Vale trimming guidance, already.

https://www.bloomberg.com/news/articles/2021-11-29/vale-lowers-production-guidance-in-boost-to-iron-ore-reboundVale Lowers Production

By and

Guidance in Boost

to Iron-Ore ReboundNovember 30, 2021, 2:28 AM GMT+10 Updated on November 30, 2021, 4:25 AM GMT+10

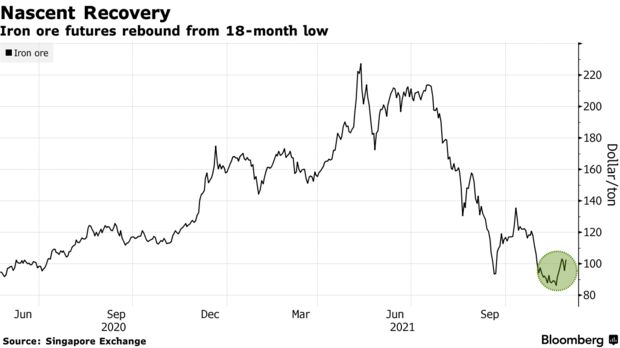

Vale SA just gave some much needed supply-side support to a nascent recovery in iron ore prices, trimming its production guidance for this year and issuing a lower-than-expected projection for next year.

The world’s second-largest producer of the steelmaking ingredient now expects to produce 315-320 million metric tons this year, compared with previous guidance of 315-335 million tons. Next year, Vale anticipates 320-335 million tons compared with a 346 million-ton consensus among analysts.

Vale is defending margins by withholding some lower-quality supply and seeking $1 billion in cost savings after iron ore futures tumbled in recent months as China limited steel output to contain pollution and power use.

“Value over volume is our mantra,” Marcello Spinelli, head of iron ore, said Monday at the Brazilian mining giant’s annual investor day at the New York Stock Exchange. “We are not going to produce if the market doesn’t need it.”

The Rio de Janeiro-based company’s ongoing recovery from an early-2019 tailings dam collapse makes it a major swing factor on the supply side. The latest guidance may support a recent rebound in iron ore futures amid optimism over restocking by Chinese mills.

Still, Vale continues to target annual production capacity of 400 million tons, which could make it the world’s No. 1 iron ore producer once again, a title it lost to Rio Tinto Group in the wake of the Brumadinho dam disaster. In September, Vale postponed the capacity goal from 2022 to “medium term” partly because of sluggish permitting.

- Forums

- ASX - By Stock

- FEX

- Price of Iron Ore

Price of Iron Ore, page-857

Featured News

Add FEX (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

26.5¢ |

Change

0.005(1.92%) |

Mkt cap ! $190.9M | |||

| Open | High | Low | Value | Volume |

| 26.0¢ | 26.5¢ | 26.0¢ | $499.4K | 1.910M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 20 | 2102866 | 26.0¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 26.5¢ | 174750 | 6 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 20 | 2102866 | 0.260 |

| 6 | 220000 | 0.255 |

| 27 | 531655 | 0.250 |

| 15 | 494345 | 0.245 |

| 14 | 466367 | 0.240 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.265 | 174750 | 6 |

| 0.270 | 213586 | 6 |

| 0.275 | 319941 | 5 |

| 0.280 | 234281 | 9 |

| 0.285 | 206513 | 3 |

| Last trade - 16.10pm 12/11/2024 (20 minute delay) ? |

Featured News

| FEX (ASX) Chart |

The Watchlist

NUZ

NEURIZON THERAPEUTICS LIMITED

Michael Thurn, CEO & MD

Michael Thurn

CEO & MD

SPONSORED BY The Market Online