* Dow and S&P500 hit all time highs while the Fed turned hawkish, DXY up and AUD and BTC turned lower and US 2yr and 10 yr yields continued moving above 4pc AND

VIX remain high above 20

https://x.com/SuburbanDrone/status/1844018183247995130

* Seems disconnected, and therein lies the danger in that market participants are now seemingly impervious and apathetic towards all risks including even prospect of no further cuts this year if CPI tonight proves to be stubborn and higher than expectations (low 0.1% for Sept, due 11:30pm AEST)

Stocks Up, Yields Up, Dollar Up, China Down As Hawkish Minutes Hit Ahead Of CPI

by Zero Hedge

Thursday, Oct 10, 2024 - 07:00 AM

Despite the threat of CPI hovering over the vol markets...

Source: Bloomberg

...and notably hawkish minutes from The Fed (more divided over the scale of cuts than previously thought), which dragged rate-cut expectations lower still...

Source: Bloomberg

The Dow outperformed but the Nasdaq and S&P were solid performers as Small Caps gave back early gains...

S&P 500 hit another all-time intraday record high today and is now experiencing the strongest YTD performance of the 21st century...

The US ain't cheap!!

Source: Bloomberg

Still not cheap...

Source: Bloomberg

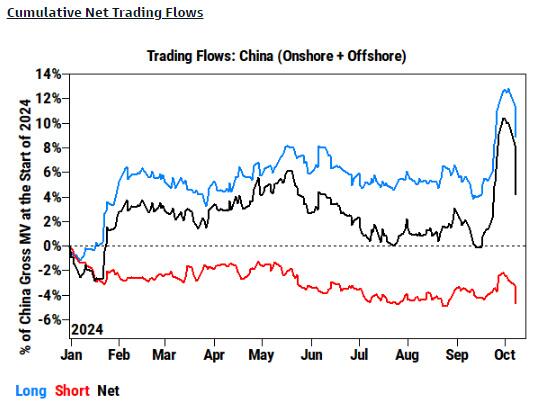

But across the Pacific, Beijing was battered again...

Source: Bloomberg

Goldman Sachs trading desk notes that "We saw record single-day selling in Chinese equities on Tuesday..."

Source: Goldman Sachs

"To put this in a historical context, this net selling was 1.4 times larger than the previous record for net selling and represents a 6.5 Standard Deviation event on our records. Three-quarters of the net selling was driven by selling in A-shares as market opened up after a week long holiday. The remaining one-quarter of the selling activity was in H-shares while activity in ADRs was relatively muted. Hedge funds not only unwound their long positions but added shorts to their books as well, with long sells being double the amount of short sells."

Source: Goldman Sachs

Back to the US markets, Mag7 stocks managed gains once again...

Source: Bloomberg

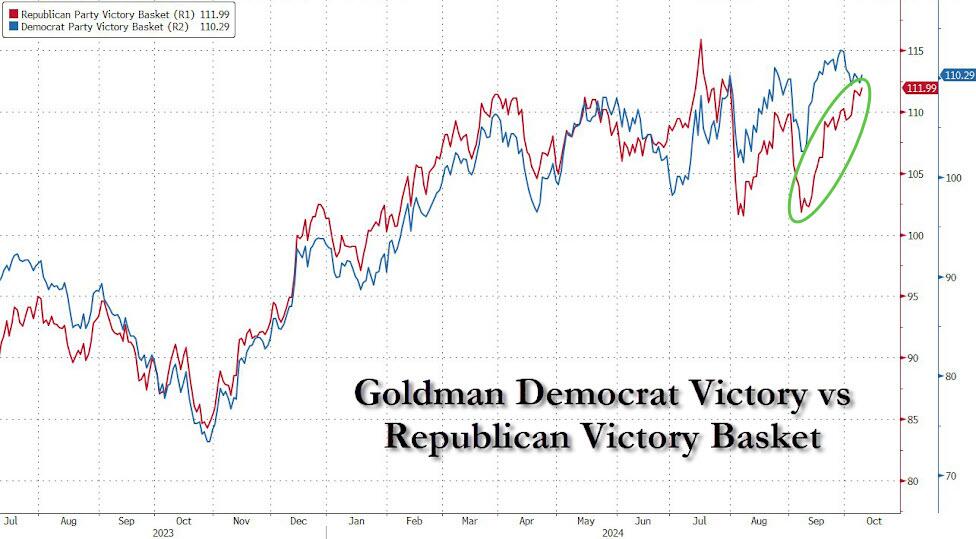

Before we leave stock-land, it's worth noting that Goldman's "Republican Victory" basket has been significantly outperforming the "Democratic Victory" basket in recent days, and they are now tied...

Source: Bloomberg

It's been an interesting few weeks in the bond-stock relationship...

Source: Bloomberg

Treasury yields were higher across the board today (5-6bps up with no curve bias), pushing 2Y and 10Y further above 4.00% (and 20Y to 4.40%). The belly of the curve is the worst performer of the week for now (7Y +10.5bps)

Source: Bloomberg

Meanwhile, USA sovereign risk is screaming higher still - now at its hottest since December...

Source: Bloomberg

The dollar just won't stop rallying, now at its strongest since mid-August, retracing all the drop since the August CPI print (ahead of tomorrow's CPI)...

Source: Bloomberg

Dollar Strength weighed down gold prices modestly today but spot held above $2600...

Source: Bloomberg

Bitcoin was pummeled again, testing down tro $61,000 inatrday...

Source: Bloomberg

Crude prices fell again amid weakening hopes of more China strimmies and a big crude build (likely hurricane driven)...

Source: Bloomberg

Finally, just when you hoped that rate-cuts would ease the pain for homeowners... the exact opposite is happening as growth and inflation anxiety is pushing the long-end of the curve up - sending mortgage rates dramatically higher (back near 7%)

Source: Bloomberg

Prompting a big drop in mortgage applications. Be careful what you wish for.

- Forums

- ASX - General

- Its Over

* Dow and S&P500 hit all time highs while the Fed turned...

Featured News

Featured News

The Watchlist

NUZ

NEURIZON THERAPEUTICS LIMITED

Michael Thurn, CEO & MD

Michael Thurn

CEO & MD

SPONSORED BY The Market Online