Sven puts it all too well...

Welcome To The "Anything Goes" Market

by Zero Hedge

Tue, 06/09/2020 - 08:15

Authored by Sven Henrich via NorthmanTrader.com,

President Trump is mocking Warren Buffett for having sold his airline stocks, Druckenmiller crying on TV about having been humbled by the market while every Robinhood retail trader piling into ever more calls is laughing all the way to the bank. The professionals gobsmacked at the complete upside down events in markets compared to any other time in recorded history given the economic backdrop while retail is giddy jumping into any ticker symbol that’s moving, valuations be damned, hey let’s even chase bankrupt companies, why not?

Sven Henrich

✔@NorthmanTrader

This market is so bullish even bankrupt companies are rallying.$HTZ

3,867

12:37 AM - Jun 6, 2020

Twitter Ads info and privacy

1,166 people are talking about this

Anything goes in the market.

I myself, have been surprised by the recent vertical strength that keeps running from gap to gap to gap.

Sometimes you just have to laugh:

Sven Henrich

✔@NorthmanTrader

$NYSE chart art.

584

11:52 PM - Jun 8, 2020

Twitter Ads info and privacy

126 people are talking about this

On the day of the lows I talked about an awe-inspiring rally coming. Consider me sufficiently awe inspired.

And now the same folks that told people to buy stocks in January and February right before the crash are back out and telling people to buy stocks again except this time at much higher multiples and valuations.

My variant take here which may well turn out to be very wrong: The Fed is setting markets up for another crash. Why? Because they’ve set in motion a stock market mania we have not seen since the 2000 tech bubble. But this time while we’re still in a recession.

And it is a mania and it’s important to recognize this. And like all manias it’ll end badly. The amount of “ever’s” keep building up.

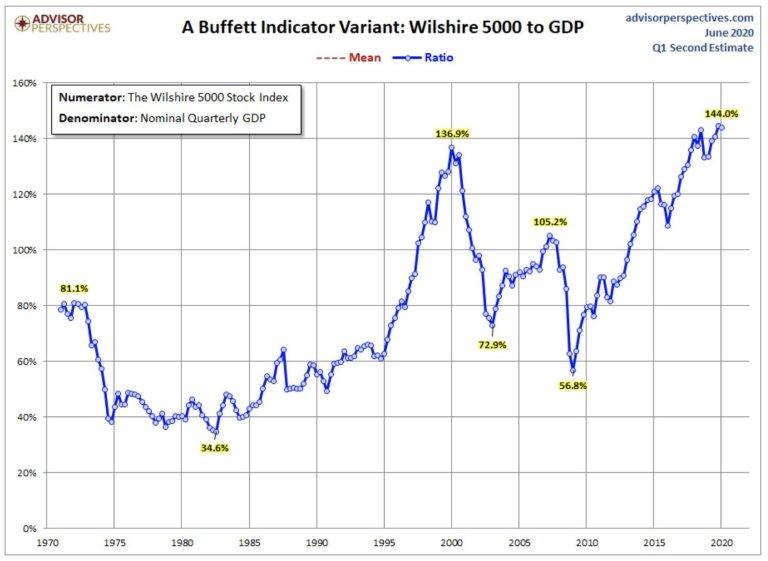

We have the highest market valuations ever (market cap to GDP) 151% on Friday’s close with old GDP data hence the real figure is higher. This chart from the beginning of June:

