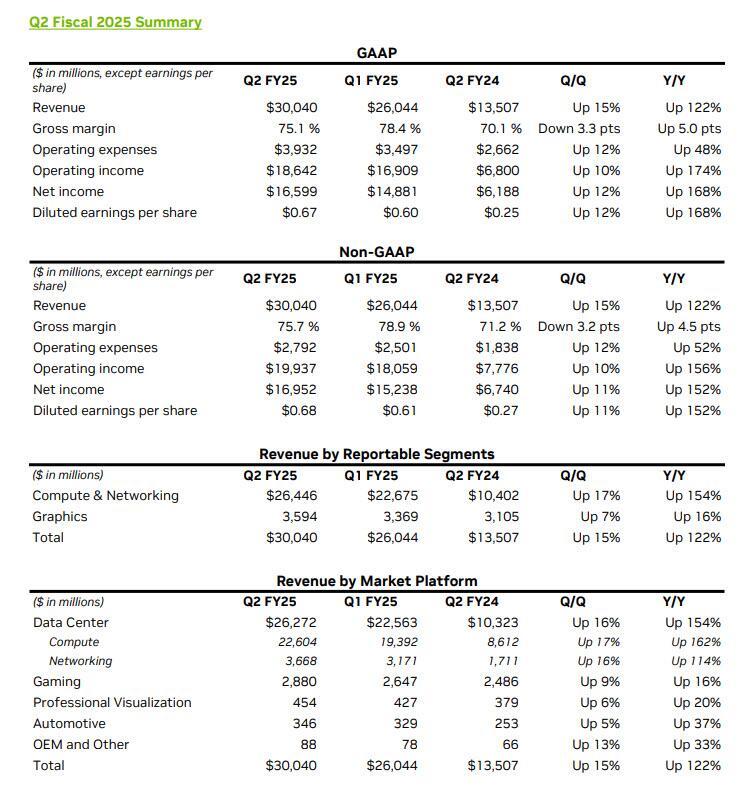

And so, amid skyhigh expectations for the current quarter, even loftier expectations for the company's guidance with questions about its main product line, here is what NVDA reported moments ago for the second quarter:

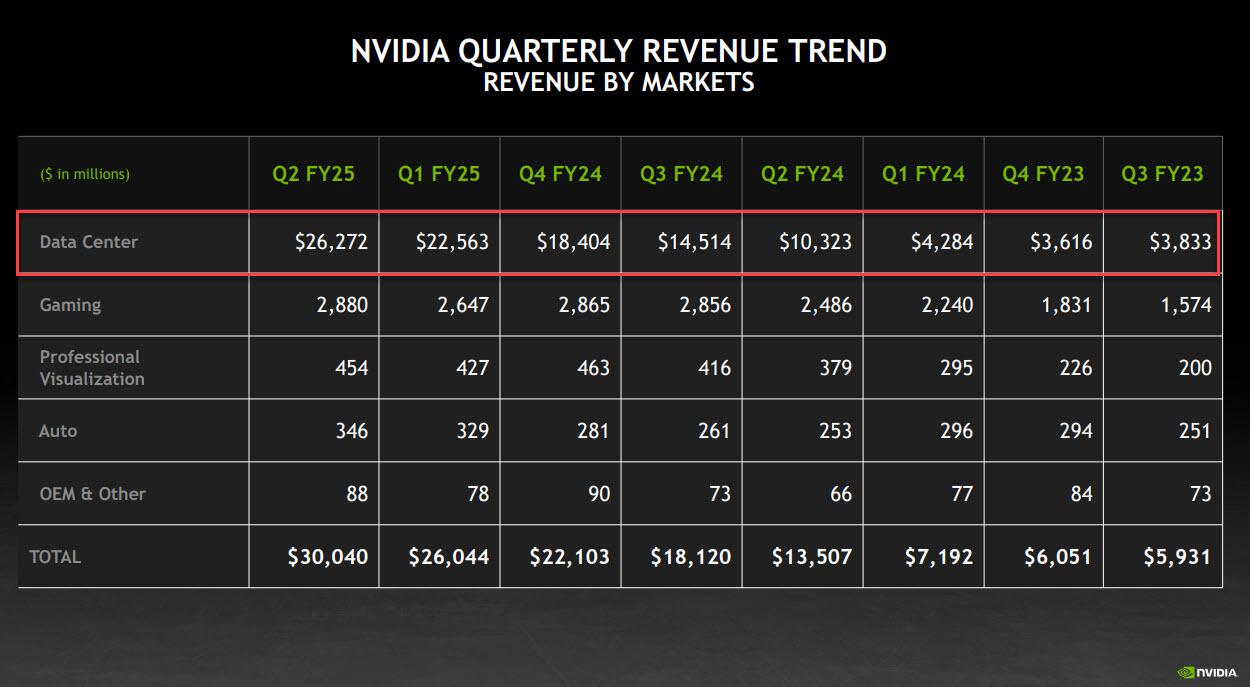

The revenue trend, as expected, is impressive especially at the Data Center level where all the growth is.

- Q2 Rev. $30.04B, up 122% YoY, beating estimates of $28.86B, and beating not only the upper end of the guidance ($27.44BN-$28.56BN) but also above the JPM whisper number of $29.85BN.

