If you really want to quanitfy the forecast appetite for lithium, graphs are your best friend:

Growth (real and forecast) of EV-centric vehicle sales.

Amount of Li needed per application. 50kg of Li per Tesla Model 3. 400K Model 3's on order already. and every other major car manufacturers now moving head-square into EV adaptation.

A projection of broader lithium consumption:

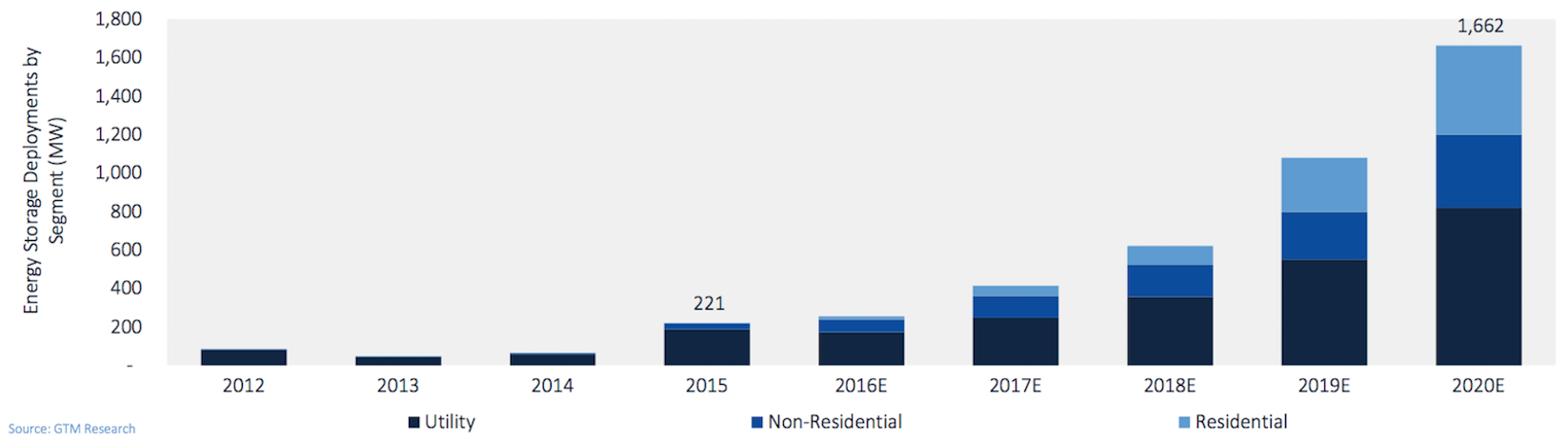

And here's the real cash cow in my eyes. Home/residential energy storage.... the Powerwall (and variants). I personally expect residential energy storage to take off like wildfire, with adoption at a much faster/higher rate than that we're currently forecasting of EV cars.

Not to mention that everyone from Kim in Korea to Ntulu in Nigeria now has a mobile phone in their pocket, aspire to own a laptop or tablet, all born with an appetite for newer, better tech to improve their lives... and all this tech is driven via a Li battery variant of some sort.

No denying these dips can be stressful. And technically, this is poised to be the biggest price attack we've seen this year. That said, i'm comfortable with my decision to go long with GXY, so my best bet here might be simply to turn off the screen until spring to keep my sanity in check.

Add to My Watchlist

What is My Watchlist?