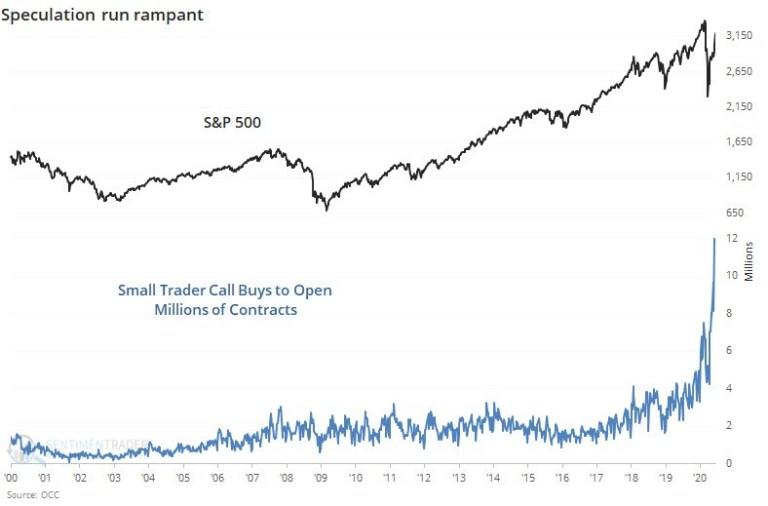

We are seeing the highest amount of speculative call buying ever:

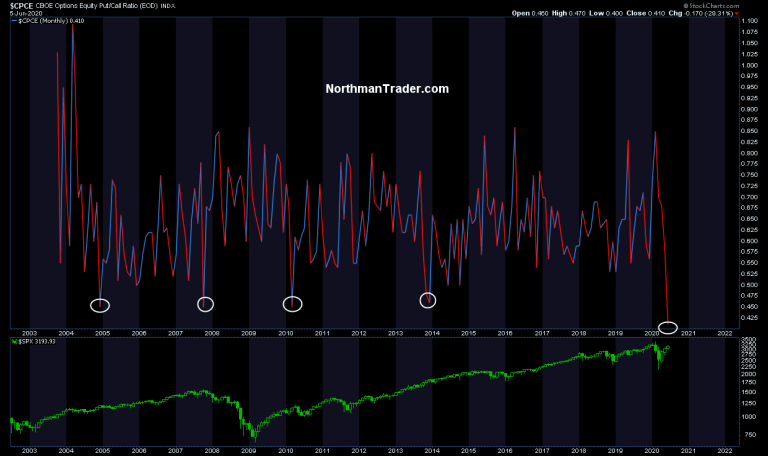

We have the lowest put call ratios ever, meaning everything is one sided and complacent:

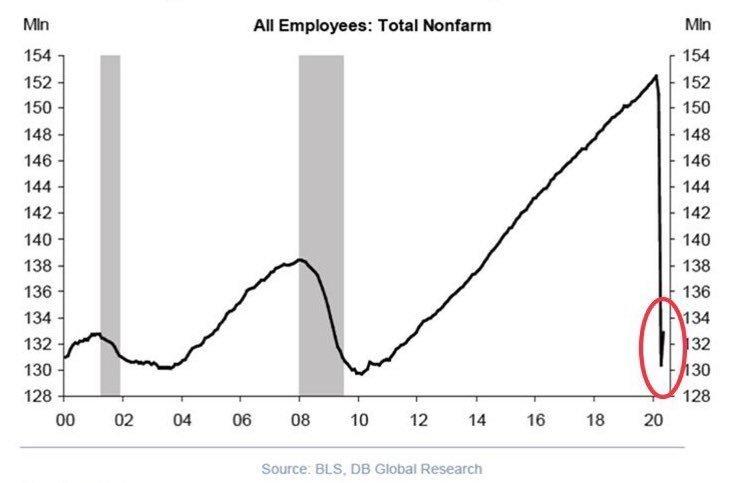

We also have the highest unemployment ever, at least since the post WWII period. The highest unemployment in the post WWII period was 10.8% in 1982.

Friday’s jobs report was as accurate as the Fed’s inflation model. Totally misrepresentative of the real economy as 4.9M unemployed people were counted as employed. 13.3% reported in reality north of 16% and perhaps much higher.