- Q2 Data Center Revenue $26.3B, beating exp. $25.08B

- Q2 EPS $0.68, up 152% YoY, beating exp. $0.64

- Q2 Gross Margin 75.7%, up 4.5% YoY from 71.2, beating exp. 75.5%, but down from 78.9% in Q1. Peak margins?

And here is a full breakdown of recent results:

Commenting on the quarter, Robert Schiffman, senior credit analyst for Bloomberg Intelligence, said free cash flow generation consistently growing: “That’s going to drive cash balances far in excess of operating needs, which may result in a bit of an anomaly -- higher shareholder returns and a better credit profile.” Hence the new buyback authorization.

While the Q2 earnings were impressive, beating both estimates and the even loftier whisper numbers across the board, there was just a touch of weakness in the company's guidance: NVDA projected Q3 revenue will be $32.5 million, +/- 2%. While this was above the average estimate was $31.9 billion, it was below JPM's whisper of $32.95BN and certainly below the most optimistic sellside prediction of $37.9 billion.

Some other guidance:

Perhaps anticipating the potential market revulsion to the modest guidance disappointment, NVDA tried to appease investors by announcing a massive new $50 billion buyback .

- Gross margins are expected to be 74.4% and 75.0%, respectively, plus or minus 50 basis points. For the full year, gross margins are expected to be in the mid-70% range.

- Operating expenses are expected to be approximately $4.3 billion and $3.0 billion, respectively. Full-year operating expenses are expected to grow in the mid to upper 40% range.

The company also tried to preempt questions about its reportedly troubled Blackwell chips, saying “samples are shipping to our partners and customers” and says that it expects to ship several billion dollars of Blackwell revenue in Q4 even as it admits in its earnings release that it needs to improve Blackwell production, to wit:

We shipped customer samples of our Blackwell architecture in the second quarter. We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue. Hopper demand is strong, and shipments are expected to increase in the second half of fiscal 2025.

While initially NVDA shares bounced on the big beat, the since dipped on the disappointing guidance, sliding as much as 6% after hours, and have since whiplashed by the results as the stock is still fighting for direction, swinging between gains and losses as traders digest the earnings. As a reminder, options markets had priced in a swing of 10% after hours, so for now the reaction is positive tame relative to expectations.

Big-Tech, Bullion, & Bitcoin Battered Before NVDA's Big Night

by Zero Hedge

Thursday, Aug 29, 2024 - 06:00 AM

Coming off yesterday's lowest volume (full) session of the year (and Monday was the 2nd lowest), the low level of liquidity was very apparent in today's anxiety-filled session as traders puked back gains ahead of "the most important earnings announcement ever".

Nasdaq was clubbed like a baby seal, but all the majors saw two big legs down intraday. That, of course, was met with a wave of BTFDing as the last hour began

Mag7 stocks were dumped for the fifth day in a row...

Source: Bloomberg

Also, 'most shorted' stocks were dumped, erasing all the post-Powell euphoria...

Source: Bloomberg

1-Day-VIX soared higher ahead of tonight's earnings news (higher than VIX)...

Source: Bloomberg

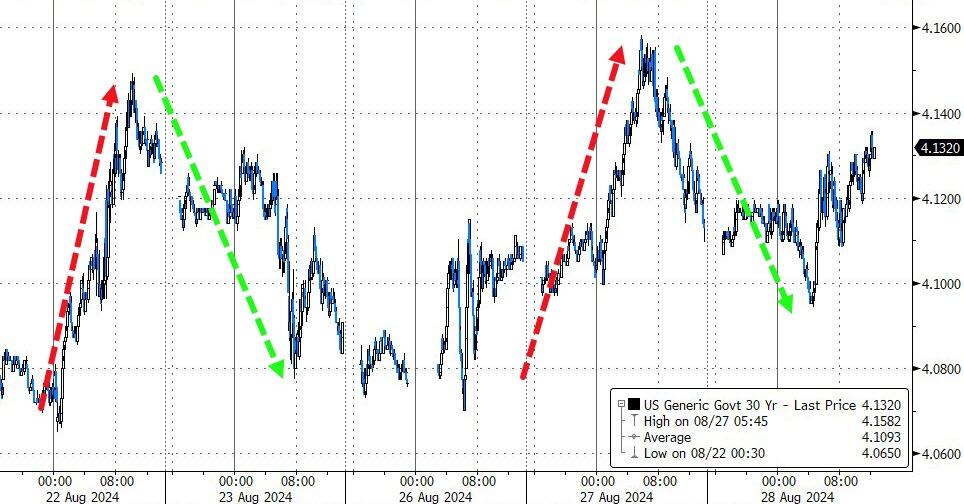

Treasury yields were higher across the curve by 1-2bps on the day with the long-end very modestly underperforming...

Source: Bloomberg

The dollar extended its rebound gains, erasing 75% of the post-Powell plunge...

Source: Bloomberg

Bitcoin was battered today with a big puke shortly after yesterday's equity cash market closed. The cryptocurrency found support at $58,000 and tested back up to $60,000...

Source: Bloomberg

Gold also tumbled on the day, only to find support at $2500...

Source: Bloomberg

Oil prices dipped for the second day with WTI holding above $74...

Source: Bloomberg

Finally, is it time for stocks to catch back down to bonds' reality?

Source: Bloomberg

- Forums

- ASX - General

- Its Over

* Stocks fell overnight before release of NVIDIA's results; in...

-

- There are more pages in this discussion • 830 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)