...the final innings of the Melt-Up. Unfortunately there's been no restraint, booze going all around, and soon a hangover.

The proportion of US stocks with P/E ratios over 30x is high.

https://x.com/LanceRoberts/status/1772934912179315154?s=20

BY Zero Hedge

THURSDAY, MAR 28, 2024 - 07:00 AM

The month-/quarter-end rebalance-fest continued with a giant short-squeeze offsetting the $32 billion in US equities to sell given the moves in stocks and bonds in Q1...

Stocks up large (and non-stop in Q1) while bond (prices) drifted lower (yields higher)...

Which may explain why bonds were bid today (given the absence of macro data), with 10Y Yields back at their lowest in two weeks...

Source: Bloomberg

Nasdaq lagged again on the day (relabalancing) but Small Caps face-ripped higher on the day. Today saw a late-day buying panic (as opposed to the last two days of dumping in the last 30 minutes) which lifted nasdaq green and small caps to a giant day...

Sell, Sell, Sell, Buy!!!!

Thanks in large part to a gigantic short-squeeze - the biggest low-to-high rip for 'most shorted' stocks since the end of February...

Source: Bloomberg

Mag7 stocks staged a very late-day comeback today to close green barely...

Source: Bloomberg

And Trump-mania continued with DJT up another 15% today...

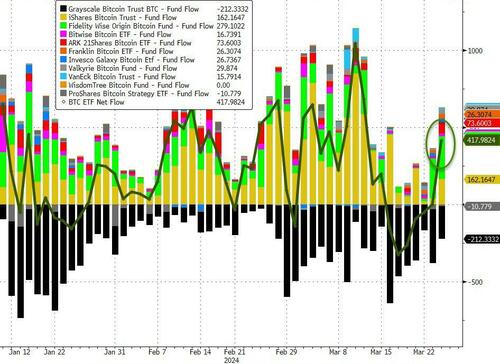

Yesterday saw a big resurgent net inflow (over $417mm) into BTC ETFs...

Source: Bloomberg

And that helped lift bitcoin early on but SEC vs COIN headlines prompted some selling which was immediately pounced upon by futures sellers, dragging bitcoin back below $69,000...

Source: Bloomberg

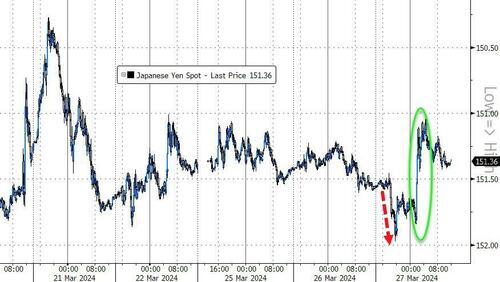

Away from the headlines that are usually front and center on CNBC, the FX market had quite a day as USDJPY tested a key level and was desperately jawboned by every Japanese official that could fog a mirror that "we'll do something really big, don't make us!!".

152 is the weakest for the yen against the dollar since 1990... and is the same level that prompted intervention in 2022...

Source: Bloomberg

It may not look like much but that level is make or break and Tokyo knows it.

But the dollar looked like it did nothing on the day...

Source: Bloomberg

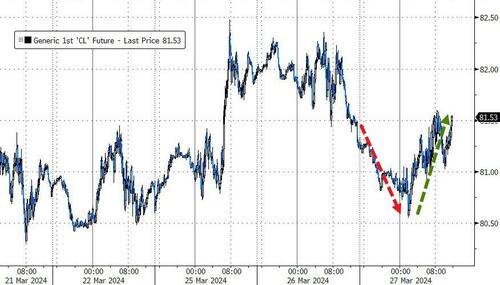

Oil prices rebounded on the day, erasing the post-API losses (as official data came in with a much smaller build)...

Source: Bloomberg

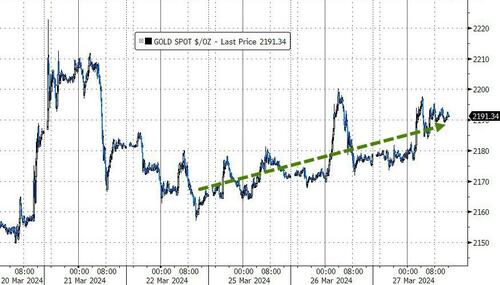

Gold continues to drift higher, testing back up towards $2200 today...

Source: Bloomberg

But closing at a record high in USD...

Source: Bloomberg

Finally, if you're Japanese, gold has been a great bet...

Source: Bloomberg

...and so has bitcoin...

Source: Bloomberg

- Forums

- ASX - General

- Its Over

...the final innings of the Melt-Up. Unfortunately there's been...

- There are more pages in this discussion • 797 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)