Fact is we are in a historically disastrous environment:

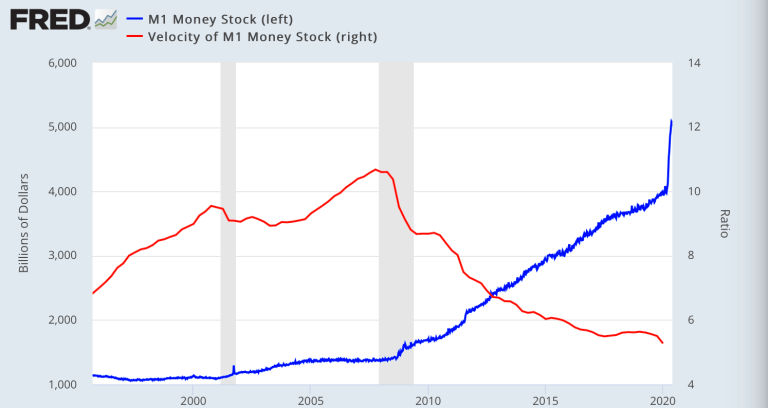

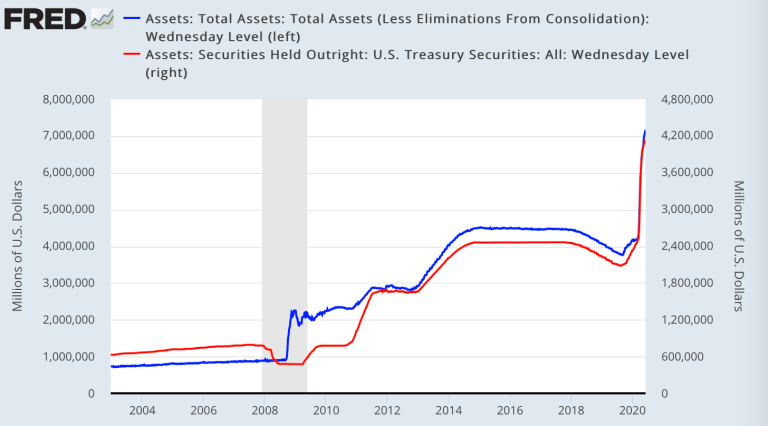

And of course we are witnessing the largest deficit (approx. $4 trillion) and monetary intervention ever:

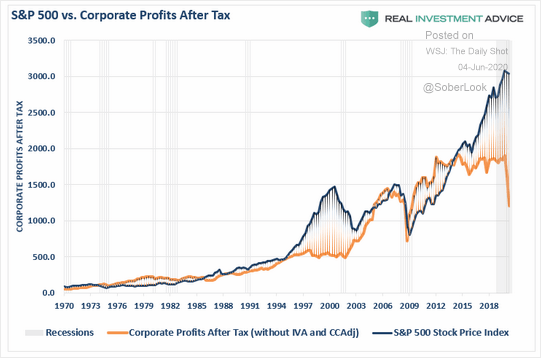

The largest disconnect from corporate profits ever, even worse than during the 2000 bubble:

$SPX is now farther disconnected from its 50MA than pretty much ever before:

Sven Henrich

✔@NorthmanTrader

One one of the highest extensions above the 50MA by $SPX ever.

Ever is a long time.

512

7:45 PM - Jun 8, 2020

Twitter Ads info and privacy

136 people are talking about this

The only precedence for this was in 2009. Then markets retraced to the 50MA and then rallied on from there to new highs. Back then it took years, perhaps this time it will take weeks. Who is to say in this environment.

