....most already considered 'what-if' the market crashes, YET they do nothing because

1. The mainstream mantra assumption of 'Better for Longer'- just hold, you'd be right eventually (may apply to some blue chip stocks but definitely not across the board)

2. The market has shown resilience to bounce back every time it falls - the BTFD mantra - so its the boy who cry wolf or the person wearing the Scream mask pulling a prank...don't worry about it

3. Nobody can predict when it will happen, it may not, for a long while yet. That's true and can continue to be true. But if you are climbing a tree, and get up higher and higher, at some point, you run a higher risk of falling and falling hard. Laws of gravity - you can't defy it indefinitely.

4. When the going is good, few contemplate serious problems lurking. When things start becoming bad, everyone is looking for the exit. One would have to balance out exiting ahead of time but missing the action OR exiting when everyone else is. I know how hard the latter is- prices start at ridic levels and even then the move down accelerates so fast you have to put several bids under. Most just won't panic, and when the fall gets deeper, they pull the plug only to lose more. And those who stayed the course would subject their fate to what the stock does eventually. Some stocks just get pummelled and never saw daylight again, others disappear while the stronger ones can recover but over a protracted time. Most of you know what is like being caught out holding a micro cap stock no one wants to buy, and it stays low for ages. You give up in the end, and regret not pulling the plug sooner.

When people already felt what market reaction was like in early Aug, the next correction can be swift and brutal because people have that memory. Confidence can flip quickly when we see capitulation. Until then, all remains good. And can remain good for even sometime yet. This is why some believe that human psychology will lead to a final FOMO Melt up as people get sucked in for a final time to BTFD before the eventual eventful day.

Does Anyone Else Smell A Market Crash In The Air?

by Zero Hedge

Tuesday, Sep 10, 2024 - 08:05 AM

Authored by Charles Hugh Smith via OfTwoMinds blog,

Markets are manipulated, yes, but they're still structures of tightly bound, self-organizing complexity which lend themselves to sudden non-linear collapses.

Just as thunderstorms scent the air before their arrival, market crashes often announce themselves in the autumn zephyrs. Markets don't crash when everyone's in full-blown panic? they crash when the headlines and data are reassuring, analysts are confident in ever-higher profits, and complacency reigns supreme, evidenced by record-high household allocation in stocks and bullish sentiment readings.

Markets crash after a brief bit of panic selling is immediately bought and markets are returned to a permanently high plateau of valuation as we saw in August, as the S&P 500 shot back up within a whisker or two of all-time highs. Punters buy every dip because this quick reaction to any drop has been richly rewarded for 15 years, and everyone has confidence in the Fed Put , ie the belief that the Fed will move Heaven and Earth to restore "market confidence" and the wealth effect .

In other words, market participants have embraced moral hazard : there is no real downside, there is only upside to buying every dip.

Markets crash when the rot beneath the surface is invisible or goes unnoticed. The few doom-and-gloomers who note extremes are immediately mocked off the stage, and the headlines tout the resilience of the economy, markets, employment, profits, and the techno-wonders heading our way.

After the crash nobody predicted, analysts swarm like ravenous locusts to the digital airwaves to lay claim to their prescience: look, look, I added a one-line disclaimer about "irrational exuberance" at the end of my report!

I'll spare you the analog charts and go right to the chase: the Oasis Indicator , brought to our collective attention by Joe Sullivan-Bennett via BondVigilantes.com: The Peculiar Relationship Between Oasis & Periods Of Extreme Market Volatility (Zero Hedge). (Fun fact: Before Oasis Wonderwall , there was George Harrison's 1968 soundtrack LP Wonderwall .)

Those turning up their nose at the Oasis Indicator might benefit from pondering these "jaws of death" charts. Everything is extreme and stays extreme until it doesn't. Consider the gaping pearly teeth of the SPX (S&P 500) and JPY (Japanese yen).

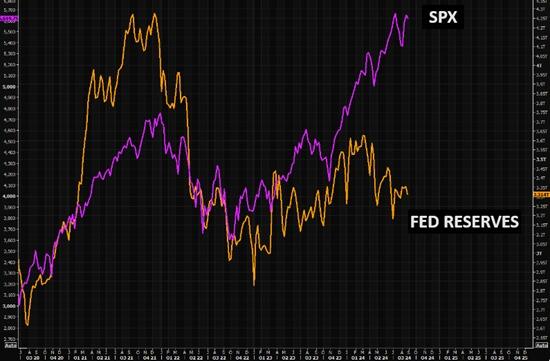

Or the Mack the Knife of SPX and Fed reserves: You know when that shark bites with his teeth, Scarlet billows start to spread...

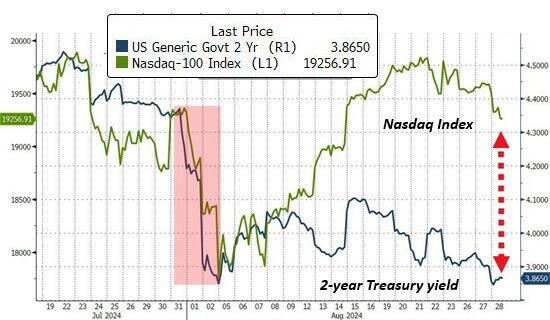

And last but not least, the 2-year Treasury yield and the Nasdaq Index:a loaded mousetrap if there ever was one.

There's no convincing the complacent. You either sense what's coming or you don't. It's like a sixth sense in a way, an intuitive awareness developed by absorbing huge losses in previous "unpredicted" crashes.

Markets are manipulated, yes, but they're still structures of tightly bound, self-organizing complexity which lend themselves to sudden non-linear collapses.

But never mind, a little autumn shower never hurts anyone. And so nobody carries an umbrella on a day that starts out sunny and clouds over too quickly to respond.

- Forums

- ASX - General

- Its Over

....most already considered 'what-if' the market crashes, YET...

-

- There are more pages in this discussion • 3 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)