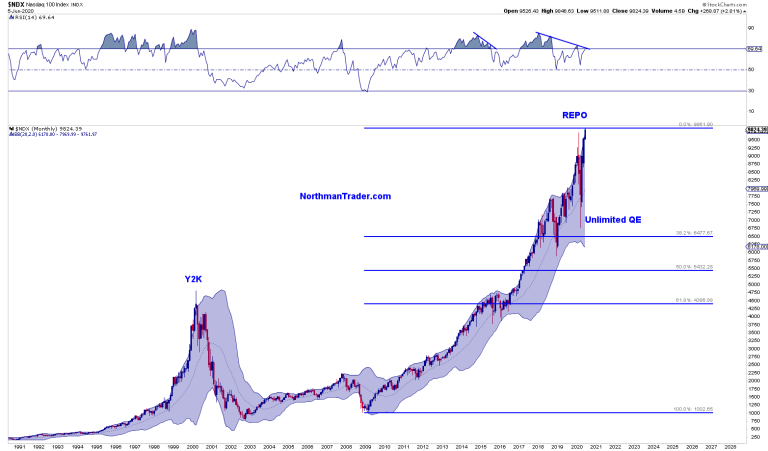

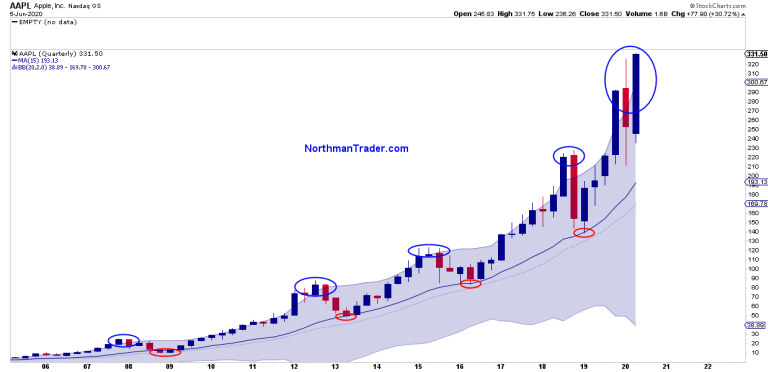

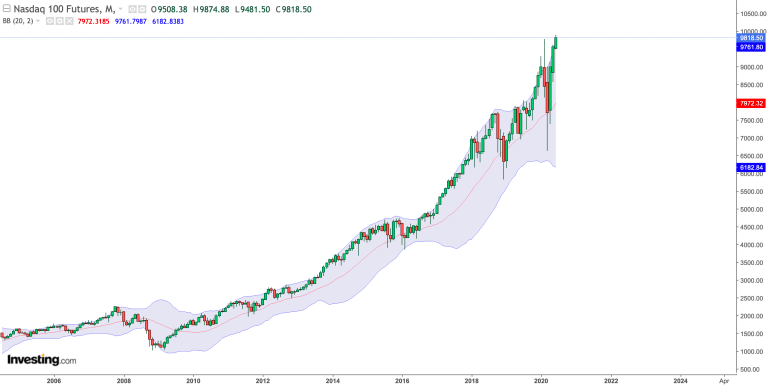

My point here: The combination of all of these factors has contributed to the largest dislocation we’ve ever seen only perhaps rivaled by the Nasdaq bubble of 2000:

Except now we have trillion dollar market cap companies that trade at massive forward multiples and are experiencing unseen multiple expansion during a time when there is little revenue or earnings growth. And it’s just not this year. It all started in 2019 and has now extended into 2020.

And that’s the definition of a mania. Exuberant embracing of a vertical stock market rally by a majority of people of stock market valuations that are entirely unrealistic and untethered from the economic reality on the ground. A complete disregard for risk and markets that move vertically in one direction.

And of course the cheerleading. “We’re back” Jim Cramer celebrated a miscalculated jobs report on Friday. Trump celebrated the biggest jobs gain ever, when the real unemployment rate actually went north of 16% and reality is a bounce is to be expected off of a disastrous historic shut down, it’s not an accomplishment.

But the cheerleading trophy goes to, who else, Larry Kudlow, celebrating a soaring stock market and declaring himself a winner:

The White House

✔@WhiteHouse

America is coming back!

21.4K

8:14 AM - Jun 6, 2020

Twitter Ads info and privacy

15.9K people are talking about this

The same person that declared the cornonavirus contained before it killed over a 100,000 people. That same person the said “we’re killing it on the economy” only a few months before it collapsed.

I know it’s an election year and they have to cheerlead. The polls are looking terrible for Trump and I think he starts recognizing it as he complained on twitter last night. More and more traditional Republicans are getting vocal in not supporting him. Last week it was James Mattis and other generals that rebuked him, including his former chief of staff John Kelly, and this weekend it was George Bush, Romney, and Colin Powell.

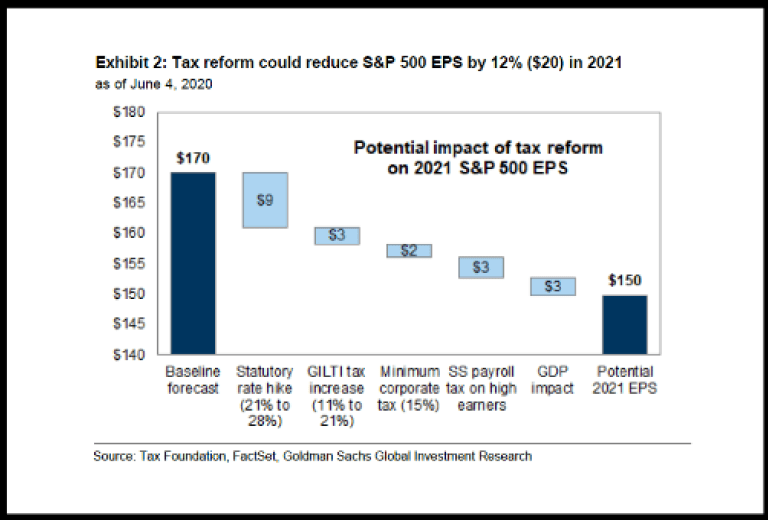

It all reeks of desperation and I keep coming back to this point: What happens when markets suddenly price in a Democratic win in November? The tax landscape would change drastically. Stocks already massively stretched would have to contend with further reductions in after tax earnings outlooks.

And Goldman Sachs is crunching the numbers on the impact:

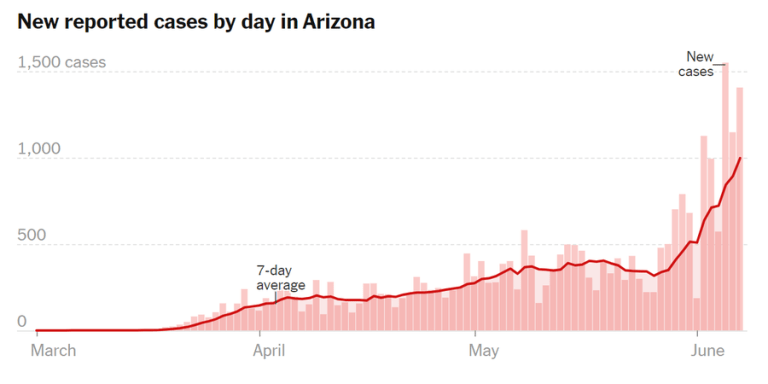

Also: Reopening everywhere, but tell me, where is the evidence of a drastic reduction in Covid cases? Yes a slow down in key states following lockdowns, but also a massive increase in many others. Newsflash: The virus hasn’t gone away, it’s migrating. Fact is the number of new infections worldwide continues to increase. While deaths have been decreasing in aggregate I also will have to point out that this is what you would expect due to the lockdowns and social distancing measures. B eclear: Cases are rising in many states, take Arizona as an example:

But Covid is largely ignored now as a risk factor despite the fact that this Sunday saw the highest new infections globally yet.

While infections have slowed down dramatically in many states we can thank shutdown measures and social distancing. Well, those measures are out the door now:

UK:

Hamid Taheri@Hamid_Taheri1

Police is beating the protesters in England too! London protest goes violent...#BlackLivesMatter #protests

8

4:49 AM - Jun 7, 2020

Twitter Ads info and privacy

See Hamid Taheri's other Tweets

US:

Ron Kurokawa@ronkurokawa

LA TODAY!!!!! #BlackLivesMattters #GeorgeFloyd

9,997

4:15 PM - Jun 8, 2020

Twitter Ads info and privacy

3,410 people are talking about this

So you tell me.

The virus is not gone, the numbers are bigger than ever and now we’re entering a new phase. I seriously doubt there is any political will to shut down the economy again. I don’t know what will happen with reinfection rates, but if this virus (which has shown itself to be active in warm climates as well, think Arizona) is reasserting itself we will know in the next few weeks.

Also in the next few weeks: Earnings reports, you know, reality checks.

As it stands markets and individual stocks are stretched to the hilt:

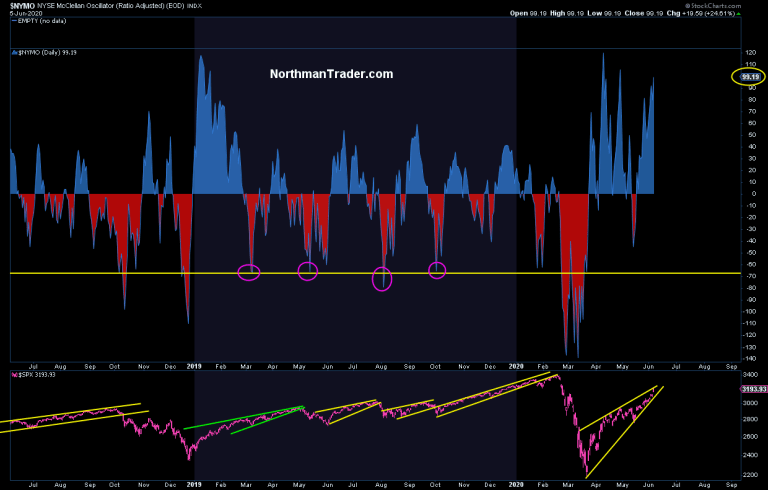

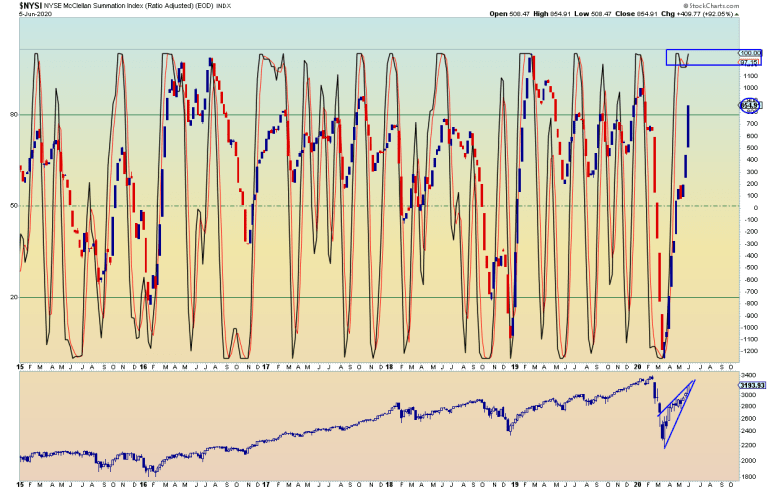

100 $NYMO again on Friday:

$NYSI continuing to scream overbought:

And massively stretched charts reflecting no economic reality with tech taking the cake with new all time highs far above the upper monthly Bollinger band again:

Manias are reason defying by definition and they can go farther than anyone expects.

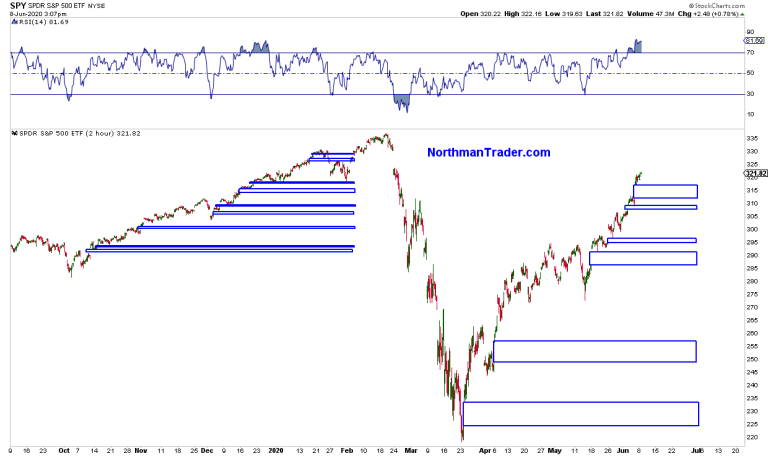

Too strong is the draw and chase of the Fed put is which advertised as delivering $SPX turning green for the year this week:

“Look for the S&P 500 to turn positive for the year with a boost from the Fed in the week ahead”

That’s sentiment at the moment and probably the most frustrating aspect of a mania. The most reckless look the most right and the most reasonable the fools for not chasing or trying to fade.

FOMO thanks to POMO.

Will they go straight for that 3300+ gap from February? I can’t say, I suppose in an environment where nothing fundamental matters anything can happen.

This week Powell will add more programs and perhaps yield curve control. Every aspect of these markets is manipulated at the moment and every tiny dip is relentlessly bought as it is in any mania.

Yet the size of the dislocations continue to strengthen the sell case and indeed the number of open gaps are increasingly looking to be the achilles heel of this market, never mind historic valuations.

Remember the non stop gaps in Q4 of last year leading to the top in February 2020? They all look like child’s play compared to the ones we have now:

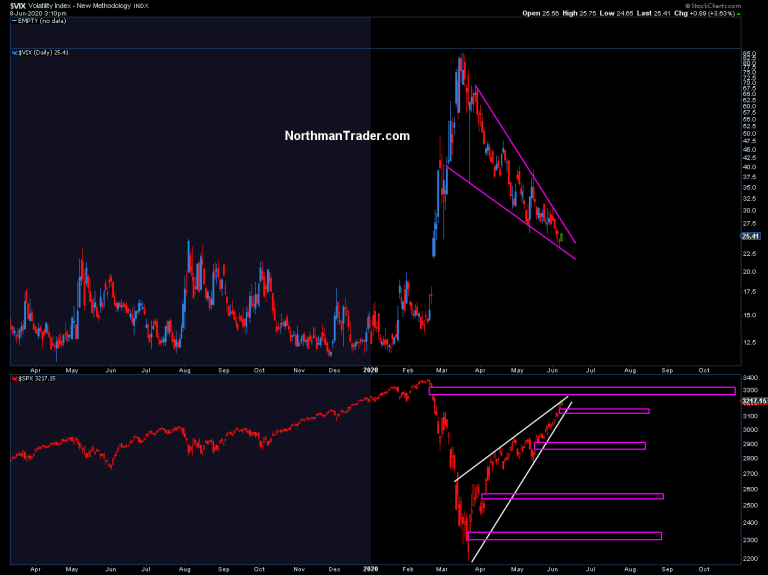

And guess what? All those gaps last year when the market seemed invincible? All of them filled. This market has some gap filling to do, especially in context of a $VIX that looks to want to party again at some stage:

Look, I’ve always said in recent months that this is all about control, can the Fed control the market equation? For now it clearly has, but it’s created a bloated pig of a market as a result.

And this pig is now big and fat and any sizable reversion can in itself shake the very confidence and optimism the Fed has sought to propagate. The Fed is peddling a fantasy, a fantasy that says money and wealth can be created out of thin air with nothing of substance needed to back it up, no growth, no earnings, none of that.

My premise: Markets and the economy can’t live on multiple expansion alone, but this is what the market ran on in 2019 and it is what it is running on again.

Like Druckenmiller I’ve been surprised at the vertical nature of this move, but unlike him I don’t attribute it to the reopening optimism, I attribute it only to one thing: A stock mania created by an overzealous Fed that is trying to save the economy, but in process has created the largest asset bubble of our time, and with that they put in the conditions in place that markets could be faced with another crash. I may well be wrong on this, but the circus like atmosphere in context of historic valuations, optimism and giddiness along with bears crying are exactly the type of conditions that have ended bear market rallies in previous periods of history.

To think it’s different this time is to count on it being different this time. Well, in one aspect it already is different this time: The first stock mania inside of a recession. Not discounted far below at all time highs, but rather sitting on top of the largest disconnect between the economy and the stock market ever. Inside of a recession no less.

- Forums

- ASX - General

- Its Over

Sven puts it all too well... Welcome To The "Anything Goes"...

- There are more pages in this discussion • 17,667 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

LU7

LITHIUM UNIVERSE LIMITED

Alex Hanly, CEO

Alex Hanly

CEO

SPONSORED BY The Market Online